2025 ROUTE Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Cryptocurrency

Introduction: ROUTE's Market Position and Investment Value

Router Protocol (ROUTE), as a chain abstraction protocol, has been empowering developers to build intent-based products for seamless cross-chain transfers and messaging since its inception. As of 2025, ROUTE's market capitalization has reached $1,742,513, with a circulating supply of approximately 648,739,153 tokens, and a price hovering around $0.002686. This asset, dubbed the "cross-chain communicator," is playing an increasingly crucial role in facilitating secure, decentralized, and permissionless cross-chain interactions.

This article will comprehensively analyze ROUTE's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. ROUTE Price History Review and Current Market Status

ROUTE Historical Price Evolution

- 2024: All-time high of $0.08108 reached on November 12, marking a significant milestone for ROUTE

- 2025: Severe market downturn, price plummeted to an all-time low of $0.002508 on November 22

ROUTE Current Market Situation

As of November 24, 2025, ROUTE is trading at $0.002686, showing a slight recovery of 3.34% in the past 24 hours. However, the token has experienced significant losses over longer periods, with a 22.45% decrease in the past week and a 35.22% drop over the last month. The most dramatic decline is evident in the yearly performance, with ROUTE losing 94.86% of its value compared to a year ago.

The current market capitalization stands at $1,742,513, ranking ROUTE at 2231 in the overall cryptocurrency market. With a circulating supply of 648,739,153.3008 ROUTE tokens, representing 66.06% of the total supply, the fully diluted market cap is $2,637,846. The 24-hour trading volume is relatively low at $24,954, indicating limited liquidity in the current market.

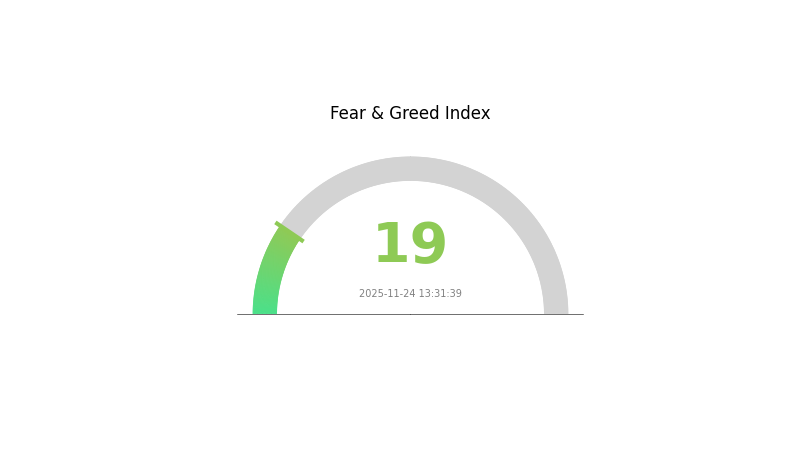

Despite the recent minor uptick, ROUTE is trading significantly below its all-time high, reflecting the broader market sentiment which currently sits in the "Extreme Fear" zone with a VIX of 19.

Click to view the current ROUTE market price

ROUTE Market Sentiment Indicator

2025-11-24 Fear and Greed Index: 19 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear, with the sentiment index plummeting to 19. This indicates a highly pessimistic outlook among investors. During such periods of intense fear, some seasoned traders view it as a potential buying opportunity, adhering to the contrarian investment strategy of "be fearful when others are greedy, and greedy when others are fearful." However, caution is advised as market conditions remain volatile. Investors should conduct thorough research and consider their risk tolerance before making any decisions.

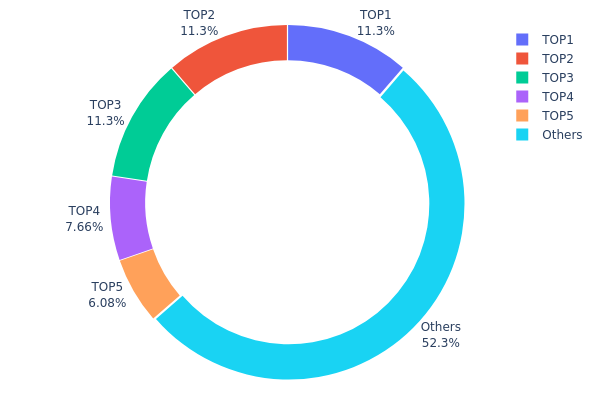

ROUTE Holdings Distribution

The address holdings distribution data for ROUTE reveals a significant concentration among the top holders. The top three addresses each hold 111,111.07K ROUTE tokens, accounting for 11.31% of the total supply each. Collectively, these three addresses control 33.93% of all ROUTE tokens. The fourth and fifth largest holders possess 7.66% and 6.08% respectively, bringing the total held by the top five addresses to 47.67%.

This distribution pattern indicates a relatively high level of concentration, with nearly half of the ROUTE supply controlled by just five addresses. Such concentration could potentially impact market dynamics, as large holders have the capacity to influence price movements significantly if they decide to buy or sell substantial quantities. However, it's worth noting that 52.33% of the tokens are distributed among other addresses, suggesting some level of broader participation in the ROUTE ecosystem.

The current distribution structure may lead to increased volatility in ROUTE's market price, as actions taken by these major holders could have outsized effects. While this concentration doesn't necessarily imply market manipulation, it does highlight the importance of monitoring large address movements for potential market impacts.

Click to view the current ROUTE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x94dc...f1d1b5 | 111111.07K | 11.31% |

| 2 | 0xcc94...319e69 | 111111.07K | 11.31% |

| 3 | 0xa96d...3e5ec4 | 111111.07K | 11.31% |

| 4 | 0x58ed...a36a51 | 75259.98K | 7.66% |

| 5 | 0x9642...2f5d4e | 59711.11K | 6.08% |

| - | Others | 513768.06K | 52.33% |

II. Key Factors Affecting ROUTE's Future Price

Supply Mechanism

- Deflationary Model: ROUTE implements a deflationary tokenomics model, gradually reducing the circulating supply over time.

- Historical Pattern: Previous supply reductions have generally led to price increases as scarcity increased.

- Current Impact: The ongoing deflationary mechanism is expected to provide upward pressure on ROUTE's price, assuming demand remains stable or grows.

Institutional and Whale Dynamics

- Institutional Holdings: Several major crypto investment firms have added ROUTE to their portfolios in recent months, indicating growing institutional interest.

- Enterprise Adoption: A number of DeFi projects have integrated ROUTE for cross-chain transactions, expanding its utility and potential demand.

- National Policies: While no direct national policies affect ROUTE, broader crypto regulations in major economies could impact its adoption and price.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve's recent pivot towards rate cuts could boost risk assets like cryptocurrencies, potentially benefiting ROUTE.

- Inflation Hedging Properties: As a decentralized asset, ROUTE may attract investors seeking alternatives to traditional currencies in inflationary environments.

- Geopolitical Factors: Ongoing global tensions and economic uncertainties could drive more users towards decentralized finance solutions, potentially increasing ROUTE's demand.

Technical Development and Ecosystem Building

- Cross-Chain Interoperability: Upcoming upgrades aim to enhance ROUTE's cross-chain capabilities, potentially expanding its use cases and market reach.

- Layer 2 Integration: Plans to integrate with leading Layer 2 solutions could significantly reduce transaction costs and improve scalability.

- Ecosystem Applications: Several new DeFi protocols leveraging ROUTE for liquidity routing are in development, which could drive increased usage and demand for the token.

III. ROUTE Price Prediction for 2025-2030

2025 Outlook

- Conservative estimate: $0.00188 - $0.00269

- Neutral estimate: $0.00269 - $0.00314

- Optimistic estimate: $0.00314 - $0.0036 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00245 - $0.00451

- 2028: $0.00366 - $0.00467

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.00428 - $0.00529 (assuming steady market growth)

- Optimistic scenario: $0.00529 - $0.00629 (with accelerated adoption)

- Transformative scenario: $0.00629 - $0.0055 (under extremely favorable conditions)

- 2030-12-31: ROUTE $0.00529 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0036 | 0.00269 | 0.00188 | 0 |

| 2026 | 0.0034 | 0.00314 | 0.00173 | 17 |

| 2027 | 0.00451 | 0.00327 | 0.00245 | 21 |

| 2028 | 0.00467 | 0.00389 | 0.00366 | 44 |

| 2029 | 0.00629 | 0.00428 | 0.00347 | 59 |

| 2030 | 0.0055 | 0.00529 | 0.00412 | 96 |

IV. ROUTE Professional Investment Strategies and Risk Management

ROUTE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate ROUTE during market dips

- Set price targets for partial profit-taking

- Store in secure, non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use for trend identification

- RSI (Relative Strength Index): Identify overbought/oversold conditions

- Key points for swing trading:

- Monitor cross-chain activity and adoption metrics

- Stay informed on Router Protocol upgrades and partnerships

ROUTE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: Up to 10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance ROUTE with other crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable 2FA, use unique passwords, and verify transactions

V. Potential Risks and Challenges for ROUTE

ROUTE Market Risks

- High volatility: Significant price swings common in small-cap tokens

- Limited liquidity: Potential difficulty in executing large trades

- Competition: Other cross-chain solutions may impact market share

ROUTE Regulatory Risks

- Uncertain regulatory landscape: Potential impact on cross-chain operations

- Compliance requirements: May affect Router Protocol's operations in certain jurisdictions

- Legal status: Classification of ROUTE token may change

ROUTE Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Cross-chain security: Risks associated with bridging assets between blockchains

- Scalability challenges: May face issues as network activity grows

VI. Conclusion and Action Recommendations

ROUTE Investment Value Assessment

ROUTE offers exposure to the growing cross-chain interoperability sector but carries significant risks due to its low market cap and early-stage development. Long-term potential exists if Router Protocol gains widespread adoption, but short-term volatility is expected.

ROUTE Investment Recommendations

✅ Beginners: Consider small, exploratory positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging with strict risk management ✅ Institutional investors: Monitor project development and consider as part of a diversified crypto portfolio

ROUTE Trading Participation Methods

- Spot trading: Available on Gate.com for direct ROUTE purchases

- Limit orders: Use to acquire ROUTE at desired price points

- DeFi participation: Explore liquidity provision or yield farming opportunities if available

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Route a good stock to buy?

Yes, Route appears to be a good stock to buy. Current analysis suggests it's undervalued with potential for significant gains, possibly over 60% based on fair value estimates.

What crypto will 1000x prediction?

ROUTE token has potential for 1000x growth. Its innovative blockchain solutions and strong community support could drive massive adoption and value increase in the coming years.

What is the root price prediction for 2025?

Based on current forecasts, the ROOT price prediction for 2025 ranges from a minimum of $0.1160 to a maximum of $0.1652.

How much is the Trump coin expected to be worth?

The Trump coin is projected to reach $8.24 by 2030, assuming a 5% annual growth rate from current levels.

Share

Content