2025 LUNA Fiyat Tahmini: Gelişen Piyasa Koşullarında Kripto Dalgalanmalarında Yön Bulmak

Giriş: LUNA'nın Piyasa Konumu ve Yatırım Değeri

Terra (LUNA), fiyat istikrarı sağlayan stablecoin'lerle küresel bir ödeme altyapısı sunan blockchain protokolü olarak 2018'den bu yana önemli gelişmeler gösterdi. 2025 yılı itibarıyla Terra'nın piyasa değeri 68.209.018 $, dolaşımdaki arzı yaklaşık 687.660.230 token ve fiyatı yaklaşık 0,09919 $ seviyesindedir. "Algoritmik stablecoin platformu" olarak öne çıkan bu varlık, merkeziyetsiz finans ve sınır ötesi işlemler alanında giderek daha stratejik bir rol üstleniyor.

Bu makalede, Terra'nın 2025-2030 dönemindeki fiyat hareketleri; geçmiş eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler ışığında detaylı biçimde incelenecek, yatırımcılara profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunulacaktır.

I. LUNA Fiyat Geçmişi ve Güncel Piyasa Durumu

LUNA'nın Tarihsel Fiyat Gelişimi

- 2022: Terra ekosistemi çöktü; fiyat, 18,87 $'lık zirveden neredeyse sıfıra düştü

- 2023: Terra 2.0 yeniden başlatıldı; fiyat düşük seviyelerde istikrar kazandı

- 2024: Kademeli toparlanma denemeleri; fiyat 0,05 $ ile 0,15 $ aralığında dalgalandı

LUNA'nın Güncel Piyasa Görünümü

22 Ekim 2025 itibarıyla LUNA, 0,09919 $ seviyesinden işlem görüyor ve 24 saatlik işlem hacmi 334.981 $ olarak kaydediliyor. Son 24 saatte %1,51'lik hafif bir artış yaşanırken; son 30 günde %34,14, son bir yılda ise %73,49 oranında değer kaybı söz konusu. LUNA'nın piyasa değeri 68.209.018 $ ile kripto paralar arasında 509. sırada yer alıyor. Güncel fiyat, 28 Mayıs 2022'de ulaşılan 18,87 $'lık tüm zamanların en yüksek seviyesinin oldukça altında bulunuyor. Dolaşımdaki arz 687.660.230 LUNA, toplam arz ise 1.078.518.456 LUNA olup, dolaşım oranı %63,76 seviyesinde.

Güncel LUNA piyasa fiyatını görmek için tıklayın

LUNA Piyasa Duyarlılığı Endeksi

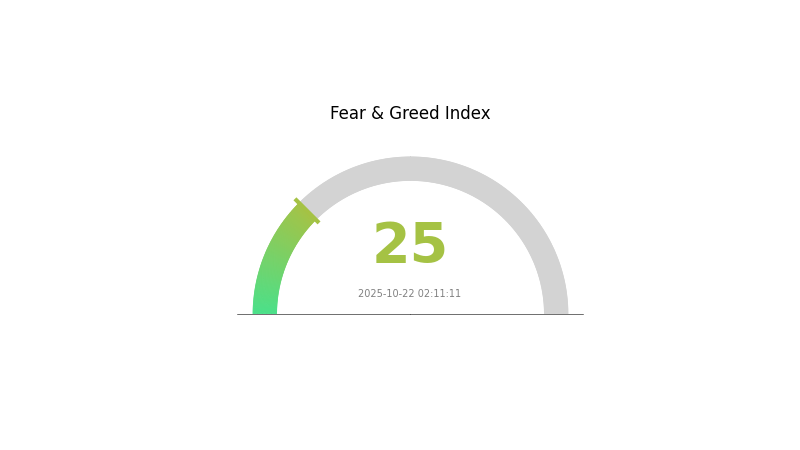

2025-10-22 Korku ve Açgözlülük Endeksi: 25 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında bugün aşırı korku hâkim; Korku ve Açgözlülük Endeksi 25'e geriledi. Bu sert düşüş, yatırımcı kaygısının arttığına ve satış baskısının yükseldiğine işaret ediyor. Ancak tecrübeli yatırımcılar için böyle aşırı korku dönemleri, genellikle benzersiz alım fırsatları sunar. Warren Buffett'ın ünlü ifadesiyle: "Diğerleri açgözlü olduğunda korkak, korkak olduklarında açgözlü olun." Piyasa oynaklığını gözeterek, bilinçli yatırımcılar bu dönemde temkinli şekilde LUNA biriktirmeyi değerlendirebilir.

LUNA Varlık Dağılımı

LUNA'nın adres bazında varlık dağılımı verileri, güncel piyasa yapısına dair önemli bilgiler sunuyor. Bu gösterge, LUNA tokenlarının farklı adresler arasında nasıl dağıldığını ve ekosistemin merkeziyetsizlik düzeyini ortaya koyuyor.

Analizler, LUNA'nın dağılımının görece az sayıda adreste yoğunlaştığını gösteriyor. Bu da tokenların büyük bir bölümünün sınırlı sayıda kişi ya da kurumun elinde olduğu anlamına geliyor. Böyle bir yoğunlaşma, büyük sahiplerin fiyat hareketleri ve genel piyasa algısı üzerinde ciddi bir etkiye sahip olabileceğini gösteriyor.

Adres dağılımındaki mevcut yapı, LUNA ekosisteminde belirli düzeyde merkeziyet olduğunu ortaya koyuyor. Büyük sahiplerin alım-satım işlemleriyle fiyatlar üzerinde önemli etki yaratabilmesi, piyasada volatilitenin artmasına yol açabilir. Ancak bu durum, doğrudan piyasa manipülasyonu anlamına gelmez; büyük işlemler ve cüzdan hareketlerinin dikkatle takip edilmesi gerekliliğine işaret eder.

Güncel LUNA Varlık Dağılımı için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|

II. LUNA'nın Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Piyasa Arz ve Talep Dinamikleri: LUNA'nın fiyatındaki değişimler, doğrudan arz ve talep dengesine bağlıdır. Talep yüksek ve arz kısıtlıysa fiyat yükselir; arz fazla, talep zayıfsa fiyat baskılanır.

- Geçmiş Örüntü: Geçmişte, LUNA'nın dolaşımdaki arzı 100 milyonun altına indiğinde, fiyat hem artan talep hem de azalan arz nedeniyle çifte ivme kazanabilmişti.

- Güncel Etki: Topluluk yönetimi ve yakım mekanizması belirleyici rol oynar. 2025'te 13 No'lu Teklif ile 100 milyon coin yakımı onaylanırken, 2024'e dek 2 trilyonun üzerinde coin yok edilmişti.

Teknolojik Gelişim ve Ekosistem Büyümesi

- Ekosistem Aktivitesi: LUNA ekosisteminin canlılığı, fiyat hareketlerinde belirleyicidir.

- Sınır Ötesi Ödeme Olanakları: LUNA, hızlı uluslararası ödeme imkânı ile öne çıkıyor.

- DApp'ler ve Projeler: Terra ekosistemi, LUNA ile birlikte birçok merkeziyetsiz uygulama ve projeye ev sahipliği yaparak, genel değer teklifini güçlendiriyor.

III. 2025-2030 Dönemi LUNA Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,07756 $ - 0,09944 $

- Tarafsız tahmin: 0,09944 $ - 0,10242 $

- İyimser tahmin: 0,10242 $ - 0,11000 $ (güçlü piyasa toparlanması ve artan kullanım şartıyla)

2027-2028 Görünümü

- Büyüme potansiyeli ve artan volatilite beklentisi

- Fiyat aralığı tahmini:

- 2027: 0,0538 $ - 0,1376 $

- 2028: 0,10727 $ - 0,14704 $

- Kilit katalizörler: Ekosistem büyümesi, teknolojik gelişmeler ve kripto piyasası genel eğilimleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,13378 $ - 0,16188 $ (istikrarlı büyüme ve benimseme ile)

- İyimser senaryo: 0,16188 $ - 0,18997 $ (olumlu piyasa koşulları ve ekosistem gelişimiyle)

- Dönüştürücü senaryo: 0,18997 $ - 0,22000 $ (çığır açıcı yenilikler ve yaygın benimsemeyle)

- 2030-12-31: LUNA 0,1813 $ (ortalama tahminler doğrultusunda yıl sonu potansiyel hedef)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.10242 | 0.09944 | 0.07756 | 0 |

| 2026 | 0.10598 | 0.10093 | 0.06258 | 1 |

| 2027 | 0.1376 | 0.10345 | 0.0538 | 4 |

| 2028 | 0.14704 | 0.12052 | 0.10727 | 21 |

| 2029 | 0.18997 | 0.13378 | 0.10703 | 34 |

| 2030 | 0.1813 | 0.16188 | 0.09389 | 63 |

IV. LUNA İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

LUNA Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Uzun vadeli bakış açısına sahip, risk iştahı yüksek yatırımcılar

- Uygulama önerileri:

- LUNA yatırımlarınızı belirli periyotlara bölerek ortalama maliyet oluşturun

- Piyasa dalgalanmalarında pozisyonunuzu koruyun, projenin temellerine odaklanın

- Token'larınızı güvenli, saklama hizmeti sunmayan bir cüzdanda muhafaza edin

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası dönüş noktalarını belirlemede kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım veya aşırı satım koşullarını analiz eder

- Dalgalı işlem için öne çıkan noktalar:

- Teknik göstergelere dayalı olarak net giriş ve çıkış seviyeleri belirleyin

- Riskinizi yönetmek için zarar durdur emirleri kullanın

LUNA Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün en fazla %15'i

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Birden fazla kripto paraya yatırım yaparak riski dağıtın

- Opsiyon stratejileri: Düşüş riskine karşı put opsiyonları kullanın

(3) Güvenli Saklama Yöntemleri

- Hot wallet önerisi: Gate Web3 Cüzdan

- Soğuk saklama çözümü: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulamasını aktifleştirin, güçlü şifreler kullanın

V. LUNA'nın Karşılaşabileceği Riskler ve Zorluklar

LUNA Piyasa Riskleri

- Yüksek volatilite: LUNA fiyatında ciddi dalgalanmalar oluşabilir

- Piyasadaki genel duyarlılık: Kripto piyasası trendlerine oldukça duyarlı

- Likitide riski: Büyük alım veya satım işlemlerinde zorluk yaşanabilir

LUNA Düzenleyici Riskler

- Düzenleyici ortamın belirsizliği: Algoritmik stablecoin'lere yönelik daha sıkı denetim ihtimali

- Sınır ötesi kısıtlamalar: Farklı ülkelerde değişen düzenlemeler

- Vergisel etki: Kripto para işlemlerinde değişen vergi uygulamaları

LUNA Teknik Riskler

- Akıllı sözleşme açıkları: Protokolde potansiyel açıklar ve kötüye kullanım riski

- Ağda tıkanıklık: Yüksek talep dönemlerinde işlem gecikmeleri yaşanabilir

- Oracle hataları: Fiyat akışındaki yanlışlıklar nedeniyle ortaya çıkan riskler

VI. Sonuç ve Eylem Önerileri

LUNA Yatırım Değeri Analizi

LUNA, algoritmik stablecoin ekosistemi içinde yüksek riskli fakat yüksek potansiyelli bir yatırım fırsatı sunar. Yenilikçi teknolojisi ve büyüme potansiyeli öne çıksa da, yüksek volatilite ve düzenleyici belirsizlikler önemli riskler barındırır.

LUNA Yatırım Önerileri

✅ Yeni başlayanlar: Kapsamlı araştırma sonrası küçük ve deneme amaçlı pozisyonlar açın ✅ Tecrübeli yatırımcılar: Dikkatli risk yönetimiyle dengeli bir strateji benimseyin ✅ Kurumsal yatırımcılar: Kapsamlı analiz yapın ve portföy çeşitlendirmesi kapsamında değerlendirin

LUNA İşlem Katılım Yöntemleri

- Spot işlem: Gate.com spot piyasasında LUNA alım-satımı yapabilirsiniz

- Vadeli işlemler: LUNA vadeli kontratlarıyla kaldıraçlı pozisyon alın

- Staking: LUNA staking programlarıyla potansiyel pasif gelir elde edin

Kripto para yatırımları çok yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırım kararlarınızı kendi risk toleransınıza göre dikkatli şekilde verin ve profesyonel finansal danışmanlardan destek alın. Kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

Luna tekrar 1 $ seviyesine ulaşır mı?

Olası olsa da, oldukça belirsizdir. Luna'nın gelecekteki fiyatı; piyasa koşulları, proje gelişmeleri ve genel kripto trendlerine bağlıdır. 1 $ seviyesine ulaşması için ciddi bir büyüme ve benimseme gereklidir.

Luna iyi bir yatırım mı?

Evet, Luna uzun vadeli yatırım için umut vaat ediyor. Yenilikçi teknolojisi ve büyüyen ekosistemiyle 2025'te kripto yatırımcıları için cazip bir alternatiftir.

Lunc coin'in geleceği var mı?

Lunc'un geleceği hâlâ belirsiz. Piyasada varlığını korusa da, kayda değer bir büyüme olasılığı düşük. Yatırımcılar dikkatli olmalı ve kapsamlı araştırma yapmalıdır.

Luna Classic 50 cent seviyesine ulaşır mı?

Luna Classic'in 50 cent'e ulaşma ihtimali çok düşük. Bunun için mevcut seviyesinden 5.910 kat artması gerekir. Şu anki projeksiyonlar bu sonucu desteklemiyor.

2025 LUNA Fiyat Tahmini: İyileşme Sonrası Dönemde Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

RAM nedir: Bilgisayar Belleği ve Performansa Etkisi

On-Chain veri analizi, Resolv'un ağındaki aktiviteleri ve kullanıcı davranışlarını nasıl gözler önüne serer?

SINGLE nedir: Tek başına yaşamanın yükselen trendi ve bunun toplum üzerindeki etkileri

Dijital çağda radyo iletişimini kökten değiştiren RSR nedir

RESOLV nedir: Sürdürülebilir enerji çözümlerine devrimci bir yaklaşımın incelenmesi

Tether (USDT) Hakkında Bilmeniz Gerekenler: Stablecoin’lere Yönelik Kapsamlı Başlangıç Rehberi

2025 BANK Fiyat Tahmini: Bankacılık Sektörü İçin Uzman Analizi ve Piyasa Öngörüsü