2025 CAMP Price Prediction: Expert Analysis and Market Outlook for the Year Ahead

Introduction: CAMP's Market Position and Investment Value

Camp Network (CAMP) serves as the Autonomous IP Layer built to power the future of intellectual property and AI, functioning as a purpose-built Layer-1 blockchain. Since its launch, Camp Network has introduced the Proof of Provenance Protocol, embedding IP registration, licensing, and royalty distribution directly at the execution layer. As of December 2025, CAMP's market capitalization has reached $14,859,600, with a circulating supply of approximately 2.1 billion tokens and a current price hovering around $0.007076. This innovative asset, characterized as a "creator and developer empowerment protocol," is playing an increasingly critical role in enabling tokenization of intellectual property and AI agents on-chain.

This article will comprehensively analyze CAMP's price trends from 2025 to 2030, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

Camp Network (CAMP) Price History and Market Analysis Report

I. CAMP Price History Review and Current Market Status

CAMP Historical Price Evolution

- August 2025: CAMP reached its all-time high of $0.32554 on August 27, 2025, marking the peak of the token's price performance since launch.

- October 2025: CAMP declined to its all-time low of $0.00506 on October 10, 2025, representing a significant correction from the all-time high.

- December 2025: CAMP continues to trade in a depressed range, reflecting the bearish sentiment across the broader crypto market over the past four months.

CAMP Current Market Position

As of December 21, 2025, CAMP is trading at $0.007076, representing a market capitalization of $14,859,600 with a fully diluted valuation of $70,760,000. The token exhibits the following characteristics:

Price Performance Metrics:

- 24-hour change: +2.3%, indicating modest short-term recovery

- 1-hour change: -0.069%, showing minor intraday weakness

- 7-day change: -3.67%, reflecting continued downward pressure over the week

- 30-day change: -27.88%, demonstrating sustained decline throughout the month

- 1-year change: -86.089%, highlighting severe depreciation since token inception

Market Indicators:

- Current price sits $0.318464 below the all-time high, representing a 97.83% decline from peak valuation

- Trading volume in the last 24 hours stands at $226,804.31 across 13 exchanges

- Circulating supply comprises 2,100,000,000 tokens (21% of total supply), with a maximum supply cap of 10,000,000,000 tokens

- Token holder count reaches 1,668 addresses

- Market dominance remains minimal at 0.0021%

Market Sentiment: The token trades amid extreme fear conditions in the broader cryptocurrency market (VIX indicator at 20), suggesting heightened risk aversion and selling pressure across digital assets.

Click to view current CAMP market price

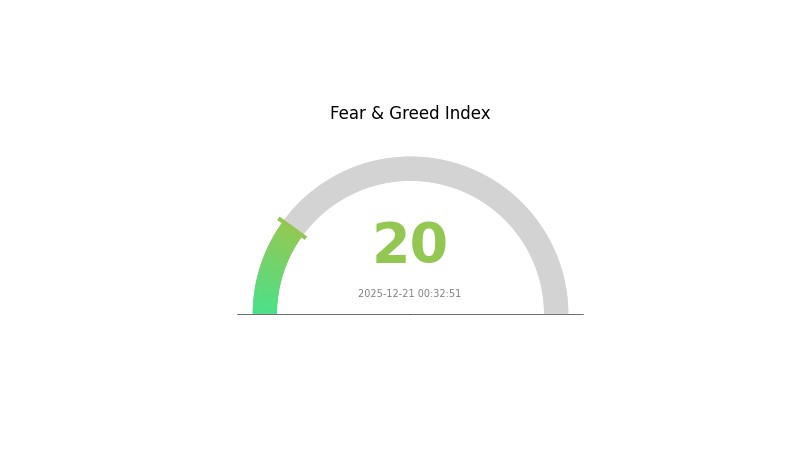

CAMP Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear sentiment with the Fear and Greed Index at 20, signaling heightened market anxiety and panic. This reading suggests investors are highly risk-averse, with significant selling pressure and pessimistic outlook dominating the market. Such extreme fear conditions often present contrarian opportunities for long-term investors, as markets tend to overreact during panic periods. However, caution is advised, as further downside movements may occur before sentiment stabilizes. Monitor market developments closely and consider your risk tolerance before making investment decisions.

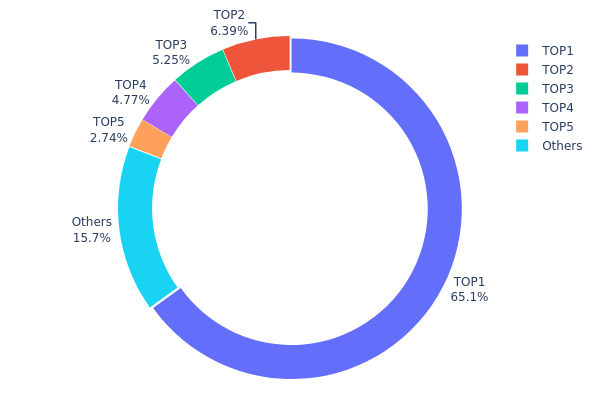

CAMP Holdings Distribution

The address holdings distribution is a key metric that reflects how token ownership is concentrated across different addresses on the blockchain. This data provides crucial insights into the decentralization level, potential market manipulation risks, and the overall health of a token's ecosystem. By analyzing the top holders and their respective percentages, we can assess whether token ownership is broadly distributed or concentrated in the hands of a few entities.

CAMP currently exhibits significant concentration risk, with the top holder controlling 65.10% of the total supply. This level of concentration substantially exceeds healthy decentralization thresholds and raises material concerns about market structure stability. The top five addresses collectively hold 84.24% of all CAMP tokens, indicating highly asymmetric ownership distribution. While the remaining addresses account for 15.76% of holdings, this fragmented base is insufficient to counterbalance the dominant position of the leading holder. Such extreme concentration creates inherent vulnerabilities, as coordinated actions or decisions by major holders could disproportionately influence token valuation and market dynamics.

The current distribution pattern suggests elevated risks for price volatility and potential market manipulation. The substantial holdings concentrated in individual addresses mean that large-scale transactions from these entities could trigger significant price movements. Furthermore, the disparity between the largest holder and secondary participants (65.10% versus 6.39%) indicates a hierarchical ownership structure that deviates significantly from optimal decentralization. This concentration may limit organic market participation and create liquidity challenges during periods of increased selling pressure, as the market lacks sufficient distributed holders to absorb large supply variations.

Access current CAMP Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0233...a92418 | 499660.37K | 65.10% |

| 2 | 0x63cf...642fea | 49062.47K | 6.39% |

| 3 | 0x25e0...3c4ca7 | 40306.64K | 5.25% |

| 4 | 0x3dd6...bb5f1b | 36630.84K | 4.77% |

| 5 | 0x4383...637c1c | 21000.00K | 2.73% |

| - | Others | 120801.33K | 15.76% |

II. Core Factors Impacting CAMP's Future Price

Macro Economic Environment

-

Monetary Policy Impact: Major central bank policies will have profound effects on CAMP prices. Interest rate adjustments and quantitative easing policies directly influence cryptocurrency market sentiment. Global economic environment changes, trade frictions, and domestic inflation control will become key factors affecting future economic trends.

-

Inflation Hedge Properties: CAMP's performance in inflationary environments reflects its role as a potential hedge asset within the cryptocurrency market ecosystem.

-

Geopolitical Factors: International situations and trade dynamics influence the broader cryptocurrency market conditions affecting CAMP valuations.

Technology Development and Ecosystem Building

-

Ecosystem Attraction: Camp Network's future development depends on several core factors, particularly the ability to attract high-quality content creators and IP holders into the ecosystem. The platform's success relies on balancing early token circulation with long-term holding incentives.

-

Ecosystem Applications: The platform's strength in attracting quality content creators and IP owners directly impacts token utility and long-term value proposition, positioning CAMP within the broader Web3 and AI-driven IP economy landscape.

Three、2025-2030 CAMP Price Forecast

2025 Outlook

- Conservative Forecast: $0.00496 - $0.00709

- Neutral Forecast: $0.00709

- Optimistic Forecast: $0.00886 (requiring sustained market sentiment and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and stabilization phase with increasing institutional adoption and protocol maturation

- Price Range Forecast:

- 2026: $0.00741 - $0.01172

- 2027: $0.00768 - $0.01083

- Key Catalysts: Enhanced utility adoption, strategic partnerships, technological upgrades, and broader cryptocurrency market recovery

2028-2030 Long-term Outlook

- Base Case Scenario: $0.01003 - $0.01509 (assuming moderate adoption growth and stable macroeconomic conditions)

- Optimistic Scenario: $0.01477 - $0.01806 (contingent upon accelerated ecosystem expansion and mainstream integration)

- Transformative Scenario: $0.01723+ (contingent upon breakthrough technological innovations, regulatory clarity, and significant increase in network utility and transaction volume)

- 2030-12-31: CAMP trading at $0.01539 (average price level reflecting consolidated mid-term growth trajectory)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00886 | 0.00709 | 0.00496 | 0 |

| 2026 | 0.01172 | 0.00797 | 0.00741 | 12 |

| 2027 | 0.01083 | 0.00985 | 0.00768 | 39 |

| 2028 | 0.01509 | 0.01034 | 0.01003 | 46 |

| 2029 | 0.01806 | 0.01272 | 0.00839 | 79 |

| 2030 | 0.01723 | 0.01539 | 0.01477 | 117 |

Camp Network (CAMP) Investment Strategy and Risk Management Report

IV. CAMP Professional Investment Strategy and Risk Management

CAMP Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Early-stage technology adopters, AI and IP ecosystem believers, long-term value investors

- Operational Recommendations:

- Accumulate during market corrections when price drops below $0.007, capitalizing on volatility

- Dollar-cost averaging (DCA) approach over 6-12 months to reduce timing risk

- Hold through protocol upgrades and ecosystem development milestones

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support/Resistance Levels: Monitor historical price points including $0.007 (current support), $0.0065 (lower support), and $0.0075 (resistance)

- Volume Analysis: Track the 24-hour trading volume ($226,804) to identify breakout opportunities and validate price movements

- Swing Trading Key Points:

- Execute buy positions on price dips toward $0.006-$0.007 range with take-profit targets at $0.008-$0.009

- Maintain stop-loss orders at $0.006 to manage downside risk and prevent catastrophic losses

CAMP Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of portfolio allocation

- Aggressive Investors: 2-5% of portfolio allocation

- Professional Investors: 3-8% of portfolio allocation

(2) Risk Hedging Solutions

- Volatility Management: Use position sizing to limit exposure, given the token's 86.089% one-year decline

- Correlation Diversification: Balance CAMP holdings with established assets to reduce concentration risk

- Rebalancing Protocol: Review and rebalance quarterly to maintain target allocation percentages

(3) Secure Storage Solutions

- Hardware Security Approach: Store significant holdings in secure self-custody solutions with multi-signature configurations

- Hot Wallet Strategy: Maintain trading positions on Gate.com for active trading while minimizing active holdings

- Security Best Practices: Enable two-factor authentication on all exchange accounts, use hardware address whitelisting, and maintain backup seed phrases in secure locations

V. CAMP Potential Risks and Challenges

CAMP Market Risk

- Price Volatility: Token has declined 86.089% over the past year and 27.88% in the past month, indicating significant price instability and potential further downside

- Liquidity Risk: With 24-hour trading volume of only $226,804 and 1,668 token holders, limited liquidity may result in significant slippage during large trades

- Market Sentiment Risk: The 1H decline of 0.069% and 7D decline of 3.67% suggest current negative market sentiment requiring careful entry timing

CAMP Regulatory Risk

- Blockchain Regulation Uncertainty: As an emerging Layer-1 blockchain focusing on IP tokenization, regulatory frameworks for IP rights on-chain remain undefined globally

- Jurisdictional Compliance: Different regions may have conflicting regulations on tokenized intellectual property, potentially limiting adoption

- Enforcement Challenges: Regulatory bodies worldwide are still developing frameworks for AI agent tokenization and on-chain IP licensing enforcement

CAMP Technical Risk

- Protocol Maturity: As a Layer-1 blockchain, Camp Network requires sustained development and potential protocol upgrades to remain competitive and secure

- Smart Contract Risk: Vulnerabilities in the Proof of Provenance Protocol could compromise IP registration and licensing mechanisms

- Ecosystem Dependency: Success depends on developer adoption and third-party integration with the AI agent deployment infrastructure

VI. Conclusion and Action Recommendations

CAMP Investment Value Assessment

Camp Network presents a compelling narrative around tokenized intellectual property and AI agent infrastructure, addressing emerging market demands at the intersection of AI and blockchain technology. However, the dramatic 86% one-year price decline, limited trading liquidity, and early-stage protocol status present substantial risks. The project targets a large addressable market but faces significant regulatory uncertainty and competitive pressures. Investment consideration should be tempered by the token's current market position (ranking #982) and the unproven demand for on-chain IP tokenization at scale.

CAMP Investment Recommendations

✅ Beginners: Start with micro-positions (0.5-1% allocation) through Gate.com to gain exposure while limiting downside risk; focus on understanding the IP tokenization use case before increasing exposure

✅ Experienced Investors: Consider 2-5% portfolio allocation with staged entry points during price dips; implement disciplined stop-loss strategies at $0.006 and active profit-taking at resistance levels

✅ Institutional Investors: Conduct detailed technical and regulatory due diligence before positioning; consider small positions (3-5%) with structured investment programs and regular governance monitoring

CAMP Trading Participation Methods

- Gate.com Spot Trading: Purchase CAMP tokens directly through Gate.com's trading interface using ERC-20 contracts on the Ethereum blockchain

- Price Monitoring: Use Gate.com's real-time price tracking and alert features to identify optimal entry and exit points aligned with your strategy

- Community Engagement: Follow official channels on X (@campnetworkxyz, @camp_fnd) and Discord to stay informed on protocol updates, partnerships, and ecosystem developments

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must exercise careful judgment based on their individual risk tolerance and financial circumstances. Consultation with a professional financial advisor is strongly recommended. Never invest more than you can afford to lose.

FAQ

Which coin price prediction 2025?

CAMP token is positioned for growth in 2025. Based on market analysis, expect potential appreciation driven by ecosystem expansion and increased adoption. Monitor key support and resistance levels for optimal entry points.

What is CAMP token and what is its current price?

CAMP token is a cryptocurrency currently ranked #1003 by market cap, priced at $0.007194 as of 2025-12-21. It represents a utility token within its ecosystem with active trading volume and market presence.

What factors influence CAMP price movements?

CAMP price movements are driven by market demand, trading volume, utility adoption, ecosystem developments, and broader crypto market sentiment. Token supply changes and governance activities also impact price dynamics.

What is the price target for CAMP in 2024-2025?

The price target for CAMP in 2024-2025 is $10.39, based on estimates from six analysts. This reflects positive market sentiment for the token's performance during this period.

2025 TAO Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Crypto Ecosystem

2025 FET Price Prediction: Bullish Trends and Key Factors Driving Fetch.ai's Future Value

Is Bittensor (TAO) a good investment?: Analyzing the potential and risks of this AI-powered cryptocurrency

Is Act I: The AI Prophecy (ACT) a Good Investment?: Analyzing Risks and Potential Returns in the Emerging AI Token Market

What is AITECH: Exploring the Frontier of Artificial Intelligence Technology

2025 IQPrice Prediction: Analyzing Market Trends and Growth Potential for the Next Bull Cycle

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?