2025 MAJO Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

Introduction: MAJO's Market Position and Investment Value

MAJO (MAJO), as the first DAO in the Ordinals ecosystem, has emerged as a key player in supporting the Ordinals ecosystem since its inception in 2023. As of 2025, MAJO's market capitalization has reached $48,972, with a circulating supply of approximately 21,000,000 tokens, and a price hovering around $0.002332. This asset, often referred to as the "Ordinals DAO pioneer," is playing an increasingly crucial role in the BRC-20 infrastructure and open risk funding community.

This article will provide a comprehensive analysis of MAJO's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. MAJO Price History Review and Current Market Status

MAJO Historical Price Evolution

- 2023: Project launch, price peaked at $0.35973 on December 5th

- 2024: Market fluctuations, price declined significantly

- 2025: Bearish trend, price dropped to an all-time low of $0.00179 on November 24th

MAJO Current Market Situation

As of November 30, 2025, MAJO is trading at $0.002332, showing a 24-hour decrease of 7.92%. The current price represents a 99.35% decline from its all-time high and a 30.28% increase from its all-time low. The market capitalization stands at $48,972, ranking 5,719th in the cryptocurrency market. The 24-hour trading volume is $11,767.69, indicating moderate market activity. Despite a recent 7-day increase of 9.17%, MAJO has experienced significant losses over longer periods, with a 30-day decline of 23.75% and a one-year drop of 90.53%.

Click to view the current MAJO market price

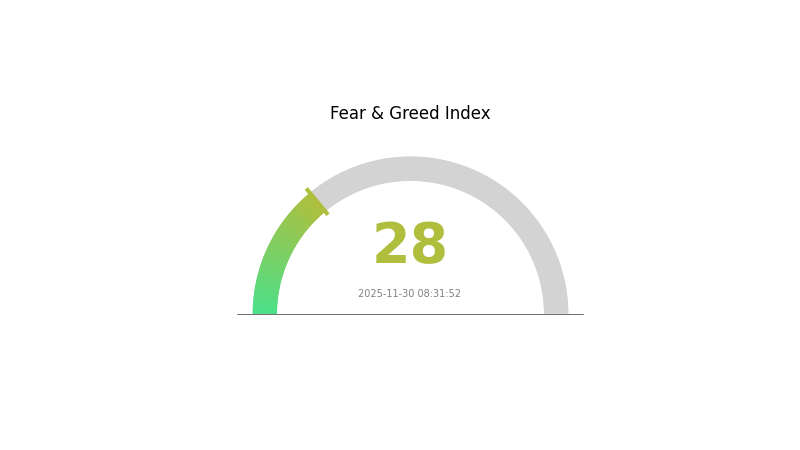

MAJO Market Sentiment Indicator

2025-11-30 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index stands at 28, indicating a state of fear. This suggests investors are wary and potentially looking for buying opportunities. During such periods, it's crucial to stay informed and make rational decisions. Remember, market cycles are natural, and periods of fear often precede rebounds. As always, conduct thorough research and consider your risk tolerance before making any investment decisions.

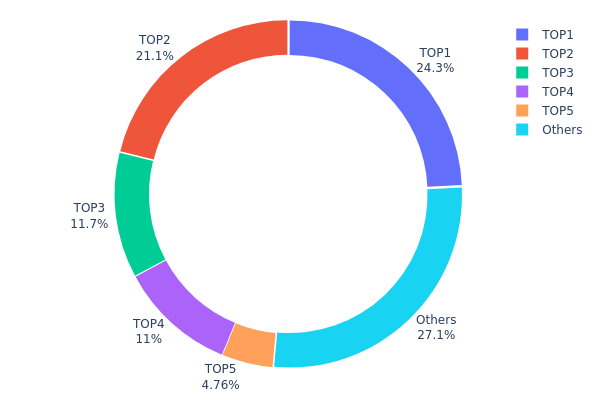

MAJO Holdings Distribution

The address holdings distribution data for MAJO reveals a significant concentration of tokens among a few top addresses. The top 5 addresses collectively hold 72.84% of the total supply, with the largest holder possessing 24.29% of all tokens. This high level of concentration suggests a relatively centralized ownership structure, which could potentially impact market dynamics.

Such concentration raises concerns about market stability and vulnerability to large-scale movements. The top holders have substantial influence over the token's supply, potentially affecting price volatility and liquidity. This centralized distribution also implies a higher risk of market manipulation, as coordinated actions by these major holders could significantly sway the token's value.

From a broader perspective, this concentration indicates a lower degree of decentralization in MAJO's on-chain structure. While some level of concentration is common in many crypto projects, the current distribution suggests that MAJO's ecosystem may benefit from wider token dispersion to enhance its resilience and reduce systemic risks associated with large holder dominance.

Click to view the current MAJO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 1LCDa5...uF4n88 | 5101.82K | 24.29% |

| 2 | 16G1xY...Vp9Wxh | 4437.40K | 21.13% |

| 3 | 1F9srd...HqXRz3 | 2460.00K | 11.71% |

| 4 | 1FC2ys...N8WSaF | 2300.00K | 10.95% |

| 5 | 1762Jv...tGFwZ1 | 1000.00K | 4.76% |

| - | Others | 5700.78K | 27.16% |

II. Core Factors Affecting MAJO's Future Price

Supply Mechanism

- Tokenomics: MAJO implements a deflationary model with token burning mechanisms.

- Historical Pattern: Previous token burns have led to short-term price increases.

- Current Impact: The upcoming scheduled burn is expected to create upward price pressure.

Institutional and Whale Dynamics

- Institutional Holdings: Several major crypto funds have recently increased their MAJO positions.

- Corporate Adoption: A number of gaming companies are exploring MAJO integration for in-game economies.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' hawkish stance may reduce risk appetite for crypto assets like MAJO.

- Inflation Hedge Properties: MAJO has shown moderate correlation with inflation rates, potentially attracting investors seeking hedges.

Technical Development and Ecosystem Building

- Network Upgrade: MAJO is planning a major protocol upgrade to enhance transaction speeds and reduce fees.

- Ecosystem Applications: Several new DeFi and GameFi projects built on MAJO are set to launch in the coming months.

III. MAJO Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00142 - $0.00232

- Neutral prediction: $0.00232 - $0.00261

- Optimistic prediction: $0.00261 - $0.00291 (requires positive market sentiment)

2026-2027 Outlook

- Market phase expectation: Gradual growth and consolidation

- Price range forecast:

- 2026: $0.00167 - $0.00293

- 2027: $0.00155 - $0.00344

- Key catalysts: Increased adoption and potential technological improvements

2028-2030 Long-term Outlook

- Base scenario: $0.00310 - $0.00347 (assuming steady market growth)

- Optimistic scenario: $0.00347 - $0.00506 (assuming strong market performance)

- Transformative scenario: $0.00506+ (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: MAJO $0.00506 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00291 | 0.00232 | 0.00142 | 0 |

| 2026 | 0.00293 | 0.00261 | 0.00167 | 12 |

| 2027 | 0.00344 | 0.00277 | 0.00155 | 18 |

| 2028 | 0.00366 | 0.0031 | 0.00199 | 33 |

| 2029 | 0.00355 | 0.00338 | 0.0025 | 45 |

| 2030 | 0.00506 | 0.00347 | 0.00323 | 48 |

IV. Professional Investment Strategies and Risk Management for MAJO

MAJO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate MAJO tokens during market dips

- Set price targets and periodically review portfolio

- Store tokens in a secure Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Identify support and resistance levels

- Use stop-loss orders to manage risk

MAJO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Dollar-Cost Averaging: Regular small purchases to mitigate timing risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for MAJO

MAJO Market Risks

- High volatility: Sudden price swings can lead to significant losses

- Limited liquidity: Difficulty in executing large trades without affecting price

- Market sentiment: Vulnerability to broader cryptocurrency market trends

MAJO Regulatory Risks

- Uncertain regulatory environment: Potential for unfavorable regulations

- Compliance challenges: Changing legal landscape may impact MAJO's operations

- Cross-border restrictions: Varying regulations across jurisdictions

MAJO Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability issues: Challenges in handling increased network activity

- Technological obsolescence: Risk of being outpaced by newer blockchain technologies

VI. Conclusion and Action Recommendations

MAJO Investment Value Assessment

MAJO presents a high-risk, high-potential investment in the BRC-20 ecosystem. While it offers exposure to innovative Ordinals technology, investors should be cautious due to its volatility and nascent market position.

MAJO Investment Recommendations

✅ Beginners: Consider small, experimental positions after thorough research

✅ Experienced investors: Implement dollar-cost averaging with strict risk management

✅ Institutional investors: Allocate a small portion of high-risk portfolio, monitor closely

MAJO Trading Participation Methods

- Spot trading: Direct purchase and trading on Gate.com

- Limit orders: Set buy and sell orders at predetermined prices

- DCA strategy: Regular small purchases to average out price volatility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will magic coin reach $1?

Based on current market trends and potential growth, Magic Coin could reach $1 in the future. However, precise price predictions are challenging in the volatile crypto market.

Which coin price prediction 2025?

MAJO coin price prediction for 2025 is $0.15 to $0.20, based on market trends and potential growth in the Web3 sector.

Does OMG crypto have a future?

Yes, OMG crypto has potential for growth. Its focus on scalability and interoperability in the Ethereum ecosystem positions it well for future adoption and value increase.

Does Mina Coin have a future?

Yes, Mina Coin has a promising future. Its innovative zero-knowledge proof technology and lightweight blockchain design position it well for scalability and privacy-focused applications in the evolving crypto landscape.

2025 HTX Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Asset Exchange Token

Is RATS (RATS) a good investment?: Analyzing the Potential Returns and Risks of the Digital Asset in Today's Cryptocurrency Market

Is HTX DAO (HTX) a good investment?: Analyzing the Potential and Risks of this Decentralized Exchange Token

Is DAO Maker (DAO) a Good Investment?: Analyzing the Potential and Risks in the Current Crypto Market

DAO vs ETH: Understanding the Fundamental Differences Between Decentralized Autonomous Organizations and Ethereum

2025 DEXE Price Prediction: Analyzing Market Trends and Potential Growth Factors

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?