2025 MVRK Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Emerging Cryptocurrency

Introduction: MVRK's Market Position and Investment Value

Mavryk Network (MVRK), as a next-generation Layer-1 blockchain powering real-world asset tokenization, has achieved significant milestones since its inception. As of 2025, MVRK's market capitalization has reached $1,141,984, with a circulating supply of approximately 56,200,000 tokens, and a price hovering around $0.02032. This asset, dubbed the "RWA Tokenization Pioneer," is playing an increasingly crucial role in bridging traditional assets with blockchain technology.

This article will provide a comprehensive analysis of MVRK's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. MVRK Price History Review and Current Market Status

MVRK Historical Price Evolution

- 2025 (September): MVRK reached its all-time high of $0.734, likely due to the announcement of the $10B+ RWA tokenization deal.

- 2025 (November): Market downturn, price dropped significantly to its all-time low of $0.02028.

MVRK Current Market Situation

As of November 25, 2025, MVRK is trading at $0.02032, experiencing a 2.4% decline in the last 24 hours. The token has seen a substantial decrease of 79.70% over the past year, reflecting a bearish trend. MVRK's market capitalization stands at $1,141,984, with a circulating supply of 56,200,000 tokens. The current price is 97.23% below its all-time high, indicating a significant market correction. Trading volume in the last 24 hours is $6,041.036217, suggesting moderate market activity. The token's fully diluted valuation is $20,320,000, with only 5.62% of the total supply currently in circulation.

Click to view the current MVRK market price

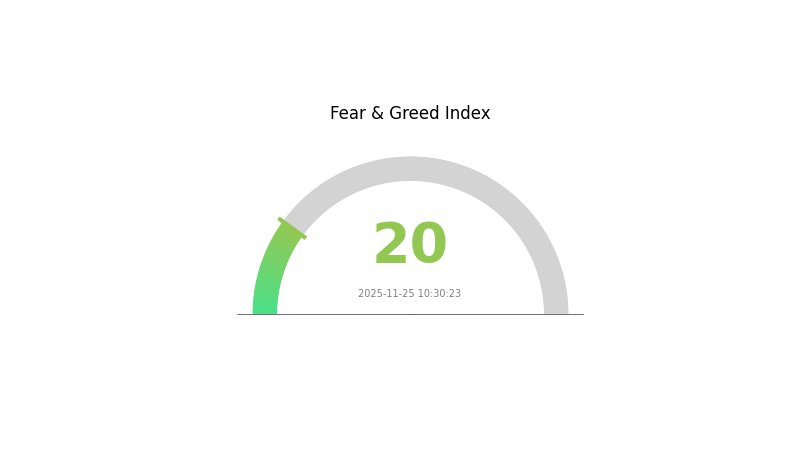

MVRK Market Sentiment Indicator

2025-11-25 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear today, with the sentiment index plummeting to 20. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Traders on Gate.com should consider this sentiment alongside other technical and fundamental indicators before making investment decisions. Remember, while fear can create opportunities, it's crucial to manage risk and conduct thorough research in these uncertain times.

MVRK Holdings Distribution

The address holdings distribution data for MVRK reveals an interesting picture of token concentration. This metric is crucial for understanding the decentralization and potential market dynamics of a cryptocurrency.

Based on the provided data, it appears that MVRK's token distribution is relatively balanced, with no single address holding a disproportionately large percentage of the total supply. This suggests a healthy level of decentralization, which is generally favorable for the token's ecosystem. The absence of extreme concentration reduces the risk of market manipulation by large holders and promotes a more stable price discovery process.

However, it's important to note that while the top addresses don't show excessive concentration, the overall distribution pattern still indicates a degree of wealth concentration typical in many cryptocurrency projects. This structure likely reflects a mix of early adopters, institutional investors, and active traders. The current distribution suggests a market with diverse participation, potentially contributing to increased liquidity and reduced volatility in MVRK trading.

Click to view the current MVRK Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing MVRK's Future Price

Supply Mechanism

- Staking: MVRK offers two staking methods, allowing users to earn rewards while maintaining self-custody of their tokens. Delegate staking can yield up to ~15% APR.

Institutional and Whale Dynamics

- Enterprise Adoption: The value of MVRK is closely tied to ecosystem development and asset scale growth. If on-chain asset migration becomes a core narrative in the next three to five years, Mavryk could be a project worth focusing on.

Macroeconomic Environment

- Inflation Hedging Properties: Inflation remains a core risk factor affecting the broader cryptocurrency market, including MVRK.

Technological Development and Ecosystem Building

-

Decentralized Governance: MVRK employs a multi-layered governance design, aiming to create mutually beneficial relationships between liquidity providers, borrowers, developers, and the protocol itself. This approach attempts to address issues common in traditional DeFi ecosystems, such as capital concentration and skewed profit distribution.

-

Ecosystem Applications: The Mavryk ecosystem is focused on developing DeFi applications, with potential future growth areas including:

- Maturation of on-chain derivatives markets, especially options and perpetual contracts

- More efficient off-chain data integration through decentralized oracles

- Multi-agent systems for enhanced ecosystem functionality

III. MVRK Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.01768 - $0.02032

- Neutral prediction: $0.02032 - $0.02438

- Optimistic prediction: $0.02438 - $0.02845 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.02365 - $0.02926

- 2027: $0.01878 - $0.03621

- Key catalysts: Increased adoption and technological improvements

2028-2030 Long-term Outlook

- Base scenario: $0.03152 - $0.03622 (assuming steady market growth)

- Optimistic scenario: $0.03622 - $0.03813 (assuming strong market performance)

- Transformative scenario: $0.03813 - $0.04000 (assuming exceptional project developments and market conditions)

- 2030-12-31: MVRK $0.03767 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02845 | 0.02032 | 0.01768 | 0 |

| 2026 | 0.02926 | 0.02438 | 0.02365 | 20 |

| 2027 | 0.03621 | 0.02682 | 0.01878 | 32 |

| 2028 | 0.03813 | 0.03152 | 0.02553 | 55 |

| 2029 | 0.03761 | 0.03483 | 0.03065 | 71 |

| 2030 | 0.03767 | 0.03622 | 0.03079 | 78 |

IV. MVRK Professional Investment Strategies and Risk Management

MVRK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and belief in the long-term potential of RWA tokenization

- Operational advice:

- Accumulate MVRK tokens during market dips

- Stay informed about Mavryk Network's partnerships and RWA tokenization progress

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Watch for news catalysts related to new RWA tokenization deals

- Monitor overall market sentiment towards Layer-1 blockchains and RWA projects

MVRK Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance MVRK holdings with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords, and regularly update software

V. Potential Risks and Challenges for MVRK

MVRK Market Risks

- High volatility: MVRK price may experience significant fluctuations

- Limited liquidity: Currently listed on only one exchange, potentially affecting price stability

- Competitive landscape: Other Layer-1 blockchains may enter the RWA tokenization space

MVRK Regulatory Risks

- Uncertain regulatory environment: RWA tokenization may face regulatory scrutiny in various jurisdictions

- Compliance challenges: Ensuring compliance with evolving global regulations for tokenized assets

- Legal framework: Potential legal issues surrounding the ownership and transfer of tokenized real-world assets

MVRK Technical Risks

- Scalability challenges: Ability to handle increased transaction volume as more RWAs are tokenized

- Smart contract vulnerabilities: Potential for exploits or bugs in the underlying blockchain code

- Interoperability issues: Challenges in integrating with other blockchain networks and traditional financial systems

VI. Conclusion and Action Recommendations

MVRK Investment Value Assessment

MVRK presents a unique opportunity in the emerging RWA tokenization market, with significant long-term potential backed by major partnerships. However, short-term risks include high volatility, limited liquidity, and regulatory uncertainties.

MVRK Investment Recommendations

✅ Novice investors: Consider small, long-term positions after thorough research ✅ Experienced investors: Implement a dollar-cost averaging strategy and actively monitor project developments ✅ Institutional investors: Explore strategic partnerships and larger positions, with careful risk management

MVRK Trading Participation Methods

- Spot trading: Available on Gate.com

- Staking: Participate in any available staking programs to earn passive income

- Governance participation: Engage in the Mavryk Network ecosystem through voting and proposals, if applicable

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does movement coin have a future?

Movement coin's future appears uncertain. Forecasts suggest a decline to $0.03899 by late 2025, indicating a bearish market outlook.

What crypto has the highest price prediction?

Bitcoin is predicted to have the highest price in 2025. Analysts expect it to reach new all-time highs based on adoption trends and market dynamics.

Will Wink ever recover?

Yes, Wink is expected to recover. Projections suggest a positive outlook, with price stabilization likely by 2050 in the range of $0.00002 to $0.00008.

What is the MKR prediction for 2025?

Based on current market analysis, the MKR price prediction for 2025 ranges from a minimum of $5,750 to a maximum of $8,246.

Share

Content