2025 FOXY Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Cryptocurrency

Introduction: FOXY's Market Position and Investment Value

Foxy Linea (FOXY), as Linea's premier culture coin, has been dedicated to building a vibrant community based on good memes since its inception. As of 2025, FOXY's market capitalization has reached $5,290,359.8, with a circulating supply of approximately 5,858,000,000 tokens, and a price hovering around $0.0009031. This asset, known as a "meme-driven community token," is playing an increasingly crucial role in fostering cultural engagement on the Linea blockchain.

This article will comprehensively analyze FOXY's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. FOXY Price History Review and Current Market Status

FOXY Historical Price Evolution

- 2024: FOXY launched, reaching an all-time high of $0.030527 on June 6

- 2024: Market correction, price dropped to an all-time low of $0.00051 on April 12

- 2025: Continued market volatility, price fluctuating between highs and lows

FOXY Current Market Situation

As of November 22, 2025, FOXY is trading at $0.0009031, with a 24-hour trading volume of $72,139.04. The token has experienced a 2.67% decrease in the last 24 hours. FOXY's market cap currently stands at $5,290,359.8, ranking it at 1522 in the overall cryptocurrency market.

The token is showing bearish trends across multiple timeframes, with a 24.15% decrease over the past week and a 34.55% decline in the last 30 days. The year-to-date performance is significantly negative, with a 93.7% drop.

FOXY's circulating supply is 5,858,000,000 tokens, which represents 58.58% of its total supply of 10,000,000,000. The fully diluted market cap is $9,031,000.

The current price is considerably lower than its all-time high, indicating a substantial market correction since its peak. The market sentiment for cryptocurrencies is currently described as "Extreme Fear," which may be influencing FOXY's price performance.

Click to view the current FOXY market price

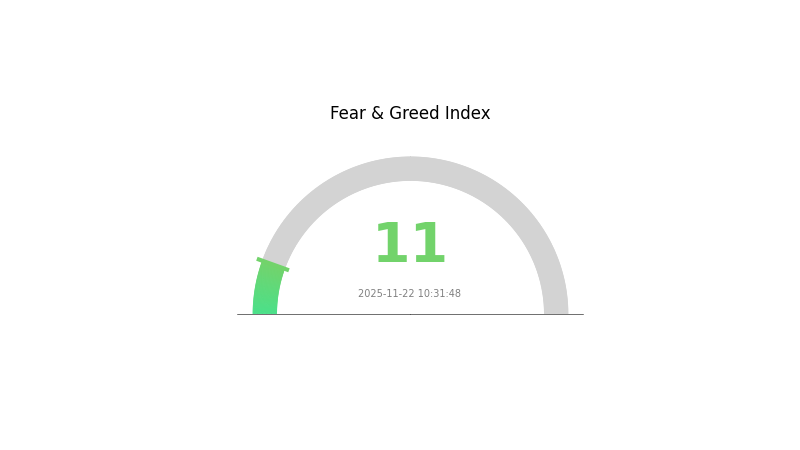

FOXY Market Sentiment Indicator

2025-11-22 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear today, with the sentiment index plummeting to 11. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market conditions remain volatile. Traders should consider dollar-cost averaging and thorough research before making any decisions. Remember, while fear can present opportunities, it's crucial to manage risks and only invest what you can afford to lose in this unpredictable market environment.

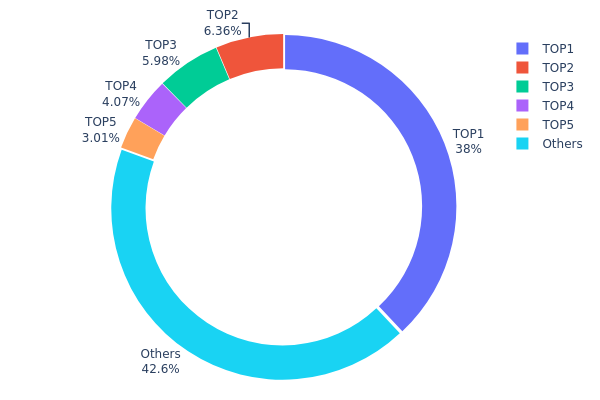

FOXY Holdings Distribution

The address holdings distribution data for FOXY reveals a significant concentration of tokens among a few top addresses. The largest holder controls 38% of the total supply, while the top 5 addresses collectively hold 57.41% of FOXY tokens. This high concentration suggests a relatively centralized ownership structure, which could potentially impact market dynamics.

Such a concentrated distribution raises concerns about market manipulation risks and price volatility. The top address, holding over one-third of the supply, wields substantial influence over the token's circulating supply and, consequently, its market price. This concentration could lead to increased price fluctuations if large holders decide to sell or accumulate more tokens.

However, it's worth noting that 42.59% of FOXY tokens are distributed among other addresses, indicating some level of broader market participation. This distribution pattern reflects a mixed market structure, combining elements of centralization with a degree of wider token dispersion, which may affect the overall stability and decentralization of the FOXY ecosystem.

Click to view the current FOXY Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7f5c...a3476f | 3800000.00K | 38.00% |

| 2 | 0xf89d...5eaa40 | 636030.35K | 6.36% |

| 3 | 0xe4b7...e0a008 | 598484.59K | 5.98% |

| 4 | 0x0d07...b492fe | 406860.88K | 4.06% |

| 5 | 0xd621...d19a2c | 301106.52K | 3.01% |

| - | Others | 4257517.66K | 42.59% |

II. Key Factors Influencing FOXY's Future Price

Supply Mechanism

- Token Burn: FOXY implements a token burn mechanism to reduce the overall supply over time.

- Historical Pattern: Previous token burns have generally had a positive impact on FOXY's price due to the reduction in circulating supply.

- Current Impact: The ongoing token burn is expected to continue supporting FOXY's price by maintaining scarcity.

Institutional and Whale Dynamics

- Institutional Holdings: Several major crypto investment firms have added FOXY to their portfolios, indicating growing institutional interest.

Macroeconomic Environment

- Inflation Hedging Properties: FOXY has shown some resilience during inflationary periods, attracting investors looking for alternative stores of value.

Technological Development and Ecosystem Building

- Ecosystem Applications: The FOXY ecosystem includes several DApps and projects focused on decentralized finance and NFT marketplaces, contributing to its utility and adoption.

III. FOXY Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00086 - $0.00090

- Neutral prediction: $0.00090 - $0.00095

- Optimistic prediction: $0.00095 - $0.00107 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00094 - $0.00146

- 2028: $0.00119 - $0.00142

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.00127 - $0.00155 (assuming steady market growth)

- Optimistic scenario: $0.00155 - $0.00173 (assuming strong market performance)

- Transformative scenario: $0.00173 - $0.00190 (assuming exceptionally favorable conditions)

- 2030-12-31: FOXY $0.00190 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00107 | 0.0009 | 0.00086 | 0 |

| 2026 | 0.00131 | 0.00099 | 0.00085 | 9 |

| 2027 | 0.00146 | 0.00115 | 0.00094 | 27 |

| 2028 | 0.00142 | 0.0013 | 0.00119 | 44 |

| 2029 | 0.00173 | 0.00136 | 0.00106 | 50 |

| 2030 | 0.0019 | 0.00155 | 0.00127 | 71 |

IV. FOXY Professional Investment Strategies and Risk Management

FOXY Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate FOXY tokens during market dips

- Set a target holding period of at least 1-2 years

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss and take-profit levels

- Monitor Linea ecosystem developments for potential price catalysts

FOXY Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance FOXY with other Linea ecosystem tokens

- Position sizing: Limit individual trade sizes to manage exposure

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, and regularly update software

V. Potential Risks and Challenges for FOXY

FOXY Market Risks

- High volatility: Meme coins are subject to extreme price swings

- Liquidity risk: Limited trading volume may impact ease of entry/exit

- Competition: Other meme coins on Linea may dilute FOXY's market share

FOXY Regulatory Risks

- Uncertain regulatory environment: Potential for increased scrutiny of meme coins

- Compliance challenges: FOXY may face difficulties meeting future regulatory requirements

- Cross-border restrictions: Varying regulations across jurisdictions may limit accessibility

FOXY Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Linea network dependence: FOXY's success is tied to Linea's performance and adoption

- Scalability concerns: High network congestion could impact transaction speeds and costs

VI. Conclusion and Action Recommendations

FOXY Investment Value Assessment

FOXY presents a high-risk, high-reward opportunity within the Linea ecosystem. While its meme coin status offers potential for rapid growth, it also carries significant volatility and uncertainty. Long-term value depends on community engagement and Linea's overall success.

FOXY Investment Recommendations

✅ Beginners: Limit exposure to a small portion of portfolio, focus on education ✅ Experienced investors: Consider short-term trading opportunities with strict risk management ✅ Institutional investors: Evaluate FOXY as part of a broader Linea ecosystem investment strategy

FOXY Trading Participation Methods

- Spot trading: Purchase FOXY tokens on Gate.com for direct ownership

- Staking: Explore potential staking opportunities if offered by the project

- Community participation: Engage with the FOXY community to stay informed of developments

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Foxy a good investment?

Yes, Foxy shows strong potential as an investment in 2025. With its innovative features and growing adoption, Foxy is likely to see significant price appreciation in the coming years.

Does Flux crypto have a future?

Yes, Flux crypto has a promising future. Its innovative decentralized cloud infrastructure and growing ecosystem suggest potential for long-term growth and adoption in the Web3 space.

Which crypto will reach $1000 in 2030?

Bitcoin is the most likely cryptocurrency to reach $1000 by 2030, with Ethereum also having a strong chance. Other potential candidates include Cardano, Solana, and Polkadot, depending on their technological advancements and adoption rates.

Can Solana reach $1000 in 2025?

Yes, Solana could potentially reach $1000 in 2025. With its high-speed blockchain and growing ecosystem, Solana has the potential for significant price appreciation, especially if crypto market conditions remain favorable.

Share

Content