2025 PIZZA Price Prediction: Expert Analysis and Market Forecast for the Digital Asset

Introduction: Market Position and Investment Value of PIZZA

PIZZA (PIZZA), as a BRC-20 ordinals-based digital asset distributed by UniSat on May 22nd to celebrate Bitcoin Pizza Day, has established itself as a notable player in the blockchain ecosystem. As of December 2025, PIZZA maintains a market capitalization of $2,179,800 with a circulating supply of 21,000,000 tokens, trading at approximately $0.1038 per token. This uniquely positioned asset, recognized for its symbolic connection to Bitcoin's historical narrative, continues to generate market interest among cryptocurrency enthusiasts.

This article will provide a comprehensive analysis of PIZZA's price movements and market trends, examining historical performance metrics, trading volume dynamics, and ecosystem developments to deliver professional price forecasts and practical investment guidance for market participants.

PIZZA Market Analysis Report

I. PIZZA Price History Review and Current Market Status

PIZZA Historical Price Evolution Trajectory

PIZZA is a BRC-20 token that was distributed by UniSat on May 22, 2024, in celebration of Bitcoin Pizza Day. Since its launch in April 2024, the token has experienced significant price volatility:

- May 2024: Launch and initial distribution phase, with the token reaching its all-time high of $8.80 on June 9, 2024

- June - December 2025: Extended downtrend phase, experiencing a substantial decline of 94.6% over the one-year period

- December 2025: Current period showing recent volatility, with the token trading near multi-month lows established on December 16, 2025 at $0.08451

PIZZA Current Market Status

As of December 25, 2025, PIZZA is trading at $0.1038, representing the following performance metrics across different timeframes:

- 1-Hour Performance: +2.31% ($0.002344 change)

- 24-Hour Performance: +4.58% ($0.004546 change) with trading range between $0.09979 and $0.10951

- 7-Day Performance: +1.41% ($0.001443 change)

- 30-Day Performance: -24.68% ($-0.034012 change)

- 1-Year Performance: -94.60% ($-1.818422 change)

The token maintains a market capitalization of approximately $2,179,800 with a fully diluted valuation identical to its current market cap, reflecting 100% circulation of its 21,000,000 maximum supply. PIZZA commands a market dominance of 0.000068%, ranking #2080 among all cryptocurrencies. The 24-hour trading volume stands at $12,486.20, with the token actively traded on 4 exchanges. The current holder base comprises 78,178 addresses.

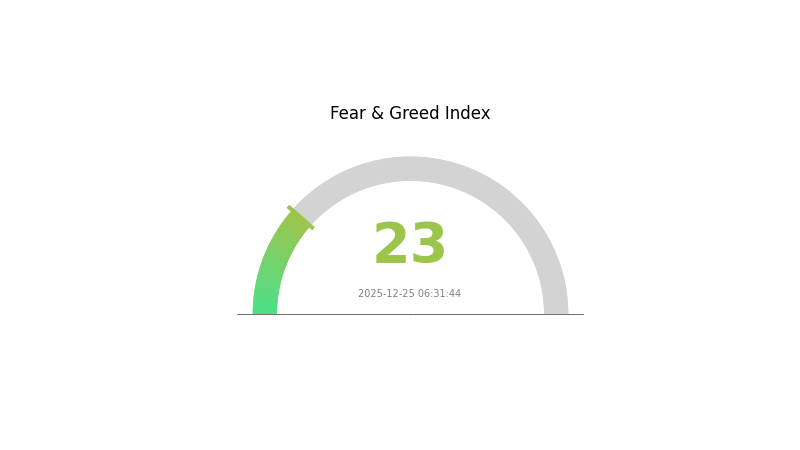

Market sentiment indicators show "Extreme Fear" conditions (VIX: 23), suggesting bearish market psychology during this period.

View current PIZZA market price

PIZZA Market Sentiment Index

2025-12-25 Fear & Greed Index: 23 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear & Greed Index dropping to 23. This indicates intense market pessimism and heightened risk aversion among investors. During such periods of extreme fear, market volatility typically increases significantly. Long-term investors often view this as a potential accumulation opportunity, as prices tend to be undervalued. However, traders should remain cautious and implement proper risk management strategies. Monitor key support levels closely and consider dollar-cost averaging to mitigate timing risks in this highly volatile environment.

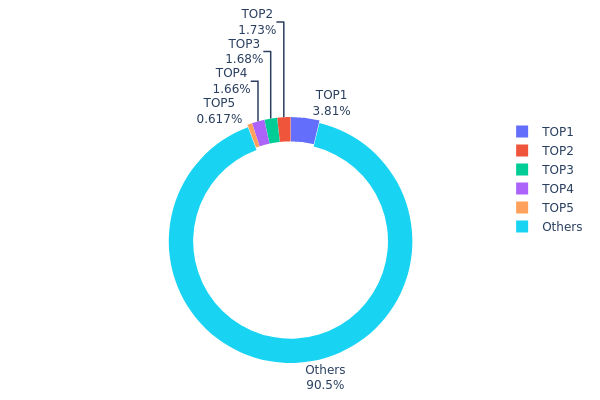

PIZZA Holdings Distribution

The holdings distribution chart illustrates the concentration of PIZZA tokens across blockchain addresses, providing critical insights into token ownership patterns and potential market dynamics. By examining the top holders and their respective percentage allocations, analysts can assess the degree of decentralization and identify concentration risks that may influence price stability and market behavior.

The current distribution data reveals a relatively healthy decentralization structure for PIZZA. The top five addresses collectively account for only 9.47% of total token supply, with the largest holder controlling 3.80%. This distribution contrasts sharply with excessive concentration scenarios where a single or few addresses dominate token holdings. The remaining 90.53% of tokens are distributed across numerous other addresses, indicating a broad-based ownership model that mitigates single-entity control risks.

This dispersed holding pattern suggests a lower susceptibility to coordinated market manipulation or sudden price pressure from major holders. The absence of dominant whale positions—where top holders typically exceed 10-15% individually—reduces the likelihood of large-scale token dumps destabilizing market prices. Furthermore, the granular distribution of tokens across thousands of addresses reflects a mature market structure characterized by improved on-chain stability and enhanced resilience against concentrated liquidation events. Such balanced distribution patterns typically correlate with stronger organic demand, improved market sentiment, and reduced volatility driven by individual actor decisions.

For current PIZZA holdings distribution data, visit Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | bc1pug...fla347 | 800.00K | 3.80% |

| 2 | bc1ps0...ss2vxa | 363.74K | 1.73% |

| 3 | 14vkgC...4CSaCo | 352.78K | 1.67% |

| 4 | 16G1xY...Vp9Wxh | 348.93K | 1.66% |

| 5 | bc1pyd...wykt7z | 129.55K | 0.61% |

| - | Others | 19004.99K | 90.53% |

Analysis of Core Factors Affecting PIZZA's Future Price

II. Core Factors Affecting PIZZA's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: According to market experts, the U.S. Federal Reserve's (FED) future interest rate policy decisions will significantly influence global liquidity flows. These monetary policy shifts have direct implications for asset valuations, including cryptocurrencies and related digital assets.

-

U.S. Stablecoin Legislation: The specific implementation progress of U.S. stablecoin regulatory frameworks will directly impact market dynamics and institutional adoption of cryptocurrency-related assets and platforms.

III. 2025-2030 PIZZA Price Forecast

2025 Outlook

- Conservative Forecast: $0.05718 - $0.10588

- Neutral Forecast: $0.10588

- Optimistic Forecast: $0.13023 (requires sustained market momentum and increased adoption)

2026-2028 Mid-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with steady accumulation of market participants and ecosystem development

- Price Range Forecast:

- 2026: $0.08972 - $0.13458

- 2027: $0.07327 - $0.14148

- 2028: $0.08971 - $0.14461

- Key Catalysts: Enhanced protocol functionality, expanded community engagement, strategic partnerships within the blockchain ecosystem, and positive sentiment cycles

2029-2030 Long-term Outlook

- Base Case Scenario: $0.09748 - $0.18939 (assumes steady ecosystem growth and moderate market expansion)

- Optimistic Scenario: $0.13926 - $0.18939 (assumes accelerated adoption and strong market recovery)

- Transformational Scenario: $0.16432 - $0.17089 (extreme favorable conditions including major institutional interest and breakthrough utility expansion)

- 2030-12-25: PIZZA reaches potential long-term equilibrium with sustained upward trajectory of approximately 58% cumulative gain from current baseline

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.13023 | 0.10588 | 0.05718 | 2 |

| 2026 | 0.13458 | 0.11806 | 0.08972 | 13 |

| 2027 | 0.14148 | 0.12632 | 0.07327 | 21 |

| 2028 | 0.14461 | 0.1339 | 0.08971 | 28 |

| 2029 | 0.18939 | 0.13926 | 0.09748 | 34 |

| 2030 | 0.17089 | 0.16432 | 0.09366 | 58 |

PIZZA Investment Strategy and Risk Management Report

IV. PIZZA Professional Investment Strategy and Risk Management

PIZZA Investment Methodology

(1) Long-term Hold Strategy

- Suitable Investors: BRC-20 asset collectors and Bitcoin ecosystem enthusiasts

- Operation Recommendations:

- Accumulate PIZZA during market downturns, as the token has experienced a -94.6% decline over the past year, potentially offering entry opportunities

- Maintain positions through multiple market cycles to capture potential recovery upside

- Set price targets based on historical highs of $8.8 and support levels around $0.08451

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Use the 24-hour low of $0.09979 and high of $0.10951 as immediate trading boundaries

- Volatility Metrics: Monitor 24-hour volume of 12,486.20 units to assess liquidity and price movement intensity

- Wave Trading Key Points:

- Execute short-term trades during high volatility periods when 24-hour price changes exceed 4%

- Capitalize on intraday movements, as 1-hour pricing shows 2.31% fluctuations

PIZZA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% allocation maximum to highly speculative BRC-20 assets

- Active Investors: 2-5% allocation with strict stop-loss discipline

- Professional Investors: 5-10% allocation within diversified cryptocurrency portfolios

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance PIZZA holdings with stable BRC-20 tokens and established cryptocurrencies

- Stop-Loss Implementation: Set stops at 15-20% below entry prices to manage downside risk

(3) Secure Storage Solutions

- Hardware wallet Approach: Store BRC-20 assets in secure self-custody solutions that support Ordinals protocol

- Exchange Custody: Maintain trading positions on Gate.com for active trading while transferring long-term holdings to cold storage

- Security Precautions: Never share private keys, enable multi-signature protocols where available, and verify contract addresses against official sources at https://uniscan.cc/brc20/pizza

V. PIZZA Potential Risks and Challenges

PIZZA Market Risk

- Extreme Volatility: The token has declined 94.6% year-over-year and 24.68% over the past month, indicating severe price instability

- Limited Liquidity: With only 4 exchanges providing trading pairs and relatively low 24-hour volume, PIZZA faces significant liquidity constraints

- Market Capitalization Concentration: At $2.18 million fully diluted valuation, PIZZA remains a micro-cap asset vulnerable to manipulation

PIZZA Regulatory Risk

- BRC-20 Asset Uncertainty: As an emerging token standard on Bitcoin, regulatory classification remains unclear across jurisdictions

- Compliance Status: Limited information on compliance frameworks for ordinals-based assets may create future regulatory challenges

- Exchange Delisting Risk: Regulatory pressures could result in reduced exchange support or delisting on trading platforms

PIZZA Technical Risk

- Protocol Dependency: PIZZA relies on Bitcoin's ordinals infrastructure, which is still experimental and subject to network changes

- Scalability Concerns: As a BRC-20 token, transaction throughput and settlement times depend on Bitcoin network capacity

- Standard Evolution: Changes to the ordinals or BRC-20 standards could impact token functionality and value

VI. Conclusions and Action Recommendations

PIZZA Investment Value Assessment

PIZZA represents a highly speculative, micro-cap BRC-20 token created to commemorate Bitcoin Pizza Day. While the project benefits from association with Bitcoin's ecosystem and the innovative ordinals technology, it faces substantial challenges including extreme price volatility (down 94.6% year-over-year), minimal trading liquidity, and regulatory uncertainty. The token's small market cap of $2.18 million and concentration among 78,178 holders creates significant price risk. Long-term value proposition remains unclear beyond novelty and community appeal.

PIZZA Investment Recommendations

✅ Beginners: Avoid direct PIZZA purchases; if interested in BRC-20 assets, start with extensive research and allocate only 0.5-1% of cryptocurrency portfolio to experimental tokens

✅ Experienced Investors: Consider small speculative positions (1-3% of crypto allocation) using Gate.com for trading, with strict risk management and stop-losses at 15-20% below entry

✅ Institutional Investors: Unsuitable for institutional portfolios due to illiquidity, micro-cap status, and unclear regulatory framework; research-only recommendation

PIZZA Trading Participation Methods

- Direct Purchase on Gate.com: Access PIZZA through Gate.com's trading platform with BTC or USDT pairs for active traders

- Ordinals Protocol Integration: Use Bitcoin wallet solutions supporting ordinals to manage PIZZA holdings in self-custody

- Research Participation: Monitor price trends and community sentiment on https://pizzaday.io/ before committing capital

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

What is the price of the pizza in Bitcoin?

The Bitcoin Pizza Index currently values pizza at approximately $874,997,813, representing the milestone of the first documented Bitcoin pizza transaction. The exact price in Bitcoin fluctuates based on current market conditions and Bitcoin's value.

What happens when the price of pizza decreases?

When PIZZA price decreases, demand typically increases as it becomes more affordable. Lower prices attract more buyers and can boost trading volume. This often signals growing market interest and potential buying momentum in the PIZZA ecosystem.

What factors influence PIZZA token price movements?

PIZZA token price is influenced by market demand, trading volume, investor sentiment, macroeconomic conditions, NFT sector trends, and community adoption rates.

How can I predict PIZZA price trends in the short term?

Use technical analysis with indicators like MACD, RSI, and Bollinger Bands. Monitor trading volume, market sentiment, and on-chain data to identify short-term price movement patterns and trends.

What is the historical price performance of PIZZA?

PIZZA reached an all-time high of $0.000017 on December 19, 2025. The token has experienced significant price fluctuations throughout 2025, reflecting market volatility typical of emerging cryptocurrency projects.

Is PIZZA a good investment for price appreciation?

PIZZA demonstrates strong fundamentals with consistent trading activity and growing market adoption. Its tokenomics support price appreciation potential, making it an attractive option for investors seeking exposure to the crypto market.

Will Crypto Recover in 2025?

2025 BRCST Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 DRAC Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

2025 O4DX Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Cryptocurrency

Maximize Your Crypto Portfolio: Comprehensive Guide to 1000SATS Token Listings

2025 O4DX Price Prediction: Expert Analysis and Market Forecast for the Coming Year

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?