2025 BUY Price Prediction: Analyzing Market Trends and Potential Growth for the Burency Token

Introduction: BUY's Market Position and Investment Value

Buying.com (BUY) has established itself as a localized micro-distribution network since its inception, focusing on last-mile delivery services. As of 2025, Buying.com's market capitalization has reached $1,620,943.87, with a circulating supply of approximately 654,081,134.05 tokens, and a price hovering around $0.0024782. This asset, known as the "one-hour delivery enabler," is playing an increasingly crucial role in the e-commerce and logistics sectors.

This article will provide a comprehensive analysis of Buying.com's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. BUY Price History Review and Current Market Status

BUY Historical Price Evolution

- 2021: BUY reached its all-time high of $0.106518 on August 14, marking a significant milestone.

- 2023: The token experienced a severe downturn, hitting its all-time low of $0.000000000142752 on November 2.

- 2025: BUY has shown signs of recovery, with the price currently at $0.0024782.

BUY Current Market Situation

As of November 25, 2025, BUY is trading at $0.0024782. The token has shown a strong 24-hour performance with a 7.69% increase. Over the past month, BUY has demonstrated significant growth, rising by 22.18%. However, the yearly performance remains negative, with a 91.18% decrease compared to the previous year.

The current market capitalization of BUY stands at $1,620,943.87, ranking it at 2285 in the cryptocurrency market. The 24-hour trading volume is $101,769.50, indicating moderate market activity. With a circulating supply of 654,081,134.05 BUY tokens out of a total supply of 986,800,000, the token has a circulation ratio of 65.41%.

Despite the recent positive short-term trends, BUY is still trading significantly below its all-time high, suggesting potential room for growth if the project can maintain its momentum and deliver on its promises in the logistics and delivery sector.

Click to view the current BUY market price

BUY Market Sentiment Indicator

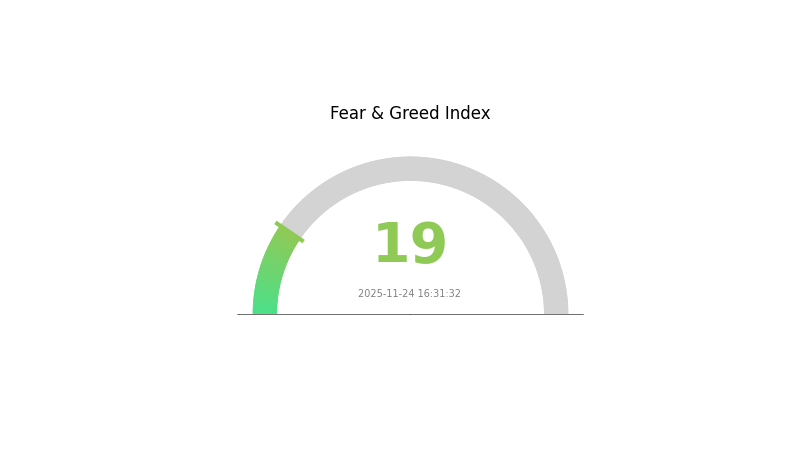

2025-11-24 Fear and Greed Index: 19 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at a low of 19. This level of pessimism often presents potential buying opportunities for savvy investors. Historically, periods of extreme fear have preceded market rebounds. However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Remember, market sentiment can shift rapidly in the volatile crypto space.

BUY Holdings Distribution

The address holdings distribution data for BUY reveals a unique situation where no specific addresses are listed as top holders. This unusual pattern suggests an extremely decentralized token distribution, which is quite rare in the cryptocurrency market.

The absence of large individual holders indicates that BUY tokens are likely widely distributed among a large number of addresses, each holding relatively small amounts. This high level of decentralization can be interpreted as a positive sign for the project's community engagement and resistance to market manipulation. It potentially reduces the risk of large sell-offs by whales that could drastically impact the token's price.

However, this distribution pattern also presents challenges in terms of governance and coordinated decision-making for the project. Without significant stakeholders, it may be more difficult to implement changes or reach consensus on important matters. Overall, the current address distribution of BUY reflects a highly decentralized and potentially stable market structure, though it may face unique challenges in project development and governance.

Click to view the current BUY Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing BUY's Future Price

Supply Mechanism

- Halving mechanism: BUY's supply is reduced by half at regular intervals, increasing scarcity and potentially driving up prices.

- Historical patterns: Previous halvings have generally led to price increases in the long term.

- Current impact: The next halving is anticipated to reduce supply, potentially creating upward price pressure.

Institutional and Large Holder Dynamics

- Corporate adoption: Some notable companies have begun adopting BUY as a strategic asset.

- Government policies: National-level policies regarding cryptocurrency regulation and adoption can significantly impact BUY's price.

Macroeconomic Environment

- Monetary policy impact: Central bank policies, especially those of major economies, can influence BUY's price as an alternative asset.

- Inflation hedging properties: BUY's performance during inflationary periods may affect its appeal as a store of value.

- Geopolitical factors: International tensions and economic uncertainties can drive investors towards or away from BUY.

Technological Developments and Ecosystem Building

- Network upgrades: Improvements to BUY's underlying technology can enhance its utility and attract more users.

- Ecosystem applications: The growth of decentralized applications (DApps) and projects built on BUY's network can increase its value proposition.

III. BUY Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00137 - $0.00250

- Neutral forecast: $0.00250 - $0.00286

- Optimistic forecast: $0.00286 - $0.00322 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range prediction:

- 2027: $0.00173 - $0.00383

- 2028: $0.00199 - $0.00515

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.00435 - $0.00506 (assuming steady market growth)

- Optimistic scenario: $0.00578 - $0.00653 (assuming strong bull market)

- Transformative scenario: $0.00653+ (extremely favorable market conditions)

- 2030-12-31: BUY $0.00653 (potential peak)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00322 | 0.0025 | 0.00137 | 0 |

| 2026 | 0.00369 | 0.00286 | 0.00271 | 15 |

| 2027 | 0.00383 | 0.00327 | 0.00173 | 31 |

| 2028 | 0.00515 | 0.00355 | 0.00199 | 43 |

| 2029 | 0.00578 | 0.00435 | 0.00352 | 75 |

| 2030 | 0.00653 | 0.00506 | 0.00461 | 104 |

IV. BUY Professional Investment Strategies and Risk Management

BUY Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate BUY tokens during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Monitor Buying.com's business developments and partnerships

BUY Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, backup private keys securely

V. BUY Potential Risks and Challenges

BUY Market Risks

- High volatility: Significant price fluctuations common in small-cap tokens

- Limited liquidity: May affect ability to enter/exit positions quickly

- Competition: Other e-commerce and logistics platforms may impact market share

BUY Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on crypto assets

- Cross-border operations: Varying regulations in different countries may affect expansion

BUY Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Scalability challenges: Ability to handle increased transaction volume as the platform grows

- Cybersecurity threats: Risk of hacks or data breaches on the Buying.com platform

VI. Conclusion and Action Recommendations

BUY Investment Value Assessment

BUY token presents a high-risk, high-potential investment in the e-commerce and logistics sector. Long-term value lies in Buying.com's innovative last-mile delivery solution, but short-term volatility and market risks are significant.

BUY Investment Recommendations

✅ Beginners: Consider small, experimental positions with strict risk management ✅ Experienced investors: Implement dollar-cost averaging strategy with a 1-2 year outlook ✅ Institutional investors: Conduct thorough due diligence and consider as part of a diversified crypto portfolio

BUY Trading Participation Methods

- Spot trading: Available on Gate.com for direct BUY token purchases

- Staking: Explore potential staking options if offered by Buying.com in the future

- DeFi integration: Monitor for potential DeFi protocols supporting BUY tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is Nvidia's price target?

Nvidia's price target is $239.72, based on analyst forecasts as of 2025-11-24. The range spans from $140.00 to higher values.

What is the 7% rule in stock trading?

The 7% rule is a stop-loss strategy where traders exit a position if the stock price drops 7% below the purchase price. It helps manage risk and protect capital while allowing profitable trades to continue.

Is NVDA a good buy right now?

Yes, NVDA is a strong buy. Its AI leadership and solid fundamentals make it a promising long-term investment despite short-term volatility.

What stock will skyrocket in 2025?

Nvidia, Taiwan Semiconductor, and Amazon are expected to skyrocket in 2025 due to strong growth prospects in AI and tech sectors.

Share

Content