2025 LAUNCHCOIN Fiyat Tahmini: Yükseliş Trendleri ve Potansiyel Büyümeyi Destekleyen Ana Etkenler

Giriş: LAUNCHCOIN'un Piyasa Konumu ve Yatırım Değeri

LaunchCoin (LAUNCHCOIN), Clout üzerinde ön satışını tamamlayan ilk token olarak, kuruluşundan itibaren dikkat çekici bir ilerleme kaydetmiştir. 2025 yılı itibarıyla LaunchCoin'in piyasa değeri 64.821.837,64 $ seviyesine ulaşırken, dolaşımdaki arzı yaklaşık 999.874.095,94 adet ve fiyatı ise yaklaşık 0,06483 $ seviyesindedir. “Clout'un Öncü Token'ı” olarak tanınan bu varlık, sosyal token ve influencer ekonomisi alanlarında giderek daha önemli bir rol üstlenmektedir.

Bu makalede, LaunchCoin'in 2025-2030 dönemi fiyat hareketleri; geçmiş eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik ortam birlikte değerlendirilerek, yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. LAUNCHCOIN Fiyat Geçmişi ve Güncel Piyasa Durumu

LAUNCHCOIN Tarihsel Fiyat Gelişimi

- 2025: İlk çıkış ve PASTERNAK'tan yeniden markalaşma, 19 Mayıs'ta 0,2999 $ ile zirve yaptı

- 2025: Piyasa dalgalanması, 10 Ekim'de 0,03414 $ ile dip seviyeyi gördü

- 2025: Toparlanma dönemi, 22 Ekim itibarıyla fiyat 0,06483 $ seviyesinde

LAUNCHCOIN Güncel Piyasa Durumu

LAUNCHCOIN şu anda 0,06483 $ seviyesinden işlem görüyor, 24 saatlik işlem hacmi 963.015,05 $. Son 24 saatte %5,2 oranında değer kaybetti. Piyasa değeri 64.821.837,64 $ ve kripto para piyasasında 526. sırada yer alıyor. Dolaşımdaki arz 999.874.095,94 LAUNCHCOIN olup, toplam arzın %99,99'unu oluşturuyor. Son bir haftada LAUNCHCOIN %33,83 oranında değer kaybederken, yıllık bazda %6.682,18 gibi dikkat çekici bir artış gösterdi. Kripto para piyasasındaki mevcut duyarlılık “Aşırı Korku” olarak tanımlanıyor ve VIX endeksi 25 seviyesinde.

Güncel LAUNCHCOIN piyasa fiyatını görmek için tıklayın

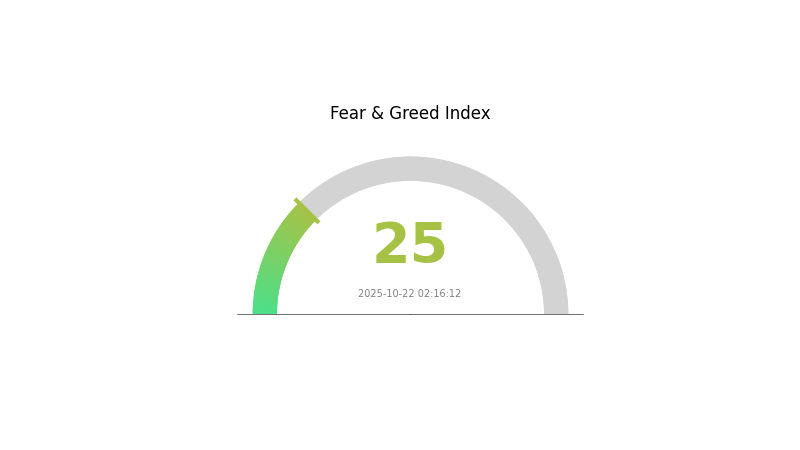

LAUNCHCOIN Piyasa Duyarlılığı Göstergesi

2025-10-22 Korku ve Açgözlülük Endeksi: 25 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksi'ni görmek için tıklayın

Kripto para piyasası şu anda aşırı korku döneminden geçiyor ve Korku & Açgözlülük Endeksi 25 seviyesinde. Bu, yatırımcıların piyasaya yönelik kısa vadeli beklentilerinde son derece temkinli ve karamsar yaklaştığını gösteriyor. Böylesi dönemlerde piyasa aşırı satılmış olarak değerlendirilebilir ve özellikle kontraryen yatırımcılar için fırsatlar doğabilir. Ancak, bu volatil ortamda yatırım kararı almadan önce kapsamlı araştırma yapmak ve dikkatli hareket etmek önemlidir.

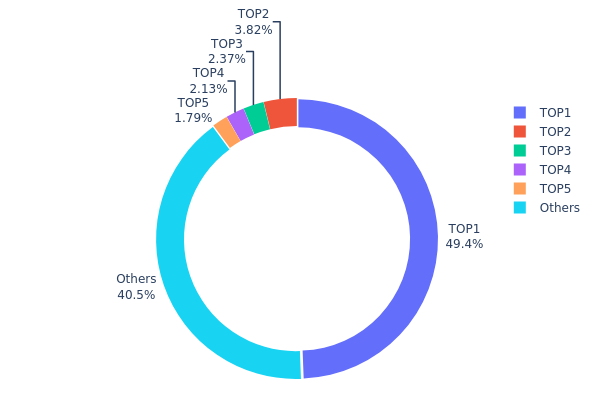

LAUNCHCOIN Varlık Dağılımı

LAUNCHCOIN adreslerinin varlık dağılımı verileri, oldukça yoğunlaşmış bir sahiplik yapısı ortaya koymaktadır. En büyük adres, toplam arzın %49,39'unu elinde bulundururken, bu da ciddi bir merkezileşme anlamına gelir. Sonraki 4 büyük adres ise toplam %10,09'luk paya sahip, kalan %40,52'lik kısım ise diğer adresler arasında dağılmıştır.

Bu yoğunlaşma, piyasa manipülasyonu ve fiyat oynaklığı riskini artırır. Arzın neredeyse yarısının tek bir adreste toplanması, büyük ölçekli satış veya alımların LAUNCHCOIN'un piyasa dinamiklerini ciddi şekilde etkileme potansiyelini ortaya koyar. Yüksek yoğunluk, aynı zamanda merkeziyetsizlik ilkesinin zayıfladığını gösterir.

Piyasa yapısı açısından bu dağılım, LAUNCHCOIN'un zincir üzerindeki istikrarının, birkaç ana adresin hareketlerine bağlı olduğunu gösterir. Bazı durumlarda bu, fiyat hareketlerinde öngörülebilirlik sağlarken, sahiplik davranışındaki ani değişimlere karşı token'ı savunmasız bırakır.

Güncel LAUNCHCOIN Varlık Dağılımı'nı görmek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 6bmRJP...M3iTBS | 493.914,50K | 49,39% |

| 2 | DPQkRg...z6Bcmg | 38.180,44K | 3,81% |

| 3 | A77HEr...oZ4RiR | 23.669,69K | 2,36% |

| 4 | 77DXFZ...pSwdjB | 21.315,52K | 2,13% |

| 5 | ASTyfS...g7iaJZ | 17.926,52K | 1,79% |

| - | Diğerleri | 404.865,50K | 40,52% |

II. LAUNCHCOIN'un Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- İşlem Vergisi: Platformda uygulanan işlem vergisi mekanizması mevcut, yatırımcıların bunu dikkate alması gerekir.

Kurumsal ve Whale Dinamikleri

- Whale Aktivitesi: Büyük yatırımcılar, fiyat eğilimlerini etkilemek için yüksek tutarlı alımlar yaparak bazı günlerde işlem hacmini %500'ün üzerine çıkarıyor.

Makroekonomik Ortam

- Piyasa Duyarlılığı: Yatırımcı güveni ve algısı, LAUNCHCOIN fiyat hareketlerini doğrudan etkiler. Yaygın benimsenme veya önemli teknolojik gelişmelerle ilgili haber akışı piyasaya yön verir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Demokratik Tokenleştirme: Token yaratımının herkese açık olması, gelecekteki büyümenin anahtarıdır.

- ICM Uyumlu: İnternete özgü yaratıcılığı ve merkeziyetsiz sermaye oluşumunu destekler.

- Ekosistem Uygulamaları: Platform, gerçek ürünlerle entegre edilmekte ve çok sayıda Web2 içerik üreticisi ekosisteme katılmaktadır.

III. LAUNCHCOIN 2025-2030 Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,05015 $ - 0,06000 $

- Nötr tahmin: 0,06000 $ - 0,07000 $

- İyimser tahmin: 0,07000 $ - 0,07425 $ (olumlu piyasa koşulları gerektirir)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,05594 $ - 0,11619 $

- 2028: 0,09708 $ - 0,13854 $

- Temel katalizörler: Benimsenme artışı, teknolojik gelişmeler, piyasa duyarlılığı

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,11984 $ - 0,13122 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,14261 $ - 0,18765 $ (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,20000 $+'ın üzeri (önemli yenilikler ve kitlesel benimsenme ile)

- 2030-12-31: LAUNCHCOIN 0,18765 $ (potansiyel tepe değer)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,07425 | 0,06513 | 0,05015 | 0 |

| 2026 | 0,10244 | 0,06969 | 0,05157 | 7 |

| 2027 | 0,11619 | 0,08607 | 0,05594 | 32 |

| 2028 | 0,13854 | 0,10113 | 0,09708 | 55 |

| 2029 | 0,14261 | 0,11984 | 0,07909 | 84 |

| 2030 | 0,18765 | 0,13122 | 0,09579 | 102 |

IV. LAUNCHCOIN Profesyonel Yatırım Stratejileri ve Risk Yönetimi

LAUNCHCOIN Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Risk alabilen, uzun vadeli hedefe sahip yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde LAUNCHCOIN biriktirin

- En az 1-2 yıl hedefli bir tutma süresi belirleyin

- Token'ları güvenli Gate Web3 cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve dönüş noktalarını belirlemek için kullanılır

- RSI: Aşırı alım/satım seviyelerini takip için önemlidir

- Kısa vadeli al-sat için önemli noktalar:

- Risk yönetimi için kesin stop-loss emirleri kullanın

- Kar alımlarınızı belirlenen direnç seviyelerinde yapın

LAUNCHCOIN Risk Yönetim Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Yatırımları birden fazla kripto varlık arasında dağıtın

- Stop-loss emirleri: Olası kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Gate Web3 cüzdanı

- Yazılım cüzdanı seçeneği: Gate.com'un yerleşik cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulama açın, güçlü şifreler kullanın

V. LAUNCHCOIN Olası Riskler ve Zorluklar

LAUNCHCOIN Piyasa Riskleri

- Yüksek volatilite: Kripto piyasalarında sık görülen sert fiyat dalgalanmaları

- Düşük likidite: Büyük tutarlı işlemlerde likidite sorunu yaşanabilir

- Piyasa duyarlılığı: Hızlı değişen yatırımcı algısına karşı hassasiyet

LAUNCHCOIN Regülasyon Riskleri

- Düzenleyici belirsizlik: Token statüsünü etkileyebilecek yeni regülasyonlar çıkabilir

- Sınır ötesi kısıtlamalar: Farklı ülkelerde değişen yasal statü

- Uyum gereklilikleri: İleride KYC/AML zorunlulukları gelebilir

LAUNCHCOIN Teknik Riskler

- Akıllı sözleşme zaafiyetleri: Açıklar veya yazılım hatalarından kaynaklanabilecek riskler

- Ağ tıkanıklığı: Solana blockchain'inde işlem gecikmeleri görülebilir

- Cüzdan güvenliği: Özel anahtar kaybı veya çalınması riski

VI. Sonuç ve Eylem Önerileri

LAUNCHCOIN Yatırım Değeri Değerlendirmesi

LAUNCHCOIN, volatil kripto para piyasasında yüksek riskli ancak yüksek potansiyelli bir fırsat sunar. Uzun vadeli değeri Believe platformunun büyümesine bağlıdır; kısa vadede ise piyasa oynaklığı ve regülasyon belirsizlikleri öne çıkar.

LAUNCHCOIN Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Portföyün küçük bir kısmını ayırın, eğitime odaklanın

✅ Deneyimli yatırımcılar: Çeşitlendirilmiş kripto portföyünde bulundurun

✅ Kurumsal yatırımcılar: Detaylı inceleme yapın, regülasyon gelişmelerini takip edin

LAUNCHCOIN Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden LAUNCHCOIN alıp satın

- Staking: Uygun programlar varsa staking'e katılın

- DeFi: Solana ekosistemindeki DeFi seçeneklerini değerlendirin

Kripto para yatırımları son derece yüksek risk içerir, bu makale yatırım tavsiyesi değildir. Yatırımcılar, kararlarını kendi risk profillerine göre dikkatle almalı ve profesyonel finansal danışmanlardan destek almalıdır. Kaldıramayacağınızdan fazlasını asla yatırmayın.

SSS

Launchcoin iyi bir yatırım mı?

Evet, Launchcoin yatırım açısından umut vericidir. Son dönem yükselişleri ve güçlü piyasa performansı, kripto piyasasında daha fazla büyüme potansiyelini göstermektedir.

2025'te hangi coin 1 $'a ulaşacak?

Altura (ALU), yapay zeka özellikleri ve güçlü büyüme ivmesiyle 2025'te 1 $'a ulaşması en muhtemel coin olarak öne çıkıyor.

Launch Coin ne kadar?

22 Ekim 2025 itibarıyla Launch Coin'in fiyatı 0,052552 $ ve piyasa değeri 52,54 milyon $'dır.

Hangi coin 1000x kazandırır?

LAUNCHCOIN, 1000x getiri potansiyeline sahip. Yenilikçi teknolojisi ve artan benimsenmesiyle, önümüzdeki yıllarda patlayıcı büyüme için en güçlü adaylardan biridir.

2025 LM Fiyat Tahmini: Lityum Metallerin Geleceğini Belirleyen Piyasa Trendleri ve Etkenlerin Analizi

2025 F3 Fiyat Tahmini: BMW'nin Elektrikli Çağında Kompakt Lüksün Geleceğinde Yol Almak

2025 BOX Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 LVLY Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Friend3 (F3) iyi bir yatırım mı?: En yeni sosyal medya platformunun potansiyeli ve riskleri üzerine analiz

AsMatch (ASMATCH) iyi bir yatırım mı?: Bu yeni ortaya çıkan kripto paranın olası riskleri ve getirileri üzerine bir analiz

Web3 meraklıları için Arbitrum köprüsünü kullanma konusunda eksiksiz rehber

Ronin Network (RON) iyi bir yatırım mı?: Oyun blokzinciri ekosisteminde performans, riskler ve gelecek potansiyeline dair kapsamlı bir analiz

KUB Coin (KUB) iyi bir yatırım mı?: 2024’te Fiyat Performansı, Piyasa Potansiyeli ve Risk Faktörlerinin Kapsamlı Analizi

MAG7.ssi (MAG7SSI) yatırım için uygun mu?: Performans, riskler ve geleceğe dair kapsamlı bir değerlendirme

Ravencoin (RVN) iyi bir yatırım mı?: Fiyat Trendleri, Teknolojisi ve Piyasa Potansiyelinin Kapsamlı Analizi