2025 PLA Price Prediction: Analyzing Market Trends and Technological Advancements in 3D Printing Materials

Introduction: PLA's Market Position and Investment Value

PlayDapp (PLA), as a blockchain gaming platform designed to democratize access to digital assets, has made significant strides since its inception in 2020. As of 2025, PlayDapp's market capitalization stands at $1,576,127, with a circulating supply of approximately 634,355,934 tokens and a price hovering around $0.00248461. This asset, often referred to as the "NFT gaming enabler," is playing an increasingly crucial role in the realm of blockchain gaming and interoperable digital assets.

This article will provide a comprehensive analysis of PlayDapp's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. PLA Price History Review and Current Market Status

PLA Historical Price Evolution

- 2021: PLA reached its all-time high of $3.74 on October 31, marking a significant milestone for the token.

- 2025: The token experienced a sharp decline, reaching its all-time low of $0.00220456 on November 20.

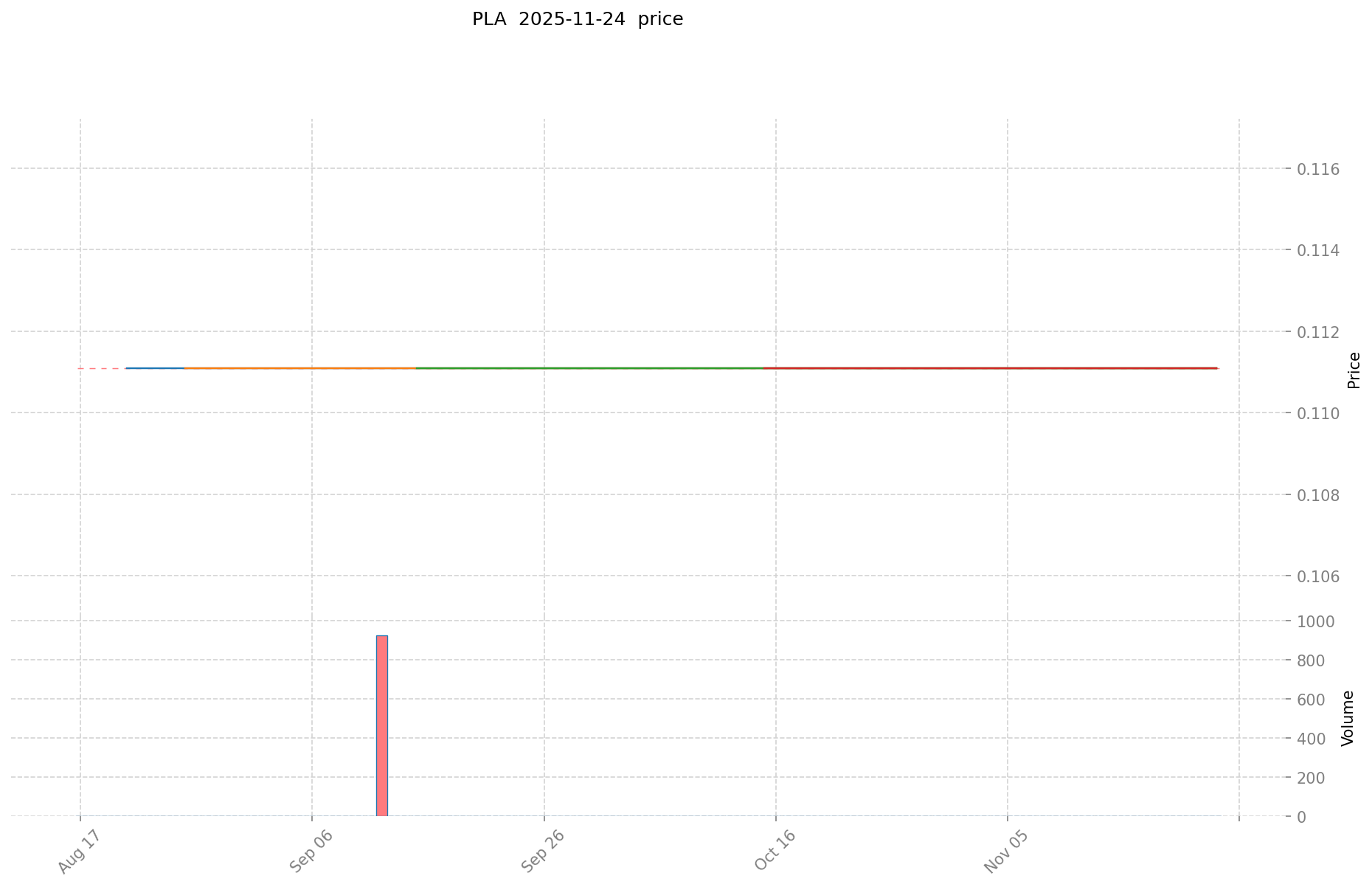

PLA Current Market Situation

As of November 25, 2025, PLA is trading at $0.00248461. The token has shown some signs of recovery in the short term, with a 2.26% increase in the last hour and a 4.55% gain over the past week. However, the longer-term trend remains bearish, with a 22.23% decrease over the last 30 days and a 20.76% decline in the past year.

The current market capitalization of PLA stands at $1,576,127, ranking it at 2314 in the cryptocurrency market. The token's circulating supply is 634,355,934 PLA, which represents 25.48% of its total supply of 700,000,000 tokens.

Despite the recent positive short-term momentum, PLA is still trading significantly below its all-time high, indicating a challenging market environment for the token.

Click to view the current PLA market price

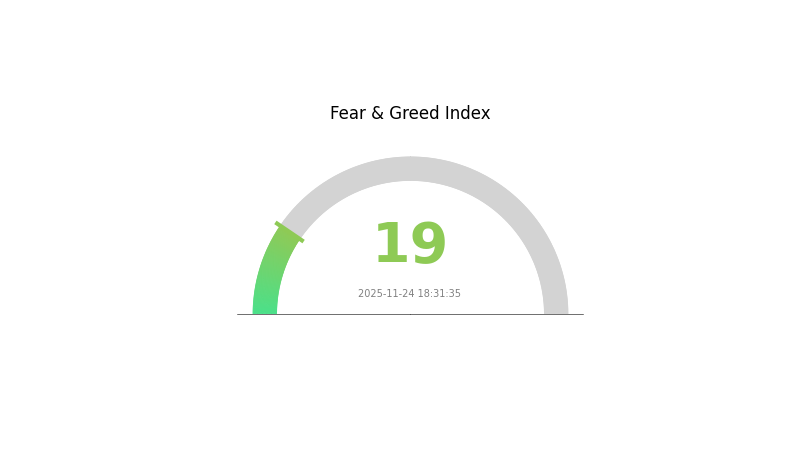

PLA Market Sentiment Indicator

2025-11-24 Fear and Greed Index: 19 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment has plunged into extreme fear territory, with the Fear and Greed Index registering a low of 19. This indicates widespread pessimism and uncertainty among investors. Such extreme fear levels often present potential buying opportunities for contrarian investors, as markets tend to overreact in both directions. However, caution is advised as the underlying reasons for this sentiment should be carefully evaluated before making any investment decisions.

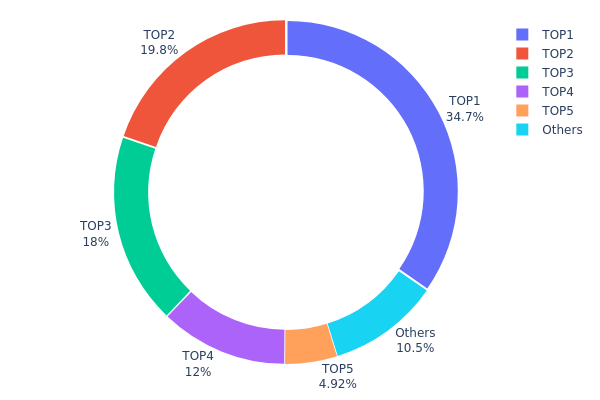

PLA Holdings Distribution

The address holdings distribution data for PLA reveals a highly concentrated ownership structure. The top address holds a substantial 34.67% of the total supply, while the top 5 addresses collectively control 89.46% of all PLA tokens. This level of concentration raises concerns about the token's decentralization and potential market manipulation risks.

Such a concentrated distribution can lead to significant price volatility and market instability. With a small number of addresses holding the majority of tokens, large sell-offs or purchases by these whale accounts could dramatically impact PLA's price. Furthermore, this concentration potentially compromises the project's governance structure, as these major holders may have disproportionate influence over decision-making processes.

The current distribution pattern suggests that PLA's on-chain structure lacks robust decentralization, which is generally considered a key principle in cryptocurrency ecosystems. This concentration may deter some investors due to perceived risks of market manipulation and power imbalances within the network.

Click to view the current PLA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa8ef...06c738 | 863340.93K | 34.67% |

| 2 | 0x40ec...5bbbdf | 493231.32K | 19.80% |

| 3 | 0x72ff...a4d3b1 | 449087.93K | 18.03% |

| 4 | 0xc0da...72405b | 300000.00K | 12.04% |

| 5 | 0xe09a...f64207 | 122598.61K | 4.92% |

| - | Others | 261741.22K | 10.54% |

II. Key Factors Affecting PLA's Future Price

Supply Mechanism

- Raw Material Costs: The price of key raw materials like corn and cassava directly impacts PLA prices.

- Historical Patterns: In 2021, rising pulp prices led to an increase in paper market prices.

- Current Impact: The price trends of relevant raw materials have a significant influence on PLA prices.

Macroeconomic Environment

- Inflation Hedging Properties: Gold and silver prices have experienced significant increases, with institutions maintaining a positive outlook on their long-term value.

- Geopolitical Factors: Frequent global geopolitical conflicts and uncertain economic recovery prospects enhance gold's attractiveness as an ultimate safe-haven asset.

Technical Development and Ecosystem Building

- Energy Storage Applications: The energy storage industry is driving lithium battery demand, with growth expected to exceed 30% next year.

- AI-Driven Demand: AI is promoting explosive growth in data center scale, requiring energy storage to smooth grid impact and support peak computing power.

III. PLA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.10777 - $0.11

- Neutral prediction: $0.11 - $0.13

- Optimistic prediction: $0.13 - $0.13999 (requires favorable market conditions and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential consolidation followed by growth phase

- Price range forecast:

- 2027: $0.06915 - $0.17415

- 2028: $0.13448 - $0.16621

- Key catalysts: Technological advancements, ecosystem expansion, and broader market trends

2029-2030 Long-term Outlook

- Base scenario: $0.15866 - $0.19594 (assuming steady growth and adoption)

- Optimistic scenario: $0.19594 - $0.23323 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $0.23323 - $0.24493 (with breakthrough applications and mainstream integration)

- 2030-11-25: PLA $0.24493 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.13999 | 0.1111 | 0.10777 | 4371 |

| 2026 | 0.13056 | 0.12554 | 0.09165 | 4952 |

| 2027 | 0.17415 | 0.12805 | 0.06915 | 5053 |

| 2028 | 0.16621 | 0.1511 | 0.13448 | 5981 |

| 2029 | 0.23323 | 0.15866 | 0.09837 | 6285 |

| 2030 | 0.24493 | 0.19594 | 0.15675 | 7786 |

IV. Professional Investment Strategies and Risk Management for PLA

PLA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate PLA tokens during market dips

- Stake PLA tokens to earn additional rewards

- Store PLA tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Gauge overbought or oversold conditions

- Key points for swing trading:

- Monitor PlayDapp ecosystem developments and partnerships

- Set stop-loss orders to manage downside risk

PLA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple gaming tokens

- Options contracts: Use to protect against downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for PLA

PLA Market Risks

- Volatility: Gaming token prices can be highly volatile

- Competition: Increasing competition in the blockchain gaming sector

- Market sentiment: Shifts in overall crypto market sentiment

PLA Regulatory Risks

- Gaming regulations: Potential changes in online gaming regulations

- Crypto regulations: Evolving cryptocurrency regulations globally

- NFT regulations: Possible new rules governing NFT trading and ownership

PLA Technical Risks

- Smart contract vulnerabilities: Potential exploits in PlayDapp's smart contracts

- Scalability issues: Challenges in handling increased user activity

- Interoperability problems: Difficulties in cross-chain asset transfers

VI. Conclusion and Action Recommendations

PLA Investment Value Assessment

PLA presents long-term potential in the growing blockchain gaming sector but faces short-term volatility and competitive risks. Its value proposition lies in its interoperable NFT ecosystem and growing user base.

PLA Investment Recommendations

✅ Beginners: Start with small positions, focus on understanding the PlayDapp ecosystem ✅ Experienced investors: Consider dollar-cost averaging and actively monitor project developments ✅ Institutional investors: Conduct thorough due diligence and consider PLA as part of a diversified gaming token portfolio

PLA Trading Participation Methods

- Spot trading: Buy and sell PLA tokens on Gate.com

- Staking: Participate in PLA staking programs for additional rewards

- NFT trading: Engage in PlayDapp's NFT marketplace for potential gains

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will POL reach 1$?

While possible, POL reaching $1 is uncertain. Market conditions and adoption will play key roles in its future price movement.

Will pi coin reach $100?

It's unlikely Pi coin will reach $100 soon. While some optimistic predictions exist, its future value remains highly uncertain and speculative.

How much will 1 pi be worth in 2025?

Based on current market analysis, 1 pi is projected to be worth between $500 and $520 in 2025. This estimate reflects potential growth trends in the cryptocurrency market.

Is PlayDapp a good investment?

Yes, PlayDapp shows potential for good returns. Its innovative blockchain gaming platform and growing user base make it an attractive investment in the Web3 space.

Share

Content