2025 BLESS Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: BLESS Market Position and Investment Value

Bless (BLESS) is a decentralized edge computing network providing on-demand CPU and GPU power for AI, machine learning, and advanced data tools near end users. As of December 2025, BLESS has achieved a market capitalization of $20.30 million, with a circulating supply of approximately 1.84 billion tokens trading at around $0.01102 per unit. This innovative asset is playing an increasingly critical role in the edge computing and AI infrastructure domains.

This article will provide a comprehensive analysis of BLESS's price trajectory and market dynamics, integrating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors seeking exposure to this emerging computational infrastructure asset.

BLESS Market Analysis Report

I. BLESS Price History Review and Market Status

BLESS Historical Price Evolution

Based on available data, BLESS has experienced significant volatility since its market inception:

- October 15, 2025: All-time high (ATH) reached at $0.2304, representing peak market enthusiasm for the project.

- December 19, 2025: All-time low (ATL) established at $0.00993, marking a substantial correction from the ATH.

- Current Period (As of December 20, 2025): Price trading at $0.01102, reflecting ongoing market adjustment from historical peaks.

The token has experienced a decline of approximately -22.01% over the past year, indicating a challenging market environment for the asset since its launch.

BLESS Current Market Status

Price Performance:

- Current Price: $0.01102 USD

- 24-Hour Change: +7.52%

- 7-Day Change: -20.94%

- 30-Day Change: -38.03%

- 1-Hour Change: -1.43%

Market Capitalization Metrics:

- Market Cap: $20,295,166.67

- Fully Diluted Valuation (FDV): $110,200,000.00

- Market Cap to FDV Ratio: 18.42%

- 24-Hour Trading Volume: $213,297.57

- Market Dominance: 0.0034%

Supply Distribution:

- Circulating Supply: 1,841,666,667 BLESS (18.42% of total)

- Total Supply: 10,000,000,000 BLESS

- Maximum Supply: 10,000,000,000 BLESS

- Current Holders: 5,501 addresses

Trading Range (24H):

- High: $0.0114

- Low: $0.01017

Market Listing:

- Listed on 17 exchanges globally

- Available on Gate.com for trading

- Blockchain: BSC (Binance Smart Chain, BEP-20 standard)

- Contract Address: 0x7c8217517ed4711fe2deccdfeffe8d906b9ae11f

Click to view current BLESS market price

BLESS Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 20. This indicates heightened market anxiety and pessimism among investors. Such extreme fear conditions often present contrarian opportunities for long-term investors, as panic selling may create attractive entry points. However, exercise caution and conduct thorough research before making investment decisions. Market volatility remains elevated, so consider your risk tolerance and investment strategy carefully during this period of market uncertainty.

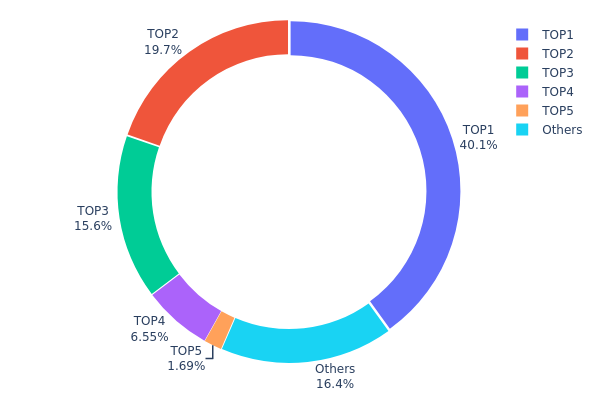

BLESS Holdings Distribution

The address holdings distribution map reveals the concentration patterns of token ownership across the blockchain network. By analyzing the top addresses and their proportional holdings, this metric provides critical insights into the decentralization level, market structure stability, and potential concentration risks within the BLESS ecosystem. Understanding these distribution patterns is essential for assessing market maturity and identifying potential vulnerabilities to price manipulation.

BLESS currently exhibits significant concentration risk, with the top four addresses controlling approximately 81.88% of total token supply. The leading address alone holds 40.06% of all tokens, representing over 123.8 million BLESS. The second and third largest holders account for 19.69% and 15.59% respectively, creating a steep concentration gradient. While the remaining distributed addresses (classified as "Others") hold 16.44% of tokens, this fragmentation among numerous smaller holders is substantially outweighed by the dominant position of the top tier holders. This distribution pattern indicates pronounced centralization within the token's initial structure.

Such concentrated holdings present tangible implications for market dynamics and price stability. The top four addresses collectively possess sufficient token volume to materially influence market sentiment and price movements through coordinated actions or substantial liquidations. This concentration may amplify volatility during periods of uncertainty and potentially limit the token's ability to achieve robust, independently-driven price discovery. The significant gap between major holders and the broader community suggests that BLESS remains in an early phase of decentralization, with wealth and governance influence heavily concentrated among a limited number of stakeholders rather than distributed across a diverse, engaged network.

Click to view current BLESS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x070f...73f5f0 | 123898.00K | 40.06% |

| 2 | 0x73d8...4946db | 60896.08K | 19.69% |

| 3 | 0x0d07...b492fe | 48223.00K | 15.59% |

| 4 | 0x4998...ecc9db | 20251.68K | 6.54% |

| 5 | 0x75f8...8a5f66 | 5217.42K | 1.68% |

| - | Others | 50787.25K | 16.44% |

II. Core Factors Affecting BLESS's Future Price

Supply Mechanism

-

Token Allocation for Airdrops: BLESS reserves 8.5% of tokens for airdrops, with claiming opened on September 24th. This allocation mechanism impacts token distribution and market supply dynamics.

-

Current Impact: The airdrop mechanism distributes tokens to community participants, potentially increasing circulating supply and affecting price through broader token distribution in the early stages of the project.

Market Sentiment and Volatility

-

Price Volatility: As an emerging project, BLESS token price experiences significant fluctuations during its early trading phase. Historical price movements have shown considerable volatility, with the token trading in the range of $0.00025-$0.00030 USD during consolidation phases.

-

Sentiment-Driven Movements: Future price performance depends significantly on social momentum and market sentiment. Price movements are heavily influenced by news, social media discussion, and investor confidence rather than fundamental factors alone.

-

Market Risk: The nascent nature of the BLESS project creates substantial market volatility risk, with potential for sharp price swings driven by market emotion and speculative trading activity.

Institutional and Market Dynamics

-

Exchange Listings: BLESS gained significant attention as a Binance Alpha project, demonstrating nearly 3x price appreciation following its listing and inclusion in institutional trading platforms, indicating growing institutional interest in the project.

-

Trading Volume Correlation: Price movements require careful analysis of volume patterns. Genuine price appreciation typically correlates with increased trading volume, whereas price increases with stagnant or declining volume may indicate forced liquidations rather than organic buying pressure.

Macroeconomic Environment

-

Federal Reserve Policy: The broader cryptocurrency market, including BLESS, remains sensitive to monetary policy expectations. Statements from Federal Reserve officials indicate cautious approaches to policy normalization, which generally supports risk assets like cryptocurrencies during periods of policy accommodation.

-

Inflation Hedge Characteristics: As part of the broader cryptocurrency asset class, BLESS shares inflation hedge properties, though these characteristics are secondary to its project-specific fundamentals and market sentiment factors.

Three、2025-2030 BLESS Price Forecast

2025 Outlook

- Conservative Forecast: $0.00964 - $0.01096

- Neutral Forecast: $0.01096

- Optimistic Forecast: $0.01173 (requires sustained market stability and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and accumulation phase with moderate growth trajectory

- Price Range Predictions:

- 2026: $0.00737 - $0.01191

- 2027: $0.00837 - $0.01302

- 2028: $0.00666 - $0.0159

- Key Catalysts: Ecosystem expansion, increased adoption rate, strategic partnerships, and overall market sentiment recovery

2029-2030 Long-term Outlook

- Base Case: $0.01298 - $0.01933 (assuming steady adoption and favorable macroeconomic conditions)

- Optimistic Case: $0.01933 - $0.02207 (assuming accelerated institutional adoption and major protocol upgrades)

- Transformational Case: $0.02207+ (assuming breakthrough technological innovations and widespread mainstream acceptance)

- 2030-12-20: BLESS $0.02207 (representing a 51% potential upside from current levels over five years)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01173 | 0.01096 | 0.00964 | 0 |

| 2026 | 0.01191 | 0.01134 | 0.00737 | 2 |

| 2027 | 0.01302 | 0.01163 | 0.00837 | 5 |

| 2028 | 0.0159 | 0.01232 | 0.00666 | 11 |

| 2029 | 0.01933 | 0.01411 | 0.01298 | 28 |

| 2030 | 0.02207 | 0.01672 | 0.01589 | 51 |

BLESS Investment Strategy and Risk Management Report

IV. BLESS Professional Investment Strategy and Risk Management

BLESS Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Believers in decentralized edge computing infrastructure and AI/ML computational resource sharing models

- Operational Recommendations:

- Accumulate during market downturns when BLESS trades significantly below historical highs (currently 52% below the ATH of $0.2304)

- Dollar-cost averaging (DCA) approach to mitigate volatility—allocate fixed amounts monthly regardless of price movements

- Hold positions for 12+ months to benefit from potential network adoption and utility expansion as edge computing demand grows

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages (MA): Monitor 20-day and 50-day moving averages to identify trend reversals; trading opportunities emerge when price crosses these key levels

- Relative Strength Index (RSI): Use RSI(14) to identify overbought (>70) and oversold (<30) conditions; current market sentiment indicates potential accumulation phases

- Wave Trading Key Points:

- Establish buy positions during 7-day and 30-day downtrends when RSI signals oversold conditions

- Set profit-taking targets at 15-25% gains based on 24-hour volatility patterns; implement trailing stops to protect gains

BLESS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio allocation

- Active Investors: 3-8% of total portfolio allocation

- Professional Investors: 5-15% of total portfolio allocation

(2) Risk Hedging Strategies

- Portfolio Diversification: Balance BLESS holdings with stablecoins or major cryptocurrencies to reduce single-asset risk exposure

- Position Sizing: Never allocate more capital to BLESS than you can afford to lose completely; treat as high-risk/high-reward asset class

(3) Secure Storage Solutions

- Hot Wallet Option: Use Gate.com Web3 wallet for active trading and frequent transactions, ensuring convenient access while maintaining reasonable security standards

- Cold Storage Practice: Transfer long-term holdings to secure offline storage solutions to minimize exchange counterparty risk

- Security Precautions: Enable two-factor authentication (2FA) on all exchange accounts; use strong, unique passwords; never share private keys or recovery phrases; regularly verify contract addresses before transactions

V. BLESS Potential Risks and Challenges

BLESS Market Risks

- Severe Volatility: BLESS has experienced a 38% decline over 30 days and 22% decline annually, indicating extreme price fluctuations that may amplify losses

- Liquidity Concerns: 24-hour trading volume of $213,297.57 is relatively modest for a token with $110.2M market cap, creating potential slippage during large orders

- Market Capitalization Concentration: With only 18.42% of total supply circulating (1.84B of 10B tokens), significant dilution risk exists when additional tokens enter circulation

BLESS Regulatory Risks

- Jurisdictional Uncertainty: Edge computing networks and decentralized infrastructure face evolving regulatory frameworks globally; regulatory classification remains ambiguous in many markets

- Compliance Requirements: Changes in data protection regulations (GDPR, CCPA) or AI governance rules could impact Bless Network's operational model

- Exchange Listing Risk: Regulatory pressures could lead to delisting from platforms like Gate.com in certain jurisdictions, reducing accessibility

BLESS Technology Risks

- Project Maturity: Limited adoption metrics and network growth indicators available; early-stage technology with unproven scalability

- Competition from Established Infrastructure: Faces competition from established cloud computing providers and emerging edge computing platforms with more resources and market presence

- Smart Contract Vulnerabilities: BEP-20 token standard implementation could contain bugs or security flaws; network infrastructure is vulnerable to 51% attacks or other consensus-level threats

VI. Conclusion and Action Recommendations

BLESS Investment Value Assessment

Bless Network operates in the promising decentralized edge computing space, addressing genuine infrastructure needs for distributed AI and ML applications. However, the project exhibits characteristics of early-stage, speculative technology with extreme volatility (currently 52% below all-time high), limited liquidity, and significant supply dilution risk. The token's fundamental value proposition remains dependent on achieving meaningful network adoption and utility, which remain unproven at scale. Investment suitability depends entirely on individual risk tolerance and investment horizon.

BLESS Investment Recommendations

✅ Beginners: Start with 1% portfolio allocation through dollar-cost averaging on Gate.com; use this as a learning opportunity for high-risk assets rather than core holdings; prioritize education on edge computing technology before increasing exposure

✅ Experienced Investors: Allocate 3-8% for tactical positions; employ technical analysis to time entry points during oversold conditions; maintain strict stop-loss levels at 20-25% below entry; actively rebalance quarterly

✅ Institutional Investors: Conduct comprehensive due diligence on network adoption metrics, team credibility, and roadmap execution; limit allocation to 5-15% as experimental/venture allocation; establish governance frameworks for position monitoring

BLESS Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase of BLESS tokens on Gate.com's spot market; suitable for long-term holders seeking simple accumulation

- Leverage Trading: Use gate.com's leverage trading features (with extreme caution) for experienced traders with hedging strategies; amplifies both gains and losses

- Strategic Accumulation: Participate in DCA programs during extended downtrends; average purchase prices to build positions over time while managing volatility

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and conduct thorough due diligence. Consult professional financial advisors before committing capital. Never invest more than you can afford to lose completely.

FAQ

What is bless coin price prediction?

Bless coin is forecasted to trade between $0.007151 and $0.01024 next year, with an expected decrease of -2.39% based on current market trends and analysis.

What is bless crypto?

Bless (BLESS) is a cryptocurrency for a decentralized computing platform that uses unused device power. BLESS tokens are used to pay for computing tasks and can be staked for network incentives. BLESS was listed on WEEX in 2025.

What factors influence BLESS token price movements?

BLESS token price is primarily influenced by network demand, the number of active nodes, trading volume, and overall cryptocurrency market trends. Increases in network adoption and node participation typically drive price appreciation.

Is BLESS a good investment for 2024-2025?

BLESS shows promising potential with notable price momentum in 2025. Trading on reputable platforms like Bitget and Kraken provides liquidity. However, market volatility remains high. Consider your risk tolerance and investment goals before deciding.

What is the current market cap and supply of BLESS coin?

BLESS coin has a current market cap of approximately $18.86 million with a circulating supply of 1.84 billion tokens, representing less than 0.01% of the total cryptocurrency market capitalization.

Is Shieldeum (SDM) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Is Clore.ai (CLORE) a good investment?: Analyzing the Potential and Risks of this Emerging AI Token

Is PinGo (PINGO) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

2025 AIOT Price Prediction: Expert Analysis and Market Trends for the Next Generation of Connected Devices

2025 PINGO Price Prediction: Analyzing Potential Growth and Market Trends for the Emerging Cryptocurrency

Is Bless (BLESS) a good investment? Comprehensive Analysis of Features, Risks, and Market Potential

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?