2025 MAJOR Price Prediction: Bullish Trends and Key Factors Driving Cryptocurrency Growth

Introduction: MAJOR's Market Position and Investment Value

Major (MAJOR), as a "Play to Earn" game token on the Telegram platform, has attracted over 70 million users since its inception. As of 2025, Major's market capitalization has reached $6,453,200, with a circulating supply of approximately 85,000,000 tokens, and a price hovering around $0.07592. This asset, dubbed the "Telegram gaming phenomenon," is playing an increasingly crucial role in the intersection of social messaging and blockchain gaming.

This article will comprehensively analyze Major's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. MAJOR Price History Review and Current Market Status

MAJOR Historical Price Evolution

- 2024: Project launch, price peaked at $1.54344 on November 28

- 2025: Market downturn, price dropped to its all-time low of $0.02741 on October 10

- 2025: Gradual recovery, current price at $0.07592 as of November 22

MAJOR Current Market Situation

MAJOR is currently trading at $0.07592, experiencing a 9.55% decrease in the last 24 hours. The token has seen significant volatility, with a 24-hour high of $0.08731 and a low of $0.07224. The current price represents a 95.07% decrease from its all-time high and a 177.15% increase from its all-time low. With a market cap of $6,453,200 and a fully diluted valuation of $7,592,000, MAJOR ranks 1430th in the cryptocurrency market. The token's trading volume in the past 24 hours stands at $23,819.21, indicating moderate market activity. The circulating supply is 85,000,000 MAJOR, which is 85% of the total supply of 100,000,000 tokens.

Click to view the current MAJOR market price

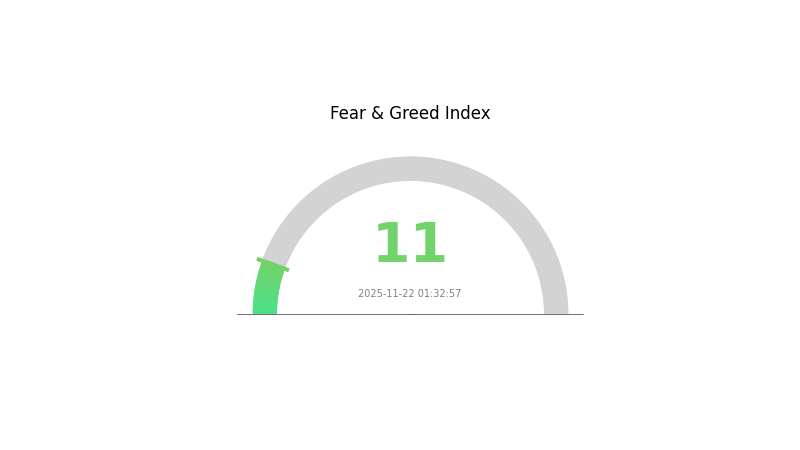

MAJOR Market Sentiment Indicator

2025-11-22 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the index plummeting to 11. This level of pessimism often precedes significant market movements. Savvy investors may see this as a potential buying opportunity, adhering to the adage "be greedy when others are fearful." However, caution is advised as extreme fear could signal underlying market issues. Traders on Gate.com should closely monitor market trends and conduct thorough research before making any decisions in this highly volatile environment.

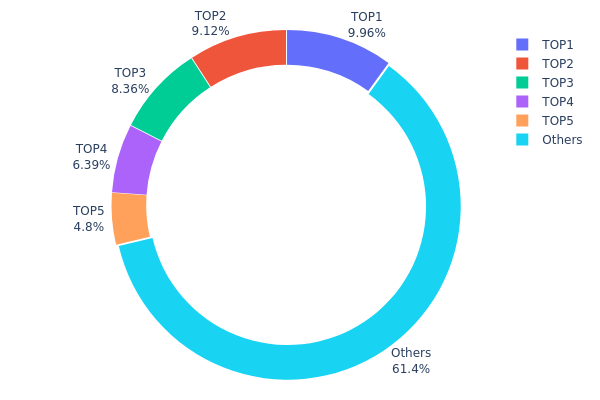

MAJOR Holdings Distribution

The address holdings distribution data provides insights into the concentration of MAJOR tokens among top holders. Analysis reveals a moderate level of centralization, with the top 5 addresses controlling 38.6% of the total supply. The largest holder possesses 9.95% of MAJOR tokens, followed by four addresses holding between 4.80% and 9.11% each.

This distribution pattern suggests a balanced market structure, where no single entity has overwhelming control. However, the concentration among top holders could potentially influence price movements, especially if large volumes are traded. The presence of 61.4% of tokens held by other addresses indicates a degree of decentralization, which may contribute to market stability and reduce the risk of price manipulation by a single large holder.

Overall, the current MAJOR token distribution reflects a moderately decentralized ecosystem, with a healthy balance between major stakeholders and smaller holders. This structure may promote market resilience and support long-term growth potential for the MAJOR token.

Click to view the current MAJOR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | UQBmoe...5E5Uii | 9827.83K | 9.95% |

| 2 | UQAEi4...zPkU7i | 9000.01K | 9.11% |

| 3 | UQB7Uw...wqOEz1 | 8254.56K | 8.36% |

| 4 | UQDDsF...aoBFto | 6302.81K | 6.38% |

| 5 | UQDckH...wSGwFA | 4737.47K | 4.80% |

| - | Others | 60571.67K | 61.4% |

II. Core Factors Affecting MAJOR's Future Price

Supply Mechanism

- Halving: The periodic reduction in block rewards, typically occurring every four years.

- Historical Pattern: Previous halvings have historically led to significant price increases in the following months.

- Current Impact: The next halving is anticipated to potentially trigger a bull run, as supply reduction often leads to increased scarcity and demand.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions and corporations are increasingly adding MAJOR to their balance sheets as a store of value.

- Corporate Adoption: Notable companies like MicroStrategy and Tesla have made substantial MAJOR purchases, setting a trend for corporate treasury diversification.

- National Policies: Several countries are exploring or have implemented MAJOR as legal tender, influencing global adoption rates.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' ongoing quantitative easing and low interest rates may drive investors towards MAJOR as an alternative asset.

- Inflation Hedging Properties: MAJOR is increasingly viewed as a hedge against inflation, particularly in economies experiencing high inflation rates.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions often result in increased interest in MAJOR as a safe-haven asset.

Technical Development and Ecosystem Building

- Lightning Network: Continued development and adoption of the Lightning Network is improving MAJOR's scalability and transaction speed.

- Taproot Upgrade: This upgrade enhances privacy, scalability, and smart contract functionality, potentially expanding MAJOR's use cases.

- Ecosystem Applications: The growth of DeFi protocols and Layer 2 solutions built on MAJOR's network is expanding its utility beyond a store of value.

III. MAJOR Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.05613 - $0.07484

- Neutral forecast: $0.07484 - $0.07933

- Optimistic forecast: $0.07933 - $0.08634 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing volatility

- Price range prediction:

- 2027: $0.0572 - $0.11603

- 2028: $0.05438 - $0.12062

- Key catalysts: Technological advancements, wider market acceptance, and possible regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $0.10975 - $0.12346 (assuming steady market growth and adoption)

- Optimistic scenario: $0.12840 - $0.13718 (assuming favorable market conditions and increased utility)

- Transformative scenario: $0.13718 - $0.15000 (assuming breakthrough innovations and mainstream adoption)

- 2030-12-31: MAJOR $0.12346 (potential for significant growth from current levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.07933 | 0.07484 | 0.05613 | -1 |

| 2026 | 0.08634 | 0.07709 | 0.04625 | 1 |

| 2027 | 0.11603 | 0.08171 | 0.0572 | 7 |

| 2028 | 0.12062 | 0.09887 | 0.05438 | 30 |

| 2029 | 0.13718 | 0.10975 | 0.08889 | 44 |

| 2030 | 0.1284 | 0.12346 | 0.11235 | 62 |

IV. Professional Investment Strategies and Risk Management for MAJOR

MAJOR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Accumulate MAJOR tokens during market dips

- Regularly review project developments and adjust holdings accordingly

- Store tokens in secure wallets with backup measures

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key Points for Swing Trading:

- Monitor Telegram user growth and TON wallet connections

- Stay informed about updates to the Major game and TON ecosystem

MAJOR Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio, depending on risk assessment

(2) Risk Hedging Solutions

- Diversification: Balance MAJOR with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate web3 Wallet

- Cold Storage Option: Hardware wallet for long-term holdings

- Security Precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for MAJOR

MAJOR Market Risks

- Volatility: High price fluctuations common in the crypto market

- Liquidity: Potential challenges in large-volume trading

- Competition: Other play-to-earn projects on Telegram or TON blockchain

MAJOR Regulatory Risks

- Regulatory uncertainty: Potential changes in cryptocurrency regulations

- TON ecosystem compliance: Possible regulatory challenges for the TON blockchain

- Gaming regulations: Potential restrictions on play-to-earn models

MAJOR Technical Risks

- Smart contract vulnerabilities: Potential security issues in the token contract

- Scalability challenges: Possible limitations in handling increased user activity

- Dependency on Telegram: Risks associated with reliance on a single platform

VI. Conclusion and Action Recommendations

MAJOR Investment Value Assessment

MAJOR presents a unique opportunity in the play-to-earn space, leveraging Telegram's vast user base. However, it faces significant short-term volatility and regulatory uncertainties. Long-term potential depends on continued user growth and TON ecosystem development.

MAJOR Investment Recommendations

✅ Beginners: Consider small, experimental investments to understand the play-to-earn model ✅ Experienced Investors: Implement a dollar-cost averaging strategy with strict risk management ✅ Institutional Investors: Conduct thorough due diligence and consider MAJOR as part of a diversified crypto portfolio

MAJOR Trading Participation Methods

- Gate.com Exchange: Trade MAJOR tokens on a reputable platform

- In-game Transactions: Participate directly in the Major game economy

- TON Wallet Integration: Connect TON wallet to engage with the MAJOR ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price of major coin in 2025?

Based on market trends and expert predictions, the price of MAJOR coin is expected to reach around $2.50 by 2025, showing significant growth potential in the coming years.

Which crypto will give 1000x?

While it's impossible to predict with certainty, emerging projects in AI, DeFi, and Web3 infrastructure have the highest potential for massive gains in the coming years.

What crypto will hit $1 in 2025?

Based on market trends and expert predictions, Cardano (ADA) and XRP are strong contenders to reach $1 by 2025, with potential for significant growth in the crypto market.

How much is a major token worth?

As of November 2025, a MAJOR token is worth approximately $2.50. The price has seen steady growth due to increased adoption and positive market sentiment in the Web3 space.

Share

Content