2025 PORTAL Price Prediction: Analyzing Market Trends and Future Growth Potential for Portal Token

Introduction: Market Position and Investment Value of PORTAL

Portal (PORTAL) is a cross-chain gaming platform with a mission to onboard more players to web3.0. Since its launch in March 2024, Portal has established itself as a notable participant in the decentralized gaming ecosystem. As of December 2025, Portal's market capitalization stands at approximately $13.05 million, with a circulating supply of approximately 591.81 million tokens and a price of around $0.022051.

This innovative asset is playing an increasingly important role in bridging traditional gamers to the Web3 gaming landscape through its cross-chain infrastructure and user-focused approach.

This article will provide a comprehensive analysis of Portal's price trends and market dynamics, incorporating historical price performance, market supply and demand fundamentals, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for the period through 2030.

Portal (PORTAL) Market Analysis Report

I. PORTAL Price History Review and Market Status

PORTAL Historical Price Evolution

Portal was launched on February 29, 2024, at an initial trading price. The token has experienced significant volatility since its inception:

-

February 2024: Portal's launch and early trading phase, reaching its all-time high of $4.666 on February 29, 2024, reflecting strong initial market sentiment and investor interest in the cross-chain gaming platform.

-

2024-2025 Period: A prolonged downtrend characterized the token's performance, with the price declining substantially from its peak as the broader market dynamics and competitive pressures in the gaming sector influenced investor sentiment.

-

October 2025: Portal reached its all-time low of $0.00732 on October 10, 2025, representing approximately a 99.84% decline from the historical peak, reflecting extreme bearish market conditions and capitulation in the token's trading activity.

PORTAL Current Market Stance

As of December 21, 2025, Portal is trading at $0.022051, positioning it at #1047 in market capitalization rankings. The token exhibits the following characteristics:

Price Performance Metrics:

- 24-hour change: -3.54%, with a trading range between $0.022051 (low) and $0.023238 (high)

- 7-day change: +1.23%, showing modest short-term recovery momentum

- 30-day change: +23.47%, indicating a significant rebound during the monthly timeframe

- 1-year change: -93.41%, reflecting the severe long-term depreciation from launch levels

Market Capitalization Data:

- Circulating market cap: $13,050,041.91

- Fully diluted valuation (FDV): $22,051,000.00

- Market cap to FDV ratio: 59.18%, indicating that approximately 591.81 million out of 1 billion total tokens are in active circulation

- Market dominance: 0.00068%

Trading Activity:

- 24-hour trading volume: $83,219.59, reflecting relatively modest daily liquidity

- Token holders: 20,469, distributed across the network

- Exchange listings: 28 platforms including Gate.com, providing multiple trading venues for PORTAL

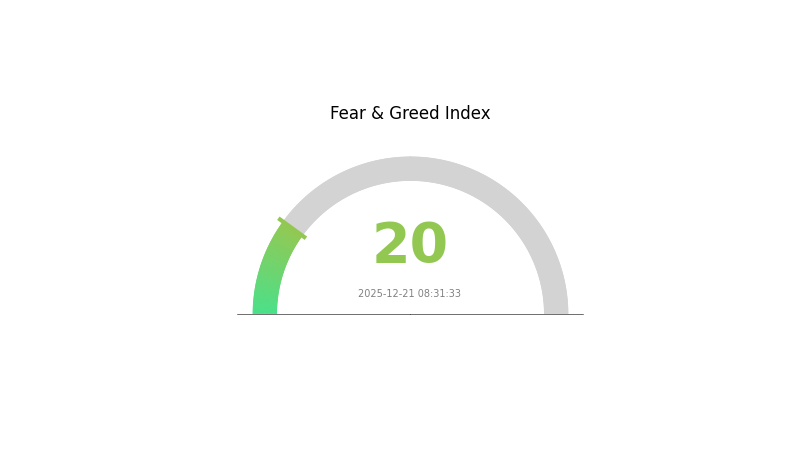

Market Sentiment: The Crypto Fear and Greed Index currently stands at 20, indicating "Extreme Fear" in the broader cryptocurrency market environment, which may be contributing to downward pressure on altcoins including PORTAL.

Click to view current PORTAL market price

PORTAL Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 20. This level typically indicates significant market pessimism and investor anxiety. When fear reaches such extremes, it often creates both risks and opportunities - many long-term investors view these periods as potential buying opportunities, while others prefer to wait for stabilization. Monitor key support levels closely and consider your risk tolerance before making trading decisions. On Gate.com, you can track real-time market sentiment and manage your portfolio accordingly.

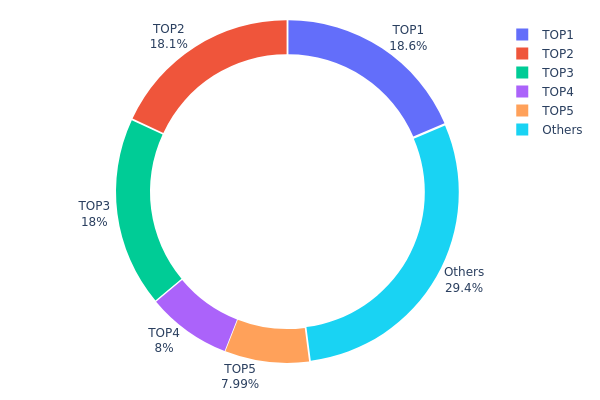

PORTAL Holdings Distribution

The holdings distribution chart illustrates the concentration of PORTAL tokens across blockchain addresses, revealing the extent to which token ownership is centralized or dispersed among holders. This metric is critical for assessing the decentralization degree and market structure stability of the token.

Current data demonstrates a notable concentration risk within the PORTAL ecosystem. The top three addresses collectively hold 54.60% of all tokens in circulation, with individual holdings ranging from 17.97% to 18.55%. This level of concentration among the leading holders indicates significant centralization, which is further amplified when considering that the top five addresses control 70.58% of total supply, leaving only 29.42% distributed among remaining holders. Such distribution patterns suggest potential vulnerability to market manipulation and substantial price volatility should these major holders execute coordinated trading activities.

The concentration profile poses meaningful implications for PORTAL's market dynamics and structural integrity. Addresses holding 8% or more of the token supply possess considerable influence over market sentiment and liquidity conditions. This asymmetric distribution may constrain organic price discovery mechanisms and create conditions conducive to whale-driven volatility. While the presence of a distributed "Others" category holding nearly 30% provides some counterbalance, the cumulative power concentrated in the top five addresses suggests that PORTAL's decentralization profile requires attention, particularly regarding the governance and strategic incentives of these major stakeholders.

Click to view current PORTAL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc08f...c212ea | 185522.23K | 18.55% |

| 2 | 0x5a52...70efcb | 180838.41K | 18.08% |

| 3 | 0xc430...092ad4 | 179798.89K | 17.97% |

| 4 | 0xf977...41acec | 80000.00K | 8.00% |

| 5 | 0xf42a...36f173 | 79868.32K | 7.98% |

| - | Others | 293972.16K | 29.42% |

II. Core Factors Influencing PORTAL's Future Price

Market Sentiment and Trading Activity

-

Overall Market Sentiment: PORTAL's price is influenced by broader cryptocurrency market sentiment and trading volume. Positive market conditions tend to drive higher trading activity, which can support price appreciation.

-

User Adoption Trends: The price movement is closely tied to user adoption trends within the PORTAL ecosystem. As more users engage with the platform and projects, increased demand can positively impact token valuation.

-

Project Development Progress: Investors must closely monitor project milestones and development progress. Any delays or challenges in project execution can create downward pressure on the token's price, while successful releases and updates can provide upward momentum.

Market Volatility and Risk Factors

-

Price Volatility: Cryptocurrency markets, including PORTAL, experience significant price fluctuations. Investors should implement robust risk management strategies to protect their positions.

-

Project Development Risks: If the PORTAL project encounters bottlenecks or significant challenges in its development roadmap, the token's intrinsic value could be negatively impacted, potentially leading to sustained price declines.

Investors considering long-term holdings of PORTAL should conduct thorough risk assessments and maintain vigilance regarding market fluctuations and project developments that could influence token performance.

III. 2025-2030 PORTAL Price Forecast

2025 Outlook

- Conservative Forecast: $0.01685 - $0.02218

- Neutral Forecast: $0.02218

- Optimistic Forecast: $0.02883 (requires sustained market confidence and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual recovery, supported by incremental adoption and protocol improvements

- Price Range Forecast:

- 2026: $0.02372 - $0.02933 (15% upside potential)

- 2027: $0.02193 - $0.03619 (24% upside potential)

- 2028: $0.02226 - $0.03657 (44% upside potential)

- Key Catalysts: Enhanced tokenomics implementation, expanded partnership ecosystem, improved on-chain activity metrics, and broader market recovery cycles

2029-2030 Long-term Outlook

- Base Case Scenario: $0.03179 - $0.03419 (55% cumulative gain by 2029, assuming steady-state adoption and normal market conditions)

- Optimistic Scenario: $0.03846 - $0.04273 (continued institutional interest and protocol value accrual)

- Transformation Scenario: $0.04923 (74% cumulative appreciation by 2030, contingent on breakthrough use cases, significant TVL growth, and favorable macroeconomic conditions)

Note: All forecasts should be monitored through platforms like Gate.com for real-time price action and fundamental developments. Historical price data and market sentiment indicators should be continuously evaluated against these projections.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02883 | 0.02218 | 0.01685 | 0 |

| 2026 | 0.02933 | 0.0255 | 0.02372 | 15 |

| 2027 | 0.03619 | 0.02741 | 0.02193 | 24 |

| 2028 | 0.03657 | 0.0318 | 0.02226 | 44 |

| 2029 | 0.04273 | 0.03419 | 0.03179 | 55 |

| 2030 | 0.04923 | 0.03846 | 0.02654 | 74 |

PORTAL Investment Strategy and Risk Management Report

IV. PORTAL Professional Investment Strategy and Risk Management

PORTAL Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Web3 gaming enthusiasts and cross-chain platform believers with medium to long-term investment horizons

- Operational Recommendations:

- Accumulate during market downturns when PORTAL trades below the 30-day average, leveraging the current -93.41% year-over-year decline as a potential entry opportunity

- Maintain consistent positions across multiple market cycles, given the project's recovery potential from all-time low of $0.00732 (reached October 10, 2025)

- Store holdings securely through Gate.com Web3 Wallet for convenient access and management

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour range ($0.022051-$0.023238) and historical price zones for entry and exit signals

- Volume Analysis: Track the 24-hour trading volume of $83,219.59 to identify potential breakout opportunities

- Wave Trading Key Points:

- Capitalize on the current 1-hour decline of -0.31% as potential reversal zones

- Utilize the positive 30-day momentum (+23.47%) as confirmation for uptrend positioning

PORTAL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation

- Active Investors: 2-5% portfolio allocation

- Professional Investors: 5-10% portfolio allocation

(2) Risk Hedging Solutions

- Stablecoin Reserve: Maintain 40-50% of allocated capital in stablecoins to capture potential dips and rebalance positions

- Position Sizing: Apply strict position limits to prevent overexposure to single crypto assets with high volatility profiles

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate.com Web3 wallet for frequent trading and accessibility

- Cold Storage Approach: Utilize hardware security practices for long-term holdings exceeding 6 months

- Security Considerations: Enable multi-signature authentication, use strong passwords, maintain offline backups of recovery phrases, and never share private keys or seed phrases with any third party

V. PORTAL Potential Risks and Challenges

PORTAL Market Risk

- Extreme Price Volatility: PORTAL has experienced a severe -93.41% decline over one year and trades significantly below its all-time high of $4.666 (February 29, 2024), indicating substantial downside exposure and potential for continued depreciation

- Limited Trading Volume: Daily trading volume of $83,219.58 is relatively modest for an ERC20 token, creating liquidity constraints that may amplify price movements and reduce exit flexibility

- Market Sentiment Uncertainty: Current negative short-term performance (-3.54% in 24 hours) reflects ongoing bearish market sentiment toward cross-chain gaming platforms

PORTAL Regulatory Risk

- Gaming Industry Regulation: Web3 gaming platforms face evolving regulatory scrutiny globally, with potential restrictions on token-based gaming economies and in-game rewards systems

- Token Classification Uncertainty: Ongoing regulatory debate regarding whether gaming tokens constitute securities could trigger compliance changes or trading restrictions

- Cross-Border Compliance: Operating across multiple blockchain networks increases exposure to fragmented regulatory regimes across different jurisdictions

PORTAL Technology Risk

- Cross-Chain Integration Complexity: Multi-blockchain operations introduce technical vulnerabilities in bridge protocols and cross-chain messaging systems

- Smart Contract Vulnerabilities: ERC20 token contracts remain subject to potential bugs, exploits, or security failures that could compromise user funds

- Adoption Bottlenecks: Success depends on achieving sufficient player adoption to establish network effects; insufficient user growth could render the platform economically unviable

VI. Conclusion and Action Recommendations

PORTAL Investment Value Assessment

Portal operates as a cross-chain gaming platform targeting Web3 player onboarding, trading at $0.022051 with a fully diluted valuation of $22.05 million and market capitalization representing 0.00068% of the total crypto market. While the project addresses a relevant market segment, the extreme -93.41% year-over-year decline from historical highs and modest trading liquidity suggest elevated risk. The platform's ability to generate sustainable user adoption and differentiate within the competitive gaming sector remains unproven. Current valuation reflects significant market skepticism regarding both the gaming narrative and cross-chain functionality viability.

PORTAL Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% portfolio weight) through Gate.com only after understanding cross-chain gaming dynamics and conducting thorough platform research ✅ Experienced Investors: Consider tactical accumulation during capitulation phases while maintaining strict stop-loss disciplines at -30% from entry prices ✅ Institutional Investors: Conduct comprehensive due diligence on gaming mechanics, user metrics, and revenue generation before considering allocation, given limited institutional coverage

PORTAL Trading Participation Methods

- Gate.com Spot Trading: Direct PORTAL/USDT and PORTAL/ETH pairs for immediate liquidity and transparent pricing

- DCA Strategy: Implement dollar-cost averaging purchases on monthly intervals to reduce timing risk and average entry prices

- Market Orders: Execute small position entries during high-volume periods to minimize slippage and optimize fill prices

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and financial circumstances. Consultation with professional financial advisors is strongly recommended. Never invest capital that exceeds your loss tolerance threshold.

FAQ

How much is the portal coin worth?

As of today, Portal coin is worth $0.02280 with a market cap of $13.49 million and trading volume of $10.16 million.

What is the price prediction for PORTAL token in 2025?

Based on market analysis, PORTAL token price predictions for 2025 range from $0.01841 to $0.35631, with an average projection around $0.08282. These forecasts reflect current market dynamics and technical indicators.

What factors could influence PORTAL coin price in the future?

PORTAL coin price is influenced by market sentiment, trading volume, technological developments, user adoption, ecosystem growth, and macroeconomic conditions. Regulatory changes and competitive dynamics also impact price movements.

Is PORTAL a good investment and what are the risks?

PORTAL presents high growth potential within the Web3 ecosystem, attracting institutional interest. However, it carries elevated volatility and market risks typical of emerging crypto projects. Conduct thorough due diligence before investing.

2025 SHARDS Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 CREO Price Prediction: Analyzing Growth Potential and Market Trends for the Emerging Cryptocurrency

2025 G3 Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2025 CELB Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2025 COPI Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Digital Asset Landscape

Is Gomble (GM) a good investment?: Analyzing the automaker's financial performance and future prospects

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?