2025 FYN Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of FYN

Affyn (FYN) is a sustainable gaming and metaverse token built on the Polygon blockchain that integrates the advantages of virtual and real worlds. Since its launch in March 2022, the project has established itself in the Web3 gaming ecosystem. As of January 1, 2026, FYN has a market capitalization of $277,652.41 with a circulating supply of approximately 383.92 million tokens, trading at $0.0007232. This innovative asset, designed to unite individuals and communities in a converged metaverse environment, continues to develop its gaming and reward mechanisms through community-held tokens as tools of empowerment.

This article will conduct a comprehensive analysis of FYN's price movements and market trends throughout 2026, integrating historical price patterns, market supply and demand dynamics, ecosystem development progress, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

I. FYN Price History Review and Market Status

FYN Historical Price Evolution Trajectory

- March 2024: All-time high of $0.193639 reached on March 22, 2024

- December 2025: All-time low of $0.0006712 reached on December 15, 2025

- 2024-2025: Significant downtrend period, with prices declining approximately 81.31% over one year

FYN Current Market Situation

As of January 1, 2026, FYN is trading at $0.0007232, reflecting recent price volatility across multiple timeframes. The 24-hour price movement shows a decline of 1.56%, with the asset trading between a 24-hour high of $0.0007365 and a low of $0.0006976. On a shorter-term basis, the 1-hour change stands at -0.22%, while the 7-day performance demonstrates a modest recovery with a 1.76% gain. However, the 30-day period reflects continued downward pressure with a -11.67% decline.

The market capitalization stands at approximately $277,652.41, with a fully diluted valuation of $723,200, representing a market cap to FDV ratio of 38.39%. The 24-hour trading volume totals $11,969.24, indicating limited liquidity in the current market environment. FYN maintains a market dominance of 0.000022%, reflecting its relatively small position within the broader cryptocurrency ecosystem. The token has a circulating supply of 383,922,023 FYN against a total supply of 1,000,000,000, with the circulating ratio at 38.39%. The project currently has 28,260 token holders.

Click to view current FYN market price

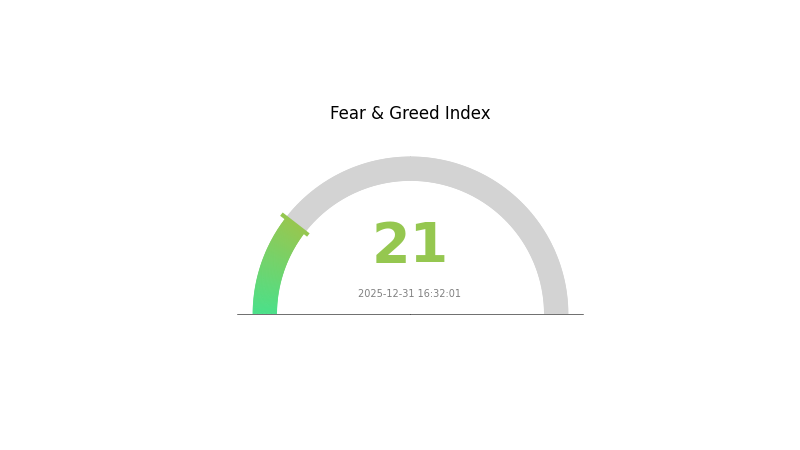

FYN Market Sentiment Index

2025-12-31 Fear and Greed Index: 21 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 21. This indicates significant market pessimism and investor anxiety. During such periods, risk-averse investors typically reduce their positions, while experienced traders may view it as a potential buying opportunity. The extreme fear reading suggests heightened volatility and uncertainty. Investors should exercise caution and conduct thorough due diligence before making trading decisions. Monitor market developments closely on Gate.com to stay updated with real-time data and analysis during this volatile period.

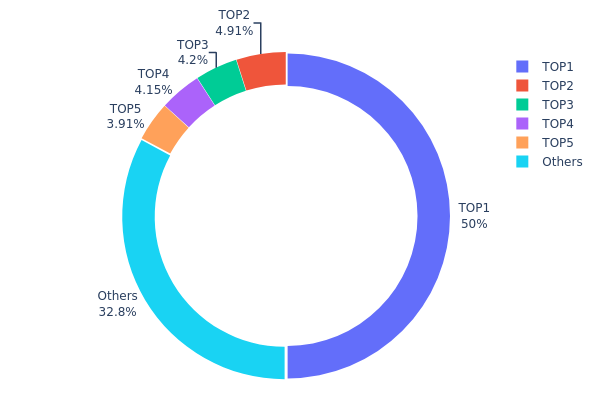

FYN Holdings Distribution

The address holdings distribution chart illustrates the concentration of FYN tokens across blockchain addresses, revealing the degree of token centralization and the distribution pattern of ownership. By analyzing the top holders and their respective percentages, investors can assess the asset's decentralization level and potential market dynamics.

FYN exhibits significant concentration characteristics in its current holdings structure. The top address holds approximately 49.99% of the total supply, representing nearly half of all tokens in circulation. Combined with the second through fifth largest holders, these five addresses collectively control 67.12% of FYN tokens, leaving only 32.88% distributed among the broader holder base. This distribution pattern indicates a pronounced concentration of token ownership, with decision-making power heavily concentrated among a limited number of addresses. Such concentration levels warrant careful consideration, as it may influence market liquidity, price volatility, and governance dynamics.

This concentrated holdings structure presents multifaceted implications for market stability and token mechanics. The predominance of large holders could potentially facilitate coordinated trading activities or rapid liquidation events that impact price discovery. Conversely, this structure may also reflect strategic allocations by early investors or project stakeholders who maintain long-term commitment to the ecosystem. The remaining 32.88% distribution among other addresses, while substantial in percentage terms, is fragmented across numerous participants, suggesting a secondary layer of distributed ownership that could serve as a stabilizing factor in market operations.

Click to view current FYN holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4d6b...47d51f | 499999.86K | 49.99% |

| 2 | 0x36d3...348e09 | 49063.27K | 4.90% |

| 3 | 0x6aa5...dd8666 | 41963.45K | 4.19% |

| 4 | 0x76fa...894413 | 41465.97K | 4.14% |

| 5 | 0xa5a5...e26763 | 39087.00K | 3.90% |

| - | Others | 328420.45K | 32.88% |

II. Core Factors Influencing FYN's Future Price

Supply Mechanism

- Total Token Supply: FYN has a fixed total supply of 1 billion tokens, which establishes scarcity as a fundamental characteristic of the asset.

- Current Impact: The limited supply of 1 billion tokens contributes to FYN's investment potential by creating a defined scarcity mechanism that can support price appreciation as demand increases.

Institutional and Whale Dynamics

- Institutional Investment Trends: Institutional investment trends play a key role in influencing FYN's price trajectory, as institutional capital flows can drive significant market movements.

- Liquidity Concentration: Large holders concentrating positions can lead to increasingly concentrated supply distribution, which may contribute to price volatility and potential price discovery mechanisms.

Macroeconomic Environment

- Overall Economic Trends: FYN's price is influenced by broader macroeconomic trends, policy regulation, and technological innovation across multiple dimensions.

- Market Sentiment: Investor sentiment and confidence significantly impact FYN's price movements, as market psychology plays a crucial role in determining short-term and medium-term price action.

Technology Development and Ecosystem Building

- Polygon Integration: Affyn's technology and ecosystem development, particularly its integration with the Polygon network, represents a key factor in its long-term value proposition and technological advancement.

III. FYN Price Forecast for 2026-2030

2026 Outlook

- Conservative Forecast: $0.00078 - $0.00083

- Base Case Forecast: $0.00083 - $0.00104

- Optimistic Forecast: $0.00104 (requires sustained market recovery and increased institutional adoption)

2027-2028 Mid-term Perspective

- Market Stage Expectation: Potential accumulation phase with gradual price discovery, supported by growing utility and ecosystem development

- Price Range Forecast:

- 2027: $0.00058 - $0.00122

- 2028: $0.00089 - $0.00122

- Key Catalysts: Enhanced tokenomics implementation, strategic partnerships, increased trading volume on platforms like Gate.com, and broader market sentiment recovery

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00087 - $0.00153 (assumes steady network growth and moderate market expansion)

- Optimistic Scenario: $0.00160 by 2029 (contingent on significant protocol upgrades and mainstream adoption acceleration)

- Transformative Scenario: $0.00138 - $0.00153 by 2030 (requires breakthrough developments in use cases and substantial increase in active users)

Note: These projections represent analytical estimates based on historical data patterns. Actual price movements may vary significantly due to market volatility, regulatory changes, and macroeconomic factors. Investors should conduct independent research and consider risk management strategies before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00094 | 0.00072 | 0.00048 | 0 |

| 2026 | 0.00104 | 0.00083 | 0.00078 | 15 |

| 2027 | 0.00122 | 0.00094 | 0.00058 | 29 |

| 2028 | 0.00122 | 0.00108 | 0.00089 | 48 |

| 2029 | 0.0016 | 0.00115 | 0.00087 | 58 |

| 2030 | 0.00153 | 0.00138 | 0.0008 | 90 |

Affyn (FYN) Professional Investment Strategy and Risk Management Report

IV. FYN Professional Investment Strategy and Risk Management

FYN Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Risk-averse investors and long-term believers in metaverse gaming ecosystems

- Operation Suggestions:

- Accumulate FYN during market downturns when price volatility decreases, focusing on dollar-cost averaging to reduce timing risk

- Monitor Polygon blockchain developments and Affyn's sustainable gaming ecosystem updates to identify inflection points

- Maintain a 2-3 year investment horizon to allow the project's gaming-to-earn model to mature and gain user adoption

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Identify key price points at historical highs ($0.193639) and recent lows ($0.0006712) to set entry and exit targets

- Volume Analysis: Monitor the 24-hour trading volume ($11,969.24) relative to moving averages to confirm trend strength and identify breakout opportunities

- Wave Trading Key Points:

- Execute entry positions during positive 7-day performance (+1.76%) while managing stops at recent 24-hour lows ($0.0006976)

- Consider scaling out of positions during rallies exceeding the 30-day downtrend, targeting resistance at previous consolidation levels

FYN Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation

- Active Investors: 2-5% of portfolio allocation

- Professional Investors: 5-10% of portfolio allocation

(2) Risk Hedging Solutions

- Position Sizing Protocol: Limit individual FYN holdings to no more than your defined risk percentage to protect against extreme volatility

- Diversification Strategy: Balance FYN exposure with other blockchain gaming or Polygon ecosystem tokens to reduce concentration risk

(3) Secure Storage Solutions

- Hot Wallet Method: Gate Web3 Wallet for active trading with frequent transactions and real-time market participation

- Cold Storage Approach: For long-term holdings exceeding 6 months, transfer FYN to secure offline storage solutions to eliminate counterparty risk

- Security Considerations: Enable two-factor authentication on all exchange and wallet accounts; never share private keys; regularly verify contract addresses before transfers; monitor token holdings for unexpected balance changes

V. FYN Potential Risks and Challenges

FYN Market Risks

- Extreme Price Volatility: FYN has experienced an 81.31% decline over the past year, indicating severe downward pressure and susceptibility to market sentiment shifts

- Low Trading Liquidity: With only $11,969 in 24-hour volume across a single exchange, FYN faces substantial slippage risk on large orders and limited exit opportunities

- Market Dominance Concentration: At 0.000022% market share, FYN remains a micro-cap token vulnerable to speculative trading and coordinated market movements

FYN Regulatory Risks

- Metaverse Classification Uncertainty: Evolving regulatory frameworks around gaming tokens and metaverse projects create potential compliance challenges across different jurisdictions

- Gaming Revenue Model Scrutiny: Regulatory bodies may increasingly examine play-to-earn mechanisms for securities law violations or gambling classification

- Blockchain Compliance Evolution: Changes to Polygon blockchain regulations or cryptocurrency standards could directly impact FYN's operational framework and token utility

FYN Technology Risks

- Smart Contract Vulnerability: Potential code exploits or security bugs within Affyn's gaming smart contracts could lead to fund losses or token devaluation

- Polygon Network Dependencies: Complete reliance on Polygon blockchain means any network congestion, forks, or security incidents directly threaten FYN functionality

- Gaming Adoption Challenges: Failure to achieve meaningful user adoption in the gaming metaverse would undermine token utility and demand fundamentals

VI. Conclusion and Action Recommendations

FYN Investment Value Assessment

Affyn (FYN) represents a high-risk, early-stage play in the blockchain gaming and metaverse ecosystem built on Polygon. While the project aims to create a sustainable gaming-to-earn model bridging virtual and real worlds, the token faces significant headwinds including extreme volatility, minimal liquidity, and unproven adoption metrics. The 81.31% year-over-year decline reflects broader market skepticism about gaming token valuations. Investors considering FYN should view it as a speculative position requiring substantial conviction in long-term metaverse gaming adoption and Affyn's competitive positioning within this nascent sector.

FYN Investment Recommendations

✅ Beginners: Avoid direct exposure until establishing foundational knowledge of blockchain gaming mechanics; if interested, limit allocation to 0.5-1% of total portfolio with dollar-cost averaging over extended periods

✅ Experienced Investors: Consider 2-5% tactical allocation during oversold conditions combined with strict stop-loss discipline; monitor project development milestones and gaming user metrics as key decision triggers

✅ Institutional Investors: Evaluate position sizing within broader Polygon ecosystem exposure; conduct thorough due diligence on Affyn's sustainable revenue model, user engagement data, and competitive differentiation before commitment

FYN Trading Participation Methods

- Direct Purchase on Gate.com: Access FYN through Gate.com's trading platform with real-time order execution and integrated wallet solutions

- Spot Trading Strategy: Execute buy and sell orders against USDT or other stablecoin pairs to manage FYN exposure with defined entry and exit parameters

- Portfolio Rebalancing: Periodically adjust FYN allocation as part of broader blockchain gaming sector positioning to maintain target risk levels

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and are strongly advised to consult professional financial advisors. Never invest capital you cannot afford to lose entirely.

FAQ

What is FYN token and what is its purpose?

FYN is the native token of Affyn ecosystem, used for transactions, staking rewards, and governance participation. It powers AR-based gaming and real-world digital interaction experiences on the platform.

What is the historical price trend of FYN?

FYN has experienced significant price volatility throughout its history. Recently, the price declined by 1.64%, currently trading at approximately $0.000721. The token has shown considerable fluctuations in trading volume and market performance over time.

How to predict FYN price? What factors should be considered?

To predict FYN price, consider market sentiment, macroeconomic trends, technological innovation, and regulatory policies. Analyze trading volume, community activity, and ecosystem development. Monitor global crypto market movements and investor behavior shifts for comprehensive forecasting.

What are the main risks of investing in FYN?

Main risks include issuer credit risk and opportunity cost from early redemption. Select high-credit issuers and monitor market conditions carefully to manage these risks effectively.

What distinguishes FYN from similar tokens?

FYN stands out with its unique dividend mechanism, rewarding token holders directly without traditional mining. The platform commits to distributing revenue to holders, making it more attractive to investors seeking passive income opportunities.

How is FYN's market liquidity and trading volume?

FYN maintains stable market liquidity across major exchanges with solid 24-hour trading volume. Strong liquidity enables efficient trading with good market depth, making it suitable for active traders seeking reliable execution.

2025 GGG Price Prediction: Bullish Trends and Key Factors Shaping the Future Market

FYN vs BCH: A Comprehensive Comparison of Two Digital Currency Platforms

2025 ELY Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 PFVS Price Prediction: Expert Analysis and Market Forecast for the Coming Year

NXPC Price Trends and Web3 Application Analysis in 2025

2025 RON Price Prediction: Analyzing Growth Potential in the Play-to-Earn Gaming Ecosystem

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?