2025 MYRIA Price Prediction: Analyzing Growth Potential and Market Trends for the Emerging Blockchain Platform

Introduction: MYRIA's Market Position and Investment Value

Myria (MYRIA), as an Ethereum Layer 2 expansion solution specifically developed for gaming, has made significant strides in deploying blockchain games and developing NFTs since its inception. As of 2025, Myria's market capitalization has reached $4,843,763, with a circulating supply of approximately 28,293,011,843 tokens, and a price hovering around $0.0001712. This asset, known for its "instant transaction confirmation and gas-free transactions," is playing an increasingly crucial role in the blockchain gaming and NFT sectors.

This article will comprehensively analyze Myria's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide professional price predictions and practical investment strategies for investors.

I. MYRIA Price History Review and Current Market Status

MYRIA Historical Price Evolution

- 2023: MYRIA reached its all-time high of $0.018239 on December 14, marking a significant milestone in its price history.

- 2024: The cryptocurrency market entered a bearish phase, causing MYRIA's price to decline steadily throughout the year.

- 2025: MYRIA experienced a sharp downturn, with its price dropping to an all-time low of $0.0001216 on November 20.

MYRIA Current Market Situation

As of November 22, 2025, MYRIA is trading at $0.0001712, showing a 19.79% increase in the last 24 hours. However, the token has seen significant declines over longer periods, with a 13.85% drop in the past week and a substantial 60.73% decrease over the last 30 days. The current market capitalization stands at $4,843,763, ranking MYRIA at 1582 among cryptocurrencies. Despite the recent 24-hour gain, MYRIA is still trading 99.06% below its all-time high, reflecting the severe market downturn it has experienced. The token's trading volume in the past 24 hours is $93,811, indicating moderate market activity. The current circulating supply is 28,293,011,843 MYRIA, which is 56.59% of the total supply of 50,000,000,000 tokens.

Click to view the current MYRIA market price

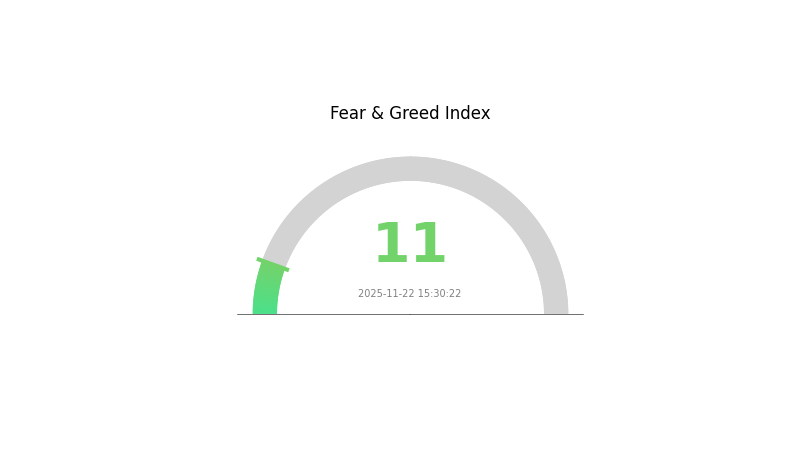

MYRIA Market Sentiment Indicator

2025-11-22 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear today, with the Fear and Greed Index plummeting to a mere 11. This deep-seated anxiety suggests investors are extremely cautious, potentially creating oversold conditions. While such extreme fear often precedes market bottoms, it's crucial to approach with caution. Savvy investors might view this as an opportunity to accumulate, adhering to the adage "be greedy when others are fearful." However, thorough research and risk management remain paramount in these volatile times.

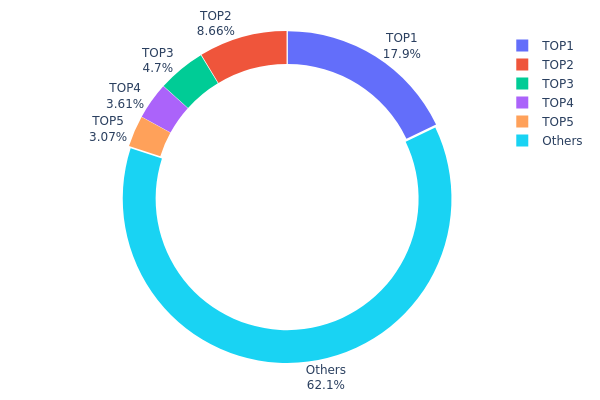

MYRIA Holdings Distribution

The address holdings distribution data for MYRIA reveals a moderately concentrated ownership structure. The top address holds 17.88% of the total supply, while the top 5 addresses collectively control 37.92% of MYRIA tokens. This concentration level suggests a significant influence from a small number of large holders, potentially impacting market dynamics.

Such a distribution pattern may lead to increased price volatility, as large holders have the capacity to move the market with substantial trades. However, with 62.08% of tokens distributed among other addresses, there is still a considerable degree of decentralization, which could help mitigate some of the risks associated with high concentration.

The current distribution reflects a balance between centralized control and wider token dispersion. While the top holders possess substantial market power, the significant allocation to other addresses indicates a growing ecosystem with diverse participation. This structure suggests a maturing market for MYRIA, but investors should remain aware of the potential for price fluctuations driven by large holder activity.

Click to view the current MYRIA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x782b...f962ed | 8940277.78K | 17.88% |

| 2 | 0x3071...2714e7 | 4332173.15K | 8.66% |

| 3 | 0x6c62...51fb34 | 2351286.71K | 4.70% |

| 4 | 0x5a9d...e53cc8 | 1807274.00K | 3.61% |

| 5 | 0xd621...d19a2c | 1535565.54K | 3.07% |

| - | Others | 31033422.83K | 62.08% |

II. Key Factors Affecting MYRIA's Future Price

Technical Development and Ecosystem Building

-

Layer 2 Scaling Solution: MYRIA is built on Ethereum as a Layer 2 scaling solution, aiming to improve transaction speed and reduce costs for blockchain gaming and NFT applications.

-

Ecosystem Applications: MYRIA focuses on developing a gaming ecosystem, including various blockchain games and NFT marketplaces. The growth and adoption of these applications within the MYRIA ecosystem could potentially impact the token's value and utility.

III. MYRIA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00015 - $0.00017

- Neutral prediction: $0.00017 - $0.00019

- Optimistic prediction: $0.00019 - $0.00022 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.00016 - $0.00024

- 2027: $0.00012 - $0.00033

- Key catalysts: Increased adoption and project development

2028-2030 Long-term Outlook

- Base scenario: $0.00025 - $0.00030 (assuming steady market growth)

- Optimistic scenario: $0.00030 - $0.00033 (assuming strong market performance)

- Transformative scenario: $0.00033+ (extreme favorable conditions in crypto market)

- 2030-12-31: MYRIA $0.00033 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00022 | 0.00017 | 0.00015 | 0 |

| 2026 | 0.00024 | 0.00019 | 0.00016 | 13 |

| 2027 | 0.00033 | 0.00022 | 0.00012 | 28 |

| 2028 | 0.00029 | 0.00027 | 0.00022 | 59 |

| 2029 | 0.00033 | 0.00028 | 0.00016 | 64 |

| 2030 | 0.00033 | 0.0003 | 0.00025 | 77 |

IV. MYRIA Professional Investment Strategies and Risk Management

MYRIA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate MYRIA tokens during market dips

- Set price targets and rebalance portfolio periodically

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined resistance levels

MYRIA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and traditional assets

- Options strategies: Use put options to protect against downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. MYRIA Potential Risks and Challenges

MYRIA Market Risks

- High volatility: MYRIA price can experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades

- Competitive landscape: Other Layer 2 solutions may gain more traction

MYRIA Regulatory Risks

- Uncertain regulatory environment: Potential for increased scrutiny of Layer 2 solutions

- Compliance issues: Changes in regulations may impact MYRIA's operations

- Cross-border restrictions: Varying regulations across jurisdictions may limit adoption

MYRIA Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability challenges: May face issues as user base grows

- Dependency on Ethereum: Susceptible to Ethereum network congestion and upgrades

VI. Conclusion and Action Recommendations

MYRIA Investment Value Assessment

MYRIA presents a high-risk, high-reward opportunity in the Layer 2 scaling solution space. While it offers potential for significant growth, investors should be aware of its volatility and the nascent state of the technology.

MYRIA Investment Recommendations

✅ Beginners: Allocate a small portion (1-2%) of your crypto portfolio to MYRIA

✅ Experienced investors: Consider a 3-5% allocation, actively manage position

✅ Institutional investors: Conduct thorough due diligence, potentially allocate 5-10% of crypto portfolio

MYRIA Trading Participation Methods

- Spot trading: Buy and hold MYRIA tokens on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Explore decentralized finance opportunities involving MYRIA

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

While it's impossible to predict with certainty, emerging projects in AI, DeFi, or gaming sectors have potential for massive growth. Always research thoroughly before investing.

Will hamster kombat reach $1?

It's unlikely for Hamster Kombat to reach $1 in the near future, given its current market performance and trends in the crypto space.

What does myria crypto do?

Myria is a Layer 2 scaling solution for Ethereum, offering fast and low-cost transactions for gaming and NFT applications. It aims to enhance blockchain gaming experiences.

What is the best AI crypto prediction for 2030?

The best AI crypto prediction for 2030 suggests a significant market growth, with leading AI-focused cryptocurrencies potentially reaching 10-20x their current values.

Share

Content