2025 MITO Price Prediction: Expert Analysis and Market Outlook for the Coming Year

Introduction: MITO's Market Position and Investment Value

Mitosis (MITO) serves as the liquidity protocol for the modular era that redefines cross-chain liquidity. Since its inception, MITO has established itself as an innovative solution making cross-chain liquidity provision more attractive by enabling liquidity for cross-chain LPing activities. As of December 2025, MITO's market capitalization stands at approximately $73.86 million, with a circulating supply of around 196.27 million tokens, trading at approximately $0.07386. This protocol, which enables LPs to receive derivative tokens convertible 1:1 to their locked assets and participate in various DeFi applications across Ethereum L1 chains and L2 rollups, is playing an increasingly important role in the cross-chain DeFi ecosystem.

This article will provide a comprehensive analysis of MITO's price trends through 2025-2030, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors considering exposure to this modular era liquidity solution.

MITO Token Market Analysis Report

I. MITO Price History Review and Market Status

MITO Historical Price Trajectory

MITO reached its all-time high of $0.45 on September 14, 2025, marking the peak performance since its launch. The token subsequently experienced a significant correction, dropping to its all-time low of $0.05 on October 10, 2025. This represents an 88.89% decline from peak to trough over approximately one month, reflecting substantial market volatility in the early trading phase.

MITO Current Market Position

As of December 21, 2025, MITO is trading at $0.07386, positioned at market rank #994 with a total market capitalization of $73,860,000. The token demonstrates the following characteristics:

Market Metrics:

- Current Price: $0.07386

- 24-Hour Price Change: -0.41%

- 7-Day Price Change: -2.19%

- 30-Day Price Change: -6.60%

- 1-Year Price Change: -64.11%

- 24-Hour Trading Volume: $16,870.92

- Circulating Supply: 196,273,082 MITO

- Total Supply: 1,000,000,000 MITO

- Circulation Ratio: 19.63%

- Token Holders: 75,627

Price Range (24-Hour):

- High: $0.07648

- Low: $0.07341

The token is currently trading approximately 83.58% below its all-time high and 47.72% above its all-time low. The market share stands at 0.0023% of the total cryptocurrency market. With the current market sentiment indicating extreme fear (VIX: 20), MITO reflects the broader market uncertainty affecting digital assets at this time.

Click to view current MITO market price

MITO Market Sentiment Index

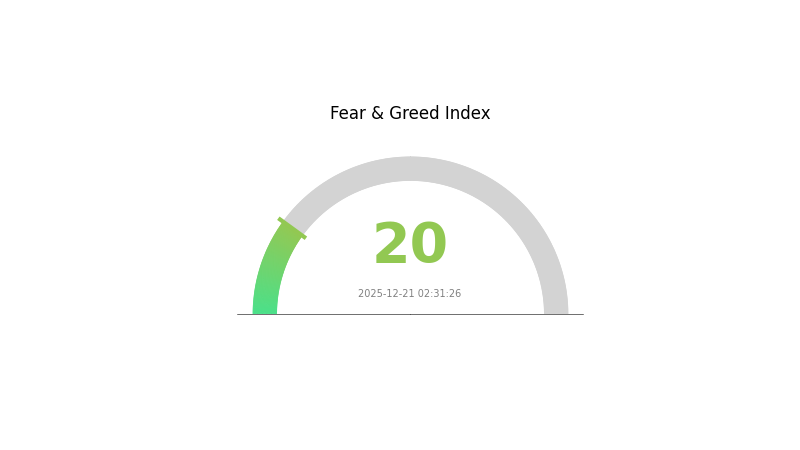

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index hitting 20. This indicates significant market pessimism and risk aversion among investors. During periods of extreme fear, assets are typically undervalued, potentially presenting buying opportunities for long-term investors with high risk tolerance. However, it's crucial to conduct thorough due diligence before making investment decisions. Monitor market developments closely on Gate.com and consider your risk management strategy carefully during this volatile period.

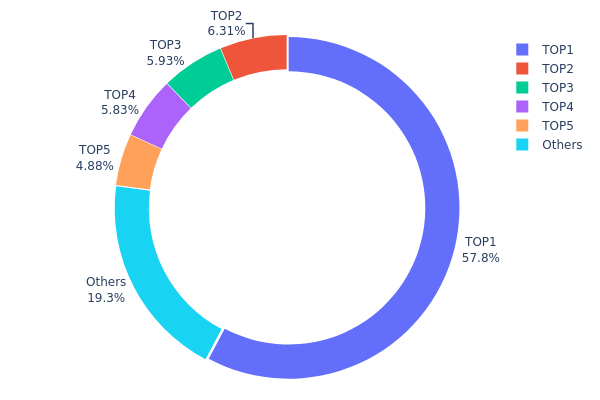

MITO Holdings Distribution

The address holdings distribution represents the concentration of token ownership across the blockchain, revealing the degree of decentralization and potential market structure risks. By analyzing the top holders and their respective percentages of total supply, this metric provides critical insights into token distribution patterns, liquidity dynamics, and vulnerability to concentrated selling pressure.

MITO exhibits significant concentration risk, with the top holder commanding 57.75% of the total supply. This extreme concentration in a single address represents an unprecedented level of centralization that substantially exceeds healthy distribution thresholds for a functioning cryptocurrency asset. The top five addresses collectively account for 80.66% of all circulating tokens, leaving only 19.34% distributed among remaining holders. This skewed distribution pattern indicates a highly asymmetrical token structure where decision-making power and price influence are concentrated among a minimal number of entities.

The concentration dynamics present considerable implications for market stability and price discovery mechanisms. The dominant position of the leading address creates substantial liquidity fragmentation and exposes the market to acute volatility risks should significant token movements occur. With nearly 80% of supply held by just five addresses, the token ecosystem remains vulnerable to coordinated actions or unilateral decisions from principal stakeholders. The relatively thin distribution among other holders suggests limited organic ownership dispersion and raises concerns regarding long-term decentralization prospects. This structural configuration indicates a market characterized by early-stage concentration typical of newly launched or insufficiently distributed tokens, where institutional accumulation patterns or early allocations remain concentrated rather than organically dispersed across diverse market participants.

Visit MITO Holdings Distribution on Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 29773.00K | 57.75% |

| 2 | 0x4368...26f042 | 3250.79K | 6.30% |

| 3 | 0x238a...d5e6c4 | 3056.24K | 5.92% |

| 4 | 0x7fcb...9f56f7 | 3003.96K | 5.82% |

| 5 | 0x8894...e2d4e3 | 2515.30K | 4.87% |

| - | Others | 9955.65K | 19.34% |

II. Core Factors Affecting MITO's Future Price

Supply Mechanism

-

Dual-Token Architecture: MITO employs a layered token design with tMITO (long-term staking) and rMITO (short-term incentives), encouraging capital retention while maintaining system stability and user engagement across different time horizons.

-

Current Impact: This stratified design enables MITO to balance both long-term and short-term demand requirements, reducing selling pressure from the token supply and supporting price stability through differentiated incentive mechanisms.

Macroeconomic Environment

- Monetary Policy Impact: The overall cryptocurrency market, including MITO, remains susceptible to short-term volatility and Federal Reserve policy decisions, which influence broader market sentiment and capital flows into digital assets.

Technology Development and Ecosystem Construction

-

Continuous Feature Development: Future price appreciation depends significantly on the project's ability to maintain steady innovation and develop new functionalities that attract developers and projects into the Mitosis ecosystem.

-

Ecosystem Growth: Attracting more development teams and protocols to the ecosystem directly increases demand for MITO tokens, creating positive price momentum as network adoption expands and use cases multiply.

III. 2025-2030 MITO Price Forecast

2025 Outlook

- Conservative Forecast: $0.05966 - $0.07365

- Base Case Forecast: $0.07365

- Optimistic Forecast: $0.08985 (requires sustained market recovery and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Consolidation phase with gradual upward momentum as the asset accumulates market recognition and adoption increases

- Price Range Forecast:

- 2026: $0.05069 - $0.08829 (10% upside potential)

- 2027: $0.07397 - $0.10458 (15% upside potential)

- Key Catalysts: Ecosystem expansion, increased institutional participation, technological upgrades, and growing utility adoption within the network

2028-2030 Long-term Outlook

- Base Case Scenario: $0.08248 - $0.13272 (28% growth by 2028, reflecting steady market maturation and fundamental strengthening)

- Optimistic Scenario: $0.07508 - $0.11945 (54% growth by 2029, assuming accelerated adoption and favorable macroeconomic conditions)

- Bull Case Scenario: $0.08395 - $0.14109 (57% growth by 2030, contingent on breakthrough partnerships, significant protocol innovations, and mainstream integration)

- 2030-12-21: MITO trades near $0.1166 (average forecast level, reflecting mature market positioning)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.08985 | 0.07365 | 0.05966 | 0 |

| 2026 | 0.08829 | 0.08175 | 0.05069 | 10 |

| 2027 | 0.10458 | 0.08502 | 0.07397 | 15 |

| 2028 | 0.13272 | 0.0948 | 0.08248 | 28 |

| 2029 | 0.11945 | 0.11376 | 0.07508 | 54 |

| 2030 | 0.14109 | 0.1166 | 0.08395 | 57 |

Mitosis (MITO) Professional Investment Analysis Report

IV. MITO Professional Investment Strategy and Risk Management

MITO Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: DeFi protocol enthusiasts, cross-chain liquidity providers, and investors with 1-3 year investment horizons

- Operational Recommendations:

- Accumulate MITO during market downturns, particularly when prices approach support levels around $0.05

- Hold derivative tokens generated from cross-chain LP positions to capture additional yield opportunities

- Reinvest protocol fee shares and yield rewards to compound returns over time

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price levels at $0.05 (historical low), $0.07 (current price zone), and $0.45 (all-time high)

- Volume Analysis: Track the 24-hour volume of approximately $16,870 to identify breakout opportunities and trend reversals

- Swing Trading Key Points:

- Exploit price volatility within the established trading range

- Monitor correlation with Ethereum L1 and L2 rollup market performance for sentiment indicators

MITO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation

- Active Investors: 3-8% of portfolio allocation

- Professional Investors: 8-15% of portfolio allocation with hedging strategies

(2) Risk Hedging Solutions

- Diversification Strategy: Balance MITO holdings with stablecoin reserves and blue-chip cryptocurrency positions

- Position Sizing: Limit single trade exposure to no more than 2% of total capital to mitigate concentration risk

(3) Secure Storage Solutions

- Cold Storage Option: Use hardware wallets for long-term holdings exceeding 6 months

- Hot Wallet Solution: Employ Gate.com Web3 Wallet for active trading and frequent transactions, featuring industry-standard security protocols

- Security Best Practices: Enable two-factor authentication, maintain backup recovery phrases in secure offline locations, and verify contract addresses before token transfers

V. MITO Potential Risks and Challenges

MITO Market Risk

- Price Volatility: MITO has experienced a 64.11% decline over the past year, indicating significant price instability and potential for further downside

- Liquidity Risk: With a 24-hour trading volume of only $16,870 and a market cap of approximately $73.86 million, the token faces liquidity constraints that could lead to wider bid-ask spreads during large transactions

- Market Sentiment Vulnerability: Current market emotion index of 1 (neutral to bearish) suggests limited bullish catalysts in the near term

MITO Regulatory Risk

- Evolving Regulatory Landscape: Cross-chain protocols face increasing regulatory scrutiny regarding market manipulation and investor protection

- Compliance Uncertainty: Derivative token structures may encounter regulatory challenges as regulators clarify securities classifications

- Geographic Restrictions: Potential expansion of trading restrictions in certain jurisdictions could limit token adoption and liquidity

MITO Technical Risk

- Cross-Chain Execution Risk: Technical failures in cross-chain communication infrastructure could compromise liquidity provision and user funds

- Smart Contract Vulnerability: Protocol updates and upgrades carry inherent security risks despite auditing processes

- Scalability Challenges: Growth in transaction volume could stress network performance and increase operational costs

VI. Conclusion and Action Recommendations

MITO Investment Value Assessment

Mitosis presents an innovative approach to cross-chain liquidity challenges, addressing a genuine market need as the crypto ecosystem becomes increasingly modular. The project's core value proposition—enabling liquid cross-chain LP positions with yield farming opportunities—resonates with sophisticated DeFi participants. However, the significant year-over-year price depreciation (64.11%), modest trading volume, and current market sentiment suggest the project is in a maturation phase with limited near-term catalysts. Investors should recognize that Mitosis represents a higher-risk, specialized investment suitable primarily for those with deep DeFi protocol knowledge and substantial risk tolerance.

MITO Investment Recommendations

✅ Newcomers: Start with minimal positions (0.5-1% of portfolio) after thorough protocol research; consider accumulating gradually during market downturns; prioritize learning how cross-chain LP positions generate yield ✅ Experienced Traders: Implement tactical swing trades within established support ($0.05) and resistance ($0.15) levels; utilize dollar-cost averaging to reduce entry price volatility; maintain stop-loss orders at 15-20% below entry points ✅ Institutional Investors: Conduct comprehensive smart contract audits before significant capital deployment; consider MITO as a hedge component within diversified DeFi protocol exposure; explore direct protocol participation through cross-chain LP provision

MITO Trading Participation Methods

- Spot Trading: Execute buy and sell orders on Gate.com with standard market or limit orders

- Yield Generation: Provide liquidity to supported Ethereum L1 chains and L2 rollups to earn protocol fee shares and governance rewards

- Strategic Accumulation: Use Gate.com's advanced order types (stop-loss, take-profit) to automate disciplined accumulation strategies

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial circumstances. It is strongly recommended to consult with professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is the price prediction for mitosis token 2025?

Based on current market analysis with 5% annual growth assumptions, MITO is predicted to reach approximately $0.010001 by December 2025. This forecast reflects moderate growth potential throughout the year.

What is MITO (Mitosis) token and what are its use cases?

MITO is a governance token enabling holders to vote on protocol proposals and influence direction. It provides liquidity for trading pairs and facilitates ecosystem participation, driving value through decentralized decision-making and platform utility.

What factors could influence MITO token price in the coming years?

MITO token price will be influenced by protocol updates, network adoption rates, market demand trends, block reward changes, and technological advancements. Ecosystem development and user growth are also key drivers.

ATS vs LRC: Comparing Automated Tracking Systems and Learning Resource Centers in Modern Education

DEEP vs OP: Unveiling the Power of Neural Networks in Competitive Gaming

Is Netswap (NETT) a good investment?: Analyzing the Potential and Risks of this DeFi Token

Is Netswap (NETT) a good investment?: Analyzing the potential and risks of this decentralized exchange token

ONX vs LRC: Comparing Two Promising Blockchain Projects in the DeFi Space

2025 DYDX Price Prediction: Analyzing Market Trends and Potential Growth Factors for the DeFi Token

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?