2025 NFE Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: NFE's Market Position and Investment Value

Edu3Labs (NFE) stands as a pioneering platform at the intersection of education and Web3 technology, dedicated to revolutionizing how people learn and interact with educational content. Since its launch in March 2024, the project has established a dynamic ecosystem combining blockchain integration with gamified learning experiences. As of January 2026, NFE maintains a market capitalization of approximately $52,593 USD, with a circulating supply of 52.59 million tokens trading around $0.001 per unit. This innovative asset is gaining recognition for its focus on democratizing educational access through decentralized mechanisms and incentive structures for both learners and content creators.

The project's ecosystem encompasses diverse offerings including the NFE Marketplace, AI University, Knowledge Contest Games, and Edu3Verse, positioning it as a significant player in the education-technology intersection. By removing geographical and socio-economic barriers to knowledge, NFE is establishing itself as a key participant in reshaping the educational landscape through Web3 solutions.

This article provides a comprehensive analysis of NFE's price trajectory from 2026 through 2031, synthesizing historical price movements, market dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for stakeholders and potential investors.

I. NFE Price History Review and Current Market Status

NFE Historical Price Evolution Trajectory

-

March 2024: NFE reached its all-time high (ATH) of $0.368 on March 21, 2024, marking the peak of the token's price performance since launch.

-

June 2025: NFE declined to its all-time low (ATL) of $0.0006458 on June 13, 2025, representing a significant correction from the previous peak.

-

January 2026: NFE recovered slightly to trade at $0.001, showing stabilization following the lows experienced in mid-2025.

NFE Current Market Status

As of January 5, 2026, NFE is trading at $0.001 with a 24-hour trading volume of $12,182.87. The token has experienced a -0.31% price change in the last 24 hours, while showing more substantial gains over the 7-day period with a +19.42% increase. Over the longer 30-day timeframe, NFE has declined -6.61%, and the 1-year performance shows a substantial -79.61% decrease from its launch price of $0.03.

The fully diluted valuation stands at $899,599.99, with a circulating market cap of $52,593.02 across 52,593,015.24 circulating tokens out of a total supply of 899,599,999.28. The circulating supply represents approximately 5.84% of the maximum supply of 900,000,000 tokens. NFE maintains a market dominance of 0.000026%, reflecting its modest position within the broader cryptocurrency market. The token is currently held by 5,287 addresses and maintains exchange presence with Gate.com as a primary trading platform on the BSC (Binance Smart Chain) network.

Check current NFE market price

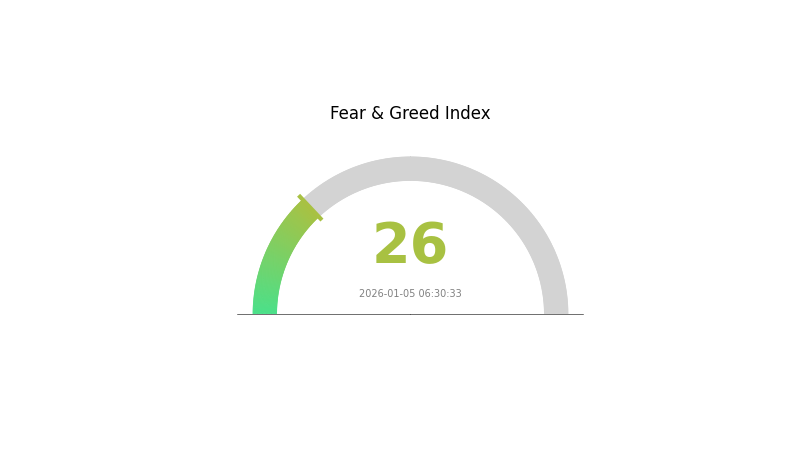

NFE Market Sentiment Indicator

2026-01-05 Fear and Greed Index: 26 (Fear)

Click to view current Fear & Greed Index

Today's cryptocurrency market is experiencing a fear sentiment with an index reading of 26, indicating heightened anxiety among investors. This level suggests market participants are cautious and risk-averse, with selling pressure potentially outweighing buying interest. During such periods, investors may consider dollar-cost averaging or identifying quality projects at discounted prices. However, extreme fear can also present long-term opportunities for those with strong conviction. Monitor key support levels and market developments closely as sentiment may shift with positive news or market stabilization signals.

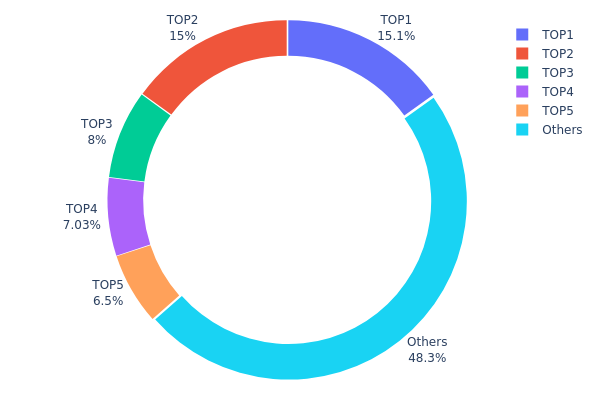

NFE Holdings Distribution

The address holdings distribution represents the concentration of NFE tokens across blockchain addresses, serving as a critical metric for assessing token decentralization and market structure integrity. By analyzing the top token holders and their proportional ownership, market participants can evaluate the potential for price manipulation, the stability of the on-chain ecosystem, and the overall health of the token's distribution model.

Currently, NFE exhibits moderate concentration characteristics in its top-tier holders. The top five addresses collectively control approximately 51.65% of the circulating supply, with the leading address holding 15.12% and the second-largest holder commanding 15.00% of all NFE tokens. While this concentration level raises considerations regarding centralization risk, the distribution does not present extreme concentration patterns comparable to highly centralized tokens. The remaining 48.35% of tokens distributed among other addresses demonstrates a reasonable degree of decentralization across the broader holder base.

The current address distribution structure presents both stabilizing and cautionary implications for market dynamics. The moderate concentration among top holders suggests that individual actors possess sufficient capital to influence short-term price movements, particularly during low-liquidity trading periods. However, the substantial portion held by dispersed addresses (nearly half of total supply) provides a counterbalance that mitigates extreme volatility risk and supports a more resilient price discovery mechanism. This distribution pattern indicates an emerging token ecosystem with adequate decentralization to function as a genuine community asset, while maintaining sufficient liquidity pools among major stakeholders to support market operations and reduce fragmentation risks.

Click to view current NFE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x60e6...7cdf7c | 136104.17K | 15.12% |

| 2 | 0xf64a...145380 | 135000.00K | 15.00% |

| 3 | 0xa260...b5b05f | 72025.95K | 8.00% |

| 4 | 0xe655...2789db | 63309.08K | 7.03% |

| 5 | 0xdb4e...62eaeb | 58500.00K | 6.50% |

| - | Others | 435060.81K | 48.35% |

Core Factors Influencing NFE's Future Price

II. Key Factors Affecting NFE's Future Price

Supply Mechanism

-

LNG Production Expansion: The North Field East (NFE) project in Qatar represents a major liquefied natural gas expansion with a production capacity of 4.3 billion cubic feet per day, set to come online in 2026. This project is part of what has been termed an "LNG expansion tsunami," with 2026-2028 representing the largest supply expansion in human history.

-

Historical Impact: Global LNG supply dynamics have historically shown strong correlation with natural gas price movements. When new production capacity enters the market, it exerts significant downward pressure on prices during the initial ramp-up phase.

-

Current Impact: The NFE project's production timeline and operational efficiency will be critical price drivers in 2026. Any delays or operational challenges could tighten supplies and support prices, while successful commissioning and rapid ramp-up could increase supply pressure. The Henry Hub futures price, which had rebounded to above $4.70 per mmbtu by December 2025, will be sensitive to NFE's contribution to global LNG supply.

Macroeconomic Environment

-

Monetary Policy Impact: Central bank policies, particularly rate decisions by the Federal Reserve, European Central Bank, and Bank of Japan, will significantly influence energy market dynamics. Expected monetary easing in 2026 could impact currency valuations and commodity pricing.

-

Currency Fluctuations: The U.S. dollar's trajectory in 2026 will be crucial for energy prices. Structural dollar weakness typically supports higher commodity prices denominated in USD, as foreign buyers find them more attractive. However, recent trends show a more positive correlation between the dollar and oil prices than historically observed.

-

Geopolitical Factors: Sanctions on major oil and gas producers (Russia and Iran), with approximately 70 million barrels of crude in floating storage as of November 2025, create supply uncertainty. Any escalation or relaxation of sanctions could dramatically impact global energy supply and pricing dynamics.

Technology Development and Ecosystem

-

Operational Efficiency: The success of NFE depends critically on advanced drilling, liquefaction, and export infrastructure. Improvements in operational efficiency and project execution will directly impact production ramp-up speed and cost competitiveness, influencing realized prices in energy markets.

-

Energy Demand Growth: Data center infrastructure supporting artificial intelligence development is driving unprecedented growth in electricity demand, with 2026 expected to see energy demand growth exceeding 2%, the highest level in 15 years. This structural demand growth for energy could provide underlying support for commodity prices if supply expansion fails to keep pace.

III. 2026-2031 NFE Price Forecast

2026 Outlook

- Conservative Forecast: $0.00081 - $0.00100

- Neutral Forecast: $0.00100 (average expectation)

- Bullish Forecast: $0.00115 (requires sustained market stability and increased adoption)

2027-2029 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with moderate growth trajectory, characterized by stabilizing fundamentals and expanding market participation

- Price Range Forecast:

- 2027: $0.00057 - $0.00146

- 2028: $0.00089 - $0.00138

- 2029: $0.00075 - $0.00172

- Key Catalysts: Technological upgrades, ecosystem expansion, institutional interest, and increased utility adoption within the NFE network

2030-2031 Long-term Outlook

- Base Case: $0.00148 - $0.00222 (assumes continued ecosystem development and market maturation with steady institutional adoption)

- Bullish Case: $0.00222 - $0.00278 (contingent on significant mainstream adoption and strategic partnerships driving demand)

- Transformative Case: $0.00278+ (under conditions of breakthrough protocol innovations, major enterprise integrations, and sustained bull market sentiment)

- 2031-12-31: NFE projected at $0.00214 average (consolidation phase following growth acceleration)

Note: Price forecasts are derived from market analysis and should be verified on Gate.com or other reliable data sources before making investment decisions. Past performance does not guarantee future results.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00115 | 0.001 | 0.00081 | 0 |

| 2027 | 0.00146 | 0.00108 | 0.00057 | 7 |

| 2028 | 0.00138 | 0.00127 | 0.00089 | 26 |

| 2029 | 0.00172 | 0.00132 | 0.00075 | 32 |

| 2030 | 0.00222 | 0.00152 | 0.00148 | 52 |

| 2031 | 0.00214 | 0.00187 | 0.00139 | 87 |

NFE (Edu3Labs) Professional Investment Strategy and Risk Management Report

IV. NFE Professional Investment Strategy and Risk Management

NFE Investment Methodology

(1) Long-Term Holding Strategy

-

Target Audience: Investors with 1-3 year investment horizons who believe in the long-term potential of blockchain-integrated education platforms and are willing to tolerate short-term price volatility.

-

Operational Recommendations:

- Accumulate NFE tokens during market downturns, particularly when prices approach the all-time low of $0.0006458 (recorded on June 13, 2025), to establish a cost-effective entry position.

- Set a long-term holding target of 18-24 months to allow the Edu3Labs ecosystem (NFE Marketplace, AI University, Knowledge Contest Games, and Edu3Verse) to mature and gain broader adoption.

- Reinvest any rewards or earnings generated from platform participation back into NFE holdings to benefit from compound growth.

-

Storage Solution:

- Utilize Gate.com Web3 Wallet for secure and convenient storage of NFE tokens on the BSC (Binance Smart Chain) network, ensuring easy access for ecosystem participation while maintaining self-custody security standards.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 52-week high of $0.368 (March 21, 2024) and recent low of $0.0006458 as critical price reference points. Use these levels to identify potential breakout and breakdown opportunities.

- Volume Analysis: Track the 24-hour trading volume of approximately $12,182.87 to identify periods of increased institutional or retail interest, which often precede significant price movements.

-

Swing Trading Key Points:

- Execute buy positions during downtrends when NFE demonstrates consolidation patterns near support levels, targeting 15-30% profit-taking at intermediate resistance levels.

- Monitor the 7-day performance metric (currently +19.42%) as an indicator of short-term momentum; consider taking partial profits when 7-day gains exceed 25% to lock in gains before potential reversals.

NFE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: Allocate 1-3% of total crypto portfolio to NFE tokens, given the project's early-stage status and ranking position (5,681 globally) with limited trading liquidity.

- Active Investors: Allocate 3-8% of total crypto portfolio to NFE, permitting more substantial exposure while maintaining diversification across other established cryptocurrencies.

- Professional Investors: Allocate up to 10-15% of total crypto portfolio to NFE as part of a specialized Web3 education sector play, subject to comprehensive due diligence and position sizing protocols.

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Implement systematic weekly or monthly purchases of fixed NFE amounts regardless of price fluctuations, reducing the impact of market timing errors and minimizing entry price volatility exposure.

- Take-Profit Scaling: Establish predetermined profit-taking targets at 25%, 50%, 75%, and 100% of initial position gains; systematically reduce exposure as price appreciation targets are achieved to secure accumulated gains.

(3) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate.com Web3 Wallet provides institutional-grade security features with multi-signature functionality, hardware wallet integration support, and seamless BSC token management capabilities specifically optimized for NFE holdings.

- Cold Storage Alternative: For holdings exceeding $10,000 USD equivalent, consider transferring NFE tokens to cold storage solutions that support BSC network integration, ensuring maximum security for long-term positions.

- Security Precautions: Never share private keys or seed phrases; enable two-factor authentication on all exchange accounts; verify contract addresses (0xf03ca04dd56d695a410f46f14fef4028b22fb79a on BSC) before executing transactions; remain vigilant against phishing attempts and fraudulent token copies.

V. NFE Potential Risks and Challenges

NFE Market Risks

-

Severe Price Volatility: NFE has experienced a -79.61% price decline over the past 12 months, dropping from higher valuations to the current $0.001 level. This extreme volatility reflects significant demand uncertainty and the speculative nature of early-stage educational blockchain projects.

-

Limited Liquidity and Trading Volume: With only 5,287 token holders and a 24-hour trading volume of approximately $12,182.87, NFE faces severe liquidity constraints. Substantial position liquidations or institutional withdrawals could trigger sharp price cascades and temporary trading halts.

-

Market Capitalization Vulnerability: The fully diluted valuation of approximately $899,599.99 remains extremely small within the broader cryptocurrency market (0.000026% market dominance). NFE is vulnerable to complete market cycles, speculative bubbles, and sudden investor sentiment reversals that could eliminate value rapidly.

NFE Regulatory Risks

-

Educational Content Compliance: As Edu3Labs operates at the intersection of blockchain technology and educational services, the platform faces potential regulatory challenges from educational authorities in various jurisdictions regarding content accreditation, credential recognition, and student data protection requirements.

-

Token Classification Uncertainty: Regulatory agencies in multiple jurisdictions may classify NFE tokens as securities rather than utility tokens, potentially triggering stringent compliance requirements, trading restrictions, or retroactive enforcement actions that could impair token value and ecosystem functionality.

-

Cross-Border Legal Exposure: Providing educational services and NFT marketplace functionality across multiple countries exposes Edu3Labs to complex, overlapping regulatory frameworks regarding consumer protection, data privacy (GDPR compliance), payment processing, and intellectual property rights enforcement.

NFE Technology Risks

-

Ecosystem Adoption Risk: The success of NFE is contingent upon achieving meaningful user adoption across the NFE Marketplace, AI University, Knowledge Contest Games, and Edu3Verse platforms. Failure to establish product-market fit or attract sufficient content creators and learners could render the token economically valueless.

-

Smart Contract Vulnerability: Blockchain-based educational platforms require complex smart contracts governing token distribution, reward mechanisms, and marketplace transactions. Undiscovered code vulnerabilities, reentrancy attacks, or design flaws could result in permanent fund loss and ecosystem compromises.

-

Scalability and Performance Limitations: As user participation scales on the BSC network, Edu3Labs may encounter network congestion, transaction latency, and escalating gas fees that degrade user experience and reduce platform competitiveness against traditional centralized educational alternatives.

VI. Conclusion and Action Recommendations

NFE Investment Value Assessment

Edu3Labs represents a nascent experiment in combining blockchain incentives with educational content delivery. The platform's ecosystem components (NFE Marketplace, AI University, Knowledge Contest Games, and Edu3Verse) address genuine inefficiencies in educational access and creator compensation. However, the project remains in early development stages, evidenced by minimal market capitalization ($52,593 circulating market cap), extreme historical volatility (-79.61% annual decline), and limited user adoption (5,287 token holders).

NFE's long-term value proposition depends critically on successfully differentiating its educational offerings from traditional platforms, achieving meaningful adoption among learners and content creators, and navigating complex regulatory frameworks across multiple jurisdictions. The current price point of $0.001 reflects substantial prior losses from the $0.368 all-time high, suggesting significant accumulated investor losses and potential capitulation-driven trading.

NFE Investment Recommendations

✅ For Beginners: Start with minimal exposure (1-2% of total crypto allocation) through dollar-cost averaging via Gate.com, focusing on understanding the Edu3Labs ecosystem's competitive advantages and user adoption metrics before committing larger capital. Prioritize education about smart contract risks and blockchain-specific security practices.

✅ For Experienced Investors: Establish a core position of 3-5% portfolio allocation using dip-buying strategies near historical support levels, while maintaining strict take-profit targets at 25% and 50% gains. Monitor quarterly ecosystem adoption metrics, user growth rates, and competitive positioning against established edtech platforms to reassess position thesis validity.

✅ For Institutional Investors: Conduct comprehensive due diligence on Edu3Labs' technical architecture, team credentials, regulatory compliance framework, and path to profitability before committing capital. Consider structural hedging strategies and position sizing protocols that accommodate extreme volatility; limit exposure to 10-15% of specialized Web3 education sector allocations.

NFE Trading Participation Methods

-

Direct Spot Trading on Gate.com: Access NFE trading pairs (such as NFE/USDT) directly through Gate.com's spot market interface, enabling efficient position entry, exit, and real-time price monitoring with competitive trading fees.

-

Ecosystem Participation Rewards: Engage with Edu3Labs' Knowledge Contest Games and AI University platforms to earn NFE token rewards, providing an organic accumulation mechanism that supplements market purchases while validating product utility.

-

NFE Marketplace Transactions: Participate in NFE Marketplace for educational content and NFT transactions denominated in NFE tokens, generating ecosystem engagement while building long-term conviction in platform adoption.

Cryptocurrency investments carry extreme risk, including potential total loss of capital. This report does not constitute investment advice. All investors must conduct independent research, assess personal risk tolerance, and consult professional financial advisors before making investment decisions. Never invest funds you cannot afford to lose completely.

FAQ

What is NFE token and what is its purpose?

NFE is the governance token of Edu3Labs platform. It enables platform participation, access to exclusive content with discounts, reduced trading fees, and allows holders to benefit from token appreciation and platform growth.

What is the current price of NFE? How has the historical price trend been?

NFE's current price fluctuates daily in the market. Historically, NFE reached an all-time high of 65.90 USD in January 2021 and a low of 0.98 USD in November 2025. The token has shown significant volatility, reflecting market dynamics and adoption trends in the Web3 ecosystem.

Will NFE price rise or fall in the future?

NFE is expected to rise in the long term, driven by growing demand for energy infrastructure and logistics solutions. Market momentum and analyst targets suggest upward potential for investors with medium to long-term horizons.

What are the main factors affecting NFE price?

NFE price is primarily influenced by macroeconomic conditions, monetary policy decisions from central banks, market volatility, trading volume, and its anti-inflationary properties as a digital asset. Market sentiment and adoption trends also play significant roles.

What are the advantages or disadvantages of NFE compared to similar tokens?

NFE excels in processing efficiency and real-time interaction capabilities, making it cost-effective for rapid applications. However, it may lack precision in complex details compared to advanced alternatives, positioning it as a practical mid-tier solution.

What risks should I be aware of when investing in NFE?

NFE price volatility is influenced by market demand, energy sector trends, and company performance. Cryptocurrency markets are highly speculative with rapid fluctuations. Conduct thorough research before investing.

Is Alt.town (TOWN) a good investment?: Analyzing the potential and risks of this emerging crypto token

REX vs CHZ: A Battle of Cryptocurrency Titans in the Digital Arena

Is Bnext (B3X) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

Is LEGION (LEGION) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Is Aki Network (AKI) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Is Lily (LIY) a good investment?: Analyzing the potential of this emerging cryptocurrency in the volatile market

Is Bitcoin Dead? The Truth About Bitcoin's Survival

Bull and Bear Markets: What They Are and How They Differ

What is cross margin

The Difference Between the 2025 and 2021 Crypto Bull Runs

How to get free bitcoins