2025 MBS Price Prediction: Expert Forecast and Market Analysis for Mortgage-Backed Securities

Introduction: MBS Market Position and Investment Value

UNKJD (MBS) is a next-generation esports metaverse that combines high-production-value multiplayer gaming with Solana & Base blockchain technology, NFTs and decentralized finance. Launched in 2021, the project has established itself as an innovative play-to-earn gaming platform offering turn-based soccer gameplay that is easy to learn yet hard to master. As of January 4, 2026, MBS maintains a market capitalization of approximately $67,797.45, with a circulating supply of 625,437,750 tokens trading at around $0.0001084 per token. This emerging gaming asset is playing an increasingly important role in the intersection of esports, blockchain technology, and decentralized gaming ecosystems.

This article provides a comprehensive analysis of MBS price trends and market dynamics, combining historical performance patterns, market supply-demand factors, ecosystem development, and broader macroeconomic conditions to deliver professional price forecasts and practical investment strategies for the period ahead.

I. MBS Price History Review and Current Market Status

MBS Historical Price Evolution

- December 2021: MBS reached its all-time high of $2.58, marking the peak of the project's market valuation during the initial momentum phase.

- 2022-2025: Sustained downtrend period, with the token experiencing significant depreciation as market conditions shifted and investor sentiment cooled.

- January 2026: MBS approached its all-time low of $0.00009439 on January 1, 2026, representing a massive 99.4% decline from its historical peak.

MBS Current Market Status

As of January 4, 2026, MBS is trading at $0.0001084 with a 24-hour trading volume of $5,199.82. The token demonstrates modest short-term momentum with a 1.02% increase over the past 24 hours, driven by a minor price movement of $0.000001095. However, this recovery is marginal against the backdrop of severe longer-term losses: the token has declined 35.67% over 7 days and 86.8% over 30 days, reflecting sustained selling pressure.

The token's fully diluted market capitalization stands at $108,400, with a circulating supply of 625,437,750 MBS tokens out of a total supply of 1,000,000,000. Currently, 40,445 token holders maintain positions in MBS. The market share remains negligible at 0.0000032%, indicating minimal market relevance relative to the broader cryptocurrency ecosystem.

The 24-hour trading range shows MBS fluctuating between $0.0000962 and $0.0001123, with the market sentiment index registering at a neutral level despite the challenging price dynamics.

Visit Gate.com to check the current MBS market price

MBS Market Sentiment Index

2026-01-04 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a fear sentiment with an index reading of 29. This indicates heightened market anxiety and pessimism among investors. During periods of fear, market participants tend to adopt a more cautious approach, often leading to increased selling pressure and price volatility. Investors should exercise prudent risk management and consider their investment strategies carefully. While fear can present buying opportunities for long-term investors, it also signals potential downside risks. Monitor market developments closely and ensure your portfolio aligns with your risk tolerance and investment objectives.

MBS Holdings Distribution

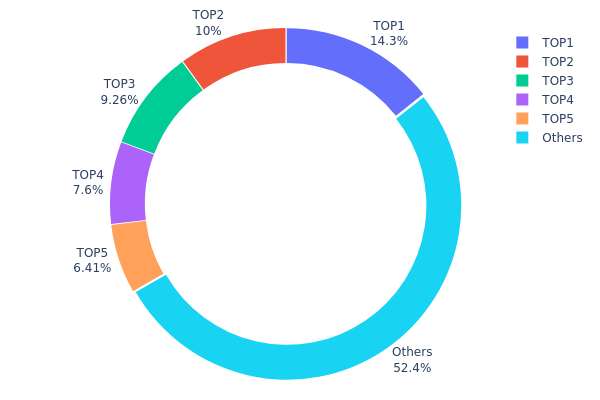

An address holdings distribution map illustrates the concentration of token ownership across blockchain addresses, revealing how MBS tokens are distributed among holders. This metric serves as a critical indicator of market structure, decentralization degree, and potential systemic risks associated with concentration of control.

The current MBS holdings data reveals moderate concentration characteristics. The top five addresses collectively control 47.59% of total supply, with the largest holder commanding 14.32%. While this concentration level does not constitute extreme centralization, it warrants attention. The top address holding approximately 143.25 million tokens represents a significant position, yet the remaining 52.41% distributed among other addresses demonstrates that the majority of tokens are dispersed across a broader holder base, mitigating the risk of absolute control by individual actors.

From a market structure perspective, this distribution pattern presents both stability and vulnerability. The moderate concentration among top holders could facilitate coordinated liquidity management and project development funding, supporting ecosystem growth. However, concentrated positions inherently introduce price volatility risks; large holders possess sufficient capital to materially influence market dynamics through substantial transactions. The relatively balanced secondary distribution, where no single address beyond the top five commands disproportionate influence, suggests the token maintains reasonable resistance to manipulation. Overall, MBS demonstrates a moderately decentralized structure that balances operational efficiency with distributed governance characteristics, though continued monitoring of top holder activities remains essential for assessing long-term market health.

Check the current MBS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | HmaVvV...dRWQ4k | 143252.33K | 14.32% |

| 2 | A2poWi...DcDZSN | 100000.00K | 10.00% |

| 3 | u6PJ8D...ynXq2w | 92608.55K | 9.26% |

| 4 | As1yDE...UNxUZH | 76000.00K | 7.60% |

| 5 | 5Q544f...pge4j1 | 64148.73K | 6.41% |

| - | Others | 523983.43K | 52.41% |

II. Core Factors Influencing MBS Future Price

Macroeconomic Environment

-

Monetary Policy Impact: The U.S. Federal Reserve's policy rate trajectory and inflation expectations will be the primary drivers of MBS price movements in 2026. Markets are gradually pricing in the possibility of inflation decline and economic slowdown, with monetary policy expectations becoming the core driver of yield curve movements. Delayed rate-cutting expectations from the Federal Reserve have been pushing up Treasury yields and increasing financial market risks.

-

Inflation Hedge Properties: MBS prices are inversely related to inflation expectations. As inflation declines, MBS prices are likely to benefit from lower interest rates, while rising inflation typically pressures yields upward. The market's gradual incorporation of 2026 inflation moderation scenarios suggests potential upside for MBS valuations.

-

Fiscal Deficit Concerns: Persistent U.S. fiscal deficits remain a key factor determining the shape of government debt yield curves, which directly impacts MBS pricing dynamics alongside monetary policy developments.

Institutional and Major Holder Dynamics

-

Institutional Holdings: In the institutional MBS market, investors benefit from higher coupon income compared to concurrent U.S. Treasury yields, which compensates for prepayment risk while maintaining similar credit quality to Treasuries. Institutional MBS represents the core of MBS assets with high liquidity and provides attractive risk-adjusted returns.

-

Federal Reserve Activity: The Federal Reserve's buying activity is currently providing price support for MBS. Following the Fed's pause in rate hikes, MBS performance has improved, with the central bank's continued presence in the market serving as a stabilizing factor for valuations.

-

Bank Holdings Dynamics: Banks have increasingly avoided additional MBS purchases due to significant asset value declines affecting internal risk assessments, which reduces institutional demand pressures on MBS pricing in the near term.

Three、2026-2031 MBS Price Forecast

2026 Outlook

- Conservative Forecast: $0.0001 - $0.00011

- Neutral Forecast: $0.00011 - $0.00015

- Optimistic Forecast: $0.00015 (requires positive market sentiment and increased adoption)

2027-2029 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation and consolidation phase with steady growth trajectory

- Price Range Forecast:

- 2027: $0.00011 - $0.00015

- 2028: $0.00009 - $0.00017

- 2029: $0.00015 - $0.00018

- Key Catalysts: Increased institutional interest, ecosystem development, mainstream adoption acceleration, and positive regulatory environment

2030-2031 Long-term Outlook

- Base Case Scenario: $0.00009 - $0.00017 (assuming steady market growth and moderate adoption rates)

- Optimistic Scenario: $0.00017 - $0.00019 (assuming accelerated ecosystem expansion and stronger institutional participation)

- Transformative Scenario: $0.00019+ (extreme favorable conditions including mainstream adoption breakthrough, major partnership announcements, and significant technological upgrades)

- 2026-01-04: MBS trading at foundational levels with 3% growth potential (early accumulation phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00015 | 0.00011 | 0.0001 | 3 |

| 2027 | 0.00015 | 0.00013 | 0.00011 | 19 |

| 2028 | 0.00017 | 0.00014 | 0.00009 | 29 |

| 2029 | 0.00018 | 0.00016 | 0.00015 | 44 |

| 2030 | 0.00017 | 0.00017 | 0.00009 | 53 |

| 2031 | 0.00019 | 0.00017 | 0.00012 | 57 |

UNKJD (MBS) Investment Strategy and Risk Management Report

IV. MBS Professional Investment Strategy and Risk Management

MBS Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Crypto gaming enthusiasts, blockchain technology believers, and risk-tolerant long-term investors who understand play-to-earn gaming mechanics

- Operational Recommendations:

- Accumulate positions during market downturns when MBS is trading significantly below historical highs, taking advantage of current bearish sentiment

- Maintain a diversified portfolio allocation to balance exposure to gaming and metaverse tokens

- Monitor project developments, partnerships with Solana and Base blockchain ecosystems, and game updates that enhance user engagement and NFT utility

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Utilize historical price data to identify key levels at $0.0001084 (current price) and resistance near the 24-hour high of $0.0001123

- Moving Averages: Apply short-term (7-day) and medium-term (30-day) moving averages to gauge trend direction, particularly given the -35.67% 7-day decline

- Wave Operation Key Points:

- Capitalize on volatility cycles created by gaming announcements, NFT releases, or ecosystem expansions on Solana and Base

- Execute entry points during temporary pullbacks and exit during rallies when technical indicators show overbought conditions

MBS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation to gaming and metaverse tokens including MBS

- Aggressive Investors: 3-5% allocation to higher-risk gaming tokens, with MBS representing a portion of this allocation

- Professional Investors: 5-10% to gaming and blockchain gaming ecosystems, using MBS as part of a diversified gaming token portfolio with defined risk parameters

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine MBS holdings with stablecoins and blue-chip cryptocurrencies to reduce volatility exposure

- Position Sizing: Implement strict position size limits based on individual risk tolerance, particularly given MBS's 99.4% one-year decline

(3) Secure Storage Solutions

- Mobile Wallet Recommendation: Gate.com Web3 Wallet for convenient and frequent trading access with built-in security features

- Cold Storage Option: Solana-compatible hardware solutions for long-term storage of larger MBS holdings to protect against exchange-related risks

- Security Precautions: Enable two-factor authentication on all exchange accounts, use hardware wallets for amounts exceeding immediate trading needs, never share private keys or seed phrases, and verify all transaction addresses before confirming transfers

V. MBS Potential Risks and Challenges

MBS Market Risk

- Extreme Price Volatility: MBS has experienced a 99.4% decline over the past year, demonstrating severe market sensitivity to sentiment shifts and gaming industry trends

- Limited Liquidity: With only 1 exchange listing (Gate.com) and 24-hour volume of $5,199.82, the token faces significant liquidity constraints that could impact exit strategies during market downturns

- Competition from Established Gaming Tokens: The crowded play-to-earn gaming space includes numerous competitors with larger communities, better funding, and more established game ecosystems

MBS Regulatory Risk

- Evolving Gaming and NFT Regulations: Jurisdictions worldwide are increasingly scrutinizing play-to-earn games and NFT assets, potentially impacting MBS's legal status and operational framework

- Blockchain Network Regulations: Changes to Solana and Base blockchain regulations could directly affect MBS's utility and trading capabilities

- Cross-Border Compliance: As an international gaming token, MBS faces varying regulatory requirements across different countries and may experience access restrictions in certain jurisdictions

MBS Technical Risk

- Blockchain Dependency: MBS relies on Solana and Base network stability; network congestion or security incidents could disrupt game functionality and token transfers

- Smart Contract Vulnerabilities: Gaming mechanics and NFT systems depend on smart contract execution; undiscovered code vulnerabilities could result in fund loss or gameplay disruption

- Game Adoption and Technical Execution: The success of the turn-based soccer game depends on maintaining server stability, regular updates, and successful NFT integration into gameplay mechanics

VI. Conclusion and Action Recommendations

MBS Investment Value Assessment

UNKJD (MBS) represents a speculative investment in the gaming and metaverse sector, combining Solana and Base blockchain technology with play-to-earn mechanics. The token's dramatic 99.4% one-year decline reflects extreme market volatility and challenges facing early-stage gaming tokens. Current positioning at $0.0001084 with minimal daily trading volume ($5,199.82) indicates either a significant discount to intrinsic value or continued fundamental weakness. Investors should recognize this as a high-risk, high-reward opportunity suitable only for those who can afford complete capital loss. The project's success depends on achieving significant player adoption, demonstrating strong NFT economics, and building sustainable competitive advantages in the crowded gaming metaverse space.

MBS Investment Recommendations

✅ Beginners: Allocate only 1% or less to MBS as a speculative position after thoroughly understanding gaming token dynamics; prioritize learning about Solana and Base ecosystems before committing capital

✅ Experienced Investors: Consider a 2-5% allocation as part of a diversified gaming token portfolio; use technical analysis to time entry points during oversold conditions; implement strict stop-loss orders at 20-30% below entry price

✅ Institutional Investors: Conduct comprehensive due diligence on game mechanics, NFT utility, development team credibility, and financial sustainability; negotiate direct exposure or structured products only after detailed risk assessment

MBS Trading Participation Methods

- Exchange Trading: Purchase MBS directly on Gate.com using established trading pairs; implement market orders for immediate execution or limit orders for price-specific entries

- Staking and Yield Programs: Participate in any staking or reward mechanisms offered by the UNKJD project to generate additional returns on holdings (verify legitimacy and terms carefully)

- Gaming Participation: Directly engage with the play-to-earn soccer game to earn MBS rewards and NFTs, combining gaming enjoyment with potential token accumulation

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on personal risk tolerance and financial circumstances. Always consult qualified financial advisors before investing. Never invest more than you can afford to lose completely.

FAQ

What is MBS (Mortgage-Backed Securities) and how is its price determined?

MBS is a security backed by residential mortgage loans. Its price is determined by prepayment models, market supply and demand, and interest rate fluctuations. Higher rates typically lower MBS prices, while lower rates increase them.

What factors affect MBS price changes and how to predict these fluctuations?

MBS prices are influenced by interest rates, economic conditions, credit risk, and trading volume. Predict changes by analyzing market trends, Federal Reserve policies, mortgage rates, and economic indicators closely.

How do interest rate changes affect MBS prices, and how can this relationship be used for prediction?

Rising interest rates decrease MBS prices as duration expands, while falling rates increase prices as duration contracts. By monitoring interest rate trends, you can predict MBS price movements inversely correlated with rate changes.

What are the most commonly used analysis methods and tools for MBS price prediction?

Common methods include technical analysis, fundamental analysis, and machine learning models. Key tools encompass moving averages, RSI indicators, trading volume analysis, and blockchain data platforms for real-time market insights and trend prediction.

What key risk factors should I monitor when investing in MBS, and how can I hedge against price volatility?

Monitor prepayment risk and credit risk when investing in MBS. Hedge price volatility by selecting government-guaranteed Agency MBS, which offer lower credit risk and more stable returns compared to Non-Agency MBS alternatives.

What are the difficulties and characteristics of MBS price prediction compared to other fixed-income products?

MBS price prediction is more complex due to sensitivity to housing market trends, interest rates, and prepayment risk. Unlike traditional bonds, MBS involves mortgage-backed securities with unique cash flow uncertainty, requiring analysis of economic indicators, mortgage rates, and housing cycles for accurate forecasting.

How do macroeconomic indicators such as CPI and employment data affect MBS price predictions?

Macroeconomic indicators like CPI and employment data directly impact MBS price predictions by reflecting economic health and influencing interest rates. Strong inflation and robust job growth typically signal rate tightening, pushing MBS prices lower, while weak data may support price appreciation.

How does prepayment risk affect the accuracy of MBS price prediction?

Prepayment risk introduces cash flow uncertainty in MBS valuations, making accurate price predictions challenging. Early borrower repayments reduce expected returns and complicate pricing models, directly impacting forecast precision and investor returns estimation.

Open Loot Explained: Core Whitepaper Logic and Gaming Applications

2025 GALA Price Prediction: Will GALA Token Reach New Heights in the Metaverse Era?

What is SKYA: Exploring the Revolutionary AI-Powered Sky Mapping Technology

What is MCRT: Exploring the Revolutionary Ray Tracing Technology in Computer Graphics

What is EPIK: A Comprehensive Guide to Teaching English in South Korea's Public Schools

What is NVG: Understanding Night Vision Goggles and Their Military Applications

Best Super Investment Strategy for SMSFs and Crypto Exposure in 2026

MoonPay Meaning In Crypto, Payments Infrastructure For Digital Assets

What Is TradFi vs DeFi? A Complete Comparison Between TradFi and DeFi

How to Go from TradFi to DeFi? A Complete Guide in 2026

Leading Crypto Projects on Blast Layer-2 Network