2025 NAFT Price Prediction: Expert Analysis and Market Outlook for the Coming Year

Introduction: NAFT's Market Position and Investment Value

Nafter (NAFT) is a photo-sharing social network designed to create profitable and viable revenue streams for social media content creators and their fans. Since its launch in 2021, the project has established itself as an innovative platform leveraging non-fungible tokens (NFTs) to enable users to sell limited-edition prints of their favorite moments to community members. As of January 2026, NAFT maintains a market capitalization of approximately $141,404.42, with a circulating supply of around 441.2 million tokens trading at $0.0003205 per unit.

This digital asset, recognized as a creator-centric NFT marketplace platform, continues to play an increasingly important role in the intersection of social media and blockchain-based content monetization. The token ecosystem has attracted over 33,000 holders, demonstrating sustained community interest in the project's vision.

This article will comprehensively analyze NAFT's price trends from 2026 through 2031, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

Nafter (NAFT) Market Analysis Report

I. NAFT Price History Review and Market Status

NAFT Historical Price Movement Trajectory

- 2021: Project launch and initial growth phase, with NAFT reaching its all-time high of $0.365373 on May 15, 2021

- 2021-2026: Extended bear market period, price declined significantly from peak levels to current trading range

- 2025: NAFT reached its all-time low of $0.00026992 on April 7, 2025, marking the lowest point in the token's trading history

- 2026: Recovery phase with modest price stabilization and slight upward momentum

NAFT Current Market Status

As of January 2, 2026, NAFT is trading at $0.0003205, representing a significant depreciation of approximately 99.91% from its all-time high. The token has a circulating supply of 441,199,428.92 NAFT out of a total supply of 1,000,000,000, with a circulating market cap of $141,404.42 and fully diluted valuation of $320,500.

The 24-hour trading volume stands at $11,870.66, with the token experiencing a positive price movement of +0.59% over the last 24 hours. Over a 7-day period, NAFT has shown positive momentum with a +3.06% gain, though the 30-day performance remains modest at +1.32%. Year-to-date performance reflects the challenging market conditions, with NAFT down -30.7% over the past year.

In terms of market position, NAFT ranks #4,504 by market cap and commands approximately 0.0000099% of the total cryptocurrency market share. The token maintains a holder base of 33,355 addresses, indicating a relatively distributed community participation.

Price volatility within the 24-hour window shows trading between a low of $0.0003157 and a high of $0.0003226, reflecting typical daily fluctuations in the micro-cap segment.

Click to view current NAFT market price

NAFT Market Sentiment Index

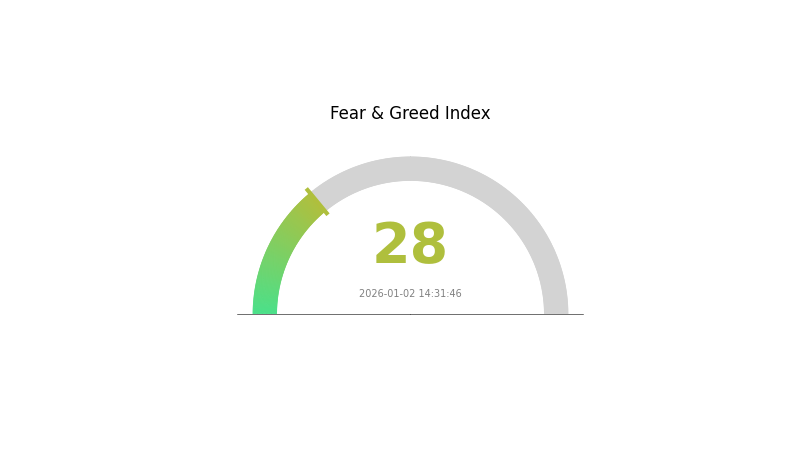

2026-01-02 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing significant fear sentiment with a Fear and Greed Index reading of 28. This indicates heightened market anxiety and risk aversion among investors. During periods of fear, volatility typically increases as market participants reassess positions and seek safer assets. This presents both challenges and opportunities for traders. Risk-conscious investors may adopt defensive strategies, while contrarian investors might view this as a potential entry point for accumulating assets at lower prices. Monitor market developments closely and ensure proper risk management before making investment decisions on Gate.com.

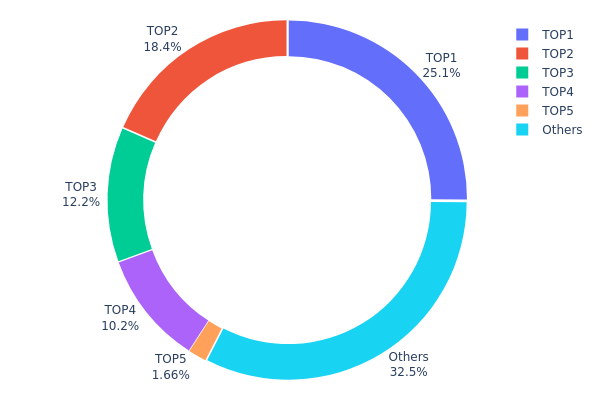

NAFT Holdings Distribution

The address holdings distribution represents the concentration of token ownership across blockchain addresses, serving as a critical metric for assessing market structure, liquidity dynamics, and potential risks associated with token concentration. This analysis examines the top addresses holding NAFT tokens and their proportional share of total supply, providing insight into the degree of decentralization and market vulnerability to large holder movements.

NAFT demonstrates moderate concentration characteristics in its current holder distribution. The top four addresses collectively control approximately 65.85% of the token supply, with the leading address (0x4fdd...e0eb25) commanding 25.05% alone. While individual holdings of this magnitude warrant attention, the distribution is not severely imbalanced, as the remaining supply is distributed across a fragmented base represented by "Others" accounting for 32.5%. The secondary tier of large holders shows a gradual decline in holdings, with the second-largest position at 18.43% and subsequent positions declining progressively. This structure suggests the presence of significant stakeholders but also indicates broader participation beyond a handful of dominant players.

The current address distribution presents moderate implications for market structure and stability. With over one-third of tokens held by dispersed addresses, the market maintains a degree of resilience against coordinated price manipulation by top holders. However, the concentration of 65.85% among the top four addresses creates potential volatility scenarios should these holders execute substantial liquidations or large transactions. The distribution pattern indicates institutional or significant investor participation rather than excessive monopolistic control, supporting relatively healthy market dynamics while maintaining awareness of concentration risks that remain inherent to the token's structure.

Click to view current NAFT holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4fdd...e0eb25 | 250000.00K | 25.05% |

| 2 | 0x2d9b...974da3 | 183885.92K | 18.43% |

| 3 | 0x0d07...b492fe | 121278.38K | 12.15% |

| 4 | 0xad1b...4d756f | 102002.50K | 10.22% |

| 5 | 0x6c66...f99219 | 16517.46K | 1.65% |

| - | Others | 323969.23K | 32.5% |

II. Core Factors Influencing NAFT's Future Price

Supply Mechanism

-

Market Supply and Demand Dynamics: Supply and demand relationships serve as fundamental determinants of digital currency pricing. The balance between available NAFT tokens in circulation and market demand directly influences price movements.

-

Historical Price Performance: NAFT reached its all-time high of $0.365373 on May 15, 2021. The token subsequently experienced significant depreciation, with its lowest price of $0.00026992 recorded on April 7, 2025. This dramatic price volatility demonstrates the token's sensitivity to market conditions and investor sentiment.

-

Current Market Impact: Price fluctuations continue to reflect market sentiment, user adoption rates, and external influencing factors. Ongoing supply adjustments and changes in market participation will remain critical in determining near-term price trajectories.

Macroeconomic Environment

-

Monetary Policy Influence: Global monetary policy conditions significantly impact cryptocurrency valuations. Interest rate environments, liquidity conditions, and central bank policy orientations influence capital flows into digital asset markets. The Federal Reserve's policy stance and international monetary policy coordination play crucial roles in shaping asset price movements globally.

-

Geopolitical Factors: Political stability and international trade policies substantially influence cryptocurrency markets. Trade policy uncertainty, regulatory changes across jurisdictions, and geopolitical tensions create volatility in digital asset pricing. Political risk, credit risk, and foreign exchange risk all represent material factors affecting NAFT's price dynamics.

III. 2026-2031 NAFT Price Forecast

2026 Outlook

- Conservative Forecast: $0.00019-$0.00032

- Neutral Forecast: $0.00032

- Bullish Forecast: $0.00047 (requires sustained market interest and positive ecosystem developments)

2027-2029 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with increasing adoption and utility expansion

- Price Range Forecasts:

- 2027: $0.0003-$0.00047 (23% potential increase)

- 2028: $0.00034-$0.00049 (34% potential increase)

- 2029: $0.00028-$0.00058 (43% potential increase)

- Key Catalysts: Platform ecosystem growth, increased institutional participation, enhanced tokenomics adoption, and strategic partnerships within the crypto market

2030-2031 Long-term Outlook

- Base Case Scenario: $0.00029-$0.00061 (assumes steady market recovery and moderate adoption curve)

- Optimistic Scenario: $0.00052-$0.00076 (assumes accelerated DeFi integration and mainstream recognition)

- Transformative Scenario: $0.00037-$0.00081 (assumes breakthrough technological innovations and significant market expansion)

- January 2, 2026: NAFT $0.00032 (trading at neutral sentiment baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00047 | 0.00032 | 0.00019 | 0 |

| 2027 | 0.00047 | 0.00039 | 0.0003 | 23 |

| 2028 | 0.00049 | 0.00043 | 0.00034 | 34 |

| 2029 | 0.00058 | 0.00046 | 0.00028 | 43 |

| 2030 | 0.00061 | 0.00052 | 0.00029 | 62 |

| 2031 | 0.00081 | 0.00056 | 0.00037 | 76 |

NAFT Professional Investment Strategy and Risk Management Report

IV. NAFT Professional Investment Strategy and Risk Management

NAFT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Content creators and digital asset collectors with long-term conviction in NFT market adoption

- Operational Suggestions:

- Accumulate NAFT during periods of market weakness, particularly when price trades below historical moving averages

- Hold positions through market cycles, recognizing that NFT adoption is still in early stages with potential for significant growth

- Reinvest any staking rewards or additional gains to compound your position over time

(2) Active Trading Strategy

- Technical Analysis Considerations:

- Price Action: Monitor the historical trading range of $0.00026992 (ATL) to $0.365373 (ATH), with current price at $0.0003205

- Volume Analysis: Current 24-hour volume of $11,870.66 indicates relatively low liquidity; trade with appropriate position sizing

- Wave Trading Key Points:

- Identify support levels near recent lows and resistance near previous highs before entering positions

- Use 24-hour and 7-day price movements (currently +0.59% and +3.06% respectively) to gauge short-term momentum

NAFT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% maximum allocation of total portfolio

- Active Investors: 3-5% maximum allocation of total portfolio

- Professional Investors: 5-10% maximum allocation, with appropriate hedging strategies

(2) Risk Hedging Approaches

- Position Sizing: Limit individual trade size to a percentage that aligns with your overall risk tolerance

- Diversification: Balance NAFT holdings with other digital assets and traditional investments to reduce concentration risk

(3) Secure Storage Solutions

- Self-Custody Recommendation: Store NAFT tokens in non-custodial wallets where you control private keys

- Exchange Storage: NAFT is available on Gate.com for trading; however, for long-term holdings, self-custody is recommended

- Security Considerations: Implement multi-signature wallet configurations for larger holdings, use cold storage solutions for extended holding periods, and never share private keys or seed phrases

V. NAFT Potential Risks and Challenges

NAFT Market Risk

- Low Trading Liquidity: With 24-hour volume of only $11,870.66, large orders could experience significant slippage

- Price Volatility: Historical price range from $0.365373 to $0.00026992 reflects extreme volatility typical of early-stage NFT tokens

- Market Adoption Risk: Success depends on sustained growth in the NFT marketplace; declining user interest could pressure token value

NAFT Regulatory Risk

- NFT Regulatory Uncertainty: Global regulatory frameworks for NFTs and digital content ownership remain evolving and unclear

- Token Classification Risk: Regulators may reclassify NAFT as a security in certain jurisdictions, potentially restricting trading

- Cross-Border Compliance: Content monetization regulations vary significantly by country, affecting platform growth

NAFT Technology Risk

- Smart Contract Risk: Vulnerabilities in NAFT's BSC-based smart contract could expose user assets

- Platform Scalability: As the NFT marketplace grows, infrastructure must handle increased transaction volume and complexity

- Integration Risk: Dependence on Binance Smart Chain (BSC) network stability and transaction costs

VI. Conclusion and Action Recommendations

NAFT Investment Value Assessment

NAFT represents a speculative investment opportunity in the NFT content monetization space. The token's extreme price volatility (1-year decline of -30.7%), relatively low market cap of $141,404.42, and thin trading liquidity suggest this is a high-risk, high-reward asset. The platform's core value proposition—enabling creators to monetize content through NFTs—aligns with growing trends in digital creator economies. However, success is contingent on mainstream NFT adoption and sustained platform user growth, both of which remain uncertain.

NAFT Investment Recommendations

✅ Beginners: Start with minimal positions (under 1% of portfolio) on Gate.com only after thoroughly understanding NFT markets and the Nafter platform ✅ Experienced Investors: Consider adding NAFT to a diversified NFT-focused allocation, implementing strict stop-loss orders at 20-30% below entry prices ✅ Institutional Investors: Conduct thorough due diligence on platform metrics, user growth, and development roadmap before any allocation; consider only as small tactical position

NAFT Trading Participation Methods

- Spot Trading: Purchase NAFT directly on Gate.com for immediate ownership and long-term holding

- Portfolio Tracking: Monitor your NAFT position through Gate.com's portfolio management tools to track performance against market benchmarks

- Gradual Accumulation: Implement dollar-cost averaging to build positions over time, reducing timing risk

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and should consult with professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is NAFT token? What are its main uses and application scenarios?

NAFT is a blockchain-based digital asset token primarily used in art and music sectors. It enables authentication, ownership verification, and trading of digital artworks and music content on decentralized platforms.

How to predict NAFT price? What analysis methods and indicators can be referenced?

Analyze NAFT price using macroeconomic indicators like GDP growth, inflation, and trade policies. Monitor global trade trends, international relations, and protectionism impacts. Track trading volume, market sentiment, and blockchain metrics for comprehensive prediction.

How has NAFT's historical price performed? What are the main factors affecting its price fluctuations?

NAFT's price has fluctuated based on market demand, sentiment shifts, and macroeconomic conditions. Key factors include trading volume, adoption trends, regulatory developments, and broader cryptocurrency market movements.

What are the risks of investing in NAFT tokens? How should I evaluate these risks?

NAFT token investments carry market volatility, technology, and regulatory risks. Evaluate risks by assessing the project team's expertise, market demand fundamentals, and regulatory landscape. Diversify your portfolio and invest only what you can afford to lose.

What are the advantages and disadvantages of NAFT compared to similar tokens?

NAFT excels in regional efficiency and customization flexibility, fostering East Asian economic cooperation. However, it faces challenges in liquidity and global acceptance compared to mainstream tokens, with stronger utility within regional markets.

What is the development prospect and roadmap of the NAFT project?

NAFT projects positive outlook with anticipated innovation in digital asset markets through 2026. The platform focuses on revolutionizing content monetization via NFT technology on social media, with expanding blockchain infrastructure and ecosystem development planned ahead.

2025 DOOD Price Prediction: Analyzing Market Trends and Growth Factors for the Coming Bull Run

2025 LION Price Prediction: Analyzing Market Trends and Future Prospects for the Digital Asset

2025 P00LS Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Creator Token

2025 RLY Price Prediction: Bullish Trends and Market Catalysts for Rally's Future Growth

2025 SKEB Price Prediction: Will This NFT Platform Token Reach New Heights?

2025 SWAY Price Prediction: Analyzing the Future Potential of this Emerging Cryptocurrency

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?