2025 LOE Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of LOE

Legends of Elysium (LOE) is a Free-To-Play fusion of Trading Card and Board Game designed to reshape the future of gaming and onboard players to web3. Since its launch in 2024, LOE has established itself as a notable player in the blockchain gaming ecosystem. As of January 3, 2026, LOE's market capitalization stands at approximately $248,352, with a circulating supply of approximately 96.14 million tokens, maintaining a price level around $0.001248. This innovative gaming asset is playing an increasingly important role in the Web3 gaming landscape.

This article will provide a comprehensive analysis of LOE's price trends from 2026 to 2031, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors interested in this emerging gaming token.

Legends of Elysium (LOE) Market Analysis Report

I. LOE Price History Review and Current Market Status

LOE Historical Price Evolution Trajectory

- March 2024: Project reached its all-time high of $0.447 on March 29, 2024, representing peak market sentiment and investor interest in the gaming platform.

- 2024-2025: Significant market correction phase, with the token experiencing substantial depreciation as market conditions shifted.

- December 2025: Token reached its all-time low of $0.00084 on December 4, 2025, marking the lowest valuation point since listing.

LOE Current Market Status

As of January 3, 2026, Legends of Elysium (LOE) is trading at $0.001248, reflecting a -92.45% decline over the past year from its historical peak. The 24-hour price range shows trading between $0.001193 and $0.001306, indicating modest volatility within a tight range.

The token demonstrates recent positive momentum with a +4.79% increase over the past 7 days and a +17.74% monthly gain, suggesting emerging buyer interest despite the significant year-to-date losses. However, the 1-hour performance shows a marginal decline of -0.076%, reflecting short-term market consolidation.

Market Capitalization and Supply Metrics:

- Current Market Cap: $119,988.78

- Fully Diluted Valuation: $248,352.00

- Circulating Supply: 96,144,853.67 LOE tokens (48.07% of total supply)

- Maximum Supply: 200,000,000 LOE tokens

- 24-Hour Trading Volume: $43,249.64

- Token Holders: 5,267

The project maintains a market dominance of 0.0000076%, indicating minimal presence in the broader cryptocurrency ecosystem. The circulating-to-maximum supply ratio of 48.07% suggests that roughly half of all tokens are still in reserve or vesting schedules.

Click to view current LOE market price

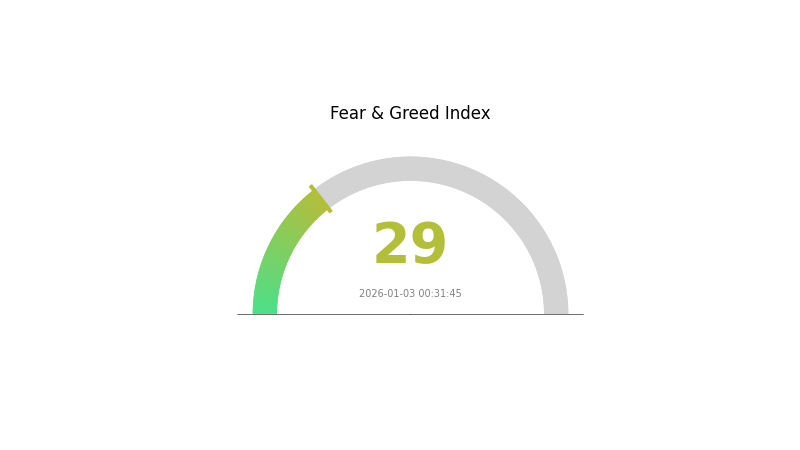

LOE Market Sentiment Index

2026-01-03 Fear and Greed Index: 29 (Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing a fear sentiment phase with an index reading of 29. This indicates heightened market anxiety and negative investor sentiment. During fear periods, market participants tend to adopt cautious strategies, potentially creating buying opportunities for long-term investors. The 29-point reading suggests moderate to significant market pessimism, where risk-averse traders may be reducing exposure. However, extreme fear often precedes market reversals. Investors should carefully assess their risk tolerance and portfolio allocations during this volatile period. Monitor market movements closely and consider dollar-cost averaging strategies when fear sentiment reaches its peak.

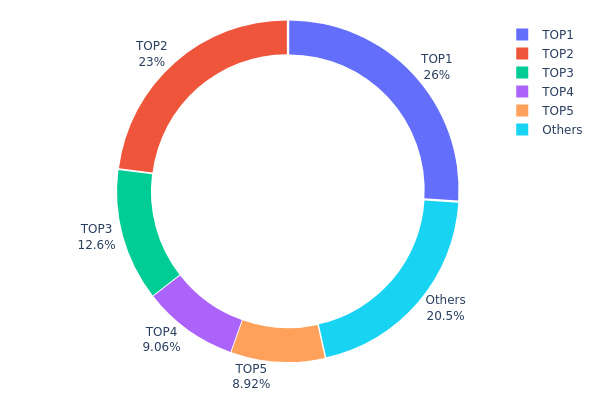

LOE Holdings Distribution

The holdings distribution chart illustrates the concentration of LOE tokens across the top wallet addresses and other holders. This metric provides critical insight into token ownership patterns, revealing whether the asset exhibits centralized characteristics or maintains a more distributed structure. By analyzing the top holders' proportions relative to total supply, investors can assess potential risks associated with token concentration and evaluate the network's decentralization level.

Current data reveals moderate concentration concerns within the LOE ecosystem. The top five addresses collectively control 79.48% of the token supply, with the largest holder accounting for 26.00% and the second-largest holding 22.97%. While the remaining 20.52% dispersed among other addresses demonstrates some distribution breadth, the significant capital concentration among the top two holders—totaling approximately 48.97%—suggests a degree of centralization risk. The fourth and fifth-ranked addresses hold 9.05% and 8.91% respectively, indicating a relatively steep concentration gradient, though the holdings do not approach extreme concentration thresholds seen in some altcoin projects.

This distribution pattern presents material implications for market structure and price stability. The substantial holdings concentrated among a limited number of addresses creates potential liquidity and volatility risks, as large sell-offs from top holders could significantly impact market dynamics. However, the presence of meaningful holdings dispersed among addresses ranked sixth and beyond provides a stabilizing factor. The current structure suggests moderate decentralization, positioned between highly concentrated projects and those with truly distributed ownership. Monitoring changes in this distribution remains essential, as significant shifts in top holder positions could indicate evolving market sentiment and influence long-term token stability.

View current LOE holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe33b...adfcdb | 52000.00K | 26.00% |

| 2 | 0x65d5...59c7e8 | 45940.31K | 22.97% |

| 3 | 0x0529...c553b7 | 25109.38K | 12.55% |

| 4 | 0xf067...b98e47 | 18113.88K | 9.05% |

| 5 | 0x0d07...b492fe | 17834.83K | 8.91% |

| - | Others | 41001.60K | 20.52% |

II. Core Factors Affecting LOE's Future Price

Market Demand and Economic Environment

-

Market Demand Dynamics: LOE's price trajectory is primarily driven by overall market demand and economic conditions. Investors need to closely monitor market trends and regulatory changes that could impact adoption rates and trading volumes on platforms like Gate.com.

-

Ecosystem Growth: Historical data and the growth of the ecosystem represent key factors influencing price movements. As the Legends of Elysium blockchain-based trading card game ecosystem expands, increased utility and user adoption can drive sustained price appreciation.

-

Regulatory Landscape: Changes in regulatory environments across different jurisdictions significantly impact LOE's valuation. Investors should remain vigilant regarding policy announcements and compliance requirements that may affect the cryptocurrency's market accessibility and legitimacy.

III. 2026-2031 LOE Price Forecast

2026 Outlook

- Conservative Forecast: $0.0011 - $0.00125

- Base Case Forecast: $0.00125

- Optimistic Forecast: $0.00185 (requires sustained market interest and ecosystem development)

2027-2029 Medium-term Outlook

- Market Stage Expectations: Gradual accumulation phase with incremental price appreciation driven by protocol improvements and increased adoption.

- Price Range Predictions:

- 2027: $0.00141 - $0.00183 (24% potential upside)

- 2028: $0.00106 - $0.0024 (35% potential upside)

- 2029: $0.00161 - $0.00263 (63% potential upside)

- Key Catalysts: Enhanced tokenomics implementation, expanded partnership networks, growing community engagement, and improved market sentiment in the altcoin sector.

2030-2031 Long-term Outlook

- Base Scenario: $0.0021 - $0.00304 (87% potential appreciation by 2030)

- Optimistic Scenario: $0.00242 - $0.00347 (115% potential appreciation by 2031, assuming mainstream institutional adoption and significant ecosystem expansion)

- Transformational Scenario: $0.00347+ (contingent on breakthrough technological developments, major exchange listings on platforms like Gate.com, and substantial increase in on-chain utility)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00185 | 0.00125 | 0.0011 | 0 |

| 2027 | 0.00183 | 0.00155 | 0.00141 | 24 |

| 2028 | 0.0024 | 0.00169 | 0.00106 | 35 |

| 2029 | 0.00263 | 0.00204 | 0.00161 | 63 |

| 2030 | 0.00304 | 0.00234 | 0.0021 | 87 |

| 2031 | 0.00347 | 0.00269 | 0.00242 | 115 |

Legends of Elysium (LOE) Professional Investment Strategy and Risk Management Report

IV. LOE Professional Investment Strategy and Risk Management

LOE Investment Methodology

(1) Long-Term Holding Strategy

- Target Audience: Web3 gaming enthusiasts and blockchain adoption believers with medium to long-term investment horizons (12+ months)

- Operational Recommendations:

- Accumulate LOE tokens during market downturns when prices show weakness, leveraging the project's long-term gaming development roadmap

- Hold through market volatility cycles, as the project has been in development since 2021 and continues iterating on its Free-To-Play model

- Position LOE as part of a diversified gaming and Web3 portfolio rather than a concentrated bet

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price levels at $0.001193 (24H low) and $0.001306 (24H high) for entry and exit signals

- Moving Averages: Track 7-day and 30-day performance trends (currently +4.79% and +17.74% respectively) to identify momentum shifts

- Trading Operation Considerations:

- Monitor the extreme volatility evident in LOE's price history (all-time high of $0.447 in March 2024 versus recent lows near $0.00084)

- Note that current 24-hour volume of $43,249.64 suggests relatively low liquidity; position sizing should reflect this constraint

LOE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of portfolio allocation

- Active Investors: 1-3% of portfolio allocation

- Professional Investors: 3-5% of portfolio allocation

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance LOE holdings with established gaming tokens and mainstream cryptocurrencies to mitigate project-specific risk

- Dollar-Cost Averaging: Implement systematic purchases over time to reduce the impact of price volatility on average entry costs

(3) Secure Storage Solutions

- Hardware Wallet Approach: For significant holdings, transfer LOE tokens from exchange wallets to self-custodial solutions where private keys are fully controlled

- Exchange Custody Method: For active traders, maintain smaller LOE positions on Gate.com for convenient trading while keeping the majority in secure storage

- Security Considerations: LOE operates on the MATIC (Polygon) chain; ensure wallet compatibility with Polygon network, use strong authentication on exchange accounts, and never share private keys or recovery phrases with third parties

V. LOE Potential Risks and Challenges

LOE Market Risk

- Extreme Price Volatility: LOE has experienced a 92.45% decline over the past year and a devastating drop from its March 2024 all-time high of $0.447 to current levels around $0.00124, indicating severe price instability

- Low Trading Liquidity: With only $43,249.63 in 24-hour volume and listed on just one exchange, LOE suffers from limited liquidity which can result in significant slippage on larger trades

- Market Capitalization Concerns: The fully diluted valuation of only $248,352 reflects extremely limited market adoption, with fewer than 5,300 token holders indicating a nascent and potentially high-risk project

LOE Regulatory Risk

- Gaming Regulatory Uncertainty: As blockchain gaming remains an evolving regulatory space, jurisdictions may impose restrictions on play-to-earn mechanics or tokenized gaming assets

- Securities Classification: Depending on gaming reward mechanisms and token utility, regulators could reclassify LOE under securities regulations in certain markets

- Geographic Compliance: The project must navigate varying regulatory frameworks across different countries regarding cryptocurrency gaming and token distribution

LOE Technology Risk

- Development Stage Maturity: Although in development since 2021, the project remains relatively early-stage, with potential delays in feature releases or market adoption challenges for Web3 gaming integration

- Blockchain Dependency: As a Polygon-based token, LOE's functionality depends on Polygon network stability and security; any critical issues on the mainnet could impact token utility

- Game Adoption Challenges: The Free-To-Play gaming model's success depends on achieving meaningful player adoption; failure to convert web2 gamers to web3 would undermine the token's value proposition

VI. Conclusions and Action Recommendations

LOE Investment Value Assessment

Legends of Elysium represents a speculative investment in the Web3 gaming sector with significant upside potential if the project successfully onboards mainstream gamers to blockchain. However, the token faces substantial headwinds including extreme historical price declines (-92.45% year-over-year), minimal liquidity, and early-stage development uncertainties. The project's long-term value depends critically on delivering compelling gameplay experiences, achieving genuine player adoption beyond crypto enthusiasts, and establishing sustainable tokenomics that drive demand. For risk-averse investors, the extreme volatility and low market capitalization present considerable challenges. For those with high risk tolerance, LOE could represent a contrarian opportunity if the gaming development roadmap successfully materializes.

LOE Investment Recommendations

✅ Beginners: Start with minimal position sizes (0.1-0.5% of portfolio) through Gate.com's trading platform to gain exposure without excessive risk; focus on understanding the gaming product roadmap before committing additional capital

✅ Experienced Investors: Consider a core-satellite approach with small long-term holdings supplemented by tactical trading around key support/resistance levels; implement strict stop-loss discipline given historical volatility patterns

✅ Institutional Investors: Conduct comprehensive due diligence on game development progress, player acquisition metrics, and token utility before considering meaningful positions; structure exposure through diversified gaming token baskets rather than concentrated LOE holdings

LOE Trading Participation Methods

- Direct Spot Trading: Purchase LOE tokens directly on Gate.com against USDT or other major trading pairs; use limit orders given low liquidity to achieve better execution prices

- Strategic Accumulation: Use dollar-cost averaging to build positions incrementally over several months, reducing the impact of short-term volatility

- Portfolio Monitoring: Regularly track game development milestones, player adoption metrics, and competitive landscape to validate the investment thesis and identify exit signals

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. All investors should conduct thorough due diligence aligned with their risk tolerance and investment objectives. It is strongly recommended to consult with qualified financial advisors before making investment decisions. Never invest more than you can afford to lose completely.

FAQ

What is LOE? What are its uses and characteristics?

LOE is a blockchain-based cultural media information platform designed to build information resource libraries and attract user traffic. Its key characteristics include decentralization, distribution, and immutability, leveraging blockchain technology to create a transparent and tamper-proof ecosystem for information sharing.

How has LOE performed historically in price?

LOE has shown steady growth potential. Based on historical performance, the projected price for 2026 is $0.003792, with predictions indicating a 38% increase by 2031, demonstrating positive long-term price trajectory.

What are the main factors affecting LOE price?

LOE price is primarily influenced by market supply and demand dynamics, technological development progress, ecosystem adoption rates, and macroeconomic conditions. Trading volume and investor sentiment also play significant roles in price movements.

How to conduct LOE price technical analysis and prediction?

Use exponential moving average (EMA) and Bollinger Bands to analyze LOE price trends and volatility. EMA tracks price momentum, while Bollinger Bands identify overbought/oversold levels. Combine trading volume analysis and support/resistance levels for comprehensive price forecasting.

What price predictions do professional institutions have for LOE in the future?

Professional institutions predict LOE will reach $0.001456 by 2028, representing an estimated growth of 15.76%. Price predictions for 2029 have not yet been released. Data current as of January 2026.

What are the advantages and disadvantages of LOE compared to similar tokens?

LOE features lower transaction fees and high liquidity. However, it lacks a large user base and strong community support. Market influence remains smaller compared to other DEX platforms, with long-term prospects requiring further observation.

What are the main risks to consider when investing in LOE?

Key risks include market volatility, price manipulation, regulatory uncertainty, and technical security vulnerabilities. LOE's value depends on gaming adoption rates and competitive pressure in the blockchain gaming sector.

How is the market liquidity and trading volume of LOE?

LOE currently has a market cap of $119,926 with circulating supply of 96.14M tokens. The 24-hour trading range shows volatility between $0.00119651 and $0.00129937. Market liquidity remains moderate as the token develops, with price fluctuations reflecting active trading interest in the ecosystem.

2025 PIXEL Price Prediction: Expert Analysis and Market Forecast for Google's Revolutionary AI Chip Token

2025 PORTAL Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 FOREST Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 ELIX Price Prediction: Expert Analysis and Market Forecast for the Next Year

2025 TICO Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

2025 TEVA Price Prediction: Expert Analysis and Market Forecast for Teva Pharmaceutical Industries

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?