2025 MONG Price Prediction: Navigating the Future of Decentralized Finance and Meme Tokens

Introduction: MONG's Market Position and Investment Value

MongCoin (MONG), as a unique meme-inspired cryptocurrency, has been making waves in the crypto space since its inception in 2023. As of 2025, MONG's market capitalization stands at $917,700, with a circulating supply of 690,000,000,000,000 tokens and a price hovering around $0.00000000133. This asset, often referred to as the "Immortal Meme Coin," is playing an increasingly significant role in the realm of community-driven and meme-based digital assets.

This article will provide a comprehensive analysis of MONG's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering investors professional price predictions and practical investment strategies.

I. MONG Price History Review and Current Market Status

MONG Historical Price Evolution

- 2023: MONG launched, price reached all-time high of $0.00000039872 on May 6

- 2024: Market fluctuations, price gradually declined

- 2025: Bearish market cycle, price dropped to all-time low of $0.000000001115 on November 21

MONG Current Market Situation

MONG is currently trading at $0.00000000133, down 3.69% in the last 24 hours. The token has experienced significant volatility, with a 24-hour trading volume of $5,329.54. MONG's market capitalization stands at $917,700, ranking it 2717th in the cryptocurrency market. The token has seen a substantial decline from its all-time high, with a 89.85% decrease over the past year. The current price is 96.66% below the all-time high and 19.28% above the all-time low.

Click to view current MONG market price

MONG Market Sentiment Indicator

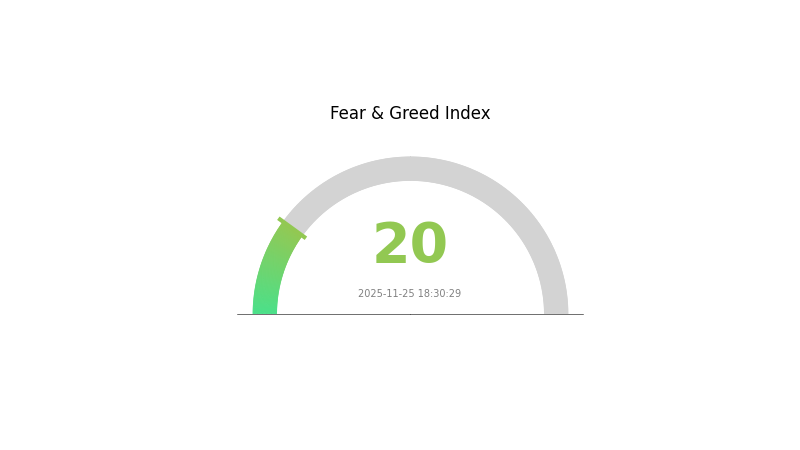

2025-11-25 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of extreme fear, with the sentiment index plummeting to 20. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to exercise caution and conduct thorough research before making any investment decisions. Remember, market sentiment can shift rapidly, and while fear may present opportunities, it also reflects significant uncertainty in the market.

MONG Holdings Distribution

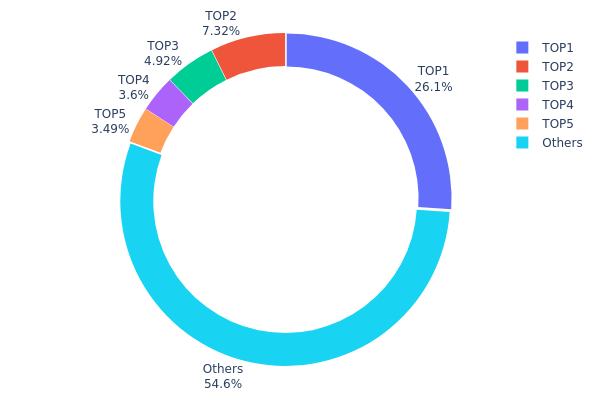

The address holdings distribution data for MONG reveals a significant concentration of tokens among a few top addresses. The largest holder possesses 26.05% of the total supply, while the top 5 addresses collectively control 45.36% of MONG tokens. This level of concentration indicates a relatively centralized distribution, which could potentially impact market dynamics.

Such a concentrated holding structure may lead to increased price volatility and susceptibility to market manipulation. The actions of these major holders could significantly influence MONG's price movements and overall market sentiment. Additionally, this concentration raises concerns about the token's decentralization and on-chain structural stability.

Despite the concentration at the top, it's worth noting that 54.64% of MONG tokens are distributed among other addresses, suggesting some level of wider distribution. However, the current holdings pattern reflects a market structure that may be vulnerable to large-scale movements by a few key players, potentially affecting liquidity and price discovery mechanisms.

Click to view the current MONG Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7054...62775c | 179774054078.45K | 26.05% |

| 2 | 0x0d07...b492fe | 50477030732.07K | 7.31% |

| 3 | 0x9642...2f5d4e | 33926786303.41K | 4.91% |

| 4 | 0x3cc9...aecf18 | 24848224846.89K | 3.60% |

| 5 | 0xd972...b56177 | 24103517207.62K | 3.49% |

| - | Others | 376870386831.56K | 54.64% |

II. Core Factors Influencing Future MONG Price

Supply Mechanism

- Central Bank Buying: Central banks' gold purchases directly increase physical demand and send positive signals to the market, enhancing investor confidence in gold.

- Historical Pattern: Central bank gold purchases have consistently exceeded 1000 tons annually since 2022, significantly impacting gold prices.

- Current Impact: Global central banks are expected to continue large-scale gold purchases in 2025 and beyond, providing ongoing support for gold prices.

Institutional and Whale Dynamics

- Institutional Holdings: Gold ETF holdings have increased, with the SPDR Gold Trust seeing its holdings rise from 996.85 tons to 1005.72 tons, a 0.89% increase.

- Corporate Adoption: Not specifically mentioned in the given context.

- National Policies: Geopolitical tensions and de-dollarization efforts by some countries are driving central banks to increase gold holdings.

Macroeconomic Environment

- Monetary Policy Impact: Expected interest rate cuts by the Federal Reserve are likely to weaken the US dollar, potentially boosting gold prices.

- Inflation Hedging Properties: Gold is viewed as an inflation hedge, with its price often rising during periods of high inflation or inflation expectations.

- Geopolitical Factors: Ongoing geopolitical conflicts and uncertainties are increasing gold's appeal as a safe-haven asset.

Technical Development and Ecosystem Building

- Market Sentiment Shift: The gold market has broken free from the constraints of a strong dollar and high US bond yields, entering a new upward cycle.

- Investor Participation: There's a growing trend of gold investment, with a shift from Asian to European and American investors expected in 2025.

III. MONG Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00095 - $0.00105

- Neutral forecast: $0.00100 - $0.00110

- Optimistic forecast: $0.00110 - $0.00120 (requires sustained market recovery)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range prediction:

- 2026: $0.00108 - $0.00119

- 2027: $0.00118 - $0.00130

- Key catalysts: Increased adoption, project developments, overall crypto market trends

2028-2030 Long-term Outlook

- Base scenario: $0.00160 - $0.00180 (assuming steady growth and adoption)

- Optimistic scenario: $0.00190 - $0.00210 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $0.00220 - $0.00240 (with breakthrough innovations and mass adoption)

- 2030-11-26: MONG $0.00217 (potential peak during this period)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0 | 0 | 0 | 0 |

| 2026 | 0 | 0 | 0 | 8 |

| 2027 | 0 | 0 | 0 | 9 |

| 2028 | 0 | 0 | 0 | 36 |

| 2029 | 0 | 0 | 0 | 51 |

| 2030 | 0 | 0 | 0 | 55 |

IV. MONG Professional Investment Strategies and Risk Management

MONG Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a high appetite for speculative assets

- Operation suggestions:

- Allocate only a small portion of your portfolio to MONG

- Set a long-term price target and hold until reached

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss and take-profit levels

- Monitor social media sentiment as it may impact price

MONG Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 0-1% of crypto portfolio

- Aggressive investors: 1-3% of crypto portfolio

- Professional investors: 3-5% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for MONG

MONG Market Risks

- High volatility: Extreme price fluctuations common in meme coins

- Limited liquidity: May face difficulties when trying to sell large amounts

- Market sentiment: Price heavily influenced by social media trends

MONG Regulatory Risks

- Uncertain regulations: Potential for stricter rules on meme coins

- Exchange delistings: Risk of removal from trading platforms

- Tax implications: Unclear tax treatment in many jurisdictions

MONG Technical Risks

- Smart contract vulnerabilities: Potential for exploits or hacks

- Network congestion: High fees and slow transactions during peak times

- Lack of utility: No clear use case beyond speculation

VI. Conclusion and Action Recommendations

MONG Investment Value Assessment

MONG presents a high-risk, speculative investment with potential for significant volatility. While it may offer short-term trading opportunities, its long-term value proposition remains uncertain due to its meme coin nature and lack of fundamental utility.

MONG Investment Recommendations

✅ Beginners: Avoid or limit to a very small portion of portfolio ✅ Experienced investors: Consider for short-term trading with strict risk management ✅ Institutional investors: Generally not recommended due to high volatility and regulatory risks

MONG Trading Participation Methods

- Spot trading: Available on Gate.com

- Limit orders: Use to enter positions at desired price levels

- DCA strategy: Consider for long-term accumulation if bullish on the project

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will meme coin reach $1?

It's possible but unlikely. Meme coins are highly volatile and speculative. Focus on potential short-term gains rather than long-term price targets.

How high will Mog Coin go?

Mog Coin could potentially reach $0.0000005 by 2026, based on current market trends and past performance. However, cryptocurrency prices are highly volatile and unpredictable.

What will Harmony be worth in 2025?

Based on technical analysis, Harmony is predicted to reach $0.004723 by December 2025, representing a 13.17% increase from current levels.

Would hamster kombat coin reach $1?

Hamster Kombat coin could potentially reach $1 by 2028, driven by blockchain gaming adoption and market trends. However, this remains a speculative forecast.

Share

Content