2025 GTBTCPrice Prediction: Analyzing Market Trends and Potential Growth Factors in the Cryptocurrency Landscape

Introduction: GTBTC's Market Position and Investment Value

Gate Wrapped BTC (GTBTC), as an on-chain BTC yield-generating asset, has been making waves since its inception. As of 2025, GTBTC's market capitalization has reached $347,657,960, with a circulating supply of approximately 3,001.64 tokens, and a price hovering around $115,822.6. This asset, dubbed the "BTC yield enhancer," is playing an increasingly crucial role in both CeFi and DeFi scenarios.

This article will provide a comprehensive analysis of GTBTC's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. GTBTC Price History Review and Current Market Status

GTBTC Historical Price Evolution

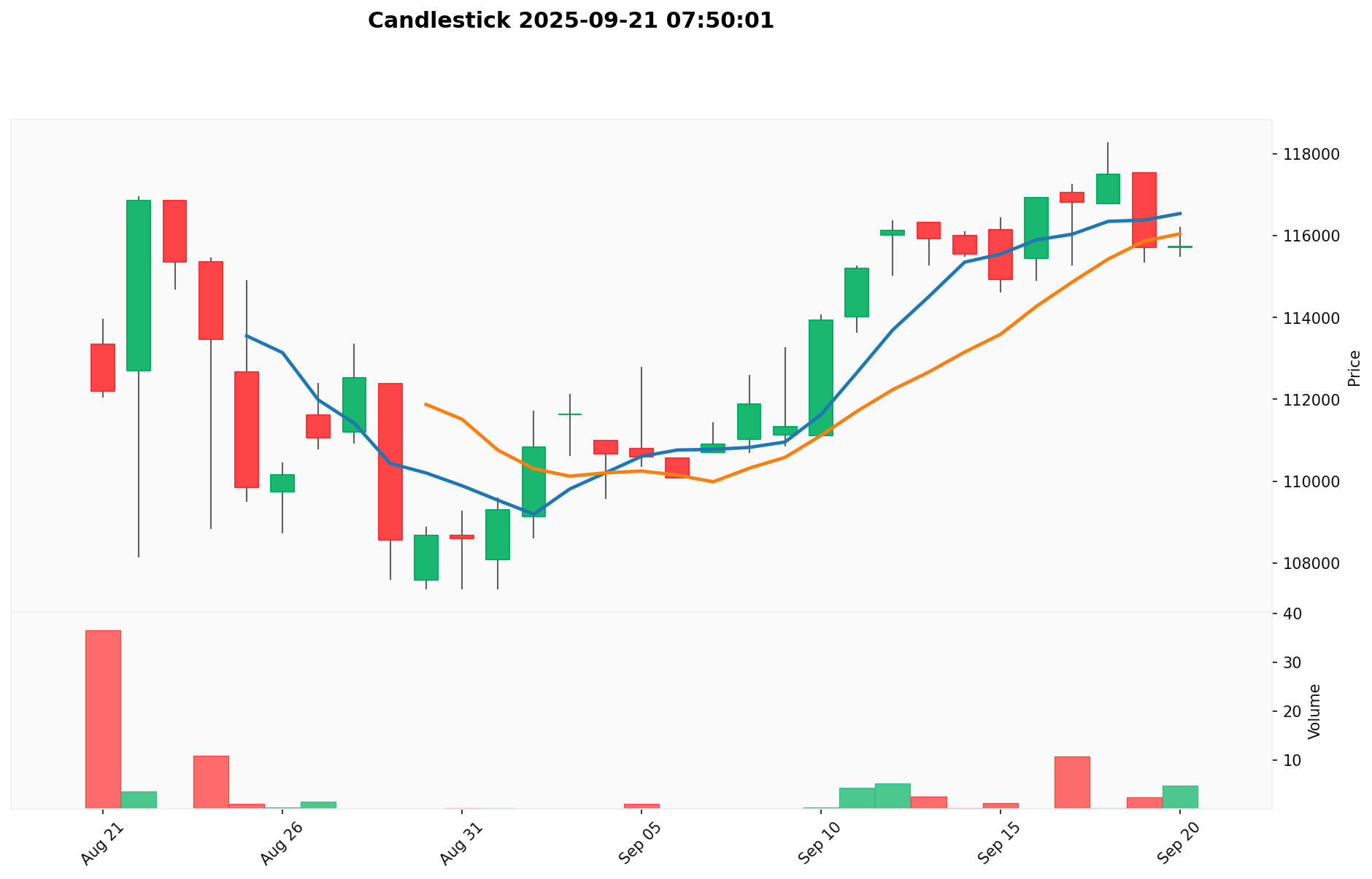

- 2025: GTBTC launched on September 1st, initial price at $107,351.9

- 2025: Reached all-time high of $118,284.3 on September 18th

- 2025: Currently trading at $115,822.6 as of September 21st

GTBTC Current Market Situation

GTBTC is currently trading at $115,822.6, showing a slight decrease of 0.07% in the past 24 hours. The token has a market capitalization of $347,657,960.79, ranking 225th in the overall cryptocurrency market. The 24-hour trading volume stands at $278,879.77, indicating moderate market activity. GTBTC has shown positive performance over the past month with a 2.31% increase, despite a minor weekly decline of 0.069%. The current price is close to its all-time high, suggesting strong market interest in this Gate.com-issued, BTC-backed asset.

Click to view the current GTBTC market price

Here's the content in English as requested:

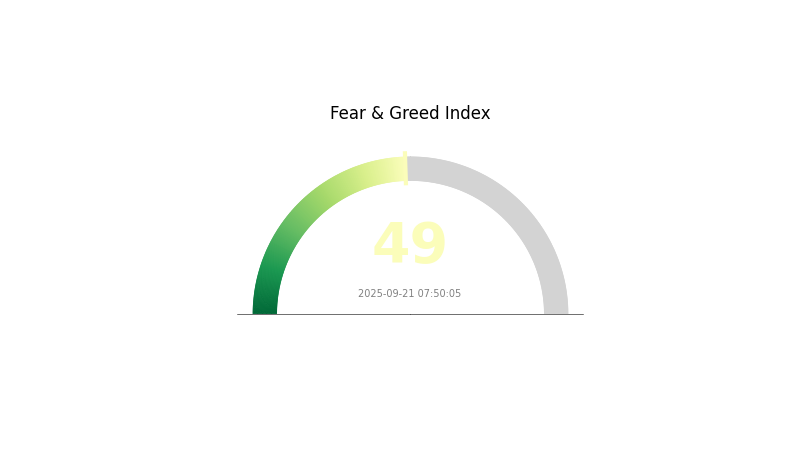

GTBTC Market Sentiment Indicator

2025-09-21 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently in a state of equilibrium, with the Fear and Greed Index at 49. This neutral sentiment suggests a balanced market, where neither extreme fear nor excessive greed is dominating investor behavior. Traders and investors should remain cautious and vigilant, as the market could potentially swing in either direction. It's advisable to conduct thorough research and consider diversifying portfolios to mitigate risks in this uncertain climate.

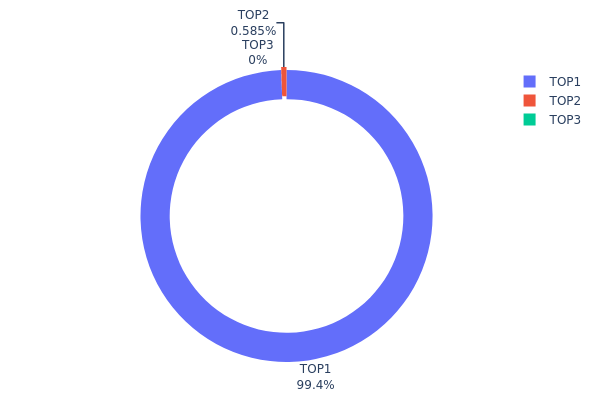

GTBTC Holdings Distribution

The address holdings distribution chart provides a snapshot of how GTBTC tokens are distributed among different blockchain addresses. According to the data, GTBTC exhibits an extremely high concentration of holdings. The top address (0xc882...84f071) holds 894.61 GTBTC, accounting for 99.41% of the total supply. The second-largest holder (0x0d07...b492fe) possesses only 5.26 GTBTC, representing 0.58% of the total.

This level of concentration raises significant concerns about the decentralization and market structure of GTBTC. With nearly all tokens held by a single address, the market is highly susceptible to potential manipulation and extreme price volatility. Such a concentrated distribution could lead to liquidity issues and make the token vulnerable to large sell-offs or accumulations by the dominant holder.

The current holdings distribution reflects a highly centralized on-chain structure for GTBTC, which may impact its perceived stability and investor confidence. This concentration suggests that the token's governance and price discovery mechanisms could be heavily influenced by a single entity, potentially compromising the principles of decentralization typically associated with blockchain-based assets.

Click to view the current GTBTC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc882...84f071 | 894.61 | 99.41% |

| 2 | 0x0d07...b492fe | 5.26 | 0.58% |

| - | Others | -0 | 0.010000000000005% |

II. Key Factors Affecting Future GTBTC Price

Supply Mechanism

- Halving: Bitcoin's supply is halved approximately every four years, reducing the rate of new coin issuance.

- Historical Pattern: Previous halvings have led to significant price increases in the following years.

- Current Impact: The next halving is expected to further reduce supply, potentially driving up GTBTC price.

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions are increasingly holding Bitcoin, including through spot ETFs.

- Corporate Adoption: Some notable companies have added Bitcoin to their balance sheets.

- Government Policies: Various countries are developing regulations around cryptocurrencies, impacting market sentiment.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly those of the Federal Reserve, significantly influence Bitcoin prices.

- Inflation Hedging Properties: Bitcoin is often viewed as a hedge against inflation, affecting its demand during inflationary periods.

- Geopolitical Factors: Global political events and economic crises can drive investors towards Bitcoin as a safe-haven asset.

Technical Development and Ecosystem Building

- Network Upgrades: Ongoing improvements to the Bitcoin network enhance its functionality and scalability.

- Layer 2 Solutions: Development of second-layer technologies aims to improve Bitcoin's transaction speed and efficiency.

- Ecosystem Applications: Growth in DeFi and other Bitcoin-based applications expands the cryptocurrency's utility and potential value.

III. GTBTC Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $74,111 - $95,000

- Neutral forecast: $95,000 - $115,799

- Optimistic forecast: $115,799 - $145,907 (requires sustained institutional adoption)

2027 Mid-term Outlook

- Market phase expectation: Potential consolidation and growth phase

- Price range predictions:

- 2026: $94,214 - $157,024

- 2027: $112,272 - $156,893

- Key catalysts: Increased mainstream adoption, technological advancements in the Bitcoin network

2030 Long-term Outlook

- Base scenario: $150,000 - $210,000 (assuming steady market growth)

- Optimistic scenario: $210,000 - $245,026 (assuming strong institutional adoption and regulatory clarity)

- Transformative scenario: $245,026+ (assuming Bitcoin becomes a global reserve asset)

- 2030-12-31: GTBTC $209,424 (potential year-end closing price based on average prediction)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 145906.99 | 115799.2 | 74111.49 | 0 |

| 2026 | 157023.72 | 130853.1 | 94214.23 | 12 |

| 2027 | 156892.86 | 143938.41 | 112271.96 | 24 |

| 2028 | 207573.57 | 150415.63 | 123340.82 | 29 |

| 2029 | 239852.77 | 178994.6 | 173624.77 | 54 |

| 2030 | 245025.71 | 209423.69 | 121465.74 | 80 |

IV. GTBTC Professional Investment Strategies and Risk Management

GTBTC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable BTC-linked returns

- Operation suggestions:

- Accumulate GTBTC during market dips

- Hold for at least 6-12 months to benefit from compounding yields

- Store in Gate Web3 wallet for enhanced security

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit downside risk

- Take profits at predetermined resistance levels

GTBTC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10% of crypto portfolio

- Aggressive investors: 15-25% of crypto portfolio

- Professional investors: Up to 40% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Allocate across multiple yield-generating assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for large holdings

- Security precautions: Enable 2FA, use unique passwords, regularly update software

V. Potential Risks and Challenges for GTBTC

GTBTC Market Risks

- BTC price volatility: GTBTC value closely tied to BTC price fluctuations

- Yield competition: Emerging products may offer higher yields

- Liquidity risk: Potential challenges in large-scale redemptions

GTBTC Regulatory Risks

- Evolving crypto regulations: Potential impact on wrapped token structures

- Cross-border compliance: Varying legal status in different jurisdictions

- Tax implications: Uncertain treatment of yield-generating tokens

GTBTC Technical Risks

- Smart contract vulnerabilities: Potential exploits in the token contract

- Blockchain network congestion: May affect minting/redemption processes

- Custodial risks: Reliance on Gate's BTC reserves

VI. Conclusion and Action Recommendations

GTBTC Investment Value Assessment

GTBTC offers a unique proposition for BTC holders seeking yield while maintaining liquidity. Long-term value lies in its ability to generate returns on idle BTC, but short-term risks include market volatility and regulatory uncertainties.

GTBTC Investment Recommendations

✅ Beginners: Start with a small allocation (1-5% of portfolio) to understand the product ✅ Experienced investors: Consider a moderate allocation (10-20%) as part of a diversified crypto strategy ✅ Institutional investors: Explore GTBTC for treasury management, with thorough due diligence on counterparty risks

GTBTC Participation Methods

- Direct purchase: Buy GTBTC on Gate.com spot market

- BTC staking: Stake BTC on Gate.com to mint GTBTC

- DeFi integration: Use GTBTC in supported DeFi protocols for additional yield opportunities

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is GBTC stock a buy?

Yes, GBTC stock is currently considered a buy. Analysts view it as low-risk with potential for high returns, making it an attractive investment opportunity.

How much BTC is left in GBTC?

As of June 24, 2025, GBTC holds 185,207.1 BTC. This represents the total amount of Bitcoin owned by Grayscale Bitcoin Trust.

Why is grayscale bitcoin trust dropping?

Grayscale Bitcoin Trust is dropping due to selling Bitcoin to meet investor redemption requests, impacting the trust's value.

Is GBTC a good way to buy bitcoin?

GBTC is a solid option for indirect Bitcoin investment, backed by actual BTC holdings. It's best suited for long-term investors seeking exposure to Bitcoin through traditional investment channels.

Share

Content