2025 DARK Price Prediction: Navigating the Shadows of Cryptocurrency's Future

Introduction: DARK's Market Position and Investment Value

Dark Eclipse (DARK), as an experimental network of Trusted Execution Environments (TEEs), has been powering the infinitely scaling world of MCPs since its inception. As of 2025, DARK's market capitalization has reached $1,810,923, with a circulating supply of approximately 999,957,849 tokens, and a price hovering around $0.001811. This asset, dubbed as "infinitely supercharged AI," is playing an increasingly crucial role in the field of artificial intelligence and automated tool integration.

This article will comprehensively analyze DARK's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic environment, to provide investors with professional price predictions and practical investment strategies.

I. DARK Price History Review and Current Market Status

DARK Historical Price Evolution

- 2024: Project launch, price fluctuated around $0.001

- 2025 April: DARK reached its all-time high of $0.04566

- 2025 October: Market correction, price dropped to its all-time low of $0.000981

DARK Current Market Situation

As of November 24, 2025, DARK is trading at $0.001811, with a market capitalization of $1,810,923.66. The token has experienced a 1.57% decrease in the last 24 hours, but shows a slight recovery of 0.27% in the past hour. Despite the recent downturn, DARK has demonstrated significant growth over the past year, with a 920.25% increase. However, the token has faced considerable pressure in the medium term, as evidenced by the 49.24% decline over the last 30 days. The current price sits well below its all-time high, suggesting potential for recovery if market conditions improve.

Click to view the current DARK market price

DARK Market Sentiment Indicator

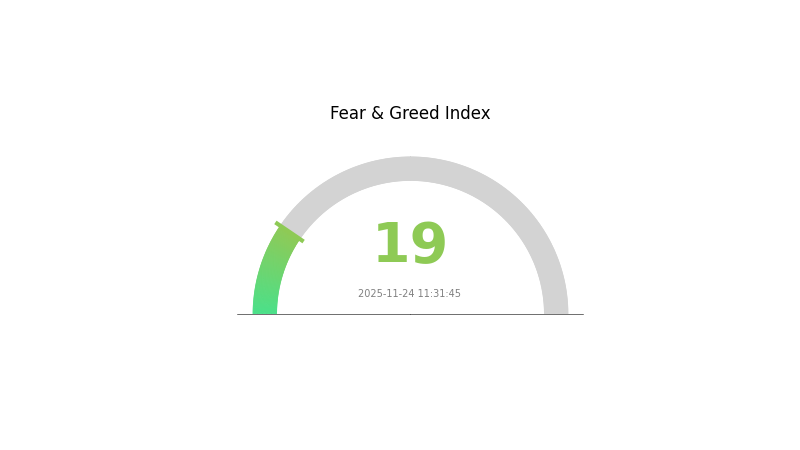

2025-11-24 Fear and Greed Index: 19 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the sentiment index plummeting to 19. This level of fear often indicates a potential buying opportunity for long-term investors, as markets tend to overreact to negative news. However, caution is advised as extreme fear can also precede further downturns. Traders should consider diversifying their portfolios and setting stop-loss orders to manage risk. As always, thorough research and careful consideration of one's risk tolerance are crucial before making any investment decisions in such a volatile market environment.

DARK Holdings Distribution

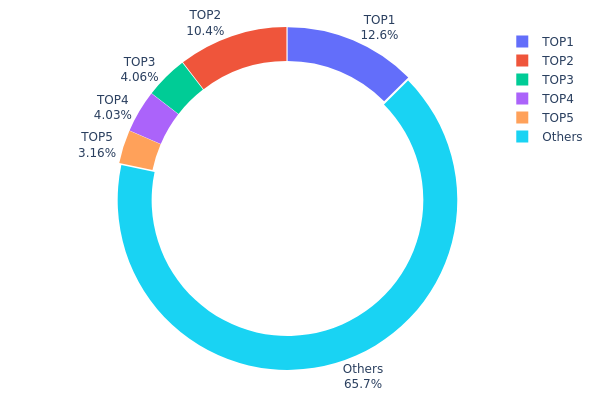

The address holdings distribution data for DARK reveals a moderately concentrated ownership structure. The top 5 addresses collectively hold 34.23% of the total supply, with the largest holder possessing 12.57%. This level of concentration suggests a significant influence from major stakeholders but falls short of extreme centralization.

The distribution pattern indicates a balanced market structure, where no single entity holds an overwhelming majority. However, the presence of two addresses holding over 10% each warrants attention, as their actions could potentially impact price movements. The remaining 65.77% spread across numerous addresses contributes to a degree of decentralization, potentially mitigating risks of market manipulation.

This distribution reflects a maturing market with a mix of large stakeholders and a broad base of smaller holders. While not fully decentralized, the current structure suggests a relatively stable on-chain ecosystem for DARK, with sufficient diversity to maintain market resilience against individual large-scale transactions.

Click to view the current DARK Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 4bLcvq...fCMsSV | 125698.39K | 12.57% |

| 2 | 9ZPsRW...ZgE4Y4 | 104324.38K | 10.43% |

| 3 | u6PJ8D...ynXq2w | 40565.66K | 4.05% |

| 4 | 9QLfMn...Vqwfj1 | 40337.44K | 4.03% |

| 5 | Cw32Ny...YLwZeh | 31592.00K | 3.15% |

| - | Others | 657262.69K | 65.77% |

II. Key Factors Influencing DARK's Future Price

Macroeconomic Environment

-

Impact of Monetary Policy: Major central banks' interest rate decisions, such as those from the Federal Reserve, European Central Bank, and Bank of Japan, are crucial for DarkStar (DARK) price trends. Their monetary policies significantly influence the cryptocurrency market.

-

Inflation Hedging Properties: As a cryptocurrency, DARK may be viewed as a potential hedge against inflation, especially in times of expansionary monetary policies and rising inflation rates.

-

Geopolitical Factors: Global economic recovery, particularly in China and Europe, as well as the booming US real estate market, are driving up demand expectations. Geopolitical tensions and international economic policies can also impact DARK's price.

Technical Development and Ecosystem Building

-

Market Sentiment: The overall sentiment in the cryptocurrency market, influenced by factors such as AI trends, can significantly affect DARK's price movements.

-

Supply and Demand Balance: The balance between supply and demand in the DARK market is a key driver of price trends. This includes factors such as mining rates, circulation, and market adoption.

III. DARK Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00165 - $0.00181

- Neutral prediction: $0.00181 - $0.00221

- Optimistic prediction: $0.00221 - $0.00261 (requires positive market sentiment)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.00144 - $0.00303

- 2027: $0.00202 - $0.00340

- Key catalysts: Increased adoption and technological advancements

2028-2030 Long-term Outlook

- Base scenario: $0.00301 - $0.00374 (assuming steady market growth)

- Optimistic scenario: $0.00374 - $0.00420 (assuming strong market performance)

- Transformative scenario: $0.00420 - $0.00498 (assuming exceptional market conditions)

- 2030-12-31: DARK $0.00498 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00261 | 0.00181 | 0.00165 | 0 |

| 2026 | 0.00303 | 0.00221 | 0.00144 | 22 |

| 2027 | 0.0034 | 0.00262 | 0.00202 | 44 |

| 2028 | 0.00355 | 0.00301 | 0.00211 | 66 |

| 2029 | 0.0042 | 0.00328 | 0.00266 | 81 |

| 2030 | 0.00498 | 0.00374 | 0.00224 | 106 |

IV. DARK Professional Investment Strategies and Risk Management

DARK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and belief in AI technology

- Operational suggestions:

- Accumulate DARK tokens during market dips

- Set up regular purchases to average out price fluctuations

- Store tokens in a secure wallet, preferably a hardware wallet

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought and oversold conditions

- Key Points for Swing Trading:

- Monitor project developments and AI industry news

- Set strict stop-loss orders to manage risk

DARK Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple AI and blockchain projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for DARK

DARK Market Risks

- High volatility: DARK's price can experience significant fluctuations

- Competition: Other AI-focused blockchain projects may emerge

- Market sentiment: AI hype cycles could affect DARK's valuation

DARK Regulatory Risks

- AI regulation: Potential government oversight on AI development

- Cryptocurrency regulations: Changing legal landscape for digital assets

- Cross-border restrictions: Possible limitations on international token transfers

DARK Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability issues: Challenges in handling increased network activity

- Integration complexities: Difficulties in incorporating new AI tools

VI. Conclusion and Action Recommendations

DARK Investment Value Assessment

DARK presents a high-risk, high-potential investment in the intersection of AI and blockchain technology. While its innovative approach to AI integration offers long-term value, short-term volatility and regulatory uncertainties pose significant risks.

DARK Investment Recommendations

✅ Beginners: Consider small, experimental positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging with strict risk management ✅ Institutional investors: Allocate as part of a diversified AI and blockchain portfolio

DARK Trading Participation Methods

- Spot trading: Purchase DARK tokens on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Explore decentralized finance options involving DARK tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Which crypto will give 1000x?

While no crypto guarantees 1000x returns, emerging projects in AI, DeFi, and Web3 show potential. Research low-cap altcoins and presales for high-risk, high-reward opportunities.

Which crypto will reach $1000 in 2030?

Bitcoin is the most likely candidate to reach $1000 by 2030, given its market dominance and growing institutional adoption.

Will Dash hit $1000 again?

Yes, Dash could potentially hit $1000 again. While current forecasts are more conservative, Dash's innovative features and growing adoption could drive significant price appreciation in the long term.

Will Solana reach $1000 in 2025?

Yes, Solana reached $1000 in 2025 during a significant bull run, confirming earlier predictions.

Share

Content