2025 NOS Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: Market Position and Investment Value of NOS

Nosana (NOS), a decentralized computing platform that democratizes CPU cloud computing, has emerged as a significant player in the blockchain infrastructure space since its inception in 2022. As of December 2025, Nosana's market capitalization has reached approximately $22.83 million, with a circulating supply of 83.4 million NOS tokens trading at around $0.2283 per token. This innovative asset, recognized for enabling developers and community members to collectively share computing resources and earn rewards, is playing an increasingly crucial role in supporting decentralized development operations and CI/CD infrastructure.

This comprehensive analysis will examine Nosana's price trajectory through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development progress, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for market participants.

Nosana (NOS) Market Analysis Report

I. NOS Price History Review and Market Status

NOS Historical Price Movement Trajectory

- October 2023: Market bottom reached at $0.01046656 (ATL date: October 24, 2023)

- March 2024: All-time high of $7.83 achieved (ATH date: March 7, 2024)

- 2024-2025: Significant decline phase, price dropped from $7.83 to current levels, representing a -92.44% decline over the past year

NOS Current Market Situation

As of December 20, 2025, NOS is trading at $0.2283 with a 24-hour trading volume of $23,486.13. The token has experienced a modest positive momentum in the short term, gaining 1.1% in the past 24 hours, though it faces headwinds on longer timeframes with a -6.01% decline over 7 days and -10.44% over the past 30 days.

The current market capitalization stands at $19,040,220.00, with a fully diluted valuation of $22,830,000.00, giving NOS a market dominance of 0.00071%. The circulating supply is 83.4 million NOS out of a total supply of 100 million tokens, with an unlimited maximum supply. Current market sentiment reflects extreme fear (VIX: 20), which may be influencing broader market dynamics.

NOS is listed on 8 exchanges and maintains an active holder base of 48,175 addresses. The token launched at $0.03 on January 16, 2022, and is built on the Solana blockchain.

Click to view current NOS market price

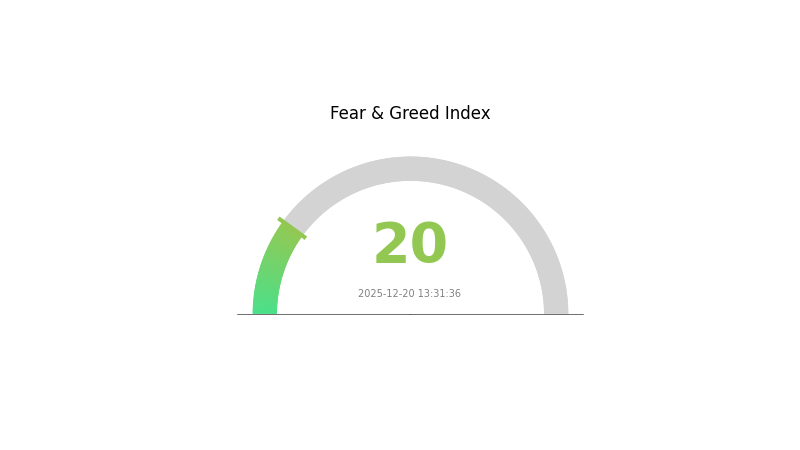

NOS Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This indicates heightened market anxiety and pessimistic sentiment among investors. During such periods, market volatility typically increases, and risk assets face significant selling pressure. However, extreme fear often presents opportunities for contrarian investors seeking favorable entry points. Traders should remain cautious, avoid emotional decision-making, and conduct thorough research before making investment moves. Monitor market developments closely and consider diversifying your portfolio on Gate.com to manage risk effectively during this uncertain period.

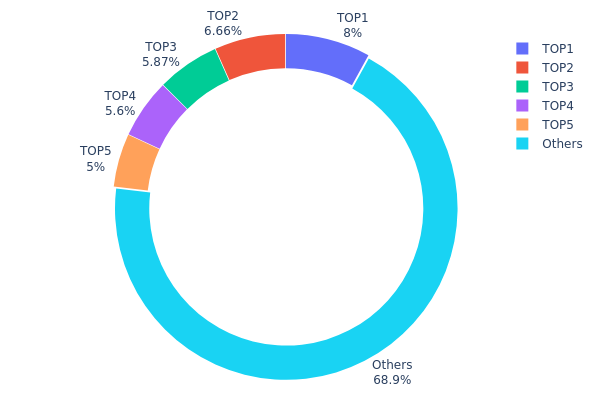

NOS Holdings Distribution

The address holdings distribution chart illustrates the concentration of NOS tokens across different wallet addresses, revealing the degree of capital concentration and decentralization within the network. By analyzing the top holders and their proportional stake, we can assess the tokenomics structure and potential market dynamics of the NOS ecosystem.

The current distribution data demonstrates a relatively moderate concentration pattern. The top five addresses collectively hold approximately 31.12% of the total supply, with the largest holder accounting for 8.00% and the second-largest at 6.65%. This concentration level, while notable, does not indicate extreme centralization, as the majority of tokens—approximately 68.88%—remain distributed across other addresses. This suggests a fairly fragmented holder base where no single entity possesses overwhelming control, reducing the risk of price manipulation through coordinated large-scale token movements by a few parties.

From a market structure perspective, the current distribution reflects a healthy balance between institutional or early stakeholder positions and broader community ownership. The absence of any address holding more than 10% of the supply indicates that NOS has achieved reasonable decentralization compared to many nascent blockchain projects. This distribution pattern generally supports price stability and reduces the probability of sudden liquidity crises triggered by concentrated sell-offs. The diverse holder composition also suggests relatively robust on-chain governance participation potential, as decision-making power is distributed rather than concentrated in the hands of a limited number of entities.

For current NOS holdings distribution data, please visit Gate.com

</Holdings Distribution Analysis>

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | nosTxp...g28g54 | 8000.00K | 8.00% |

| 2 | 9u39MP...wPpZAr | 6657.90K | 6.65% |

| 3 | nosMFV...bqpmjG | 5871.95K | 5.87% |

| 4 | nosL7e...qkWa8h | 5600.00K | 5.60% |

| 5 | nosCcR...TLmvXd | 5000.00K | 5.00% |

| - | Others | 68869.97K | 68.88% |

II. Core Factors Affecting NOS Future Price

Supply Mechanism

-

Token Supply and Scarcity: The supply mechanism and scarcity of NOS tokens directly influence their long-term value proposition. Limited token availability enhances the asset's potential appreciation, particularly as adoption increases across the Nosana Network ecosystem.

-

Historical Patterns: NOS reached its historical high of $7.83 on March 7, 2024, primarily driven by market enthusiasm and growing application adoption. The lowest price of $0.01046656 was recorded on October 24, 2023, reflecting market conditions and project development phases.

-

Current Impact: As the Nosana Network continues to mature and adoption rates increase through 2025, the fixed supply mechanism creates favorable conditions for price appreciation if demand continues to rise.

Institutional and Major Holder Dynamics

- Institutional Investment: Institutional investment and mainstream application adoption represent critical factors in determining NOS's investment potential and future price trajectory.

Macroeconomic Environment

-

Monetary Policy Impact: Global central bank policies will profoundly influence digital asset prices including NOS, with U.S. Federal Reserve adjustments being particularly critical for price movements.

-

Inflation Hedge Characteristics: As inflation pressures persist in core sectors such as food and energy, investors increasingly seek assets that provide portfolio diversification and potential inflation hedging benefits.

Technology Development and Ecosystem Building

-

EVM Compatibility and Interoperability: True interoperability and EVM compatibility are crucial technical factors for developer migration and composability with existing tools, enabling seamless integration with the broader blockchain ecosystem.

-

Data Availability and Zero-Knowledge Proofs: The implementation of data availability solutions and zero-knowledge proof models represents key technological advancements that enhance the network's scalability and security.

-

Ecosystem Partnerships: Collaboration with projects such as Nosana Network and Galactica contributes to expanding the technical capabilities and real-world applications of the NOS ecosystem.

III. NOS Price Forecast for 2025-2030

2025 Outlook

- Conservative Prediction: $0.15711 - $0.22770

- Base Case Prediction: $0.22770

- Optimistic Prediction: $0.29373 (requires sustained market momentum)

2026-2027 Mid-term Outlook

- Market Phase Expectation: Gradual recovery and accumulation phase with moderate growth trajectory

- Price Range Forecast:

- 2026: $0.21639 - $0.35718 (14% upside potential)

- 2027: $0.18228 - $0.44489 (35% upside potential)

- Key Catalysts: Ecosystem development expansion, increasing institutional adoption, improved market liquidity on platforms like Gate.com, and positive regulatory developments in major markets

2028-2030 Long-term Outlook

- Base Case Scenario: $0.28127 - $0.53617 (assumes steady ecosystem growth and gradual market maturation)

- Optimistic Scenario: $0.37692 - $0.53617 (assumes accelerated adoption and significant partnerships)

- Transformative Scenario: $0.43949 - $0.53617 (assumes breakthrough technological innovations and mainstream integration)

- 2030-12-20: NOS at $0.53617 (92% appreciation from current cycle lows, representing substantial long-term value accumulation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.29373 | 0.2277 | 0.15711 | 0 |

| 2026 | 0.35718 | 0.26072 | 0.21639 | 14 |

| 2027 | 0.44489 | 0.30895 | 0.18228 | 35 |

| 2028 | 0.42215 | 0.37692 | 0.196 | 65 |

| 2029 | 0.47944 | 0.39953 | 0.3436 | 75 |

| 2030 | 0.53617 | 0.43949 | 0.28127 | 92 |

Nosana (NOS) Professional Investment Strategy and Risk Management Report

IV. NOS Professional Investment Strategy and Risk Management

NOS Investment Methodology

(1) Long-term Hold Strategy

- Suitable Investors: Value-oriented investors who believe in decentralized computing infrastructure and are willing to hold through market cycles

- Operation Recommendations:

- Accumulate NOS tokens during market downturns, leveraging the current 92.44% year-over-year decline as a potential entry opportunity

- Dollar-cost averaging (DCA) approach to reduce timing risk and average entry costs

- Hold through ecosystem development phases as Galactica and other projects mature

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Monitor the historical high of $7.83 and low of $0.01046656 to identify potential breakout zones

- Volume Analysis: Track the 24-hour trading volume of approximately $23,486 to assess market activity and confirm price movements

-

Wave Trading Considerations:

- Monitor short-term volatility with 1-hour (-0.079%), 24-hour (+1.1%), and 7-day (-6.01%) price movements

- Execute entry positions during oversold conditions indicated by technical indicators

- Set profit-taking targets at previous resistance levels based on historical price performance

NOS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation to NOS tokens

- Aggressive Investors: 3-5% portfolio allocation to NOS tokens

- Professional Investors: 5-10% portfolio allocation with active rebalancing strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine NOS holdings with established Layer 1 tokens to balance high-risk computing infrastructure plays with proven blockchain ecosystems

- Position Sizing: Implement strict position limits based on individual risk tolerance, ensuring no single position exceeds 10% of total crypto holdings

(3) Secure Storage Solutions

- Hot Wallet Approach: Use Gate.com Web3 wallet for frequent trading and active management, with 2-3% of holdings for daily transactions

- Cold Storage Strategy: Maintain majority holdings in secure offline storage for long-term positions

- Security Considerations: Enable two-factor authentication on all trading accounts, use hardware-level security for large positions, never share private keys or recovery phrases, and verify all transaction addresses before confirmation

V. NOS Potential Risks and Challenges

NOS Market Risks

- Severe Price Volatility: NOS has experienced a dramatic 92.44% decline over the past year, from historical highs, indicating extreme volatility and potential for further drawdowns

- Low Trading Liquidity: With 24-hour trading volume of only $23,486 and a market capitalization of approximately $22.83 million, NOS faces liquidity constraints that could amplify price movements

- Limited Market Capitalization: Ranked 889th globally with only 0.00071% market dominance, NOS represents a micro-cap asset with significantly higher risk than established cryptocurrencies

NOS Regulatory Risks

- Uncertainty in Computing Infrastructure Regulation: As decentralized CPU computing platforms evolve, regulatory frameworks remain unclear and could impose restrictions on token distribution or platform operations

- Jurisdictional Compliance: Nosana's global network participants may face varying regulatory requirements across different countries, creating operational and legal complexities

- Token Classification Ambiguity: Regulatory authorities may reclassify computing tokens or adjust their treatment under securities laws, potentially impacting NOS's trading status

NOS Technology Risks

- Platform Maturity: Galactica and other Nosana projects are still in development phases, with potential technical challenges in achieving widespread adoption

- Network Security Concerns: A decentralized computing network requires robust security protocols to prevent attacks, data breaches, or computational resource misuse

- Scalability Limitations: As the network grows, maintaining performance and reliability across distributed CPU resources presents ongoing technical challenges

VI. Conclusion and Action Recommendations

NOS Investment Value Assessment

Nosana represents a speculative investment in the emerging decentralized computing infrastructure sector. While the project addresses a real market need for democratizing CPU cloud computing, the token currently exhibits extreme volatility and limited market penetration. The 92.44% year-over-year decline reflects market skepticism regarding the project's execution and commercialization potential. Investors considering NOS should view it as a high-risk, high-reward opportunity suitable only for portfolios with significant risk tolerance.

NOS Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of crypto portfolio) using Gate.com's trading platform only after thoroughly understanding the project fundamentals and blockchain technology basics. Focus on learning through small-scale transactions before increasing exposure.

✅ Experienced Investors: Employ tactical accumulation during extreme oversold conditions, maintain active position management, and integrate NOS into a diversified portfolio strategy. Use Gate.com's advanced trading tools for more sophisticated analysis and execution.

✅ Institutional Investors: Conduct comprehensive due diligence on Nosana Network's technical achievements, partnership pipeline, and revenue generation mechanisms. Establish position limits consistent with micro-cap allocation strategies and monitor ecosystem development milestones closely.

NOS Trading Participation Methods

- Spot Trading: Purchase NOS directly through Gate.com's spot trading interface for direct token ownership and long-term holding strategies

- Market Orders: Execute immediate trades during specific price targets using Gate.com's streamlined order execution

- Limit Orders: Set specific entry and exit prices to automate trading decisions and reduce emotional decision-making

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. Always consult with a qualified financial advisor before making investment decisions. Never invest more than you can afford to lose.

FAQ

What is NOS crypto?

NOS is a blockchain-powered platform providing an all-in-one ecosystem for decentralized applications. It enables new business models through crypto technology, allowing applications to leverage blockchain infrastructure for enhanced functionality and user control.

What price will NOS reach in 2030?

Based on current market trends and technical analysis, NOS is projected to reach approximately $2.561 by 2030, representing a potential increase of around 27.63% from current levels.

What factors influence NOS price prediction?

NOS price prediction is influenced by supply and demand dynamics, blockchain protocol updates, hard forks, block reward halvings, market sentiment, trading volume, and real-world adoption developments within the Nosana ecosystem.

How does NOS compare to other cryptocurrencies?

NOS offers distinct advantages including faster transaction speeds, lower transaction costs, and superior scalability compared to many competitors. Its innovative technology provides enhanced efficiency and security, positioning it as a compelling choice in the competitive cryptocurrency landscape.

What is the current market cap and trading volume of NOS?

As of December 20, 2025, NOS has a market cap of $19.03 million and a 24-hour trading volume of $248,040. The current price is approximately $0.23 per token.

Is NOS a good investment for long-term growth?

NOS demonstrates strong long-term growth potential with robust fundamentals and increasing adoption. Its technological innovations and market expansion position it well for sustained value appreciation in the crypto ecosystem.

2025 OCTA Price Prediction: Analyzing Market Trends and Growth Potential in the Digital Asset Space

2025 NATIX Price Prediction: Analyzing Market Trends and Potential Growth Factors

Render Token Future Insights: Can RNDR Hit $50 by 2030?

2025 OCTA Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 NKN Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 RZTO Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?