2025 GOHOME Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: GOHOME's Market Position and Investment Value

GOHOME (GOHOME) stands as the most expensive memecoin in history, aspiring to become the Bitcoin of memecoins. Since its launch, GOHOME has garnered significant community support with a mission to flip BTC and initiate altseason. As of December 18, 2025, GOHOME's fully diluted valuation has reached $1,150,956,197.544, with a circulating supply of approximately 524,619.425912 tokens, trading at $115.1 per token. This distinctive asset, recognized for its ambitious vision and strong community foundation, is playing an increasingly important role in the memecoin ecosystem.

This article will provide a comprehensive analysis of GOHOME's price trends through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

GOHOME Market Analysis Report

I. GOHOME Price History Review and Current Market Status

GOHOME Historical Price Evolution

GOHOME launched on January 20, 2025, and has experienced significant price volatility since its inception. The token reached its all-time high (ATH) of $598.95 on July 22, 2025, demonstrating strong market momentum during the mid-year period. However, the token subsequently experienced a substantial correction, with its all-time low (ATL) of $111.01 recorded on December 15, 2025, representing an 81.48% decline from the peak price.

GOHOME Current Market Situation

As of December 18, 2025, GOHOME is trading at $115.10, reflecting a marginal recovery from its recent ATL. The token exhibits the following key market metrics:

Price Performance:

- 1-hour change: +0.32%

- 24-hour change: -1.56%

- 7-day change: -3.73%

- 30-day change: -14.49%

- Year-to-date performance: +5,429,732.69% (since launch)

Market Capitalization and Supply:

- Market cap: $60,383,695.92

- Fully diluted valuation (FDV): $1,150,956,197.54

- Circulating supply: 524,619.43 GOHOME

- Total supply: 9,999,619.44 GOHOME

- Circulation ratio: 5.25%

Trading Activity:

- 24-hour trading volume: $72,953.34

- Market dominance: 0.037%

- Active holders: 26,756

- Listed on 9 cryptocurrency exchanges

The token is currently experiencing downward price pressure, with recent price action confined between the $113.01 and $119.71 range over the past 24 hours. The FDV-to-market cap ratio of 5.25% indicates that significant supply expansion potential exists, as the vast majority of the total token supply remains uncirculated.

Click to view current GOHOME market price

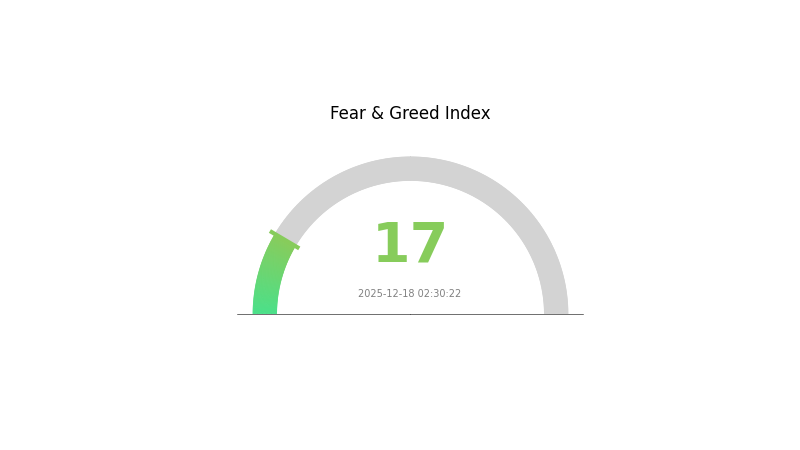

GOHOME Market Sentiment Index

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 17. This indicates severe market pessimism and heightened risk aversion among investors. During such periods, asset prices typically decline as panic selling dominates trading activity. However, extreme fear often presents contrarian opportunities for long-term investors seeking favorable entry points. Market participants should exercise caution, conduct thorough due diligence, and consider their risk tolerance before making investment decisions. Monitor Gate.com for real-time market data and sentiment analysis to stay informed about market dynamics.

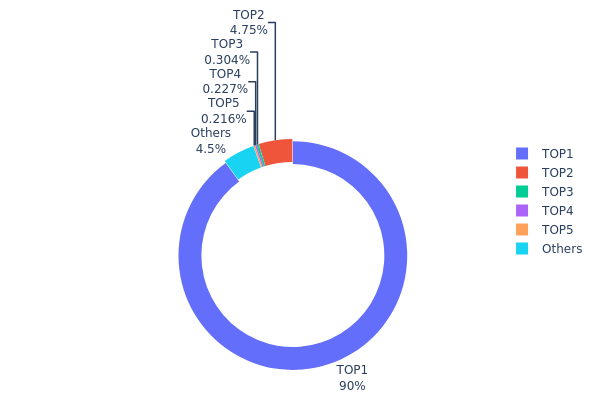

GOHOME Token Distribution

The address holding distribution represents a snapshot of how GOHOME tokens are allocated across blockchain wallets, serving as a critical indicator of token concentration and market structure. This metric reveals the degree of decentralization by measuring whether token supply is widely dispersed among numerous participants or concentrated within a limited number of addresses.

The current distribution data exhibits pronounced concentration characteristics. The top address commands 90.00% of total holdings, representing 9,000,000 tokens, which substantially exceeds typical decentralization benchmarks for healthy token ecosystems. The second-largest holder maintains a significantly smaller position at 4.75%, indicating a sharp drop-off in holdings after the dominant address. Combined, the top two addresses control 94.75% of the circulating supply, while the remaining addresses collectively hold just 5.25%. The distribution among smaller holders demonstrates gradual tapering, with positions three through five representing less than 1% each.

This extreme concentration presents notable implications for market dynamics. Such a skewed distribution creates potential vulnerabilities regarding price stability and liquidity conditions. The dominant stakeholder possesses substantial influence over supply mechanics and market sentiment, which could theoretically facilitate coordinated selling pressure or create artificial volatility. The lack of distributed ownership among multiple independent participants reduces organic price discovery mechanisms and may suppress genuine market participation from smaller investors. However, the concentration may also reflect the token's current stage in distribution, where early allocations or treasury holdings remain consolidated pending gradual release schedules.

Click to view current GOHOME Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | EL4Cpi...2JNTk3 | 9000.00K | 90.00% |

| 2 | Ftk41s...1CsaTC | 475.00K | 4.75% |

| 3 | H771Wt...bm1EdM | 30.36K | 0.30% |

| 4 | H8qJr4...tBbVab | 22.68K | 0.22% |

| 5 | ATzqCh...MAmzNL | 21.63K | 0.21% |

| - | Others | 449.95K | 4.52% |

II. Core Factors Affecting GOHOME's Future Price

Supply Mechanism

-

Limited Token Supply: GOHOME features a capped token supply that continuously restricts circulation to increase demand. This contrasts sharply with traditional fiat currencies like the US Dollar, which experiences daily monetary expansion that dilutes value.

-

Current Impact: The scarcity model creates upward price pressure through controlled supply dynamics, supporting the token's value proposition as demand grows.

Macro-Economic Environment

- Inflation Hedge Characteristics: GOHOME's limited supply structure positions it as a potential hedge against currency debasement and inflationary pressures inherent in traditional monetary systems.

Three、2025-2030 GOHOME Price Forecast

2025 Outlook

- Conservative Forecast: $89.84 - $115.18

- Neutral Forecast: $115.18 - $131.88

- Optimistic Forecast: $131.88 - $148.58 (requires sustained market momentum and positive ecosystem development)

2026-2028 Medium-term Outlook

- Market Stage Expectations: Potential accumulation and early growth phase with gradual price discovery and market adoption expansion

- Price Range Forecast:

- 2026: $113.42 - $189.91

- 2027: $143.20 - $194.68

- 2028: $151.12 - $236.46

- Key Catalysts: Ecosystem expansion, technology upgrades, institutional adoption, and market sentiment improvements

2029-2030 Long-term Outlook

- Base Case: $196.77 - $223.69 (assumes moderate adoption rates and stable market conditions)

- Optimistic Case: $223.69 - $286.49 (assumes accelerated ecosystem adoption and positive macroeconomic environment)

- Transformative Case: $286.49+ (assumes breakthrough technological developments, mainstream adoption, and favorable regulatory framework)

Note: Price forecasts are derived from analytical models and represent reasonable scenarios. Actual market performance may vary significantly based on macroeconomic conditions, regulatory developments, and technological innovations. Users are recommended to conduct their own research and consider risk management strategies when trading on Gate.com or other platforms.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 148.58 | 115.18 | 89.8404 | 0 |

| 2026 | 189.91 | 131.88 | 113.42 | 14 |

| 2027 | 194.68 | 160.89 | 143.2 | 39 |

| 2028 | 236.46 | 177.79 | 151.12 | 54 |

| 2029 | 223.69 | 207.12 | 196.77 | 79 |

| 2030 | 286.49 | 215.41 | 114.17 | 87 |

GOHOME Investment Analysis Report

I. Executive Summary

GOHOME is a Solana-based memecoin that positions itself as "the most expensive memecoin in history" with ambitious aspirations to become the Bitcoin of memecoins. As of December 18, 2025, GOHOME trades at $115.1 USD with a market capitalization of approximately $60.4 million and a fully diluted valuation of $1.15 billion.

Key Metrics:

- Current Price: $115.1

- 24-Hour Change: -1.56%

- Market Cap Rank: #452

- Circulating Supply: 524,619.43 GOHOME (5.25% of total supply)

- All-Time High: $598.95 (July 22, 2025)

- All-Time Low: $111.01 (December 15, 2025)

II. Project Overview

GOHOME Concept & Vision

GOHOME draws inspiration from the "go home" button found on the WhiteHouse.gov/es 404 error page. The project philosophy centers on the right to reject unwelcome intruders and newcomers who arrive late to the cryptocurrency market.

Core Mission: The GOHOME team aims to "flip BTC" by making the price of one GOHOME token exceed the price of one Bitcoin, while simultaneously initiating an altseason rally.

Technical Specifications

- Blockchain: Solana (SPL token standard)

- Contract Address: 2Wu1g2ft7qZHfTpfzP3wLdfPeV1is4EwQ3CXBfRYAciD

- Max Supply: 9,999,619.44 GOHOME

- Circulating Supply: 524,619.43 GOHOME (5.25% of max supply)

- Token Holders: 26,756

Community & Social Presence

The GOHOME community positions itself as unified in providing opportunities for those who missed early Bitcoin adoption at $100. The project maintains active presence on:

- Official Website: https://gohometoken.com/

- Twitter: https://x.com/GoHome_Token

- Whitepaper: https://gohometoken.com/wp

- Solana Explorer: https://explorer.solana.com/account/2Wu1g2ft7qZHfTpfzP3wLdfPeV1is4EwQ3CXBfRYAciD

III. Market Performance Analysis

Price Performance Metrics

| Time Period | Change % | Price Change |

|---|---|---|

| 1 Hour | +0.32% | +$0.37 |

| 24 Hours | -1.56% | -$1.82 |

| 7 Days | -3.73% | -$4.46 |

| 30 Days | -14.49% | -$19.50 |

| 1 Year | +5,429,732.69% | +$115.10 |

Market Position

- Global Market Share: 0.037% of total cryptocurrency market cap

- Market Cap to FDV Ratio: 5.25% (indicating significant unlocked token supply)

- Trading Volume (24H): $72,953.34 USD

- Exchange Listings: Available on 9 exchanges

- Current Market Sentiment: Positive (Market Emotion Score: 1)

Price Range Analysis

GOHOME has experienced extreme volatility since inception:

- Peak Performance: From all-time low of $111.01 (December 15, 2025) to all-time high of $598.95 (July 22, 2025) represents a 439.6% gain

- Current Correction: Recent pullback from $119.71 (24H high) to $113.01 (24H low) shows ongoing price discovery

IV. GOHOME Professional Investment Strategy & Risk Management

GOHOME Investment Methodology

(1) Long-Term Holding Strategy

Target Investors: Community believers, memecoin enthusiasts, retail investors seeking long-term altseason exposure

Operational Recommendations:

- Accumulate during market pullbacks when price approaches $111-115 support levels

- Set 2-3 year holding periods to benefit from potential protocol adoption expansion and community growth

- Establish dollar-cost averaging (DCA) schedules during high-volatility periods to reduce entry price variance

Storage Solution:

- For long-term holdings, utilize Gate Web3 wallet for secure self-custody with full control over private keys

- Enable multi-signature security for portfolio amounts exceeding $10,000

- Maintain offline backup of recovery phrases in secure physical locations

(2) Active Trading Strategy

Technical Analysis Tools:

- Relative Strength Index (RSI): Identify overbought conditions above 70 and oversold conditions below 30 for swing trade entry/exit points

- Moving Averages (20/50/200 EMA): Use crossovers to confirm trend direction and determine momentum shifts

Wave Operation Key Points:

- Trade during established consolidation patterns, targeting 15-25% gains per wave

- Monitor 24-hour trading volume; optimal entry points occur when volume exceeds $75,000 with price consolidation

- Execute swing trades on 4-6 hour timeframe patterns aligned with Solana network activity cycles

GOHOME Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation maximum, with stop-loss orders at 20% below entry price

- Aggressive Investors: 3-5% of portfolio allocation, allowing for 30% drawdown tolerance with accumulated positions strategy

- Professional Investors: 5-10% of portfolio allocation based on advanced risk modeling and portfolio correlation analysis

(2) Risk Hedging Solutions

- Stablecoin Reserves: Maintain 40-50% portfolio in USDT/USDC stablecoins to capitalize on price dips and provide liquidity for rebalancing

- Position Sizing: Never exceed 10% single-trade risk; use leverage sparingly (maximum 2:1) and only during established uptrends with support confirmation

(3) Secure Storage Solution

- Self-Custody Recommendation: Gate Web3 wallet provides institutional-grade security with hardware wallet integration capabilities, allowing users to maintain full control while benefiting from professional infrastructure

- Exchange Custody: For active traders, maintain GOHOME positions on Gate.com with robust 2-factor authentication and withdrawal whitelisting enabled

- Security Precautions: Never share private keys or seed phrases; enable IP-based login restrictions; utilize withdrawal address whitelisting to prevent unauthorized transfers

V. GOHOME Potential Risks & Challenges

GOHOME Market Risks

- Extreme Volatility Risk: GOHOME exhibits memecoin-characteristic extreme price swings (54.9% swing from 24H low to high), creating significant liquidation risk for leveraged positions and psychological stress for retail investors

- Limited Liquidity Risk: Daily trading volume of $72,953 is relatively low compared to market cap, resulting in slippage during large orders and potential price manipulation vulnerability

- Speculative Nature Risk: As a memecoin without fundamental utility beyond community sentiment, valuation depends entirely on investor psychology and social media momentum rather than technological innovation or revenue generation

GOHOME Regulatory Risks

- Memecoin Classification Uncertainty: Regulatory bodies globally remain ambiguous on memecoin treatment; potential future classification as unregistered securities could trigger delisting from exchanges and legal complications

- Geographic Restrictions: Certain jurisdictions (US, EU, Asia-Pacific) may impose specific restrictions on memecoin trading or community activities, limiting market accessibility and liquidity

- Tax Compliance Complexity: Memecoin transactions generate significant taxable events requiring detailed record-keeping; regulatory agencies increasingly scrutinize memecoin trading for tax evasion patterns

GOHOME Technical Risks

- Smart Contract Vulnerability Risk: As an SPL token on Solana, GOHOME depends on Solana network security and token contract code integrity; historical Solana network outages or contract bugs could result in permanent token loss

- Blockchain Network Risk: Solana's consensus mechanism and validator concentration expose GOHOME to network congestion, double-spending risks during high-load periods, or consensus-level attacks

- Liquidity Pool Risk: GOHOME's Solana-based DEX liquidity pools face impermanent loss for liquidity providers and potential price manipulation through flash loan attacks

VI. Conclusion & Action Recommendations

GOHOME Investment Value Assessment

GOHOME represents a high-risk, high-reward memecoin opportunity positioned at the intersection of community enthusiasm and speculative capital markets. While the project's ambitious mission to "flip Bitcoin" provides compelling narrative appeal and its 1-year return of 5,429,732.69% demonstrates extraordinary wealth creation potential, the current market conditions reflect significant maturation from peak euphoria (down 81.8% from July ATH).

The token's 5.25% circulating-to-max-supply ratio indicates substantial future dilution risk, yet growing community of 26,756 holders demonstrates emerging grassroots support. Investment merit depends entirely on community momentum sustainability rather than technological differentiation.

GOHOME Investment Recommendations

✅ New Investors: Begin with micro-allocation strategy of 0.5-1% of portfolio in 2-3 separate purchase tranches during price consolidation phases, utilizing Gate.com's low trading fees and security infrastructure. Establish strict stop-loss orders at 25% below entry price.

✅ Experienced Investors: Implement tactical swing-trading approach capitalizing on 15-25% wave patterns within established support/resistance zones. Maintain 3-5% maximum portfolio allocation with disciplined position-sizing and technical analysis entry/exit signals.

✅ Institutional Investors: Consider GOHOME as emerging-risk/emerging-reward alternative asset class allocation for memecoin market exposure through Gate.com's professional trading infrastructure. Implement quantitative models analyzing community sentiment correlation with price movements.

GOHOME Trading Participation Methods

- Gate.com Spot Trading: Access GOHOME trading pairs with industry-leading liquidity, professional-grade charting tools, and institutional custody solutions for position management

- Gate Web3 Wallet Self-Custody: Receive GOHOME transfers and maintain direct blockchain custody with private key control, enabling peer-to-peer trading and community participation without counterparty risk

- Dollar-Cost Averaging (DCA) Programs: Utilize automated investment features on Gate.com to execute regular GOHOME purchases, reducing emotional decision-making and timing risk during volatile market conditions

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on personal risk tolerance and consult professional financial advisors. Never invest funds exceeding your loss-bearing capacity.

FAQ

Can holo coin reach $1?

Holo coin reaching $1 is possible but depends on project adoption, market conditions, and network growth. While speculative, positive developments could drive significant price appreciation over time.

Will helium mobile reach $100?

Yes, Helium Mobile has strong potential to reach $100. With growing network adoption, increasing utility, and expanding ecosystem partnerships, price appreciation to this level is achievable within the medium to long term as the project scales.

Will the gravity coin go up?

Gravity coin is expected to decrease short-term by -22.16% by December 15, 2025. However, long-term prospects are bullish, with potential gains of 103.84% by 2030, suggesting strong recovery potential for patient investors.

How much will 1 Dogecoin cost in 2030?

Based on expert forecasts, Dogecoin is expected to average around $0.10 by 2030, though some analysts predict it could reach $0.28 depending on market conditions and adoption trends.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

5 ways to get Bitcoin for free in 2025: Newbie Guide

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?