2025 KINGSHIB Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of KINGSHIB

King Shiba (KINGSHIB) is a decentralized cryptocurrency token operating on the Binance Smart Chain network. As of January 4, 2026, KINGSHIB has a market capitalization of $74,548.74, with a circulating supply of approximately 296,652,381 tokens, and is currently priced at around $0.0002513. This meme coin asset is gaining traction within its growing community ecosystem.

The project provides practical utility scenarios including staking DApps for rewards and NFT minting and marketing features. With Certik audit certification and exchange listings, King Shiba aims to build long-term value for its community members.

This article will comprehensively analyze KINGSHIB's price trends from 2026 to 2031, incorporating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies. Whether you are a prospective investor or an existing holder, understanding the market fundamentals and technical outlook for KINGSHIB will be essential for making informed decisions in the evolving cryptocurrency landscape.

I. KINGSHIB Price History Review and Current Market Status

KINGSHIB Historical Price Evolution

- 2021: KINGSHIB reached its all-time high of $0.191508 on November 4, 2021, representing the peak of early market enthusiasm for the meme coin project.

- 2021: The token hit its all-time low of $0.00000716 on October 22, 2021, just before the initial surge in market interest.

- 2021-2026: A significant long-term decline of 78.3% over one year, reflecting substantial erosion from historical peak valuations to current market levels.

KINGSHIB Current Market Status

As of January 4, 2026, KINGSHIB is trading at $0.0002513, reflecting a 24-hour decline of 6.92%. The token's 24-hour trading volume stands at $11,965.23, with the day's price range between $0.0002513 and $0.0002854. Over the past seven days, KINGSHIB has experienced a 30.9% decrease, while the one-month performance shows a 42.14% decline.

The token maintains a total market capitalization of $251,300, with approximately 296.65 million tokens in circulation out of a total supply of 1 billion tokens. The circulating supply ratio represents 29.67% of the fully diluted valuation. The token operates across two exchanges and maintains a holder base of 23,070 addresses. Market dominance is extremely limited at 0.0000076%, indicating minimal influence on the broader cryptocurrency market.

The one-hour price movement shows a positive 12.049% increase, contrasting sharply with the negative trends observed in longer timeframes. This short-term volatility suggests intraday trading activity despite the broader downward trajectory.

Click to view current KINGSHIB market price

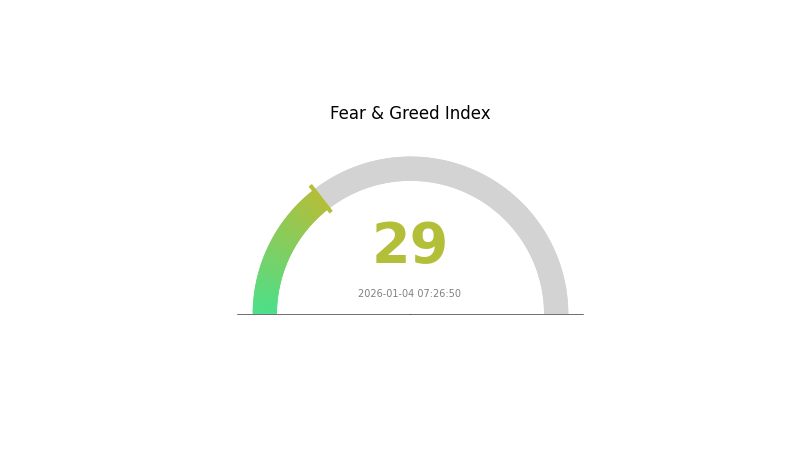

KINGSHIB Market Sentiment Indicator

2026-01-04 Fear and Greed Index: 29 (Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing a fear sentiment with an index reading of 29. This indicates increased market anxiety and conservative investor behavior. During periods of fear, market participants tend to adopt defensive positions, creating potential buying opportunities for long-term investors. Monitor market developments closely as sentiment may shift based on regulatory news, macroeconomic factors, and Bitcoin price movements. Consider dollar-cost averaging strategies on Gate.com to manage risk during volatile market conditions.

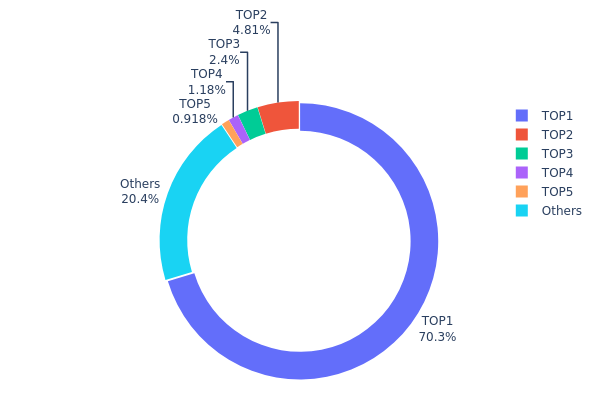

KINGSHIB Address Distribution Analysis

The address distribution chart illustrates the concentration of KINGSHIB token holdings across the blockchain network, revealing the ownership structure and market power distribution among individual addresses. This metric serves as a critical indicator for assessing tokenomics health, decentralization levels, and potential systemic risks within the token ecosystem.

KINGSHIB exhibits a highly concentrated holding structure, with the top address (0x0000...00dead) commanding 70.33% of total supply. This substantial concentration in a single address significantly exceeds healthy decentralization benchmarks. The subsequent top four addresses collectively hold an additional 9.29% of the circulating supply, bringing cumulative holdings of the top five addresses to 79.62%. The remaining 20.38% dispersed among numerous other addresses demonstrates an asymmetrical distribution pattern typical of tokens with significant early allocation concentrations or burn mechanisms, as evidenced by the dead address designation.

This pronounced concentration presents material implications for market dynamics and price stability. The overwhelming dominance of a single address substantially reduces the effective float available for active trading and increases vulnerability to potential manipulation or sudden liquidity shifts. While the dead address concentration may indicate intentional token burn mechanisms designed to reduce supply, the remaining secondary holdings still reflect relatively high concentration risk among key stakeholders. The substantial gap between the top holder and distributed addresses suggests limited organic decentralization, potentially constraining market depth and increasing price volatility during significant trading activities.

Click to view current KINGSHIB Address Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 703347.62K | 70.33% |

| 2 | 0x51d3...dc8562 | 48145.16K | 4.81% |

| 3 | 0xeae4...07cb9a | 24028.23K | 2.40% |

| 4 | 0x1080...624b0d | 11792.35K | 1.17% |

| 5 | 0x22dc...87281a | 9178.42K | 0.91% |

| - | Others | 203508.21K | 20.38% |

II. Core Factors Influencing KINGSHIB's Future Price

Supply Mechanism

-

Halving Events: Halving mechanisms periodically reduce the supply of new tokens, directly affecting asset scarcity. According to the supply-demand model, when demand remains stable or grows while supply contracts, this theoretically provides upward price momentum for assets.

-

Historical Patterns: Bitcoin's successive halving events have demonstrated that supply reduction can create price support during market cycles, establishing a precedent for how scarcity impacts cryptocurrency valuations.

-

Current Impact: As the overall cryptocurrency market trends evolve, supply dynamics continue to play a critical role in determining price trajectories through fundamental supply-demand relationships.

Market Demand and Investor Sentiment

-

Market Demand Drivers: KINGSHIB's future price is primarily influenced by market demand, which fluctuates based on cryptocurrency market trends and overall investor interest in the asset class.

-

Investor Sentiment: Price movements are significantly shaped by investor emotions and market psychology. Market volatility and uncertainty require disciplined emotional control, particularly during periods of price fluctuation.

-

Market Competition: Competition from other cryptocurrency projects and tokens affects demand allocation, influencing KINGSHIB's relative market position and price performance.

三、2026-2031年 KINGSHIB 价格预测

2026 Outlook

- Conservative Forecast: $0.00017 - $0.00025

- Neutral Forecast: $0.00025 (Expected Average)

- Optimistic Forecast: $0.00037 (Requires Market Stabilization and Increased Adoption)

2027-2029 Mid-term Outlook

-

Market Stage Expectation: Consolidation phase with gradual accumulation, characterized by steady recovery and increased institutional interest in emerging tokens.

-

Price Range Forecast:

- 2027: $0.00028 - $0.00044 (23% potential upside)

- 2028: $0.00027 - $0.00051 (48% potential upside)

- 2029: $0.00034 - $0.00064 (75% potential upside)

-

Key Catalysts: Enhanced blockchain utility implementation, strategic partnerships with major platforms like Gate.com, improved token economics, and broader crypto market recovery cycle.

2030-2031 Long-term Outlook

-

Base Case Scenario: $0.00035 - $0.00078 (115% upside potential by 2030; Assumes sustained market growth and consistent protocol development)

-

Optimistic Scenario: $0.00047 - $0.00084 (163% upside potential by 2031; Assumes accelerated adoption, significant ecosystem expansion, and favorable macroeconomic conditions)

-

Transformative Scenario: $0.00084+ (Requires breakthrough utility adoption, major institutional backing, successful integration into major DeFi protocols, and sustained cryptocurrency market bull cycle)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00037 | 0.00025 | 0.00017 | 0 |

| 2027 | 0.00044 | 0.00031 | 0.00028 | 23 |

| 2028 | 0.00051 | 0.00037 | 0.00027 | 48 |

| 2029 | 0.00064 | 0.00044 | 0.00034 | 75 |

| 2030 | 0.00078 | 0.00054 | 0.00035 | 115 |

| 2031 | 0.00084 | 0.00066 | 0.00047 | 163 |

King Shiba (KINGSHIB) Professional Investment Strategy and Risk Management Report

IV. KINGSHIB Professional Investment Strategy and Risk Management

KINGSHIB Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Community-oriented investors with high risk tolerance seeking exposure to meme coin ecosystems

-

Operational Recommendations:

- Establish a long-term position during market downturns when sentiment is negative, considering the current -78.3% year-to-date decline presents potential accumulation opportunities

- Dollar-cost averaging (DCA) strategy over 6-12 months to reduce timing risk given the token's volatility

- Monitor project development milestones including staking DApps for Shiba rewards and NFT ecosystem expansion

-

Storage Solution:

- Use secure non-custodial wallets compatible with BSC network for self-custody of KINGSHIB tokens

- Ensure regular backups of private keys and recovery phrases in secure offline locations

(2) Active Trading Strategy

-

Market Analysis Considerations:

- Current price volatility: -6.92% in 24-hour period, -30.9% over 7 days signals significant market swings

- 24-hour trading volume of $11,965 USD indicates limited liquidity; traders should exercise caution with position sizing

- Slippage setting of 13% on trading platforms reflects the token's market conditions

-

Trading Operation Key Points:

- Execute trades during higher volume periods to minimize slippage impact

- Set strict stop-loss orders given the token's historical 78.3% annual decline

- Monitor the 1-hour price action: recent +12.049% hourly movement suggests intraday volatility opportunities

KINGSHIB Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of total portfolio allocation (speculative position only)

- Active Investors: 1-3% of portfolio allocation with defined stop-loss at -20% to -30%

- Professional Investors: Case-by-case basis with sophisticated risk hedging strategies

(2) Risk Hedging Approaches

- Position Sizing Control: Limit individual trade size to 2-5% of total trading capital to manage volatility exposure

- Diversification Strategy: Allocate KINGSHIB as part of broader meme coin and utility token exposure rather than concentrated bet

(3) Secure Storage Solution

- Self-Custody Method: Utilize BSC-compatible wallets for direct token management

- Exchange Custody Option: Consider maintaining a portion on Gate.com for active trading with two-factor authentication (2FA) enabled

- Security Considerations:

- Never share private keys or seed phrases with third parties

- Verify contract address (0x84f4f7cdb4574c9556a494dab18ffc1d1d22316c on BSC) before transactions to avoid scam tokens

- Conduct transactions only on official website (https://www.kingshibaofficial.com/) and verified platforms

V. KINGSHIB Potential Risks and Challenges

Market Risk

- Extreme Volatility: Historical price swing from $0.191508 (ATH in November 2021) to current $0.0002513 represents 99.87% decline, indicating severe price instability

- Low Liquidity: Daily trading volume of approximately $11,965 USD is insufficient for large positions, creating execution risk and price slippage concerns

- Limited Market Capitalization: Fully diluted valuation of $251,300 with only 0.0000076% dominance suggests minimal market traction and susceptibility to price manipulation

Regulatory Risk

- Meme Coin Classification: As a community-driven token without clear utility beyond stated roadmap promises, regulatory scrutiny regarding securities classification could increase

- Smart Contract Risk: While the project mentions Certik audit completion, ongoing regulatory frameworks for BSC tokens remain uncertain across jurisdictions

- Exchange Listing Volatility: Limited exchange presence (only 2 exchanges) restricts liquidity and increases dependency on single platform risk

Technical Risk

- Smart Contract Vulnerabilities: Despite audit completion claims, new vulnerabilities in staking DApps and NFT minting mechanisms could emerge

- Scalability Concerns: Network congestion on BSC during high trading volumes could impact transaction execution and token transfers

- Project Development Risk: Roadmap promises including staking rewards and NFT ecosystem require successful execution; delays or feature failures could negatively impact token value

VI. Conclusion and Action Recommendations

KINGSHIB Investment Value Assessment

King Shiba represents a high-risk, speculative investment opportunity within the meme coin sector. The token demonstrates substantial community engagement (23,070 token holders) but faces significant headwinds including a 78.3% annual decline, minimal market capitalization, and limited liquidity. The project's stated utility scenarios—staking DApps and NFT platforms—remain partially unvalidated. Investment should be approached as portfolio diversification within the alternative asset category rather than a core holding strategy. The current market sentiment (neutral indicator) suggests cautious positioning.

KINGSHIB Investment Recommendations

✅ Newcomers: Begin with minimal allocation (0.5-1%) on Gate.com platform after thorough research; utilize limit orders to control entry prices during established support levels; view initial investment as educational exposure to meme coin mechanics

✅ Experienced Traders: Implement tactical swing trading during +10% to -10% price oscillations; maintain strict 15-20% stop-loss discipline; combine technical analysis with community sentiment monitoring via official Twitter (@KINGSHIBABSC) and Reddit channels

✅ Institutional Investors: Conduct comprehensive due diligence on development roadmap execution; evaluate smart contract audit credentials independently; consider KINGSHIB exposure only as fractional allocation within diversified meme token strategies

KINGSHIB Market Participation Methods

- Gate.com Trading: Access KINGSHIB trading with competitive fees; utilize platform's risk management tools including stop-loss and take-profit orders

- Direct wallet Management: Transfer tokens to personal wallets using BSC network for long-term community participation and staking opportunities once DApps launch

- Community Engagement: Monitor official channels (Twitter, Reddit, Medium) for project updates, development progress, and community voting on future initiatives

Cryptocurrency investments carry extreme risk and potential for complete capital loss. This report does not constitute investment advice. All investors must conduct independent research and assess their personal risk tolerance before participating. Consult qualified financial advisors before making investment decisions. Never invest more than you can afford to lose completely.

FAQ

What is the current price of KINGSHIB and how high might it potentially reach in the future?

KINGSHIB's current price is approximately 0.007243 HNL. Future price movements depend on market dynamics, adoption rates, and overall ecosystem development. Long-term potential suggests significant upside as the project matures and community grows stronger.

What is KINGSHIB token, and what are its uses and characteristics?

KINGSHIB is a utility token designed for the Web3 ecosystem, featuring high scalability and smart contract functionality. It serves as a medium for transactions, payments, and decentralized finance operations, offering users secure and efficient blockchain interaction capabilities.

What are the risks of investing in KINGSHIB and how should I evaluate its investment value?

KINGSHIB carries volatility and liquidity risks typical of meme coins. Evaluate by analyzing project fundamentals, community strength, trading volume, and market sentiment. Monitor price trends and development updates regularly for informed decisions.

What is the difference between KINGSHIB and other Shib-like tokens?

KINGSHIB features distinct tokenomics and supply mechanics compared to other Shib tokens. It offers unique community-driven utilities and governance features, positioning itself as an evolved alternative within the Shib ecosystem with enhanced value proposition.

What factors affect KINGSHIB's price and how to conduct fundamental analysis?

KINGSHIB's price is influenced by market demand, supply volume, market sentiment, and technical indicators. Fundamental analysis includes evaluating the project team, whitepaper, community engagement, trading volume, and ecosystem development to assess long-term value.

What is the price prediction for KINGSHIB in 2024-2025, and how do experts view it?

KINGSHIB price predictions for 2024-2025 remain uncertain due to high market volatility. Experts note that SHIB prices reflect overall market sentiment and investor behavior, with predictions dependent on market trends and trading volume dynamics.

2025 TURBO Price Prediction: Analyzing Market Trends and Future Valuation Prospects in the Evolving Cryptocurrency Ecosystem

2025 WOJAK Price Prediction: Analyzing Market Trends and Future Valuation Prospects for the Popular Meme Token

2025 WHYPrice Prediction: Market Analysis and Growth Potential for Investors

2025 DON Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 QUACK Price Prediction: Will This Meme Coin Soar or Crash in the Crypto Market?

2025 COQ Price Prediction: Expert Analysis and Market Outlook for the Coming Year

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?