2025 GNO Price Prediction: Analyzing Market Trends and Potential Growth Factors for Gnosis Tokens

Introduction: GNO's Market Position and Investment Value

Gnosis (GNO), as a decentralized prediction market platform built on the Ethereum protocol, has made significant strides since its inception in 2017. As of 2025, Gnosis has achieved a market capitalization of $385,643,952.9, with a circulating supply of approximately 2,639,589 tokens and a price hovering around $146.1. This asset, often referred to as the "oracle of decentralized forecasting," is playing an increasingly crucial role in the field of predictive markets and decentralized finance.

This article will provide a comprehensive analysis of Gnosis's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and the macroeconomic environment to offer professional price predictions and practical investment strategies for investors.

I. GNO Price History Review and Current Market Status

GNO Historical Price Evolution

- 2017: GNO launched at $31.25, price fluctuated significantly

- 2020: Market downturn, price reached an all-time low of $6.88 on March 13

- 2021: Bull market cycle, price surged to an all-time high of $644.2 on November 9

GNO Current Market Situation

As of September 20, 2025, GNO is trading at $146.1. The token has experienced a slight decline of 1.35% in the past 24 hours, with a trading volume of $48,954.47. GNO's current market cap stands at $385,643,952.9, ranking it 212th in the overall cryptocurrency market. The token's price has shown mixed performance across different timeframes, with a 0.13% increase in the last hour, a 1.28% decrease over the past week, and a significant 11.79% gain over the last 30 days. However, GNO has seen a 7.92% decline in value over the past year. The current price is well below its all-time high but significantly above its all-time low, indicating a mature market position for the token.

Click to view the current GNO market price

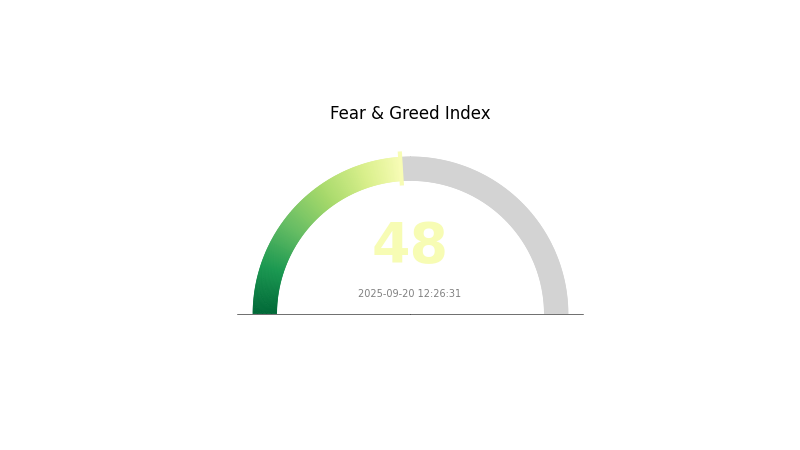

GNO Market Sentiment Indicator

2025-09-20 Fear and Greed Index: 48 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains neutral today, with the Fear and Greed Index at 48. This balanced sentiment suggests investors are neither overly fearful nor excessively greedy. While caution is still present, there's a hint of optimism in the air. Traders should remain vigilant, as market conditions can shift rapidly. It's crucial to conduct thorough research and consider risk management strategies before making any investment decisions. Keep an eye on key market indicators and stay informed about the latest developments in the crypto space.

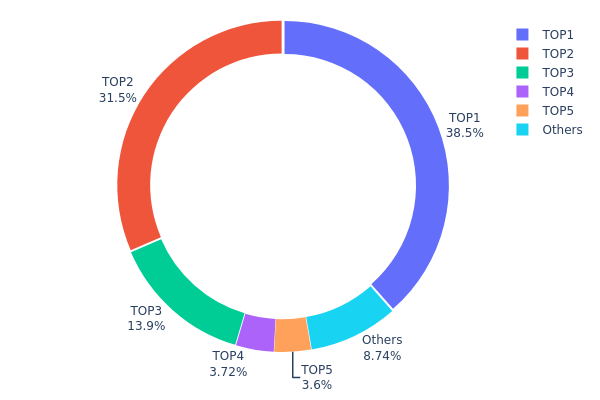

GNO Holdings Distribution

The address holdings distribution data for GNO reveals a highly concentrated ownership structure. The top address holds a significant 38.52% of the total supply, while the second-largest holder accounts for 31.47%. Together, these two addresses control over 70% of all GNO tokens. The third-largest holder possesses 13.93%, bringing the cumulative holdings of the top three addresses to nearly 84%.

This concentration of holdings raises concerns about the potential for market manipulation and price volatility. With such a large portion of tokens controlled by a few addresses, any significant movement or decision by these major holders could have a substantial impact on GNO's market dynamics. The high concentration also suggests a relatively low level of decentralization, which may affect the overall stability and resilience of the GNO ecosystem.

However, it's worth noting that the presence of smaller holders, represented by the "Others" category holding 8.77% of tokens, indicates some degree of distribution among retail investors. This could potentially provide a counterbalance to the influence of the largest holders, albeit to a limited extent given the current distribution structure.

Click to view the current GNO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xec83...bee535 | 3852.26K | 38.52% |

| 2 | 0x0000...000000 | 3147.81K | 31.47% |

| 3 | 0x88ad...655671 | 1393.51K | 13.93% |

| 4 | 0x849d...8d039d | 371.88K | 3.71% |

| 5 | 0x604e...ea350c | 360.41K | 3.60% |

| - | Others | 874.13K | 8.77% |

II. Key Factors Affecting GNO's Future Price

Supply Mechanism

- Total Supply: The total supply of GNO is capped at 2,999,934.75 tokens.

- Circulating Supply: Currently, there are 2,639,076.91 GNO tokens in circulation.

- Current Impact: With a fixed supply, any increase in demand could potentially drive up the price of GNO.

Institutional and Whale Dynamics

- Enterprise Adoption: Gnosis has gained traction as a decentralized prediction market platform, attracting institutional investors seeking legislative frameworks for cryptocurrency market participation.

Macroeconomic Environment

- Inflation Hedge Properties: As a decentralized finance (DeFi) platform, GNO may be viewed as a potential hedge against inflation in traditional financial markets.

Technological Development and Ecosystem Building

- Proprietary Blockchain: Gnosis has developed its own blockchain, which serves as a foundation for its ecosystem.

- Decentralized Prediction Markets: The platform's focus on prediction markets sets it apart in the DeFi space.

- Ecosystem Applications: Gnosis supports the creation of prediction market applications, providing infrastructure and tools for developers.

The future price of GNO is influenced by factors such as market demand, technological advancements, and regulatory policies. Investor sentiment and market trends also play crucial roles. The development of Gnosis's ecosystem and decentralized platform significantly impacts its price trajectory.

III. GNO Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $131.40 - $146.00

- Neutral prediction: $146.00 - $179.58

- Optimistic prediction: $179.58 - $213.16 (requires sustained market growth and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential bull market phase with significant growth

- Price range forecast:

- 2027: $147.70 - $314.40

- 2028: $228.55 - $375.67

- Key catalysts: Technological advancements, wider blockchain adoption, and potential regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $245.77 - $325.57 (assuming steady market growth and adoption)

- Optimistic scenario: $325.57 - $393.94 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $393.94+ (extreme positive developments in the crypto ecosystem)

- 2030-12-31: GNO $325.57 (projected average price, indicating substantial growth from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 213.16 | 146 | 131.4 | 0 |

| 2026 | 242.43 | 179.58 | 154.44 | 22 |

| 2027 | 314.4 | 211.01 | 147.7 | 44 |

| 2028 | 375.67 | 262.7 | 228.55 | 79 |

| 2029 | 331.95 | 319.18 | 245.77 | 118 |

| 2030 | 393.94 | 325.57 | 266.97 | 122 |

IV. Professional GNO Investment Strategies and Risk Management

GNO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors and Gnosis ecosystem supporters

- Operational suggestions:

- Accumulate GNO during market dips

- Participate in Gnosis DAO governance

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor Gnosis ecosystem developments for potential price catalysts

GNO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi and prediction market projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Use two-factor authentication, store private keys offline

V. Potential Risks and Challenges for GNO

GNO Market Risks

- Volatility: Crypto market fluctuations can lead to significant price swings

- Competition: Emerging prediction market platforms may challenge Gnosis' market share

- Liquidity: Limited trading volume may impact price stability

GNO Regulatory Risks

- Uncertain regulations: Evolving crypto regulations may affect Gnosis operations

- Prediction market legality: Some jurisdictions may restrict prediction market activities

- Token classification: Potential for GNO to be classified as a security

GNO Technical Risks

- Smart contract vulnerabilities: Potential for exploits in Gnosis protocols

- Scalability challenges: Ethereum network congestion could impact user experience

- Oracle reliability: Dependency on external data sources for prediction markets

VI. Conclusion and Action Recommendations

GNO Investment Value Assessment

Gnosis (GNO) presents a unique value proposition in the prediction market and DeFi space. While it offers long-term potential for ecosystem growth and adoption, investors should be aware of short-term volatility and regulatory uncertainties.

GNO Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about the Gnosis ecosystem ✅ Experienced investors: Consider a balanced approach, combining holding and active trading strategies ✅ Institutional investors: Explore opportunities for large-scale participation in Gnosis prediction markets and DeFi products

GNO Trading Participation Methods

- Spot trading: Buy and sell GNO on Gate.com

- DeFi staking: Participate in Gnosis DAO staking programs for potential rewards

- Prediction markets: Engage directly with Gnosis prediction market platforms

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future of Gnosis?

Gnosis aims to expand its ecosystem, focusing on open finance and decentralized applications. It will continue to support early-stage projects and build innovative solutions in payments, identity, and internet freedom.

What is the price prediction for quantum coin in 2025?

Based on technical analysis, QuantumCoin is predicted to reach a minimum price of $0.0000017329934 in 2025.

When was the gno coin launched?

The GNO coin was launched in April 2017, with an initial trading price of $63.97.

How much is a GNO token worth?

As of 2025-09-20, a GNO token is worth $146.31. The total market cap is $386.20 million.

Share

Content