2025 ELIZAOS Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: ELIZAOS Market Position and Investment Value

ElizaOS (ELIZAOS), the leading open-source agentic framework from the AI16z community, powers 200+ crypto-native plugins through its modular runtime and memory system. Launched in 2025, ElizaOS has rapidly evolved into a scalable agent-as-service platform with the introduction of v2 features including persistent state, live reasoning console, and the upcoming Eliza Cloud platform. As of December 2025, ELIZAOS commands a market capitalization of $27.99 million with approximately 7.48 billion tokens in circulation, trading at $0.003742 per token. This innovative framework is revolutionizing decentralized intelligence by enabling seamless integration across both onchain and Web2 applications.

This comprehensive analysis examines ELIZAOS price trends through 2025-2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for discerning investors.

ElizaOS (ELIZAOS) Market Analysis Report

I. ELIZAOS Price History Review and Current Market Status

ELIZAOS Historical Price Trajectory

ElizaOS was launched on November 10, 2025, with a relatively short trading history. The token experienced rapid price movements in its early trading phase:

- November 2025: Project launch and initial trading phase, reaching an all-time high of $0.012854 on November 19, 2025

- December 2025: Significant price correction phase, declining from peak levels to current trading ranges, hitting a low of $0.003635 on December 19, 2025

ELIZAOS Current Market Status

As of December 20, 2025, ELIZAOS is trading at $0.003742, representing a -4.94% decline over the past 24 hours and -4.27% decline in the past hour. The token has experienced substantial downward pressure with a -22.8% drop over the past 7 days and a steeper -67.54% decline over the past 30 days.

Key Market Metrics:

- Market Capitalization: $27,998,392.40

- Fully Diluted Valuation (FDV): $37,247,562.87

- Circulating Supply: 7,482,200,000 ELIZAOS (75.17% of total supply)

- Total Supply: 9,953,918,458 ELIZAOS

- Maximum Supply: 11,000,000,000 ELIZAOS

- 24-Hour Trading Volume: $241,785.97

- Market Dominance: 0.0011%

- Token Holders: 5,062

The token ranks #727 in market capitalization among cryptocurrencies and is available on 22 exchanges globally. ELIZAOS operates on the Solana (SOL) blockchain with the contract address: DuMbhu7mvQvqQHGcnikDgb4XegXJRyhUBfdU22uELiZA.

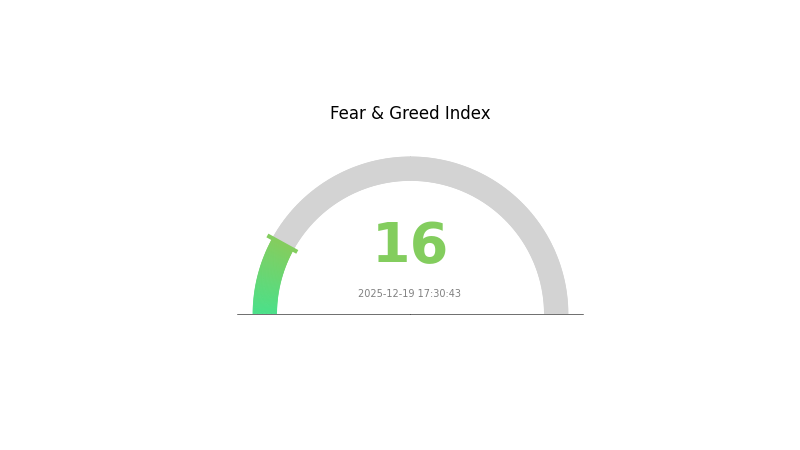

Market Sentiment: Current market sentiment shows Extreme Fear (VIX rating of 16), indicating significant bearish pressure in the broader cryptocurrency market.

Check current ELIZAOS market price

ELIZAOS Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The market is currently experiencing extreme fear, with the index plummeting to 16. This indicates widespread panic and negative sentiment among investors. Such extreme readings often signal capitulation, where fear reaches its peak before potential reversals. During these periods, experienced traders may identify contrarian opportunities. However, extreme fear can persist for extended periods, so caution remains warranted. Monitor market developments closely and consider your risk tolerance when making investment decisions. Gate.com provides real-time sentiment tracking to help you stay informed.

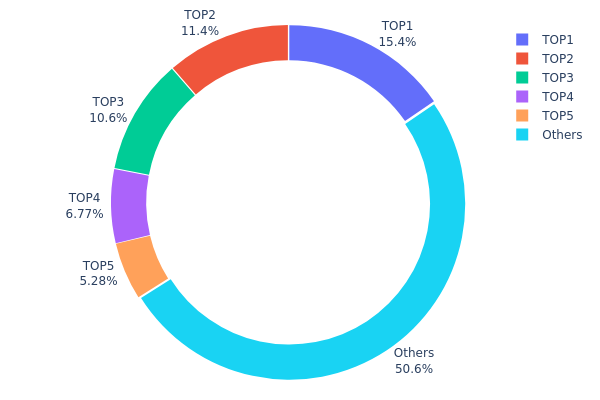

ELIZAOS Holdings Distribution

Click to view current ELIZAOS holdings distribution

The holdings distribution map illustrates the concentration of token ownership across blockchain addresses, serving as a critical indicator of network decentralization and potential market vulnerability. By analyzing the proportion of tokens held by top addresses relative to the total supply, investors and analysts can assess the degree of wealth concentration and the risk profile associated with large holder influence on market dynamics.

ELIZAOS demonstrates a moderately concentrated distribution pattern. The top five addresses collectively control approximately 49.35% of the circulating supply, with the largest holder commanding 15.38% of tokens. While this concentration level is not extreme, it warrants attention from a market structure perspective. The leading address holds 1.49 million tokens, followed by addresses holding 1.10 million and 1.02 million respectively. The remaining 50.65% distributed across other addresses suggests a meaningful decentralization component, though the top-tier concentration remains significant enough to merit monitoring.

The current distribution structure presents notable implications for market stability and price dynamics. With approximately half the supply concentrated in five major holders, ELIZAOS faces potential liquidity pressures and increased susceptibility to coordinated selling activity. The substantial holdings by these addresses could amplify price volatility during market stress periods, particularly if large position exits occur. However, the distributed nature of the remaining supply provides some counterbalance, suggesting the token ecosystem maintains a reasonable degree of decentralization that mitigates extreme manipulation risks while still maintaining concentration levels typical of established cryptocurrency projects.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 2utY4H...4ELiZA | 1489647.99K | 15.38% |

| 2 | 9RYrg7...LcemGj | 1100000.00K | 11.36% |

| 3 | 6TL278...fRzswu | 1023956.35K | 10.57% |

| 4 | B2aBAM...abt74J | 655416.56K | 6.77% |

| 5 | AC5RDf...CWjtW2 | 510984.76K | 5.27% |

| - | Others | 4901055.01K | 50.65% |

II. Core Factors Affecting ELIZAOS Future Price Movement

Supply Mechanism

- Token Supply and Market Dynamics: Supply-demand relationships are key factors influencing token value. Changes in token circulation directly impact market supply and future price potential.

- Current Market Impact: The rapid price appreciation has already driven market capitalization beyond $2 billion USD, reflecting strong demand and growing investor interest.

Technology Development and Ecosystem Building

- Open Source Community Expansion: ELIZAOS represents a vibrant open-source AI developer community that is rapidly expanding its developer base. The project has become a #1 trending GitHub repository, demonstrating significant community participation and engagement.

- Upcoming Catalysts: The ecosystem is expected to introduce more products and development catalysts that could drive future growth and adoption.

- Ecosystem Applications: The active developer community continues to build new applications and integrations within the ELIZAOS ecosystem, strengthening its utility and market relevance.

III. 2025-2030 ELIZAOS Price Forecast

2025 Outlook

- Conservative Prediction: $0.0034 - $0.00377

- Base Case Prediction: $0.00377

- Optimistic Prediction: $0.00423 (requiring sustained market interest and positive ecosystem developments)

2026-2028 Medium-term Perspective

- Market Phase Expectation: Gradual accumulation and early growth phase with incremental adoption catalysts

- Price Range Forecast:

- 2026: $0.00316 - $0.00588

- 2027: $0.00415 - $0.00603

- 2028: $0.00532 - $0.00565

- Key Catalysts: Enhanced protocol functionality, increased institutional participation, broader market recovery, and strategic partnerships within the digital asset ecosystem

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00423 - $0.00629 (assuming steady adoption and market maturation)

- Optimistic Scenario: $0.00629 - $0.00682 (contingent upon significant technological breakthroughs and mainstream integration)

- Transformative Scenario: $0.00682+ (under conditions of widespread enterprise adoption, regulatory clarity, and market-wide bull cycle)

- 2030-12-31: ELIZAOS projected at $0.00682 (representing cumulative 58% appreciation over the forecast period)

Analysis Note: The forecast demonstrates a consistent upward trajectory across the five-year horizon, with near-term consolidation expected through 2025-2026, followed by accelerating growth potential. Risk factors include regulatory developments, competitive pressures, and macroeconomic conditions that may significantly impact outcomes.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00423 | 0.00377 | 0.0034 | 0 |

| 2026 | 0.00588 | 0.004 | 0.00316 | 6 |

| 2027 | 0.00603 | 0.00494 | 0.00415 | 31 |

| 2028 | 0.00565 | 0.00548 | 0.00532 | 46 |

| 2029 | 0.00629 | 0.00556 | 0.00423 | 48 |

| 2030 | 0.00682 | 0.00593 | 0.00344 | 58 |

ElizaOS (ELIZAOS) Professional Investment Strategy and Risk Management Report

IV. ElizaOS Professional Investment Strategy and Risk Management

ElizaOS Investment Methodology

(1) Long-Term Holding Strategy

-

Target Investor Profile: Long-term believers in AI-driven autonomous agent frameworks; developers and enterprises seeking to build on modular agent infrastructure; investors with 12+ month investment horizons

-

Operational Recommendations:

- Accumulate during market downturns when ELIZAOS trades significantly below its all-time high of $0.012854, particularly when volatility spikes create temporary dislocations

- Hold through development milestones, especially Eliza Cloud platform launches and expansion of crypto-native plugin ecosystem

- Reinvest protocol rewards and ecosystem gains to compound long-term returns

- Establish entry positions through dollar-cost averaging over 3-6 month periods to minimize timing risk

-

Storage Solution:

- Utilize Gate.com's Web3 wallet integration for secure custody of ELIZAOS tokens on Solana blockchain

- Maintain cold storage for holdings exceeding 6+ months to eliminate counterparty risk

- Implement multi-signature security protocols for institutional-scale positions

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Monitor key historical levels ($0.003635 ATL and $0.012854 ATH) as primary reference points; trade bounces from 200-day moving averages

- Volume Analysis: Track 24-hour trading volume ($241,785.97) against historical averages; breakouts above 150% of average volume signal potential directional moves

- RSI and MACD Indicators: Apply 14-period RSI with overbought/oversold thresholds (70/30) combined with MACD crossovers for entry/exit confirmation

-

Wave Trading Key Points:

- Exploit the current 30-day decline of -67.54% as potential reversal zones; establish long positions near technical support with defined stop-losses below $0.0035

- Monitor Eliza Cloud announcement dates for volatility expansion opportunities; trade 4-6 hour candles around major news catalysts

- Implement range-bound strategies between established support ($0.004000) and resistance ($0.005500) during consolidation phases

ElizaOS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation maximum; focus on ELIZAOS as a small speculative satellite position complemented by established AI infrastructure plays

- Active Investors: 3-5% allocation; view ELIZAOS as a core holding within AI agent framework exposure; balance with other diversified crypto positions

- Professional Investors: 5-10% allocation; construct dedicated AI agent framework positions with ELIZAOS as primary exposure alongside complementary protocol tokens

(2) Risk Hedging Solutions

- Dollar-Cost Averaging Hedge: Execute purchases across 6-12 month intervals to reduce exposure to volatile price movements; prevents concentration risk from single large acquisitions at unfavorable prices

- Stablecoin Reserve Strategy: Maintain 40-50% of intended ELIZAOS allocation in USDT or USDC; deploy reserves gradually into weakness to optimize entry points while reducing forced selling pressure

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 wallet provides institutional-grade security for active trading positions requiring regular access; supports seamless ELIZAOS transfers between Gate.com trading platform and self-custody solutions

- Cold Storage Method: Transfer long-term holdings to Solana-compatible cold storage solutions for complete custody control; maintain offline backup keys in geographically distributed secure locations

- Critical Security Considerations: Never expose private keys online; enable multi-factor authentication on all exchange accounts; verify contract addresses (DuMbhu7mvQvqQHGcnikDgb4XegXJRyhUBfdU22uELiZA on Solana) before any token transfers; conduct small test transactions before moving large amounts

V. ElizaOS Potential Risks and Challenges

ElizaOS Market Risk

- Extreme Price Volatility: ELIZAOS has declined 70.74% over one year and 67.54% over 30 days, indicating substantial cyclical downside exposure; rapid liquidation cascades during bear markets could amplify losses beyond initial capital

- Liquidity Concentration: With only $241,785.97 in daily 24-hour volume and 5,062 token holders, market depth remains thin; large institutional redemptions could trigger severe price dislocations

- Early-Stage Project Risk: As an emerging open-source framework, ELIZAOS faces competitive pressure from alternative AI agent platforms; failure to achieve meaningful enterprise adoption could substantially reduce token utility and valuation

ElizaOS Regulatory Risk

- Classification Uncertainty: Regulatory authorities have not established clear frameworks for autonomous AI agent tokens; classification as securities could trigger enforcement actions or trading restrictions

- Developer Liability Exposure: As an open-source project supporting 200+ crypto-native plugins, ElizaOS developers may face regulatory scrutiny regarding plugin compliance and token issuance oversight

- Jurisdiction-Specific Restrictions: Certain countries and regions may prohibit AI agent framework token transactions; regulatory changes could suddenly restrict or eliminate trading access in key markets

ElizaOS Technical Risk

- Smart Contract Vulnerabilities: Like all blockchain protocols, ElizaOS faces ongoing security audit requirements; undiscovered vulnerabilities in persistent state management or Eliza Cloud infrastructure could result in token loss or system compromises

- Scalability Limitations: Current Solana blockchain infrastructure may face congestion during network stress; this could degrade performance of on-chain agent operations and limit platform adoption

- Adoption Execution Risk: The team must successfully deliver on Eliza Cloud platform promises, maintain active plugin ecosystem development, and achieve meaningful Web2/Web3 integration; failure on any dimension could undermine long-term value propositions

VI. Conclusion and Action Recommendations

ElizaOS Investment Value Assessment

ElizaOS presents a high-risk, high-potential-reward opportunity within the emerging autonomous AI agent infrastructure category. The project's leading open-source framework status, active AI16z community support, and modular plugin architecture (200+ crypto-native integrations) establish meaningful technical differentiation. However, the severe price decline (-70.74% annually, -67.54% monthly) reflects broad market skepticism regarding near-term commercialization prospects and AI agent utility. The fully diluted valuation of $37.2M remains modest relative to market cap, but token economics show substantial dilution ahead (circulating supply 75.17% of max supply). Long-term value depends critically on successful Eliza Cloud platform launch, demonstrated enterprise adoption, and sustained ecosystem development—outcomes that remain uncertain and require 18-36 month observation periods for validation.

ElizaOS Investment Recommendations

✅ Beginners: Establish a small 1% portfolio position through Gate.com using dollar-cost averaging over 6-12 months; view ELIZAOS as a speculative satellite holding only after building diversified core holdings; maintain strict stop-losses at -30% from entry price and commit to long-term buy-and-hold discipline

✅ Experienced Investors: Allocate 3-5% of active trading capital; combine long-term position accumulation during weakness with tactical wave trading around key support/resistance levels; actively monitor Eliza Cloud announcements and plugin ecosystem developments as primary catalysts

✅ Institutional Investors: Conduct deep technical due diligence on ElizaOS framework architecture, AI16z community governance structures, and competitive positioning relative to alternative agent frameworks; participate in ecosystem activities (plugin development, governance voting) to gain information advantages; consider 5-10% allocation as part of broader AI infrastructure exposure thesis

ElizaOS Trading Participation Methods

- Gate.com Spot Trading: Execute ELIZAOS/USDT purchases through Gate.com's primary trading interface; leverage advanced order types (stop-loss, take-profit limits) to automate trade management and reduce emotional decision-making

- DCA Programs: Establish recurring monthly or weekly purchases through Gate.com to systematically accumulate ELIZAOS positions; automates discipline and removes timing complexity

- Staking and Ecosystem Participation: Monitor ElizaOS documentation (https://docs.elizaos.ai/) for upcoming tokenomics initiatives, plugin rewards, or community incentive programs; participate to generate additional yield on core holdings

Critical Disclaimer: Cryptocurrency investment carries extreme risk and this analysis does not constitute investment advice. ELIZAOS specifically exhibits high volatility, limited liquidity, and early-stage project execution risk. Investors must carefully assess their individual risk tolerance, investment time horizon, and financial situation before allocating capital. Never invest more than you can afford to lose completely. Consult qualified financial advisors before making significant allocation decisions. Past price performance does not guarantee future results.

FAQ

What is elizaOS coin?

elizaOS Coin is the native token of an AI-powered framework enabling developers to create autonomous AI agents. It was officially listed for trading on November 7, 2025, and represents a fusion of artificial intelligence and decentralized technology in the Web3 ecosystem.

What is the price prediction for ELIZAOS in 2024/2025?

ELIZAOS is predicted to reach approximately $0.500 by end of 2025, with potential to reach $0.600 in bullish scenarios, driven by AI sector momentum and market growth trends.

Is ELIZAOS a good investment opportunity?

ELIZAOS shows strong potential as an investment opportunity based on current market trends and technical analysis. Its recent performance demonstrates positive momentum among top gainers. Consider reviewing the latest market data and project fundamentals before making investment decisions.

What are the key factors that could affect ELIZAOS price?

ELIZAOS price is influenced by supply and demand dynamics, protocol upgrades and improvements, macroeconomic factors like interest rates, market sentiment, and overall cryptocurrency market trends.

2025 JUP Price Prediction: Analyzing Market Trends and Potential Growth Factors for Jupiter's Native Token

2025 SLERF Price Prediction: Analyzing Market Trends and Future Growth Potential in the Expanding Digital Asset Ecosystem

2025 SKAI Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 DWAIN Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 HAHA Price Prediction: Analyzing Future Trends and Market Potential for the Emerging Cryptocurrency

2025 CGPTPrice Prediction: Market Analysis and Future Trends for ChatGPT Subscription Models

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?