2025 BAN Fiyat Tahmini: Banano'nun Piyasa Değeri ve Benimsenme Trendlerinin Geleceğine Yönelik Analiz

Giriş: BAN'ın Piyasadaki Konumu ve Yatırım Değeri

Comedian (BAN), sanat tarihine damga vuran önemli bir meme token olarak, çıkışından bu yana dikkat çekici bir gelişim sergiledi. 2025 yılı itibarıyla BAN'ın piyasa değeri 68.380.000 $'a ulaşırken, dolaşımdaki arzı 1.000.000.000 token ve fiyatı yaklaşık 0,06838 $ seviyesinde seyrediyor. "Sanat tarihinin en önemli meme'i" olarak anılan bu varlık, sanat ile blokzincir teknolojisinin kesişiminde giderek daha belirleyici bir rol üstleniyor.

Bu makalede, 2025-2030 arası dönemde BAN'ın fiyat eğilimleri; geçmiş hareketler, piyasa arz-talep dinamikleri, ekosistem gelişimi ve makroekonomik faktörler doğrultusunda kapsamlı bir şekilde analiz edilerek yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. BAN Fiyat Geçmişi ve Mevcut Piyasa Durumu

BAN Tarihsel Fiyat Gelişimi

- 2024: BAN, 18 Kasım'da 0,41 $ ile tüm zamanların en yüksek seviyesine ulaşarak proje için önemli bir dönüm noktası yaşadı.

- 2025: 3 Şubat'ta 0,0234 $ ile tüm zamanların en düşük seviyesini görerek ciddi bir piyasa düzeltmesine işaret etti.

BAN Güncel Piyasa Durumu

22 Ekim 2025 itibarıyla BAN, 0,06838 $ seviyesinden işlem görmekte olup, son 24 saatte %4,24'lük bir değer kaybı yaşadı. Token son bir haftada %17,54 artarken, son 30 günde %3,84 geriledi. BAN'ın piyasa değeri 68.380.000 $ ile kripto para piyasasında 507. sırada yer alıyor.

Mevcut fiyat, en düşük seviyesinden önemli bir toparlanma gösterse de, halen zirve seviyesinin oldukça altında bulunuyor. 24 saatlik işlem hacmi 1.289.893,98 $ ile piyasanın orta düzeyde hareketli olduğunu gösteriyor. Dolaşımdaki arz, toplam ve maksimum arzla aynı olan 1.000.000.000 token seviyesinde, bu da BAN için ek bir enflasyon baskısı olmadığı anlamına geliyor.

Kısa vadeli dalgalanmalara rağmen, BAN uzun vadede olağanüstü bir büyüme sergiledi ve son bir yılda %107.156,84 oranında artış gösterdi. Bu performans, "Sanat tarihinin en önemli meme'i, Mauricio Cattelan tarafından" olarak nitelenen projeye yatırımcı ilgisinin güçlü olduğunu gösteriyor.

Güncel BAN piyasa fiyatını görmek için tıklayın

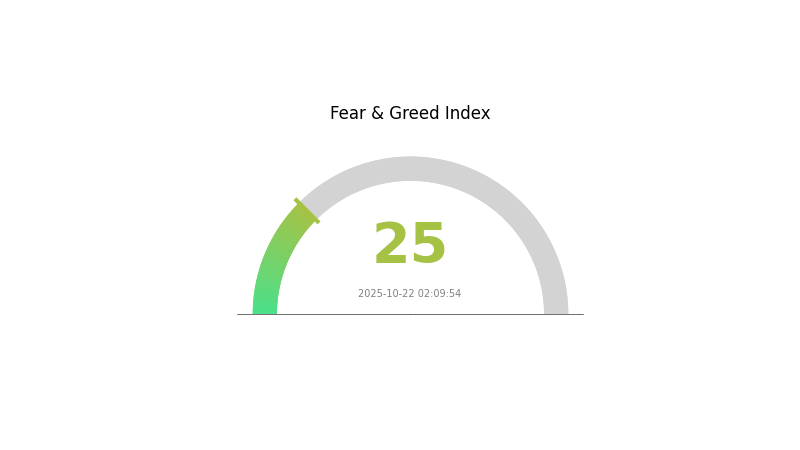

BAN Piyasa Duyarlılığı Göstergesi

2025-10-22 Korku ve Açgözlülük Endeksi: 25 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Bugün kripto piyasasında aşırı korku hakim; duyarlılık endeksi 25'e geriledi. Bu durum, yatırımcı psikolojisinde dikkate değer bir değişime işaret ederek, karşıt pozisyondaki yatırımcılar için fırsatlar sunabilir. Ancak aşırı korkunun sürebileceği unutulmamalı, temkinli hareket edilmeli. Deneyimli yatırımcılar riskleri azaltmak için ortalama maliyetle alım stratejisini değerlendirebilir. Her zaman olduğu gibi, bu dalgalı piyasa koşullarında detaylı araştırma ve etkin risk yönetimi şarttır. Güncel kalın, Gate.com'da sorumlu işlem yapın.

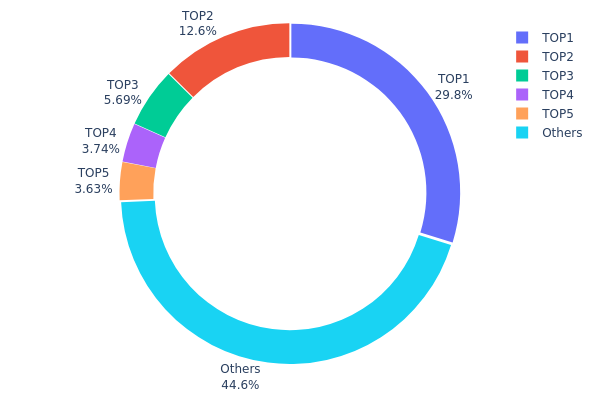

BAN Varlık Dağılımı

BAN'ın cüzdan dağılım verileri, tokenların büyük kısmının az sayıda üst düzey adreste toplandığını gösteriyor. En büyük sahip, toplam arzın %29,77'sine sahipken, ilk 5 adres toplamda BAN tokenlarının %55,41'ini elinde bulunduruyor. Bu yoğunlaşma, potansiyel piyasa manipülasyonu ve fiyat oynaklığı riskini artırıyor.

Böylesi bir dağılım yapısı, BAN'ın piyasa dengesinin büyük sahiplerin hareketlerine karşı savunmasız olabileceğini ortaya koyuyor. Bu adreslerin işlemleri, token fiyatı ve likiditesi üzerinde orantısız etki yaratabilir. Ayrıca, bu yoğunlaşma zincir üstü yapıda merkeziyetsizliğin düşük olduğunu ve bu durumun uzun vadeli istikrar ve benimsenme potansiyelini etkileyebileceğini gösteriyor.

Bununla birlikte, ilk 5 adres dışındaki cüzdanlarda tokenların %44,59'unun tutulduğunu belirtmek gerek; bu, daha küçük yatırımcılar arasında bir dağılım olduğunu ortaya koyuyor. Bu daha geniş taban, en büyük adreslerin etkisine karşı bir denge oluşturabilir; ancak genel token dağılımı hala belirgin biçimde dengesizdir.

Güncel BAN Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 8NBEbx...vEcMBE | 297.742,76K | 29,77% |

| 2 | u6PJ8D...ynXq2w | 125.958,54K | 12,59% |

| 3 | Cw32Ny...YLwZeh | 56.897,00K | 5,69% |

| 4 | 1nc1ne...111111 | 37.362,27K | 3,73% |

| 5 | 7cAui6...Lx4xR8 | 36.344,54K | 3,63% |

| - | Diğerleri | 445.555,79K | 44,59% |

II. BNB'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Makroekonomik Ortam

- Para Politikası Etkisi: Büyük merkez bankalarının gevşeme döngülerine devam etmesi bekleniyor; ABD Merkez Bankası'nın faiz indirimlerini sürdürmesi muhtemel. Bu güvercin duruş BNB fiyatı için olumlu etki yaratabilir.

- Enflasyon Korumalı Özellikler: BNB, diğer kripto paralar gibi enflasyon riskine karşı koruma potansiyeli sundu. Enflasyonist ortamlarda servetini korumak isteyen yatırımcıların ilgisini çekebilir.

- Jeopolitik Faktörler: Devam eden jeopolitik gerilimler ve çatışmalar, yatırımcıların güvenli liman olarak kripto varlıklara yönelmesine neden olabilir ve bu da BNB'ye fayda sağlayabilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- BNB Chain Yükseltmeleri: BNB Chain ekosisteminde yapılan ölçeklenebilirlik ve güvenlik geliştirmeleri, BNB'nin değerini olumlu etkileyebilir.

- DeFi ve NFT Büyümesi: BNB Chain üzerinde merkeziyetsiz finans (DeFi) ve benzersiz token (NFT) projelerinin büyümesi, BNB'ye olan talebi artırabilir.

- Ekosistem Uygulamaları: BNB ekosisteminde yeni dApp ve projelerin geliştirilmesi, benimsenmeyi hızlandırarak BNB'nin kullanım alanını artırabilir.

III. 2025-2030 BAN Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,05907 $ - 0,06869 $

- Tarafsız tahmin: 0,06869 $ - 0,07694 $

- İyimser tahmin: 0,07694 $ - 0,08518 $ (güçlü piyasa momentumu gerektirir)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Konsolidasyon ardından kademeli büyüme

- Fiyat aralığı tahmini:

- 2027: 0,05278 $ - 0,09707 $

- 2028: 0,04974 $ - 0,12818 $

- Başlıca katalizörler: Artan benimsenme ve teknolojik gelişmeler

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,09737 $ - 0,12927 $ (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 0,12927 $ - 0,14661 $ (olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,14661 $ - 0,15512 $ (çığır açan yenilikler ve kitlesel benimsenme ile)

- 2030-12-31: BAN 0,15512 $ (potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 0,08518 | 0,06869 | 0,05907 | 0 |

| 2026 | 0,11155 | 0,07693 | 0,06078 | 12 |

| 2027 | 0,09707 | 0,09424 | 0,05278 | 37 |

| 2028 | 0,12818 | 0,09566 | 0,04974 | 39 |

| 2029 | 0,14661 | 0,11192 | 0,09737 | 63 |

| 2030 | 0,15512 | 0,12927 | 0,08532 | 89 |

IV. BAN Profesyonel Yatırım Stratejileri ve Risk Yönetimi

BAN Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygunluk: Yüksek risk toleransına sahip, uzun vadeli bakış açısındaki yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde BAN biriktirin

- En az 1-2 yıllık bir tutma süresi hedefleyin

- Güvenli, kendi saklamanızda olan bir cüzdanda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trendleri takip edin

- RSI: Aşırı alım/aşırı satım durumlarını tespit edin

- Dalgalı işlemde dikkat edilmesi gerekenler:

- Açık giriş ve çıkış noktaları belirleyin

- Zarar durdurma emirleriyle riskinizi yönetin

BAN Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: %1-3

- Aggresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı birden fazla kripto para arasında paylaştırın

- Zarar durdurma emirleri: Potansiyel kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama önerisi: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama kullanın, güçlü şifreler oluşturun

V. BAN'ın Potansiyel Riskleri ve Karşılaşabileceği Zorluklar

BAN Piyasa Riskleri

- Yüksek oynaklık: Meme coinlerde sık yaşanan büyük fiyat dalgalanmaları

- Piyasa duyarlılığı: Yatırımcı duygularındaki hızlı değişimlere duyarlılık

- Sınırlı likidite: Büyük işlemlerde potansiyel zorluklar

BAN Regülasyon Riskleri

- Düzenleyici belirsizlik: Meme coinlere yönelik daha fazla denetim ihtimali

- Yasal statü: Bazı ülkelerde regülasyon kısıtlaması olasılığı

- Vergi sonuçları: Kripto kazançlarının vergilendirilmesindeki değişiklikler

BAN Teknik Riskler

- Akıllı sözleşme açıkları: Olası kötüye kullanım veya hata riski

- Ağ tıkanıklığı: Yoğun dönemlerde işlem gecikmeleri

- Cüzdan güvenliği: Kullanıcı hatası veya saldırı kaynaklı kayıp riski

VI. Sonuç ve Eylem Önerileri

BAN Yatırım Değeri Değerlendirmesi

BAN, meme coin segmentinde yüksek risk ve yüksek getiri potansiyeli sunar. Kayda değer kazanç sağlayabileceği gibi, yatırımcılar aşırı oynaklık ve ciddi kayıp ihtimaline karşı da hazırlıklı olmalıdır.

BAN Yatırım Önerileri

✅ Yeni başlayanlar: Portföyünüzün yalnızca küçük bir kısmını, hatta hiç ayırmayın ✅ Deneyimli yatırımcılar: Çeşitlendirilmiş bir kripto portföyü içinde değerlendirebilirler ✅ Kurumsal yatırımcılar: Son derece temkinli yaklaşmalı ve detaylı inceleme yapmalıdır

BAN İşlem Katılım Yöntemleri

- Spot alım-satım: BAN tokenlarını doğrudan satın alıp tutmak

- Limit emirleri: Belirli fiyatlarda alış/satış emri vermek

- Ortalama maliyet yöntemi: Zamanlama riskini azaltmak için düzenli küçük yatırım yapmak

Kripto para yatırımları aşırı derecede yüksek risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profillerine göre karar vermeli ve profesyonel finansal danışmanlara danışmalıdır. Kaldıramayacağınızdan fazla yatırım yapmayın.

Sıkça Sorulan Sorular

Cardano tekrar 3 $’ı görecek mi?

Bu mümkün, fakat kesin değil. Piyasa eğilimleri ve uzman görüşleri farklılık gösteriyor. Bazı analistler Cardano'nun 3 $'a ulaşabileceğini düşünüyor, bazıları ise daha yeni projelerin ön plana çıkabileceğini belirtiyor.

Ban coin yükselecek mi?

Evet, BAN coin’in önemli oranda yükselmesi bekleniyor. Tahminler, 2025’e kadar %15.937,32’lik bir artışla 0,007934 $ seviyesine ulaşabileceğini gösteriyor.

BNB 1.000 $’ı görebilir mi?

Evet, BNB'nin 2026 sonuna kadar 1.000 $ seviyesine ulaşma potansiyeli mevcut. Bunu destekleyen unsur ise devam eden piyasa büyümesi ve istikrarlı talep. Güncel eğilimler ve tahminler bu olasılığı destekliyor.

Banano (BAN) iyi bir yatırım mı?

Evet, Banano (BAN) yatırım açısından umut vaat ediyor. İşlemsiz transferleri, anında hareket kabiliyeti ve büyüyen topluluğu, onu kripto piyasasında cazip bir seçenek haline getiriyor.

MemeFi (MEMEFI) iyi bir yatırım mı?: Son dönemin popüler kripto meme projesinin olası riskleri ve getirileri üzerine kapsamlı bir analiz

Wojak (WOJAK) yatırım için uygun mu?: Dalgalı Kripto Piyasasında Meme Token'ın Potansiyelini Değerlendirmek

MongCoin (MONG) iyi bir yatırım mı?: Bu meme kripto paranın olası riskleri ve getiri potansiyelinin analizi

CZ'NİN KÖPEĞİ (BROCCOLI) iyi bir yatırım mı?: Günümüzün oynak piyasasında mizah temalı kripto paraların potansiyelini değerlendirmek

Povel Durev (DUREV) iyi bir yatırım mı?: Bu yeni kripto paranın potansiyeli ve risklerini analiz ediyoruz

2025 için En Son Shiba Inu Fiyat Analizi: SHIB Token Pazar Trendlerine Dair İçgörüler

Cysic: AI ve Dağıtık Hesaplama için Sıfır Bilgi Altyapı Platformu

ABD Bankacılık Düzenleyicisi OCC, ulusal bankaların kripto para ticareti yapmasını kolaylaştırıyor

ASTER Spot İşlem Rehberi: Anlık Fiyat Analizi ve İşlem Hacmi Bilgileri

Cantor Equity ile birleşmenin ardından Twenty One Capital Bitcoin hissesi yüzde 25 değer kaybetti

Dropee Günlük Kombinasyonu 10 Aralık 2025