2025 EWT Price Prediction: Analyzing Growth Potential and Market Trends for Energy Web Token

Introduction: EWT's Market Position and Investment Value

Energy Web (EWT) has established itself as a key player in the energy sector blockchain space since its inception. As of 2025, Energy Web has achieved a market capitalization of $68,748,631, with a circulating supply of approximately 83,261,029 tokens and a price hovering around $0.8257. This asset, often referred to as the "energy blockchain pioneer," is playing an increasingly crucial role in decentralized energy systems and grid management.

This article will provide a comprehensive analysis of Energy Web's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. EWT Price History Review and Current Market Status

EWT Historical Price Evolution

- 2020: EWT launched, price fluctuated as the project gained initial traction

- 2021: Bull market cycle, EWT reached its all-time high

- 2022-2023: Crypto winter, price declined significantly from previous highs

- 2024: Market stabilization, EWT price showed signs of recovery

EWT Current Market Situation

As of October 22, 2025, EWT is trading at $0.8257, experiencing a 1.84% decrease in the last 24 hours. The token's market capitalization stands at $68,748,631, ranking it 503rd in the overall cryptocurrency market. EWT has seen a significant decline of 27.52% over the past 30 days, indicating a bearish trend in the medium term. The 24-hour trading volume is relatively low at $23,684, suggesting limited liquidity in the current market. With a circulating supply of 83,261,029 EWT tokens, the project has a 100% circulation ratio, implying full token distribution. The overall market sentiment appears cautious, as reflected in the recent price movements and trading activity.

Click to view the current EWT market price

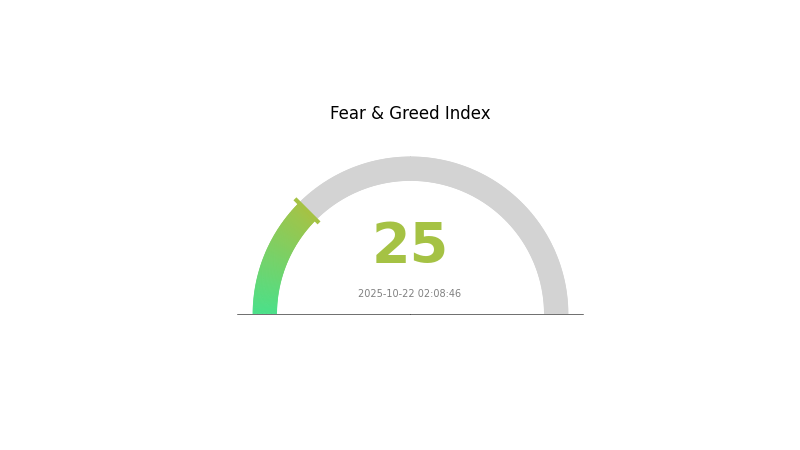

EWT Market Sentiment Index

2025-10-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 25. This level of pessimism often presents unique opportunities for savvy investors. While many are panic-selling, contrarian strategies suggest this could be an ideal time to accumulate. However, caution is advised as market volatility may persist. Diversification and thorough research remain crucial. Gate.com offers a range of tools to help navigate these turbulent waters, including detailed market analysis and risk management features.

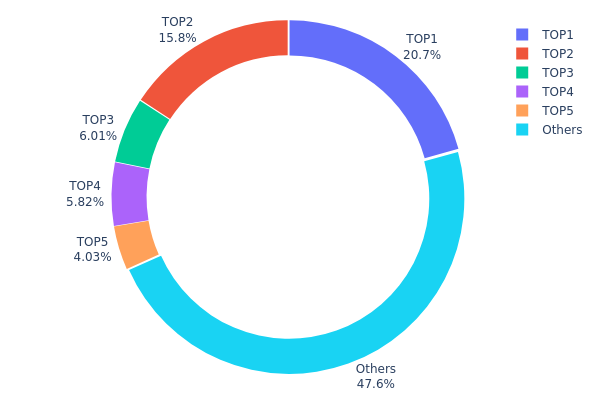

EWT Holdings Distribution

The address holdings distribution data for EWT reveals a significant concentration of tokens among a few top addresses. The top address holds 20.70% of the total supply, while the top 5 addresses collectively control 52.36% of EWT tokens. This high concentration raises concerns about the centralization of EWT's circulating supply.

Such a concentrated distribution pattern could potentially impact market dynamics. The presence of large holders, often referred to as "whales," may lead to increased price volatility if they decide to make substantial trades. Moreover, this concentration potentially gives these top holders significant influence over the EWT ecosystem and its governance decisions.

From a market structure perspective, the current distribution suggests a relatively low level of decentralization for EWT. While 47.64% of tokens are distributed among other addresses, the dominance of a few large holders indicates a need for improved token distribution to enhance network resilience and reduce the risk of market manipulation.

Click to view the current EWT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0BDb...D5d2B1 | 17236.21K | 20.70% |

| 2 | 0x1204...000003 | 13170.02K | 15.81% |

| 3 | 0x99eC...F07D38 | 5000.00K | 6.00% |

| 4 | 0x1204...00000a | 4848.38K | 5.82% |

| 5 | 0xd2DD...e6869F | 3356.58K | 4.03% |

| - | Others | 39649.83K | 47.64% |

II. Key Factors Affecting EWT's Future Price

Macroeconomic Environment

- Monetary Policy Impact: Major central banks' policies, especially the Federal Reserve's interest rate decisions, significantly influence EWT's price. Lower interest rates may lead to capital flowing back into emerging markets and cryptocurrencies like EWT.

- Inflation Hedging Properties: As a digital asset, EWT may be viewed as a potential hedge against inflation, particularly in times of economic uncertainty.

- Geopolitical Factors: International tensions and global economic shifts can impact investor sentiment towards cryptocurrencies, affecting EWT's price.

Technical Development and Ecosystem Building

- Ecosystem Applications: The growth and adoption of decentralized applications (DApps) and projects within the Energy Web ecosystem could drive demand for EWT.

III. EWT Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.51994 - $0.70

- Neutral forecast: $0.70 - $0.90

- Optimistic forecast: $0.90 - $1.04813 (requires strong market recovery)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $1.05844 - $1.5023

- 2028: $1.02976 - $1.41262

- Key catalysts: Increased adoption of energy web technology, favorable regulatory environment

2030 Long-term Outlook

- Base scenario: $1.20 - $1.50 (assuming steady market growth)

- Optimistic scenario: $1.50 - $1.84521 (assuming widespread adoption of energy web solutions)

- Transformative scenario: $2.00+ (assuming revolutionary breakthroughs in energy blockchain technology)

- 2030-12-31: EWT $1.44157 (potential yearly average)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.04813 | 0.8253 | 0.51994 | 0 |

| 2026 | 1.3395 | 0.93672 | 0.5995 | 13 |

| 2027 | 1.5023 | 1.13811 | 1.05844 | 37 |

| 2028 | 1.41262 | 1.32021 | 1.02976 | 59 |

| 2029 | 1.51672 | 1.36641 | 1.0658 | 65 |

| 2030 | 1.84521 | 1.44157 | 0.86494 | 74 |

IV. EWT Professional Investment Strategies and Risk Management

EWT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with a focus on the energy sector

- Operation suggestions:

- Accumulate EWT during market dips

- Monitor energy sector developments and EWT project updates

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Keep track of major project announcements and partnerships

EWT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets and traditional markets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, store private keys offline

V. Potential Risks and Challenges for EWT

EWT Market Risks

- Volatility: Cryptocurrency markets are known for high price fluctuations

- Competition: Other blockchain projects targeting the energy sector may emerge

- Adoption: Slow integration of blockchain technology in the energy industry

EWT Regulatory Risks

- Government regulations: Potential restrictions on cryptocurrency use in energy markets

- Compliance issues: Changing regulatory landscape may impact EWT's utility

- International differences: Varying regulatory approaches across countries

EWT Technical Risks

- Scalability: Potential limitations in handling increased network activity

- Security vulnerabilities: Possibility of smart contract exploits or network attacks

- Technological obsolescence: Rapid advancements in blockchain technology may outpace EWT

VI. Conclusion and Action Recommendations

EWT Investment Value Assessment

EWT presents a unique value proposition in the energy sector blockchain space, with potential for long-term growth. However, short-term volatility and adoption challenges pose significant risks.

EWT Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Explore strategic partnerships and larger positions with hedging strategies

EWT Trading Participation Methods

- Spot trading: Buy and hold EWT tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance options within the Energy Web ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can ETH reach $50,000?

While ambitious, ETH reaching $50,000 is possible in the long term. Factors like increased adoption, network upgrades, and market growth could drive significant price appreciation.

What is the EWT coin?

EWT is the native token of Energy Web Chain, a blockchain platform for the energy sector. It supports app development and is used for transactions and governance on the network.

Will trx coin reach $10?

TRX reaching $10 is possible but uncertain. It depends on TRON's ecosystem growth, market conditions, and adoption. Current projections vary widely.

Will Ethereum hit $5000 in 2025?

Yes, Ethereum is likely to hit $5000 in 2025. Strong market momentum and increasing adoption of Ethereum's technology could drive its price to this level.

Share

Content