2025 RLC Fiyat Tahmini: RLC Bir Sonraki Boğa Piyasasında 10 Dolar Seviyesine Ulaşacak mı?

Giriş: RLC’nin Piyasa Konumu ve Yatırım Değeri

iExec (RLC), 2017’den bu yana ilk sanal bulut kaynak pazaryeri olarak önemli başarılar elde etti. 2025 itibarıyla iExec’in piyasa değeri 62.422.709 $’a ulaştı, dolaşımdaki token sayısı yaklaşık 72.382.548 ve fiyatı 0,8624 $ civarında seyrediyor. Sektörde “merkeziyetsiz bulut bilişim öncüsü” olarak bilinen bu varlık, blokzincir tabanlı dağıtık uygulamalar ve bulut kaynakları alanında giderek daha belirleyici bir rol üstleniyor.

Bu makalede, 2025-2030 döneminde iExec’in fiyat hareketleri; geçmiş trendler, piyasa arz-talebi, ekosistem gelişimi ve makroekonomik faktörlerle birlikte analiz edilecek, yatırımcılar için profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. RLC Fiyat Geçmişi ve Güncel Piyasa Durumu

RLC Tarihsel Fiyat Seyri

- 2017: RLC token piyasaya sürüldü, fiyatı yaklaşık 0,20 $’da dalgalandı

- 2021: Boğa piyasası zirvesi, 11 Mayıs’ta rekor seviye olan 15,51 $’a ulaştı

- 2022-2023: Kripto kışı, fiyat zirveden önemli ölçüde düştü

RLC Güncel Piyasa Durumu

22 Ekim 2025 itibarıyla RLC, 0,8624 $ seviyesinden işlem görüyor ve son 24 saatte %2,67 değer kaybetti. Token, son bir yılda %51,79 oranında gerileyerek ciddi bir düşüş yaşadı. RLC’nin piyasa değeri şu anda 62.422.709 $ ve kripto paralar arasında 538. sırada bulunuyor. Son 24 saatteki işlem hacmi 38.653 $ ile orta düzeyde bir piyasa hareketliliği gösteriyor. RLC, rekor seviye olan 15,51 $’ın %94,44 altında işlem görüyor ve bu durum, genel piyasa düşüş trendini yansıtıyor.

Güncel RLC piyasa fiyatına göz atın

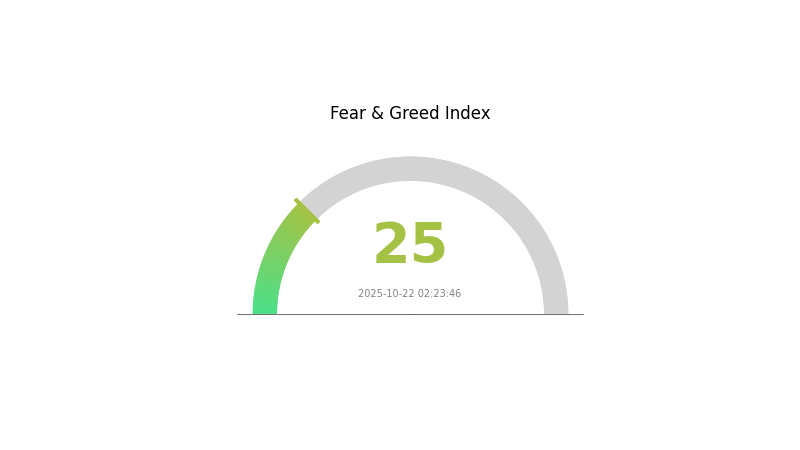

RLC Piyasa Duyarlılık Göstergesi

22 Ekim 2025 Korku ve Açgözlülük Endeksi: 25 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksini görüntüleyin

Kripto piyasasında aşırı korku hakim ve duyarlılık endeksi 25’e inmiş durumda. Bu düzey, bazen karşıt yatırımcılar için alım fırsatı olarak görülse de, yatırım kararlarında dikkatli hareket etmek ve kapsamlı araştırma yapmak önemini koruyor. Mevcut piyasa koşulları, RLC yatırımcıları için hem risk hem de fırsatlar barındırıyor. Her zaman olduğu gibi, çeşitlendirme ve risk yönetimi, kripto piyasasında belirsiz dönemlerde temel stratejilerdir.

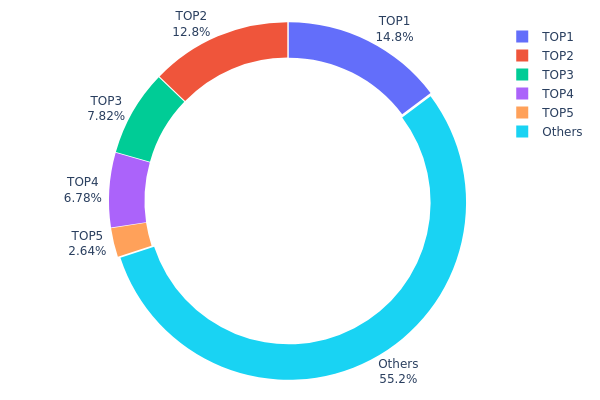

RLC Varlık Dağılımı

RLC adres varlık dağılımı, orta derecede yoğunlaşmış bir sahiplik yapısını ortaya koyuyor. En büyük beş adres, toplam RLC arzının %44,78’ini elinde tutarken, kalan %55,22 diğer adreslere dağılmış durumda. En büyük sahip %14,75’lik paya sahipken, ikinci sıradaki adres %12,81 ile onu takip ediyor; bu da kayda değer kişisel paylara işaret ediyor.

Böyle bir yoğunluk, büyük sahiplerin piyasa üzerinde etkili olabileceğini gösteriyor. Dağılım modeli fiyat oynaklığı ve likiditeyi etkileyebilir; birkaç büyük sahibin varlığı, koordineli piyasa hareketleri veya ani yüksek hacimli işlemler riski doğurabilir. Ancak arzın yarısından fazlası küçük adreslere dağılmış olduğundan, merkeziyetsizlik seviyesi bu riskleri bir ölçüde dengeleyebilir.

Sonuç olarak, mevcut RLC dağılımı, yoğunlaşma ile dağılım arasında dengeli bir piyasa yapısı sunuyor. Bu durum, üst düzey sahiplerin olası etkilerine karşı dikkatli olmayı gerektirirken, aynı zamanda likidite ve piyasa gelişimi için yeterli çeşitliliği de yansıtıyor.

Güncel RLC Varlık Dağılımını inceleyin

| Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 12.834,53K | 14,75% |

| 2 | 0xc0e3...b50afb | 11.146,72K | 12,81% |

| 3 | 0x5a52...70efcb | 6.800,00K | 7,81% |

| 4 | 0xa59b...748d10 | 5.899,80K | 6,78% |

| 5 | 0x99cf...113640 | 2.295,28K | 2,63% |

| - | Diğerleri | 48.023,46K | 55,22% |

II. RLC’nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Güncel Etki: Teknolojik inovasyonlar ve piyasa adaptasyonu arttıkça, arz değişimleri RLC fiyatını etkileyebilir ve yatırımcı güvenini destekleyebilir.

Makroekonomik Ortam

-

Para Politikası Etkisi: Küresel ekonomik koşullar ve büyük merkez bankalarının uygulamaları, RLC dahil tüm kripto piyasasında istikrarı belirleyecek. Gevşek para politikaları, kripto paralar gibi riskli varlıklara sermaye akışını tetikleyebilir.

-

Jeopolitik Faktörler: Uluslararası gelişmeler ve ülkelerin kripto paralarla ilgili düzenleyici yaklaşımları, RLC fiyatı üzerinde belirleyici olabilir. Kripto paralara yönelik olumsuz politikalar, RLC’nin piyasa performansını etkileyebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Ekosistem Uygulamaları: RLC token’ın artan kullanımı, iExec ekosisteminde inovasyonu ve benimsenmeyi hızlandırıyor. Bu gelişmeler, yatırımcı beklentilerini olumlu etkileyerek RLC fiyatı üzerinde destekleyici rol oynuyor.

III. 2025-2030 Dönemi için RLC Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,77 $ - 0,86 $

- Nötr tahmin: 0,86 $ - 0,95 $

- İyimser tahmin: 0,95 $ - 1,11 $ (pozitif piyasa duyarlılığı ve proje gelişmeleriyle)

2027-2028 Görünümü

- Piyasa evresi beklentisi: Artan volatiliteyle birlikte potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,82 $ - 1,10 $

- 2028: 0,64 $ - 1,45 $

- Ana katalizörler: Merkeziyetsiz bulut bilişimde teknolojik ilerleme ve RLC’nin kurumsal çözümlerde daha fazla kullanılması

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 1,25 $ - 1,45 $ (istikrarlı piyasa büyümesi ve sürekli proje gelişimiyle)

- İyimser senaryo: 1,45 $ - 2,00 $ (hızlı benimsenme ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 2,00 $ - 2,50 $ (çığır açan yenilikler ve merkeziyetsiz bulutun ana akıma entegrasyonu durumunda)

- 2030-12-31: RLC 1,45 $ (2025 ortalamasına göre %68 artış)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 1,11224 | 0,8622 | 0,77598 | 0 |

| 2026 | 1,08594 | 0,98722 | 0,85888 | 14 |

| 2027 | 1,09877 | 1,03658 | 0,8189 | 20 |

| 2028 | 1,45204 | 1,06768 | 0,64061 | 23 |

| 2029 | 1,65042 | 1,25986 | 0,68032 | 46 |

| 2030 | 2,00809 | 1,45514 | 0,78577 | 68 |

IV. RLC Profesyonel Yatırım Stratejileri ve Risk Yönetimi

RLC Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Uzun vadeli yatırımcılar ve blokzincir teknolojisine inananlar

- Öneriler:

- Piyasa düşüşlerinde RLC biriktirin

- iExec proje gelişimini ve ekosistem büyümesini izleyin

- Token’ları güvenli donanım cüzdanında saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüşleri belirleyin

- RSI: Aşırı alım-satım koşullarını gözlemleyin

- Dalgalı işlemde odak noktaları:

- Teknik göstergelere göre giriş-çıkış noktalarını net belirleyin

- Fiyat hareketlerinin teyidi için işlem hacmini takip edin

RLC Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Esasları

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Agresif yatırımcı: Kripto portföyünün %5-8’i

- Profesyonel yatırımcı: Kripto portföyünün %10-15’i

(2) Riski Azaltma Çözümleri

- Çeşitlendirme: Birden fazla kripto varlığa yatırım yapın

- Zarar-durdur: Olası kayıpları sınırlamak için önceden çıkış noktaları belirleyin

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 cüzdanı

- Soğuk depolama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik: İki faktörlü kimlik doğrulama ve güçlü şifreler kullanın

V. RLC İçin Potansiyel Riskler ve Zorluklar

RLC Piyasa Riskleri

- Oynaklık: Kripto piyasasında yüksek dalgalanma

- Rekabet: Bulut bilişim alanında artan rekabet

- Benimsenme: Merkeziyetsiz bulut bilişiminin yavaş benimsenmesi

RLC Düzenleyici Riskler

- Düzenleyici belirsizlik: Değişen düzenlemeler RLC’nin kullanımını etkileyebilir

- Uyumluluk sorunları: Küresel regülasyonlara uyumda zorluklar

- Vergi etkileri: Kripto varlıklara ilişkin gelişen vergi düzenlemeleri

RLC Teknik Riskler

- Akıllı sözleşme açıkları: Protokolde güvenlik zafiyetleri

- Ölçeklenebilirlik: Artan ağ talebini yönetme kapasitesi

- Teknolojik eskime: Bulut bilişimde hızlı teknolojik gelişmeler

VI. Sonuç ve Eylem Önerileri

RLC Yatırım Değeri Değerlendirmesi

RLC, merkeziyetsiz bulut bilişim alanında uzun vadeli potansiyel sunar; ancak kısa vadede volatilite ve benimsenme sorunlarıyla karşılaşabilir. Projenin başarısı, teknolojik ilerleme ve piyasa kabulüne bağlıdır.

RLC Yatırım Önerileri

✅ Yeni başlayanlar: Küçük yatırımlarla başlayın, teknolojiye odaklanın ✅ Deneyimli yatırımcılar: Portföyünüzün bir kısmını risk toleransınıza göre ayırın ✅ Kurumsal yatırımcılar: Detaylı araştırma yapın ve uzun vadeli potansiyeli değerlendirin

RLC İşlem Katılım Yöntemleri

- Spot işlem: Gate.com’da RLC alım-satımı

- Staking: Uygunsa staking programlarına katılım

- DApp etkileşimi: iExec ekosistemini kullanarak projenin işlevselliğini deneyimleyin

Kripto para yatırımları oldukça yüksek risk içerir, bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profillerine göre özenli kararlar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

RLC coin yatırım için uygun mu?

RLC, fiyat artışı potansiyeliyle dikkat çekiyor. Yenilikçi merkeziyetsiz bulut bilişim platformu, Web3 alanında özgün bir değer sunarak 2025 ve sonrası için cazip bir yatırım fırsatı oluşturuyor.

RLC’nin 2030 fiyat tahmini nedir?

Mevcut trendler ve piyasa analizleri baz alındığında, RLC 2030’da 15 ila 20 $ seviyelerine ulaşabilir ve Web3 ile merkeziyetsiz bilişimde ciddi bir büyümeyi yansıtabilir.

Chainlink 1.000 $’a ulaşabilir mi?

2030’a kadar olası görünmese de, Chainlink’in 2040’ta 1.000 $’a ulaşması ihtimal dahilinde. Tahminler, 2040’a kadar 370-456 $ seviyelerine işaret ediyor; ancak uzun vadeli tahminler spekülatif kalıyor.

RLC kripto nedir?

RLC, merkeziyetsiz bulut bilişim platformu iExec’in yerel kripto parasıdır. Hesaplama ve depolama kaynakları için ödeme aracı olarak kullanılır; merkeziyetsiz uygulamaların ölçeklenmesini destekler.

2025 STOS Fiyat Tahmini: Dijital Varlık İçin Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 PPrice Tahmini: Piyasa Trendlerinin Analizi ve Yatırımcılar İçin Gelecekteki Değerleme Potansiyelleri

2025 SQR Fiyat Tahmini: Piyasa Eğilimleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 LIY Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Etkenlerini Değerlendirmek

2025 CHAPZ Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 TOWN Fiyat Tahmini: Dijital Gayrimenkul Tokeni'nin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Cysic: AI ve Dağıtık Hesaplama için Sıfır Bilgi Altyapı Platformu

ABD Bankacılık Düzenleyicisi OCC, ulusal bankaların kripto para ticareti yapmasını kolaylaştırıyor

ASTER Spot İşlem Rehberi: Anlık Fiyat Analizi ve İşlem Hacmi Bilgileri

Cantor Equity ile birleşmenin ardından Twenty One Capital Bitcoin hissesi yüzde 25 değer kaybetti

Dropee Günlük Kombinasyonu 10 Aralık 2025