2025 QBX Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Cryptocurrency

Introduction: QBX's Market Position and Investment Value

QBX (QBX), as a decentralized loyalty currency infrastructure, has made significant strides since its inception. As of 2025, QBX's market capitalization has reached $269,308.99, with a circulating supply of approximately 82,823,529 tokens, and a price hovering around $0.0032516. This asset, known as the "loyalty currency innovator," is playing an increasingly crucial role in the field of customer loyalty and rewards programs.

This article will comprehensively analyze QBX's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. QBX Price History Review and Current Market Status

QBX Historical Price Evolution Trajectory

- 2024: QBX reached its all-time high of $0.14 on December 12, marking a significant milestone in its price history.

- 2025: The token experienced a substantial decline, hitting its all-time low of $0.0009076 on May 8, reflecting a major market correction.

QBX Current Market Situation

As of November 28, 2025, QBX is trading at $0.0032516, ranking 3869th in the cryptocurrency market. Over the past 24 hours, the token has shown a positive momentum with a 5.17% increase. However, the broader picture reveals significant volatility and overall downward pressure:

- 1-hour change: -2.06%

- 7-day change: -0.67%

- 30-day change: -17.54%

- 1-year change: -90.33%

The token's market capitalization stands at $269,308.99, with a circulating supply of 82,823,529 QBX out of a total supply of 1,380,392,157. The fully diluted market cap is $4,488,483.14, indicating substantial room for supply expansion.

Trading volume in the last 24 hours reached $16,530.41, suggesting moderate liquidity for the token. The current price represents a significant drop from its all-time high, with the token now trading at about 2.32% of its peak value.

Click to view the current QBX market price

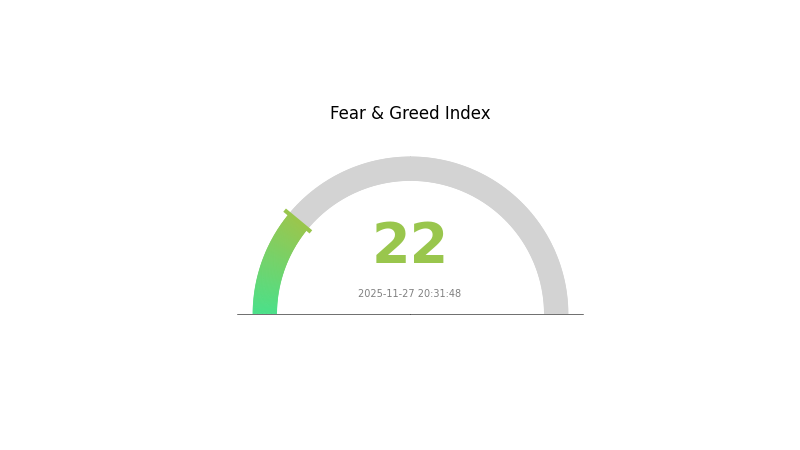

QBX Market Sentiment Indicator

2025-11-27 Fear and Greed Index: 22 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 22. This indicates a highly pessimistic sentiment among investors. During such periods, excessive fear can present potential buying opportunities for contrarian investors. However, it's crucial to conduct thorough research and exercise caution before making any investment decisions. Remember, market sentiment can shift rapidly, and past performance doesn't guarantee future results. Stay informed and consider diversifying your portfolio to manage risks effectively.

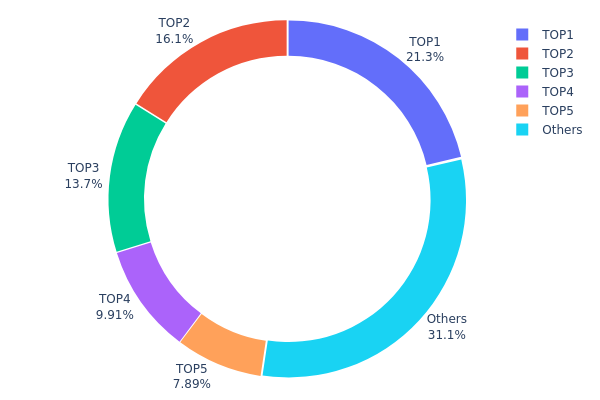

QBX Holdings Distribution

The address holdings distribution data for QBX reveals a significant concentration of tokens among a few top addresses. The top five addresses collectively hold 68.91% of the total QBX supply, with the largest holder controlling 21.30% of tokens. This level of concentration indicates a relatively centralized distribution, which could have implications for market dynamics and price stability.

The high concentration in a small number of addresses suggests potential vulnerability to large sell-offs or market manipulation. If any of these major holders were to liquidate their positions, it could lead to substantial price volatility. Additionally, this concentration may impact the overall decentralization ethos of the project, as a small group of entities holds significant influence over the token's supply.

However, it's worth noting that 31.09% of tokens are distributed among other addresses, which provides some level of diversification. This distribution pattern reflects a market structure where major players have substantial control, but there is still a meaningful portion held by smaller investors or entities. Monitoring changes in this distribution over time will be crucial for assessing the evolving market dynamics and potential risks associated with QBX.

Click to view the current QBX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0529...c553b7 | 294043.32K | 21.30% |

| 2 | 0x1a49...c339ee | 222182.32K | 16.09% |

| 3 | 0x0b47...af3072 | 189580.60K | 13.73% |

| 4 | 0x15ce...c5a58b | 136776.68K | 9.90% |

| 5 | 0xecac...e08af8 | 108975.26K | 7.89% |

| - | Others | 428833.99K | 31.09% |

II. Core Factors Affecting QBX's Future Price

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, QBX may potentially serve as a hedge against inflation, similar to other digital assets. However, its specific performance in inflationary environments would need to be closely monitored as the market evolves.

Technical Development and Ecosystem Building

- Ecosystem Applications: While specific details are not provided, QBX likely aims to develop a robust ecosystem with various decentralized applications (DApps) and projects built on its platform. The growth and success of these ecosystem projects could significantly impact QBX's future value and adoption.

III. QBX Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00288 - $0.00324

- Neutral prediction: $0.00324 - $0.00335

- Optimistic prediction: $0.00335 - $0.00346 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00386 - $0.00465

- 2028: $0.00383 - $0.00555

- Key catalysts: Increasing adoption, market recovery, and project developments

2029-2030 Long-term Outlook

- Base scenario: $0.00498 - $0.00577 (assuming steady market growth)

- Optimistic scenario: $0.00657 - $0.00791 (assuming strong market performance)

- Transformative scenario: Above $0.00791 (with exceptional market conditions and widespread adoption)

- 2030-12-31: QBX $0.00577 (potential average price by end of 2030)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00346 | 0.00324 | 0.00288 | 0 |

| 2026 | 0.00496 | 0.00335 | 0.00191 | 3 |

| 2027 | 0.00465 | 0.00416 | 0.00386 | 27 |

| 2028 | 0.00555 | 0.0044 | 0.00383 | 35 |

| 2029 | 0.00657 | 0.00498 | 0.00368 | 53 |

| 2030 | 0.00791 | 0.00577 | 0.00346 | 77 |

IV. Professional Investment Strategies and Risk Management for QBX

QBX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate QBX during market dips

- Set price targets and regularly review portfolio

- Store QBX in secure wallets with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price levels

QBX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement automatic sell orders to limit losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for QBX

QBX Market Risks

- High volatility: QBX price may experience significant fluctuations

- Limited liquidity: Low trading volume may impact ability to execute trades

- Market sentiment: Susceptible to broader cryptocurrency market trends

QBX Regulatory Risks

- Regulatory uncertainty: Potential for new regulations affecting loyalty tokens

- Cross-border compliance: Challenges in adhering to diverse international regulations

- Tax implications: Evolving tax laws may impact QBX transactions and holdings

QBX Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: Ethereum network issues may affect QBX transactions

- wallet security: Risk of loss due to poor key management or hacking attempts

VI. Conclusion and Action Recommendations

QBX Investment Value Assessment

QBX offers potential in the loyalty currency space but faces significant challenges in adoption and market volatility. Long-term value depends on the success of qiibee's vision, while short-term risks remain high.

QBX Investment Recommendations

✅ Beginners: Limited exposure, focus on education and market observation

✅ Experienced investors: Consider small position as part of a diversified portfolio

✅ Institutional investors: Thorough due diligence required, potential for strategic partnerships

QBX Participation Methods

- Gate.com exchange: Trade QBX on the established cryptocurrency platform

- DeFi protocols: Explore liquidity provision or yield farming opportunities (if available)

- Direct purchase: Acquire QBX through the qiibee ecosystem (if implemented)

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much will 1 QNT be worth in 2030?

Based on current trends and market projections, 1 QNT could potentially be worth around $5,000 to $7,000 by 2030, considering its strong technology and growing adoption in the blockchain industry.

What is QBX crypto?

QBX is a cryptocurrency token associated with the Qiblox ecosystem, designed to facilitate transactions and governance within its blockchain network. It aims to provide utility and value in the decentralized finance (DeFi) space.

How much will Quant be worth in 2025?

Based on market trends and expert predictions, Quant (QNT) could potentially reach a value of $500 to $800 per token by 2025, driven by increased adoption and network growth.

Does Marlin Pond have a future?

Yes, Marlin Pond has potential for growth in the Web3 ecosystem. Its focus on network optimization and decentralized infrastructure positions it well for future developments in blockchain technology.

2025 LUNC Price Prediction: Will Terra Luna Classic Reach $1 After Recent Market Recovery?

2025 XLM Price Prediction: Stellar Lumens' Potential Growth Trajectory in a Maturing Crypto Ecosystem

2025 CFX Price Prediction: Analyzing Growth Potential and Market Factors for Conflux Network Token

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

2025 GRT Price Prediction: Analyzing Graph Protocol's Future Value Trajectory and Market Potential

2025 FTT Price Prediction: Analyzing Market Trends and Potential Growth Factors in the Digital Asset Ecosystem

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?