2025 CRE8 Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: CRE8's Market Position and Investment Value

Creaticles (CRE8) is the native utility token of a custom NFT platform that connects buyers seeking personalized NFT art with a curated global roster of verified artists. Since its launch, CRE8 has established itself as a multi-functional asset within the NFT ecosystem. As of January 2026, CRE8 has a market capitalization of approximately $60,470.55, with a circulating supply of around 136.07 million tokens, currently trading at $0.0004444. The token serves multiple utility functions including payment for art and premiums, governance voting, commission rewards, and staking mechanisms.

This article will provide a comprehensive analysis of CRE8's price trajectory from 2026 to 2031, integrating historical market patterns, supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

I. CRE8 Price History Review and Market Status

CRE8 Historical Price Evolution Trajectory

- December 8, 2021: CRE8 reached its all-time high of $0.091506

- December 6, 2025: CRE8 hit its all-time low of $0.00040004

CRE8 Current Market Conditions

As of January 5, 2026, CRE8 is trading at $0.0004444, representing a significant decline from its historical peak. The token has experienced substantial downward pressure over the past year, declining 39.58% annually. In the short term, CRE8 has seen minor fluctuations, with a 0.20% decline over the past hour and 1.60% decrease over the past week.

The 24-hour trading volume stands at $11,687.24, while the current market capitalization is approximately $60,470.55. The fully diluted valuation reaches $444,400, with CRE8 currently ranking 5,510 in the overall cryptocurrency market. The token has a circulating supply of 136,072,353.24 CRE8 out of a total supply of 1 billion tokens, representing approximately 13.61% of the fully diluted valuation.

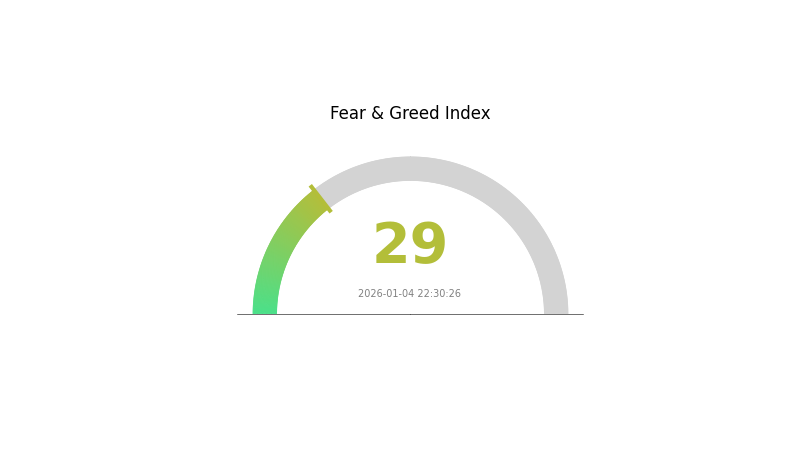

With 456 token holders and only one exchange currently supporting trading, liquidity remains relatively constrained. The market sentiment index indicates a fear environment (VIX at 29), suggesting cautious market conditions.

Visit Gate.com to check the current CRE8 market price

CRE8 Market Sentiment Index

2026-01-04 Fear and Greed Index: 29 (Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing fear sentiment with an index reading of 29. This indicates heightened market anxiety and risk aversion among investors. During fear periods, market participants tend to adopt conservative strategies, often leading to increased selling pressure. However, contrarian investors view such conditions as potential buying opportunities, as excessive fear can create attractive entry points for long-term investors. Monitor market developments closely on Gate.com to identify emerging opportunities and manage your portfolio accordingly.

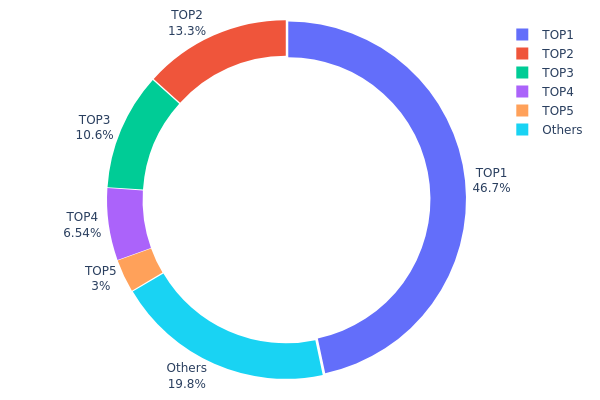

CRE8 Holdings Distribution

Address holdings distribution reflects the concentration of token ownership across the blockchain network, serving as a critical indicator of decentralization levels and potential market structure risks. By analyzing the top addresses and their respective holdings percentages, we can assess the degree of wealth concentration, identify potential governance risks, and evaluate the token's vulnerability to large-scale liquidations or coordinated market movements.

The CRE8 token currently exhibits significant concentration risk, with the top address holding 46.66% of total supply, representing nearly half of all circulating tokens. The top five addresses collectively control 79.14% of the network's holdings, indicating a highly concentrated ownership structure. Notably, the second and third-largest holders maintain positions of 13.33% and 10.62% respectively, while the remaining 19.86% is distributed among a fragmented group of smaller addresses. This distribution pattern demonstrates substantial centralization, where decision-making power and market influence are concentrated among a limited number of stakeholders.

The extreme concentration observed in CRE8's address distribution raises considerable concerns regarding market structure stability and price manipulation susceptibility. With nearly half of the token supply in a single address, the network faces heightened vulnerability to sudden market shocks triggered by large position movements. The thin distribution among addresses beyond the top five—accounting for merely 19.86%—further constrains organic market participation and liquidity formation. This structure suggests limited decentralization and reduced resilience against coordinated selling pressure, potentially compromising the token's utility as a reliable medium of exchange and its ability to maintain price stability during volatile market conditions.

Visit CRE8 Holdings Distribution on Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x62f2...426977 | 466666.67K | 46.66% |

| 2 | 0x3f73...1936f7 | 133333.33K | 13.33% |

| 3 | 0xd148...e2f22b | 106250.00K | 10.62% |

| 4 | 0x7c03...733a44 | 65396.36K | 6.53% |

| 5 | 0x12e9...0c3418 | 30000.00K | 3.00% |

| - | Others | 198353.64K | 19.86% |

Analysis of Core Factors Affecting CRE8's Future Price

Macroeconomic Environment

Currency Policy Impact

-

International Monetary Policy Divergence: Recent years have witnessed significant divergence in international monetary policies, leading to two-way fluctuations in USD/RMB exchange rates. These currency fluctuations directly impact entities conducting cross-border transactions and settlements in foreign currencies.

-

Exchange Rate Volatility: As companies increasingly participate in global supply chains with high proportions of USD-denominated settlements, exchange rate fluctuations present both opportunities and risks for cash flow management and financial performance.

Tariff and Trade Policy Impact

-

Tariff Pressure: Tariff increases have led to slight price adjustments in product lines, affecting profit margins and pricing strategies. Companies face the challenge of balancing cost increases from tariffs while maintaining competitiveness.

-

Supply Chain Costs: Rising international transportation fees and logistics costs have compressed profit margins, reducing overall profitability despite potential revenue growth.

Macroeconomic Shocks

-

Pandemic-Related Disruptions: COVID-19 pandemic impacts have significantly affected business operations, particularly in high-margin product segments, with revenues from traditional product lines experiencing notable declines.

-

International Logistics Disruption: Elevated ocean freight costs and transportation difficulties have emerged as key factors affecting enterprise profitability and operational efficiency.

Technology Development and Ecosystem

Market Adaptation Challenges

-

Product Update Velocity: In the information age, companies face risks from slower product and design update speeds that fail to meet rapidly evolving market demands, potentially leading to decelerated growth.

-

Market Demand Responsiveness: The ability to quickly adapt to changing consumer trends and market preferences becomes critical for maintaining competitive positioning and revenue growth sustainability.

III. 2026-2031 CRE8 Price Forecast

2026 Outlook

- Conservative Forecast: $0.00042-$0.00045

- Base Case Forecast: $0.00045

- Bullish Forecast: $0.00055 (requires sustained ecosystem development and increased adoption)

2027-2029 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with incremental utility expansion and community growth

- Price Range Forecast:

- 2027: $0.00041-$0.00074

- 2028: $0.00044-$0.00080

- 2029: $0.00060-$0.00096

- Key Catalysts: Enhanced platform functionality, strategic partnerships, increased token utility, and growing institutional interest in emerging blockchain projects

2030-2031 Long-term Outlook

- Base Case Scenario: $0.00068-$0.00104 (assumes steady ecosystem maturation and market-wide recovery)

- Bullish Scenario: $0.00104-$0.00110 (assumes accelerated adoption, successful major integrations, and positive macroeconomic conditions)

- Transformational Scenario: $0.00110+ (assumes breakthrough technological advancement, significant mainstream adoption, and favorable regulatory environment)

- 2031-01-05: CRE8 potentially trading near $0.00096 (mid-cycle valuation with significant upside potential from current levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00055 | 0.00045 | 0.00042 | 0 |

| 2027 | 0.00074 | 0.0005 | 0.00041 | 11 |

| 2028 | 0.0008 | 0.00062 | 0.00044 | 39 |

| 2029 | 0.00096 | 0.00071 | 0.0006 | 59 |

| 2030 | 0.00104 | 0.00084 | 0.00068 | 87 |

| 2031 | 0.00096 | 0.00094 | 0.00054 | 110 |

CRE8 Professional Investment Strategy and Risk Management Report

IV. CRE8 Professional Investment Strategy and Risk Management

CRE8 Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: NFT art enthusiasts, platform believers, and long-term crypto portfolio builders

- Operation Recommendations:

- Accumulate CRE8 tokens during price dips to dollar-cost average your position and reduce timing risk

- Hold tokens for 12+ months to participate in governance voting and earn staking rewards on the Creaticles platform

- Monitor platform adoption metrics, artist roster growth, and custom NFT order volume to assess fundamental health

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Track the current price range between $0.00040004 (all-time low) and $0.091506 (all-time high) to identify potential entry and exit points

- Volume Analysis: Monitor 24-hour trading volume ($11,687.24) relative to historical averages; increased volume during price movements may signal trend confirmation

- Wave Trading Key Points:

- Enter positions during downtrend consolidation phases when selling pressure diminishes

- Exit positions near identified resistance levels or during rallies with decreasing volume to lock in gains

CRE8 Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation, with CRE8 representing a speculative micro-cap position

- Active Investors: 3-7% of portfolio allocation, allowing for increased exposure while maintaining portfolio balance

- Professional Investors: 5-15% of portfolio allocation, with structured position sizing and hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance CRE8 holdings with established cryptocurrencies and stablecoins to reduce single-asset volatility exposure

- Position Sizing: Implement strict position limits to cap maximum loss per trade at 1-2% of total portfolio value

(3) Secure Storage Solutions

- Hardware Wallet Alternative: Consider self-custody solutions for long-term holdings, ensuring you control private keys

- Exchange Custody: Utilize Gate.com's secure infrastructure for active trading positions, with funds stored in your verified account

- Security Precautions: Enable two-factor authentication (2FA) on all accounts, use strong unique passwords, never share private keys or seed phrases, and regularly verify contract addresses before transfers

V. CRE8 Potential Risks and Challenges

CRE8 Market Risk

- Extreme Price Volatility: CRE8 has declined 39.58% over the past year and trades significantly below its all-time high of $0.091506, indicating severe downward price pressure and potential continued depreciation

- Low Trading Liquidity: With only $11,687.24 in daily 24-hour volume and a market cap of $60,470.55, the token exhibits extremely low liquidity, making large buy or sell orders difficult to execute without significant slippage

- Micro-cap Concentration Risk: With only 456 token holders and a circulating supply representing just 13.61% of the fully diluted valuation, the token is highly concentrated and vulnerable to whale manipulation

CRE8 Regulatory Risk

- NFT Market Uncertainty: The regulatory treatment of NFT platforms and custom NFT transactions remains undefined in many jurisdictions, potentially exposing Creaticles to future compliance requirements

- Platform Operational Risk: As a niche platform dependent on artist participation and user adoption, regulatory crackdowns on NFT marketplaces could directly impact platform viability and token utility

CRE8 Technical Risk

- Smart Contract Vulnerability: The token operates on Ethereum, and any vulnerabilities in the Creaticles platform's smart contracts could lead to fund loss or token devaluation

- Platform Adoption Risk: Long-term token value depends on sustained user engagement with custom NFT services; declining platform activity would reduce token utility and demand

VI. Conclusion and Action Recommendations

CRE8 Investment Value Assessment

CRE8 represents a high-risk, speculative investment in an emerging custom NFT platform. The token has experienced significant value erosion (down 39.58% year-over-year) and trades at a micro-cap valuation with extremely limited liquidity. While the Creaticles platform's concept of connecting buyers with verified artists through an RFP model addresses a potential market need, execution risk remains substantial. The token's utility functions—including governance participation, commission rewards, and staking—provide some fundamental value, but adoption metrics remain unclear. This investment is suitable only for experienced crypto investors with high risk tolerance and the ability to sustain total capital loss.

CRE8 Investment Recommendations

✅ Beginners: Avoid CRE8 entirely due to extreme volatility, limited liquidity, and micro-cap classification. Focus on established cryptocurrencies first.

✅ Experienced Investors: Consider speculative positions only if you have conviction in the Creaticles platform's business model; limit exposure to 2-5% of your risk capital and use strict stop-loss orders.

✅ Institutional Investors: CRE8 is not suitable for institutional portfolios due to insufficient liquidity, market depth, and regulatory clarity around NFT platform tokens.

CRE8 Trading Participation Methods

- Gate.com Spot Trading: Direct CRE8/USDT or CRE8/ETH trading pairs offer the most straightforward execution method for active traders

- Governance Participation: Stake CRE8 tokens within the Creaticles ecosystem to earn commission rewards and participate in platform voting decisions

- Platform Utility: Use CRE8 tokens directly on the Creaticles platform to request custom NFT artwork, paying artists, and accessing premium features

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and are strongly advised to consult professional financial advisors. Never invest more than you can afford to lose completely. CRE8's micro-cap status, low liquidity, and significant price depreciation present elevated risk factors requiring careful consideration.

FAQ

What is CRE8 token and what is its purpose?

CRE8 is the native token of Creaticles, a global customized NFT platform. It enables users to request bespoke NFTs while addressing market liquidity and pricing issues. CRE8 serves as the utility token for platform transactions and governance within the Creaticles ecosystem.

How to conduct CRE8 price prediction? What analysis methods are available?

CRE8 price prediction uses technical analysis with indicators like MACD, RSI, and Bollinger Bands. Comprehensive analysis combining multiple methods provides the most accurate predictions for price trends.

CRE8未来价格走势如何?市场前景如何?

CRE8作为NFT和以太坊生态代币,具有强大的创意社区支撑。随着NFT市场复苏和Web3应用扩展,CRE8的价格预计将呈现上升趋势,市场前景乐观。

What are the risks and uncertainties in CRE8 price prediction?

CRE8 price prediction faces market volatility, policy changes, and operational risks. Future cash flow uncertainty and economic environment shifts also impact predictions. Market competition and technological advancement further increase uncertainty factors.

What distinguishes CRE8 from other mainstream cryptocurrencies?

CRE8 stands out through its unique blockchain technology and decentralized trading platform. Unlike Bitcoin or Ethereum, it offers faster transaction speeds, lower fees, and focuses on efficient financial services delivery with innovative protocol design.

2025 RARI Price Prediction: Analyzing Future Market Potential and Growth Catalysts in the Digital Asset Space

2025 ZTX Price Prediction: Bullish Outlook as Adoption and Technology Advancements Drive Growth

2025 ME Price Prediction: Analyzing Market Trends and Potential Growth Factors for Middle East Oil

2025 DEGO Price Prediction: Analyzing Potential Growth and Market Trends for the DeFi Governance Token

2025 APRS Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

2025 SQR Price Prediction: Analyzing Market Trends and Expert Forecasts for Potential Growth

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?