2025 MNRY Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of MNRY

Moonray (MNRY) is an ERC-20 utility and governance token powering a decentralized gaming and entertainment network that supports diverse projects in gaming, comics, and animation. Since its launch, MNRY has established itself as a key asset within the Moonray ecosystem. As of January 2026, MNRY has a market capitalization of approximately $868,900, with a circulating supply of 86 million tokens and a price maintained around $0.0008689. This token, designed to empower the growing Moonray ecosystem, is playing an increasingly vital role in gaming and entertainment applications.

This article will provide a comprehensive analysis of MNRY price trends spanning 2026 through 2031, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for investors.

Moonray (MNRY) Market Analysis Report

I. MNRY Price History Review and Current Market Status

MNRY Historical Price Evolution

- December 2024: Launch and peak performance, price reached all-time high of $0.21328 on December 18, 2024

- December 2024 - January 2026: Significant market correction, price declined from peak of $0.21328 to current levels, representing a substantial pullback from initial valuations

- January 2026: Continued downtrend, price reached all-time low of $0.0006507 on December 8, 2025, with current trading at $0.0008689

MNRY Current Market Status

Price Performance Metrics:

- Current Price: $0.0008689 (as of January 4, 2026)

- 24-Hour Change: +4.97% ($0.000041 increase)

- 1-Hour Change: -1.03%

- 7-Day Change: -4.25%

- 30-Day Change: +17.69%

- 1-Year Change: -98.47%

Market Capitalization and Supply Dynamics:

- Market Cap: $74,725.40

- Fully Diluted Valuation (FDV): $868,900.00

- Circulating Supply: 86,000,000 MNRY (8.6% of total supply)

- Total Supply: 1,000,000,000 MNRY

- Market Dominance: 0.000026%

- 24-Hour Trading Volume: $32,263.87

- Market Rank: #5,237

Token Holder Information:

- Active Holders: 503

- Token Standard: ERC-20

Price Range (24-Hour):

- High: $0.00097

- Low: $0.0008048

Click to view current MNRY market price

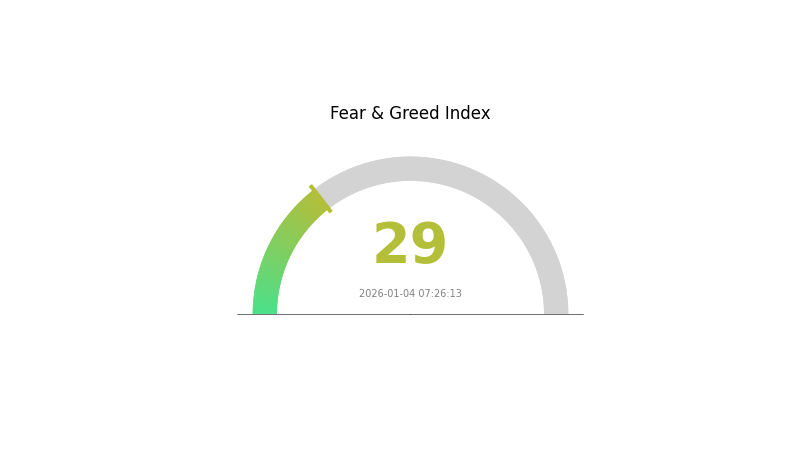

MNRY Market Sentiment Indicator

2026-01-04 Fear and Greed Index: 29 (Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing a fear sentiment with an index reading of 29. This indicates heightened market anxiety and risk aversion among investors. When fear dominates, asset prices typically face downward pressure as traders prioritize capital preservation over growth opportunities. Such market conditions often present contrarian opportunities for long-term investors. Monitor key support levels closely and consider dollar-cost averaging strategies during fearful periods. Stay informed through Gate.com's comprehensive market data tools to make informed trading decisions amid current market volatility.

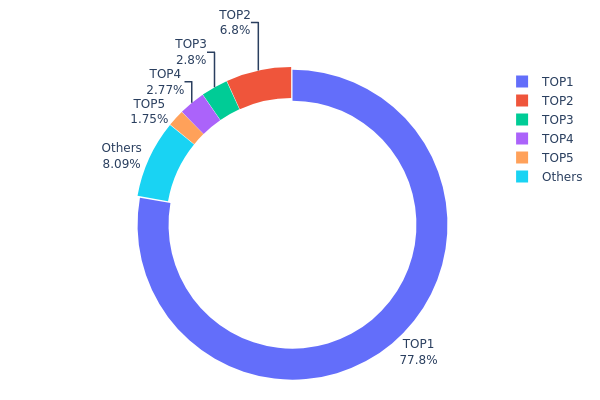

MNRY Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across the blockchain network, revealing how MNRY tokens are distributed among major stakeholders. By analyzing the top addresses and their respective holdings percentages, we can assess the decentralization degree and potential market concentration risks of the token ecosystem.

MNRY exhibits pronounced concentration characteristics, with the top holder commanding 77.79% of total supply. This extreme concentration represents a significant centralization risk, as a single address controls more than three-quarters of all circulating tokens. The second-largest holder maintains a considerably smaller position at 6.80%, creating a substantial gap between the dominant address and secondary stakeholders. The remaining top five addresses collectively represent 86.08% of total supply, while the dispersed "Others" category accounts for only 8.12%. This distribution pattern suggests that MNRY's token ownership structure lacks meaningful decentralization, with decision-making power heavily concentrated among a limited number of entities.

The current holdings distribution carries material implications for market dynamics and price stability. The overwhelming dominance of the primary address creates potential vulnerability to market manipulation, as a single entity possesses sufficient token volume to significantly impact price discovery and liquidity conditions. The thin distribution among secondary holders limits natural market depth and potentially constrains organic price discovery mechanisms. Furthermore, any significant movement or disposal decision by the largest holder could trigger substantial price volatility. From a structural perspective, this concentration suggests MNRY remains in a relatively early or controlled distribution phase, with limited evidence of broad community participation or decentralized holder base development.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5f4f...ff38b3 | 777913.97K | 77.79% |

| 2 | 0x9642...2f5d4e | 68004.53K | 6.80% |

| 3 | 0x98d7...21c921 | 27995.00K | 2.79% |

| 4 | 0xcf8c...3ffa73 | 27680.55K | 2.76% |

| 5 | 0xf89d...5eaa40 | 17464.06K | 1.74% |

| - | Others | 80941.90K | 8.12% |

II. Core Factors Affecting MNRY's Future Price

Supply Mechanism

- Deflationary Model: MNRY employs a deflationary mechanism that controls the total supply over the long term.

- Historical Experience: Reduced supply typically enhances scarcity, which in turn drives price appreciation.

- Current Impact: The ongoing deflationary mechanism is expected to support upward price pressure by maintaining limited token availability.

Macroeconomic Environment

- Monetary Policy Impact: MNRY, like other cryptocurrencies, is subject to interest rate fluctuations and US dollar strength, which are common factors affecting all digital assets.

- Inflation Hedging Properties: MNRY's deflationary mechanism provides advantages in inflationary environments, offering potential protection against currency devaluation.

Technology Development and Ecosystem Building

- Decentralized Gaming and Entertainment: MNRY demonstrates value in the decentralized gaming and entertainment industry, with ecosystem development including PC games available on Epic Games Store and mobile games under development.

- Ecosystem Focus: The PFP (Profile Picture) series serves as the core of the Moonray ecosystem, supporting the broader gaming and entertainment infrastructure.

III. 2026-2031 MNRY Price Forecast

2026 Outlook

- Conservative Forecast: $0.00057 - $0.00087

- Base Case Forecast: $0.00087

- Optimistic Forecast: $0.00122 (requiring sustained market sentiment and positive ecosystem developments)

2027-2029 Medium-term Outlook

- Market Phase Expectation: Gradual accumulation and recovery phase with moderate growth trajectory

- Price Range Forecast:

- 2027: $0.00083 - $0.00123 (20% potential upside)

- 2028: $0.00095 - $0.00142 (30% potential upside)

- 2029: $0.00068 - $0.00183 (47% potential upside)

- Key Catalysts: Enhanced utility adoption, ecosystem expansion, market sentiment recovery, and increased institutional interest in the asset class

2030-2031 Long-term Outlook

- Base Scenario: $0.00082 - $0.00191 (78% potential upside by 2030, assuming steady market conditions and continued development)

- Optimistic Scenario: $0.00097 - $0.00242 (99% potential upside by 2031, assuming accelerated adoption and favorable regulatory environment)

- Transformation Scenario: $0.00242+ (contingent on breakthrough technological milestones, significant partnerships, or major market-wide catalysts)

- January 4, 2026: MNRY trading within $0.00057 - $0.00122 range (early consolidation phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00122 | 0.00087 | 0.00057 | 0 |

| 2027 | 0.00123 | 0.00104 | 0.00083 | 20 |

| 2028 | 0.00142 | 0.00114 | 0.00095 | 30 |

| 2029 | 0.00183 | 0.00128 | 0.00068 | 47 |

| 2030 | 0.00191 | 0.00155 | 0.00082 | 78 |

| 2031 | 0.00242 | 0.00173 | 0.00097 | 99 |

Moonray (MNRY) Professional Investment Strategy and Risk Management Report

IV. MNRY Professional Investment Strategy and Risk Management

MNRY Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Gaming and entertainment ecosystem believers, blockchain adoption enthusiasts

- Operation recommendations:

- Accumulate during market downturns when MNRY trades significantly below historical highs ($0.21328), with current price at $0.0008689 representing a 99.6% decline from ATH

- Hold through ecosystem expansion phases as Moonray Game gains adoption on Epic Games Store and PlayStation platforms

- Reinvest any staking rewards or governance distributions to compound returns

(2) Active Trading Strategy

- Technical analysis tools:

- Support/Resistance Levels: Monitor $0.0006507 (ATL) as critical support and $0.00097 (24H high) as immediate resistance

- Volume Analysis: Track the current 24H trading volume of $32,263.87 to identify breakout opportunities when volume significantly increases

- Wave trading key points:

- Enter positions during negative sentiment periods when MNRY shows weakness in 1H (-1.03%) and 7D (-4.25%) metrics

- Exit or take profits when positive 30D momentum (+17.69%) extends into longer timeframes

MNRY Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of portfolio allocation, focusing on long-term ecosystem development

- Active investors: 2-5% of portfolio allocation, with tactical rebalancing based on game milestone announcements

- Professional investors: 5-10% of portfolio allocation, with sophisticated hedging strategies and position sizing

(2) Risk Hedging Solutions

- Diversification strategy: Balance MNRY position against other gaming and entertainment tokens to reduce concentration risk

- Dollar-cost averaging (DCA): Execute monthly purchases at fixed amounts to reduce timing risk and average entry costs

(3) Secure Storage Solutions

- Hot wallet solution: Gate Web3 Wallet for frequent trading and active participation in Moonray ecosystem governance

- Cold storage approach: Store majority of long-term holdings in hardware wallets with multi-signature protocols for enhanced security

- Security precautions: Never share private keys, enable two-factor authentication on all exchange accounts, verify smart contract addresses before token transfers

V. MNRY Potential Risks and Challenges

MNRY Market Risk

- Extreme price volatility: MNRY has experienced a 98.47% annual decline with a market capitalization of only $868,900, indicating extreme illiquidity and susceptibility to sharp price movements

- Liquidity constraints: With only $32,263.87 in 24H trading volume and 503 token holders, low trading volume creates significant slippage risk for larger positions

- Market capitalization concentration: Current circulating market cap of only $74,725.40 represents micro-cap status with limited price discovery mechanisms

MNRY Regulatory Risk

- Gaming industry compliance: Blockchain-based gaming faces evolving regulatory scrutiny across jurisdictions regarding gaming licenses and player protection requirements

- Securities classification uncertainty: Token utility in future games may trigger securities regulations in certain jurisdictions, potentially impacting MNRY's tradability

- Geographic market restrictions: PlayStation and Epic Games Store distribution may face regional restrictions affecting game adoption and token utility

MNRY Technology Risk

- Smart contract vulnerability: As an ERC-20 token on Ethereum, MNRY faces inherent blockchain security risks and potential smart contract exploits

- Game development execution: Delivering a AAA-quality melee-style arena combat game requires substantial development resources and technical expertise with no guaranteed launch timeline

- Ecosystem adoption challenge: Success depends on achieving critical mass adoption on PlayStation, Epic Games Store, and Moonray Mobile platforms

VI. Conclusion and Action Recommendations

MNRY Investment Value Assessment

Moonray (MNRY) represents a speculative venture in the gaming and entertainment blockchain sector. The project offers interesting utility potential through planned integration into AAA gaming titles and ecosystem expansion across multiple platforms. However, the token faces significant market challenges including extreme price decline (98.47% YoY), severe liquidity constraints, and micro-cap market positioning. The project's success hinges on successful game launches and mainstream adoption, which remain uncertain. Current market conditions reflect high skepticism regarding project viability, with MNRY trading near historical lows.

MNRY Investment Recommendations

✅ Beginners: Start with minimal allocation (less than 1% of portfolio) through Gate.com's secure platform, focusing on learning about gaming ecosystem tokenomics rather than profit expectations

✅ Experienced investors: Consider tactical accumulation during weakness if confident in project fundamentals, implementing strict stop-loss orders at critical support levels and position-sizing discipline

✅ Institutional investors: Conduct extensive due diligence on game development progress and team credentials before any allocation, avoid exposure given limited liquidity for institutional-scale positions

MNRY Trading Participation Methods

- Gate.com spot trading: Direct MNRY/USDT or MNRY/ETH trading pairs with real-time market data and professional charting tools

- Limit order execution: Place buy orders near support levels ($0.0006507 area) to accumulate during low-volume periods

- Position tracking: Use Gate.com's portfolio management tools to monitor MNRY holdings and set price alerts for strategic entry/exit points

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is MNRY token? What are its uses and value?

MNRY is a decentralized cryptocurrency designed to reflect global macroeconomic realities. It facilitates daily transactions and provides real-time market data. MNRY's value lies in its unique ability to mirror economic conditions while offering transparency through on-chain analytics and ecosystem utility.

What is the historical price performance of MNRY? What are the past price trends?

MNRY reached an all-time high of $0.211 and an all-time low of $0.0007. In the past 7 days, the price declined by 5.62%. Overall, MNRY shows volatility with significant upside potential as market adoption grows.

What are professional analysts' price predictions for MNRY in the future?

Professional analysts predict MNRY could reach a minimum of $0.0007638. Market sentiment remains optimistic with potential for further growth based on current trading volume and market dynamics in the crypto sector.

What are the main factors affecting MNRY price fluctuations?

MNRY price fluctuations are primarily driven by supply and demand dynamics, market sentiment, trading volume, ecosystem developments, and macroeconomic trends in the cryptocurrency market.

What are the differences between MNRY and other mainstream cryptocurrencies such as Bitcoin and Ethereum?

MNRY prioritizes privacy and decentralization with community-driven governance, unlike Bitcoin's store-of-value focus and Ethereum's smart contract platform. MNRY features faster transaction processing and lower fees, positioning itself as a privacy-centric alternative in the cryptocurrency market.

What are the risks of investing in MNRY? How should I evaluate them?

MNRY investment carries market volatility and potential loss risks. Evaluate by analyzing market trends, trading volume, and technical indicators. Consider your risk tolerance and investment horizon carefully.

2025 3ULL Price Prediction: Bullish Outlook for Emerging Crypto Asset

2025 VGX Price Prediction: Analyzing Potential Growth and Market Trends for Voyager Token

2025 WIZZ Price Prediction: Analyzing Growth Potential and Market Trends for the Budget Airline

2025 METALDR Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 READY Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Cryptocurrency

2025 NVIR Price Prediction: Navigating the Future of AI-Driven Investments

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?