2025 GOG Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: GOG's Market Position and Investment Value

Guild of Guardians (GOG) is a mobile Squad RPG token that combines roguelike dungeon crawling with collection building mechanics. Since its launch in December 2021, GOG has established itself within the gaming and blockchain ecosystem. As of December 2025, GOG's market capitalization stands at approximately $2.90 million, with a circulating supply of around 800 million tokens and a current price hovering near $0.003619.

This asset, which represents ownership and utility within the Guild of Guardians gaming platform, continues to play an evolving role in the Web3 gaming sector. Players utilize GOG to earn truly ownable rewards and participate in the game's economy.

This article will comprehensively analyze GOG's price trajectories and market dynamics, examining historical price movements, market supply and demand factors, and ecosystem developments to provide investors with professional price insights and practical investment guidance for informed decision-making.

Guild of Guardians (GOG) Market Analysis Report

I. GOG Price History Review and Current Market Status

GOG Historical Price Evolution Trajectory

Guild of Guardians (GOG) was published on December 21, 2021, at an initial price of $0.03. The token has experienced significant volatility since its launch:

- December 2021: Project launch at $0.03, marking the beginning of GOG's market journey

- April 2024: Reached an all-time high (ATH) of $0.3273 on April 28, 2024, representing a peak valuation period

- October 2024: Hit an all-time low (ATL) of $0.002 on October 14, 2024, indicating substantial market correction

From launch price to ATH, GOG experienced approximately a 991% increase, demonstrating significant early market enthusiasm. However, the subsequent decline from ATH to ATL represents a 99.39% drawdown, reflecting the challenging market conditions faced by gaming and Web3 projects.

GOG Current Market Posture

As of December 25, 2025, GOG is trading at $0.003619, positioning it at market rank #1,893 with a fully diluted valuation of $3,619,000. The token's circulating supply stands at 800,133,999.299 GOG out of a total supply of 1,000,000,000, representing 80.01% circulation.

Current Price Performance Metrics:

| Timeframe | Price Change | Change Percentage |

|---|---|---|

| 1 Hour | -$0.000002825 | -0.078% |

| 24 Hours | -$0.000073857 | -2.00% |

| 7 Days | -$0.000492565 | -11.98% |

| 30 Days | -$0.000096987 | -2.61% |

| 1 Year | -$0.032712693 | -90.039% |

The 24-hour trading volume stands at $12,717.87, with price range between $0.003613 (low) and $0.003718 (high). The token is currently listed on 4 exchanges with 9,081 token holders.

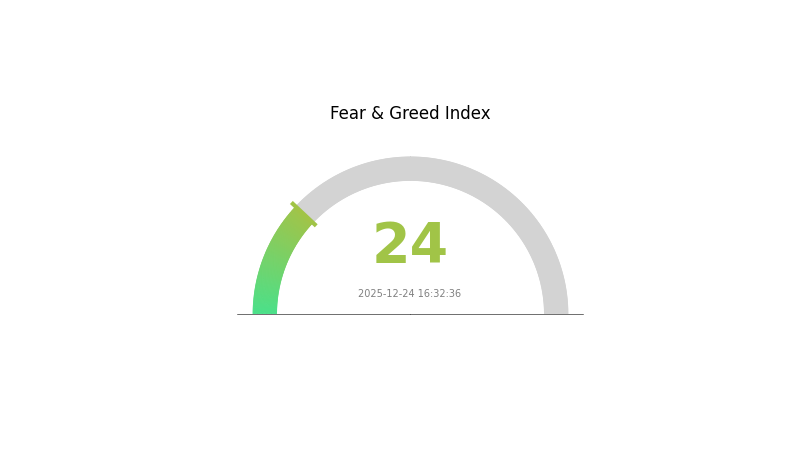

GOG operates on the Ethereum blockchain as an ERC-20 token, with contract address 0x9ab7bb7fdc60f4357ecfef43986818a2a3569c62. The market sentiment indicator shows a reading of 1, while broader market conditions indicate "Extreme Fear" (VIX: 24) as of December 24, 2025.

View current GOG market price

GOG Market Sentiment Index

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with the Fear and Greed Index at 24. This indicates heightened market anxiety and pessimistic sentiment among investors. During such periods, opportunities may emerge as assets become undervalued. Conservative traders should exercise caution, while long-term investors might consider accumulating quality projects. Monitor key support levels closely and maintain proper risk management. Consider diversifying your portfolio and avoiding impulsive decisions driven by fear. Track market developments on Gate.com to stay informed about potential recovery signals and trading opportunities.

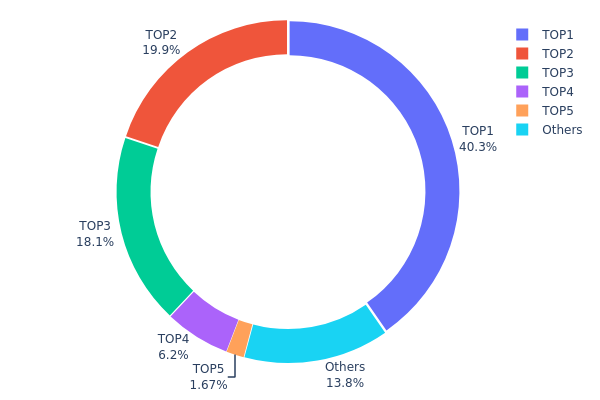

GOG Holdings Distribution

The holdings distribution chart illustrates the concentration of GOG tokens across blockchain addresses, providing crucial insights into the decentralization status and potential market structure risks. By analyzing the top wallet addresses and their respective token allocations, investors and analysts can assess the degree of wealth concentration, identify potential whale positions, and evaluate the vulnerability of the token to coordinated selling pressures or market manipulation.

GOG's current holdings distribution reveals a notable concentration pattern. The top three addresses collectively control 78.29% of the total token supply, with the leading address alone commanding 40.33%. This substantial concentration in a limited number of wallets indicates a relatively high degree of centralization risk. While the fourth and fifth addresses contribute 6.20% and 1.67% respectively, the remaining addresses account for only 13.84% of holdings, further emphasizing the oligopolistic structure of token distribution.

This pronounced concentration introduces several implications for market dynamics. The significant token holdings by top addresses create potential price volatility risks, as large-scale token transfers or liquidations from these wallets could trigger substantial market movements. Additionally, the limited distribution among the broader holder base may constrain the token's liquidity and organic market participation, potentially reducing the resilience of the market structure. From a governance and decentralization perspective, such concentration levels suggest that GOG remains in an early or highly controlled distribution phase, warranting investor caution regarding long-term sustainability and market maturity.

Click to view current GOG holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x971f...bf94a0 | 403395.47K | 40.33% |

| 2 | 0x1465...6c5741 | 198500.01K | 19.85% |

| 3 | 0x2373...2851e6 | 181116.00K | 18.11% |

| 4 | 0xba5e...d13eb6 | 62047.25K | 6.20% |

| 5 | 0x91d4...c8debe | 16746.01K | 1.67% |

| - | Others | 138195.26K | 13.84% |

Core Factors Affecting GOG Token's Future Price

Platform Ecosystem Growth

-

User Base Expansion: GOG.com has established itself as a reputable gaming distribution platform with a continuously growing user base. As the platform expands its reach in the gaming industry, the utility and adoption scope of GOG tokens are expected to increase accordingly.

-

Market Positioning: GOG.com differentiates itself through its focus on DRM-free games and retro gaming titles, carving out a unique niche in the competitive gaming distribution market. This specialized positioning may drive sustained demand for GOG tokens among the platform's ecosystem participants.

Market Liquidity and Trading Dynamics

-

Current Valuation: GOG tokens are currently trading at $0.19 USD, significantly below their historical peak of $1.9886 USD, presenting a discount to previous valuation levels.

-

Trading Volume: The 24-hour trading volume stands at 2.709 million CNY with a turnover rate of only 5.79%, indicating relatively modest liquidity in the market. This low turnover suggests limited market depth and potential price volatility during significant trading activity.

Three、2025-2030 GOG Price Forecast

2025 Outlook

- Conservative Forecast: $0.00325 - $0.00361

- Neutral Forecast: $0.00361

- Bullish Forecast: $0.00383 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with moderate accumulation opportunities as market sentiment stabilizes

- Price Range Forecast:

- 2026: $0.00339 - $0.00413

- 2027: $0.0022 - $0.00565

- Key Catalysts: Ecosystem expansion, increased adoption rates, strategic partnerships, and overall cryptocurrency market recovery

2028-2030 Long-term Outlook

- Base Case: $0.00321 - $0.0058 (assuming steady adoption and moderate market growth)

- Bullish Case: $0.00408 - $0.00619 (contingent on significant protocol upgrades and mainstream institutional adoption)

- Transformative Case: $0.00649 (extreme favorable conditions including major market breakthrough and substantial technological innovations)

Key Observation: Price forecasts indicate a 58% potential upside by 2030 compared to baseline levels, with cumulative growth trajectory suggesting strengthening market position through the decade.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00383 | 0.00361 | 0.00325 | 0 |

| 2026 | 0.00413 | 0.00372 | 0.00339 | 2 |

| 2027 | 0.00565 | 0.00393 | 0.0022 | 8 |

| 2028 | 0.0058 | 0.00479 | 0.00321 | 32 |

| 2029 | 0.00619 | 0.00529 | 0.00408 | 46 |

| 2030 | 0.00649 | 0.00574 | 0.00322 | 58 |

Guild of Guardians (GOG) Investment Analysis Report

I. Project Overview

Basic Information

Guild of Guardians is a mobile Squad RPG game set in a rich world on the brink of destruction, combining roguelike dungeon crawling with collection building. Players embark on an epic adventure where they build their dream team of Guardians to earn truly ownable rewards.

| Metric | Value |

|---|---|

| Token Symbol | GOG |

| Current Price | $0.003619 |

| Market Cap | $2,895,684.94 |

| Fully Diluted Valuation | $3,619,000 |

| Total Supply | 1,000,000,000 |

| Circulating Supply | 800,133,999.30 |

| Market Ranking | 1,893 |

| Contract Address (Ethereum) | 0x9ab7bb7fdc60f4357ecfef43986818a2a3569c62 |

| Token Standard | ERC-20 |

| Active Holders | 9,081 |

Price Performance

Current Market Status (as of December 25, 2025):

- 24H Change: -2.00%

- 7D Change: -11.98%

- 30D Change: -2.61%

- 1Y Change: -90.039%

- All-Time High: $0.3273 (April 28, 2024)

- All-Time Low: $0.002 (October 14, 2024)

- 24H Trading Volume: $12,717.87

II. Market Performance Analysis

Price Trend Assessment

GOG has experienced significant volatility since its launch. The token peaked at $0.3273 in April 2024, representing substantial upside potential from current levels. However, the 90% decline over the past year indicates persistent downward pressure and market challenges.

Key Observations:

- Short-term decline (-2% in 24H) suggests continued bearish sentiment

- The 7-day decline of -11.98% indicates weakness in recent trading activity

- Market capitalization remains relatively low at approximately $2.9 million, indicating limited market adoption

- Trading volume of $12,717.87 per 24 hours is modest, suggesting liquidity constraints

Market Position

With a market ranking of 1,893 and a market share of 0.00011%, GOG represents a micro-cap token with limited mainstream adoption. The circulating supply utilization at 80.01% indicates a relatively well-distributed token supply.

III. Fundamental Analysis

Project Strengths

-

Innovative Gameplay Model: Combining roguelike dungeon crawling with collection-based mechanics offers engaging gameplay mechanics for mobile gaming audiences.

-

Play-to-Earn Integration: The emphasis on "truly ownable rewards" aligns with Web3 gaming trends, providing players with tangible asset ownership.

-

Mobile-First Approach: Targeting the mobile gaming market, which represents a significantly larger addressable audience compared to traditional blockchain gaming platforms.

Project Challenges

-

Severe Price Decline: The 90% year-over-year decline raises concerns about token utility, player engagement, and investor confidence.

-

Low Liquidity: With only 4 exchanges listing GOG and modest trading volumes, liquidity remains a significant concern for investors seeking to enter or exit positions.

-

Limited Market Adoption: With fewer than 10,000 active token holders, adoption rates remain relatively constrained.

-

Competitive Gaming Market: The mobile gaming and play-to-earn sectors face intense competition from established titles and other blockchain-based games.

IV. GOG Professional Investment Strategy and Risk Management

GOG Investment Methodology

(1) Long-Term Holding Strategy

Suitable For: Risk-tolerant investors with belief in long-term gaming and Web3 adoption, those specifically interested in mobile gaming ecosystems.

Operational Guidelines:

- Establish positions gradually during periods of market weakness to reduce average entry cost

- Maintain a disciplined position sizing approach, allocating only a small percentage of overall portfolio to speculative assets

- Monitor project development milestones, including game updates, player growth metrics, and token utility enhancements

(2) Active Trading Strategy

Technical Analysis Considerations:

- Support and Resistance Levels: Track price behavior around historical levels ($0.002 - $0.003619) to identify entry and exit opportunities

- Trading Volume Analysis: Monitor volume patterns during price movements to confirm trend validity

Wave Trading Key Points:

- Utilize short-term price consolidations following significant declines for potential recovery trades

- Exercise caution during low-volume periods, which may indicate reduced market liquidity

GOG Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-1% of portfolio allocation

- Aggressive Investors: 1-3% of portfolio allocation

- Specialized Investors: 3-5% of portfolio allocation

(2) Risk Mitigation Approaches

- Dollar-Cost Averaging: Spread purchases over multiple time periods to reduce timing risk

- Portfolio Diversification: Maintain GOG as a small portion of a broader cryptocurrency or gaming-focused investment portfolio

(3) Secure Storage Solution

- Self-Custody Best Practices: For larger holdings, consider using secure wallet solutions compatible with ERC-20 tokens

- Exchange Storage: For active trading purposes, maintain holdings on Gate.com, which supports GOG trading

- Security Considerations:

- Never share private keys or seed phrases

- Verify contract addresses before transfers

- Use hardware wallet solutions for substantial holdings

- Enable two-factor authentication on all trading accounts

V. GOG Potential Risks and Challenges

Market Risks

-

Severe Valuation Decline: The 90% year-over-year price decrease indicates significant investor losses and erosion of project confidence. Recovery to previous valuations would require substantial narrative shifts and product success.

-

Limited Liquidity: Low trading volumes and limited exchange listings create challenges for executing large trades without substantial price impact, potentially trapping investors.

-

Competition in Gaming: The mobile and play-to-earn gaming sectors face intense competition from established games and other blockchain titles, threatening market share and user adoption.

Regulatory Risks

-

Cryptocurrency Regulatory Uncertainty: Evolving global regulations regarding gaming tokens and play-to-earn mechanics could impact token utility and trading availability.

-

Regional Gaming Restrictions: Certain jurisdictions may implement restrictions on play-to-earn games or blockchain-based gaming, limiting the addressable market.

-

Securities Classification Risk: Regulatory bodies in some regions may reclassify gaming tokens, potentially affecting trading availability and project operations.

Technology Risks

-

Smart Contract Vulnerabilities: As an ERC-20 token on Ethereum, any vulnerabilities in token smart contracts could threaten token security or functionality.

-

Game Development Execution: Delays in game updates, feature releases, or technical issues could impact player engagement and token demand.

-

Blockchain Network Risks: Ethereum network congestion or changes to gas fees could affect token transaction costs and accessibility.

VI. Conclusions and Action Recommendations

GOG Investment Value Assessment

Guild of Guardians represents a high-risk, speculative investment opportunity within the mobile gaming and play-to-earn sectors. While the project offers innovative gameplay mechanics and mobile-first positioning, the severe 90% price decline over the past year reflects significant challenges in market adoption, player engagement, and investor confidence.

The token's low market capitalization, limited trading liquidity, and modest user base suggest that success is far from assured. Recovery would require demonstrable improvements in game performance, expanding player base metrics, and restoration of market confidence.

GOG Investment Recommendations

✅ Newcomers: Allocate only a small, predetermined amount (under 1% of portfolio) that you can afford to lose entirely. Focus on understanding the game mechanics and ecosystem before committing capital. Use this as an educational investment in gaming tokenomics.

✅ Experienced Investors: Consider dollar-cost averaging small positions only if you have conviction in the mobile gaming and play-to-earn thesis. Maintain strict position sizing discipline and establish clear exit criteria based on technical or fundamental deterioration.

✅ Institutional Investors: This market cap tier generally remains below the threshold for institutional portfolio allocation due to liquidity and market depth constraints.

GOG Trading Participation Methods

- Spot Trading: Purchase GOG directly on Gate.com through its spot trading interface, facilitating both accumulation and exit strategies

- Limited Exchange Options: Verify that GOG is listed on your preferred trading platform, noting limited exchange availability may restrict trading flexibility

- OTC Considerations: For larger positions, investigate over-the-counter trading options to minimize market impact

IMPORTANT DISCLAIMER: Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. All investors should conduct thorough independent research and consult with qualified financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely. Gaming tokens and play-to-earn projects remain highly speculative and experimental. Past performance does not guarantee future results.

FAQ

What is a gog coin?

GOG coin is a Web3 token built on the Solana blockchain, designed for fast and low-cost transactions. It leverages Solana's high-speed infrastructure to enable efficient decentralized transactions in the Web3 ecosystem.

What factors influence GOG coin price predictions?

GOG price predictions are influenced by market trends, supply and demand dynamics, trading volume, ecosystem development, and macroeconomic factors. As of 2025, GOG shows steady growth potential driven by Web3 adoption and market sentiment.

What is the historical price performance of GOG coin?

GOG coin has shown modest price levels recently, trading at $0.003778 on December 14, 2025, and $0.003755 on December 15, 2025. With a market cap of $1.87 million and trading volume around $31,600, GOG demonstrates consistent micro-cap performance in the market.

Will GOG coin reach a specific price target in 2025?

Based on current market trends and moving averages, GOG coin is predicted to reach approximately $0.002954 by early 2026. Price targets depend on market conditions, but analysts expect moderate volatility throughout 2025 based on technical analysis indicators.

2025 ISLAND Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 A2Z Price Prediction: Expert Forecast and Market Analysis for the Upcoming Year

2025 MAVIA Price Prediction: Expert Analysis and Future Market Outlook for the Decentralized Gaming Token

2025 NVIR Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 OL Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 W3GG Price Prediction: Expert Analysis and Market Forecast for the Gaming Token's Future Growth Potential

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?