2025 MV Price Prediction: Analyzing Market Trends and Future Prospects for the Electric Vehicle Industry

Introduction: MV's Market Position and Investment Value

GensoKishi Metaverse (MV), as a prominent player in the GameFi sector, has made significant strides since its inception in 2022. As of 2025, MV's market capitalization stands at $1,487,823, with a circulating supply of approximately 399,737,601 tokens and a price hovering around $0.003722. This asset, often referred to as the "Metaverse MMORPG Pioneer," is playing an increasingly crucial role in the integration of blockchain technology with traditional gaming experiences.

This article will provide a comprehensive analysis of MV's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. MV Price History Review and Current Market Status

MV Historical Price Evolution

- 2022: Initial launch, price reached all-time high of $1.66 on February 9

- 2023-2024: Market cycle downturn, price declined significantly

- 2025: Price hit all-time low of $0.00330903 on November 22

MV Current Market Situation

MV is currently trading at $0.003722, up 5.11% in the last 24 hours. The token has shown some recovery in the short term, with a 7.43% increase over the past week. However, it remains in a downtrend over longer time frames, down 39.85% in the last 30 days and 64.68% over the past year. The current price is still close to its all-time low, suggesting the token is in a bearish market phase. With a circulating supply of about 399.7 million tokens out of a total supply of 2 billion, MV has a market capitalization of approximately $1.49 million, ranking it 2364th in the cryptocurrency market.

Click to view the current MV market price

MV Market Sentiment Index

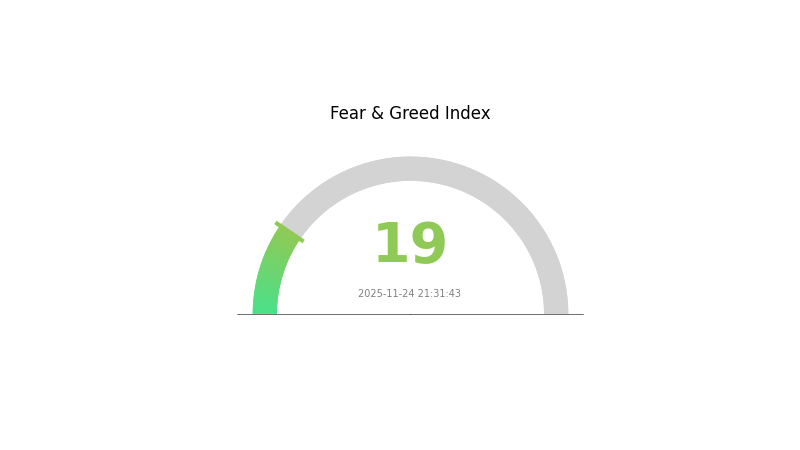

2025-11-24 Fear and Greed Index: 19 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing a period of extreme fear, with the sentiment index plummeting to 19. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to exercise caution and conduct thorough research before making any investment decisions. Remember, market sentiment can shift rapidly, and past performance doesn't guarantee future results. Stay informed and consider diversifying your portfolio to mitigate risks in these uncertain times.

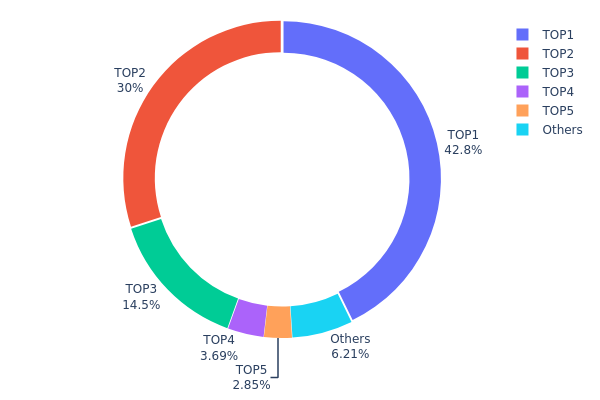

MV Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for MV. The top address holds a substantial 42.76% of the total supply, while the top five addresses collectively control 93.77% of all MV tokens. This level of concentration raises concerns about potential market manipulation and centralization of power within the MV ecosystem.

Such a concentrated distribution can lead to increased volatility and susceptibility to large price swings, as decisions made by these major holders could significantly impact the market. The high concentration also suggests that MV's on-chain structure may be less stable and more vulnerable to sudden changes in ownership or large-scale sell-offs.

Overall, this distribution pattern indicates a low degree of decentralization for MV, which may be concerning for investors seeking a more distributed and potentially more resilient token ecosystem. It also highlights the need for careful monitoring of these major addresses and their activities to gauge potential market movements.

Click to view the current MV Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1127...8cac91 | 855366.56K | 42.76% |

| 2 | 0xb2ef...cff23a | 600000.10K | 30.00% |

| 3 | 0x40ec...5bbbdf | 289540.56K | 14.47% |

| 4 | 0xe505...18a473 | 73812.33K | 3.69% |

| 5 | 0x28cc...d8841f | 57032.18K | 2.85% |

| - | Others | 124248.27K | 6.23% |

II. Key Factors Influencing MV's Future Price

Supply Mechanism

- MVRV Ratio: This indicator compares the Market Value (MV) to the Realized Value (RV) of MV, reflecting the degree to which the market value exceeds the total cost basis.

- Historical Pattern: In previous cycles, the MVRV ratio has reached at least 4 during peak periods.

- Current Impact: The current MVRV ratio suggests potential for further price appreciation, as it has not yet reached historical peak levels.

Institutional and Whale Dynamics

- Institutional Holdings: ETF providers have accumulated significant amounts of MV, with U.S. ETFs holding approximately 700,000 MV tokens since their approval.

Macroeconomic Environment

- Monetary Policy Impact: Market expectations include potential interest rate cuts by the Federal Reserve in October and December of the current year.

- Inflation Hedging Properties: MV has shown some correlation with global liquidity conditions, potentially serving as a hedge against inflation.

- Geopolitical Factors: Political events, such as U.S. elections and changes in administration, have influenced MV's price movements.

Technological Developments and Ecosystem Growth

- ETF Integration: The introduction of MV ETFs has altered market dynamics, reducing price volatility and changing the behavior of long-term holders.

- Ecosystem Applications: The development of DApps and ecosystem projects continues to expand MV's utility and adoption.

III. MV Price Predictions for 2025-2030

2025 Outlook

- Conservative prediction: $0.00317 - $0.00344

- Neutral prediction: $0.00344 - $0.00372

- Optimistic prediction: $0.00372 - $0.00391 (requires sustained market growth)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecasts:

- 2027: $0.00385 - $0.00465

- 2028: $0.00381 - $0.00593

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.00513 - $0.00536 (assuming steady market conditions)

- Optimistic scenario: $0.00559 - $0.00606 (assuming favorable market trends)

- Transformative scenario: $0.00606+ (under extremely favorable conditions)

- 2030-12-31: MV $0.00606 (potential peak based on current projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00391 | 0.00372 | 0.00317 | 0 |

| 2026 | 0.0042 | 0.00382 | 0.00344 | 2 |

| 2027 | 0.00465 | 0.00401 | 0.00385 | 7 |

| 2028 | 0.00593 | 0.00433 | 0.00381 | 16 |

| 2029 | 0.00559 | 0.00513 | 0.00436 | 37 |

| 2030 | 0.00606 | 0.00536 | 0.003 | 44 |

IV. Professional MV Investment Strategies and Risk Management

MV Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors interested in GameFi and metaverse projects

- Operational suggestions:

- Accumulate MV tokens during market dips

- Participate in the Gensokishi metaverse ecosystem to understand the project better

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- RSI (Relative Strength Index): Monitor overbought and oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to manage downside risk

- Take profits at predetermined resistance levels

MV Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple GameFi and metaverse projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for MV

MV Market Risks

- High volatility: GameFi tokens can experience significant price swings

- Competition: Increasing number of metaverse projects may impact MV's market share

- User adoption: Dependent on the success and popularity of the Gensokishi metaverse

MV Regulatory Risks

- Uncertain regulatory environment: Potential for increased scrutiny of GameFi projects

- Token classification: Risk of being classified as a security in some jurisdictions

- Cross-border compliance: Challenges in adhering to varying international regulations

MV Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Scalability issues: Possible network congestion on the Polygon blockchain

- Interoperability challenges: Limitations in cross-chain functionality

VI. Conclusion and Action Recommendations

MV Investment Value Assessment

MV presents a unique opportunity in the GameFi and metaverse sector, backed by an established game with a large user base. However, investors should be aware of the high volatility and regulatory uncertainties in this emerging market.

MV Investment Recommendations

✅ Beginners: Consider small, experimental positions to understand the GameFi ecosystem ✅ Experienced investors: Implement a dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider MV as part of a diversified crypto portfolio

MV Trading Participation Methods

- Spot trading: Available on Gate.com and other supported exchanges

- Staking: Participate in staking programs if offered by the Gensokishi platform

- In-game participation: Engage with the Gensokishi metaverse to potentially earn MV tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

DeepSnitch AI is predicted to 1000x by 2026, using AI to find crypto opportunities. Other potential 1000x candidates include Pi Network and PUMP.

Will VeChain hit $1?

VeChain has potential to reach $1, but it would require significant market growth. With a current supply of 72 billion VET, reaching $1 would mean a $72 billion market cap, nearly 5x its all-time high of $15.1 billion.

Can Solana reach $1000 in 2025?

Yes, Solana could potentially reach $1000 in 2025. Market trends and growth projections suggest this price target is achievable for SOL.

Will MultiversX go up?

Based on current market trends and MultiversX's innovative technology, there's potential for price appreciation. However, cryptocurrency markets are highly volatile and unpredictable.

Share

Content