2025 METIS Price Prediction: Analyzing Growth Potential and Market Trends for the Layer 2 Solution

Introduction: METIS's Market Position and Investment Value

Metis Token (METIS), as a revolutionary multi-network ecosystem in the blockchain space, has made significant strides since its inception in 2021. As of 2025, METIS has a market capitalization of $63,674,277, with a circulating supply of approximately 6,652,834 tokens, and a price hovering around $9.571. This asset, often referred to as the "Future of Decentralized Infrastructure," is playing an increasingly crucial role in sectors such as DeFi, gaming, DEPIN, and AI.

This article will comprehensively analyze METIS's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. METIS Price History Review and Current Market Status

METIS Historical Price Evolution

- 2021: METIS launched, price reached an all-time low of $3.45 on May 24

- 2022: METIS hit its all-time high of $323.54 on January 17

- 2025: Market downturn, price dropped significantly from its peak

METIS Current Market Situation

As of October 22, 2025, METIS is trading at $9.571, with a market cap of $63,674,277. The token has experienced a 3.21% decrease in the last 24 hours and a substantial 34.02% decline over the past 30 days. The current price represents a significant 78.5% drop from a year ago, reflecting a bearish trend in the medium to long term.

METIS has a circulating supply of 6,652,834 tokens, which is 66.53% of its total supply of 10,000,000 tokens. The fully diluted market cap stands at $95,710,000. Trading volume in the last 24 hours is $687,245, indicating moderate market activity.

The token's all-time high of $323.54, achieved on January 17, 2022, is now 97.04% above the current price, highlighting the substantial correction the token has undergone since its peak. The market currently displays signs of extreme fear, which could potentially impact METIS's short-term price movements.

Click to view the current METIS market price

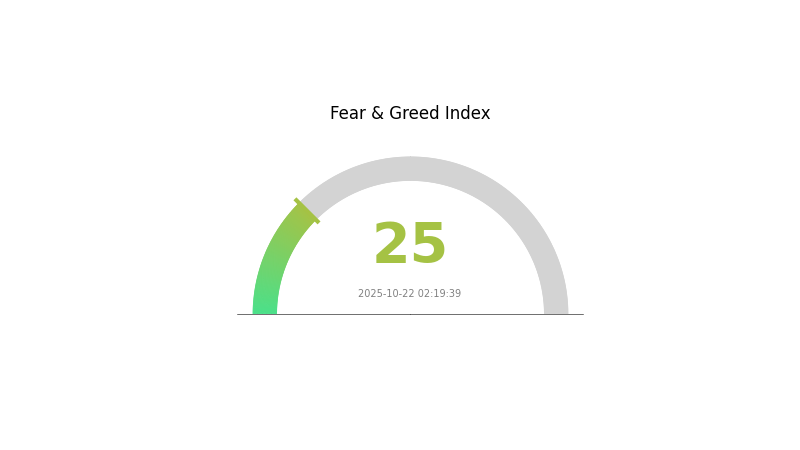

METIS Market Sentiment Indicator

2025-10-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 25. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Traders should consider dollar-cost averaging and thorough research before making decisions. Remember, while fear can create opportunities, it's crucial to manage risk and avoid emotional trading. Stay informed and consider consulting with financial advisors for personalized strategies in this challenging market environment.

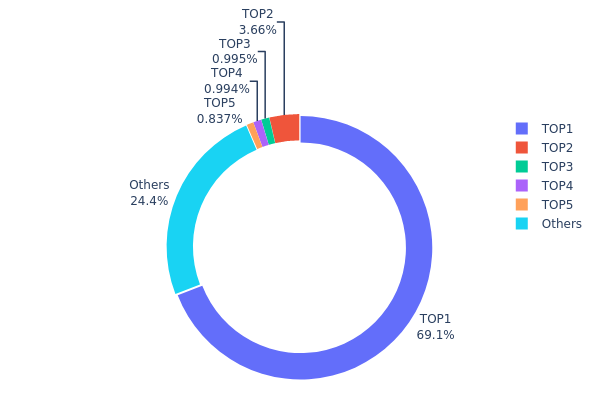

METIS Holdings Distribution

The address holdings distribution for METIS reveals a highly concentrated ownership structure. The top address holds a staggering 69.14% of the total supply, indicating significant centralization. The next four largest holders collectively account for only 6.46% of the supply, with individual holdings ranging from 0.83% to 3.65%. The remaining 24.4% is distributed among other addresses.

This concentration level raises concerns about market stability and potential price manipulation. With a single entity controlling over two-thirds of the supply, there's a risk of significant market impact should they decide to liquidate or relocate their holdings. Such concentration also challenges the principles of decentralization that many blockchain projects aim to achieve.

The current distribution suggests a less than ideal market structure for METIS. It implies a higher vulnerability to sudden price swings and a potential for market manipulation. This concentration may deter some investors due to perceived risks and could impact the token's long-term viability and adoption. Monitoring changes in this distribution will be crucial for assessing METIS's future market health and decentralization progress.

Click to view the current METIS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3980...e9c04b | 6914.15K | 69.14% |

| 2 | 0x0fe3...af5b48 | 365.85K | 3.65% |

| 3 | 0x7c01...b21056 | 99.55K | 0.99% |

| 4 | 0x8d10...eaa1fa | 99.43K | 0.99% |

| 5 | 0x02b4...a8941b | 83.74K | 0.83% |

| - | Others | 2437.29K | 24.4% |

II. Key Factors Affecting METIS Future Price

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve's interest rate decisions and expectations are becoming core drivers of recent price fluctuations.

- Inflation Hedging Properties: As a cryptocurrency, METIS may be viewed as a potential hedge against inflation in the current economic environment.

Technical Development and Ecosystem Building

- Cancun Upgrade: The implementation of the Ethereum Cancun upgrade is expected to drive significant growth for METIS in the medium to long term.

- Sequencer Pool Launch: The introduction of sequencer pools is anticipated to positively impact METIS price and ecosystem development.

- Ecosystem Development Fund: METIS ecosystem growth is being actively supported by a dedicated development fund, which could drive future price appreciation.

- MetisSDK: At the core of METIS is the revolutionary MetisSDK, a developer-centric framework that is reshaping the ecosystem.

Market Sentiment and News

- ETF Introduction: The potential introduction of spot Ethereum ETFs could have a spillover effect on Layer 2 solutions like METIS, potentially driving price growth.

- Community Sentiment: News announcements and community sentiment have been identified as important price action drivers for METIS.

- Market Analysis: Technical analysis, represented by chart patterns, often reflects market sentiment and can influence METIS price movements.

Long-term Projections

- Analyst Predictions: Some analysts predict that METIS could potentially reach $321.35 by the end of the year and $633.65 within a five-year timeframe, although these projections should be considered speculative.

III. METIS Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $5.57 - $9.62

- Neutral forecast: $9.62 - $10.82

- Optimistic forecast: $10.82 - $12.02 (requires strong market momentum)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range predictions:

- 2026: $9.19 - $13.63

- 2027: $11.37 - $17.60

- Key catalysts: Increased adoption of Layer 2 solutions, network upgrades

2028-2030 Long-term Outlook

- Base scenario: $14.91 - $19.24 (assuming steady market growth)

- Optimistic scenario: $19.24 - $22.44 (with accelerated adoption)

- Transformative scenario: $22.44 - $26.55 (with breakthrough technological advancements)

- 2030-12-31: METIS $19.24 (potential 101% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 12.0225 | 9.618 | 5.57844 | 0 |

| 2026 | 13.63352 | 10.82025 | 9.19721 | 13 |

| 2027 | 17.60671 | 12.22688 | 11.371 | 27 |

| 2028 | 17.15432 | 14.9168 | 11.33677 | 55 |

| 2029 | 22.44978 | 16.03556 | 10.74382 | 67 |

| 2030 | 26.55488 | 19.24267 | 13.46987 | 101 |

IV. METIS Professional Investment Strategy and Risk Management

METIS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and blockchain technology enthusiasts

- Operational suggestions:

- Accumulate METIS tokens during market dips

- Stay informed about Metis ecosystem developments

- Store tokens securely in a hardware wallet or reputable custodial service

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI (Relative Strength Index): Identify overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor Metis network activity and adoption metrics

METIS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Layer 2 projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for METIS

METIS Market Risks

- High volatility: Significant price fluctuations common in the crypto market

- Competition: Increasing number of Layer 2 solutions may impact market share

- Adoption concerns: Slow user adoption could affect token value

METIS Regulatory Risks

- Uncertain regulations: Evolving crypto regulations may impact operations

- Cross-border compliance: Varying international regulatory standards

- Security token classification: Potential for regulatory scrutiny

METIS Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Ability to handle increased network load

- Interoperability issues: Compatibility with other blockchain networks

VI. Conclusion and Action Recommendations

METIS Investment Value Assessment

METIS presents a promising long-term value proposition as a Layer 2 scaling solution, but faces short-term risks due to market volatility and competition in the Layer 2 space.

METIS Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging strategy with set risk limits ✅ Institutional investors: Evaluate METIS as part of a diversified Layer 2 portfolio

METIS Trading Participation Methods

- Spot trading: Buy and hold METIS tokens on reputable exchanges

- Staking: Participate in network security and earn rewards

- DeFi integration: Explore decentralized finance opportunities within the Metis ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future of Metis coin?

Metis coin is projected to reach $9.77 by late 2025. The market outlook appears bearish, but the price is expected to show modest growth based on technical analysis forecasts.

Can Matic reach $100?

While theoretically possible, reaching $100 is highly unlikely for Matic. It would require a 132x increase and a $927 billion market cap, which is extremely ambitious given current market conditions.

How much is a MATIC coin worth in 2025?

Based on market analysis, a MATIC coin is predicted to be worth approximately $0.7655 in 2025. This represents a potential high for the year.

Does Matic coin have a future?

Yes, Matic coin has a promising future. It's expected to see slight growth in the near term, with long-term predictions remaining optimistic due to its increasing adoption and utility within the Polygon ecosystem.

Share

Content