2025 BABYBNB Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: Market Position and Investment Value of BABYBNB

BABYBNB (BABYBNB) is a meme coin designed to make BNB great again, backed by the strongest BNB community. Since its launch in September 2024, it has become one of the most successful token launches from GRA.FUN, making waves in the crypto space. As of December 28, 2025, BABYBNB has a market capitalization of $871,900 with a circulating supply of 1 billion tokens, currently trading at $0.0008719. This community-driven asset is gaining traction within the BNB ecosystem.

This comprehensive analysis will examine BABYBNB's price trajectory through 2025-2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for market participants.

BABYBNB Market Analysis Report

I. BABYBNB Price History Review and Current Market Status

BABYBNB Historical Price Evolution Trajectory

-

September 2024: Project launch via GRA.FUN platform, achieved all-time high of $0.18032 on September 29, 2024, marking the strongest community-backed token debut in the BNB ecosystem.

-

September 2024 to December 2025: Significant downward correction phase, with the token experiencing substantial depreciation from its peak valuation, declining approximately 86.14% over the one-year period.

-

July 2025: Reached all-time low of $0.0004909 on July 4, 2025, representing the lowest point in the token's trading history.

-

December 2025: Price stabilization phase with current valuation at $0.0008719, showing minor fluctuations in recent trading sessions.

BABYBNB Current Market Posture

As of December 28, 2025, BABYBNB is trading at $0.0008719 with a 24-hour trading volume of $12,850.01. The token demonstrates modest hourly gains of 0.11% but faces headwinds with 24-hour declines of -1.93%. Over extended timeframes, the asset reflects challenging market conditions, showing weekly losses of -8.42%, monthly depreciation of -16.15%, and substantial year-to-date underperformance of -86.14%.

The token maintains a fully diluted market capitalization of $871,900, with a circulating supply of 1 billion BABYBNB tokens out of a total supply of 1 billion tokens (100% circulating ratio). The project boasts 18,097 active token holders and maintains listings across 3 exchange platforms. BABYBNB operates on the BEP20 standard on the Binance Smart Chain network, with contract address 0x2d5f3b0722acd35fbb749cb936dfdd93247bbc95.

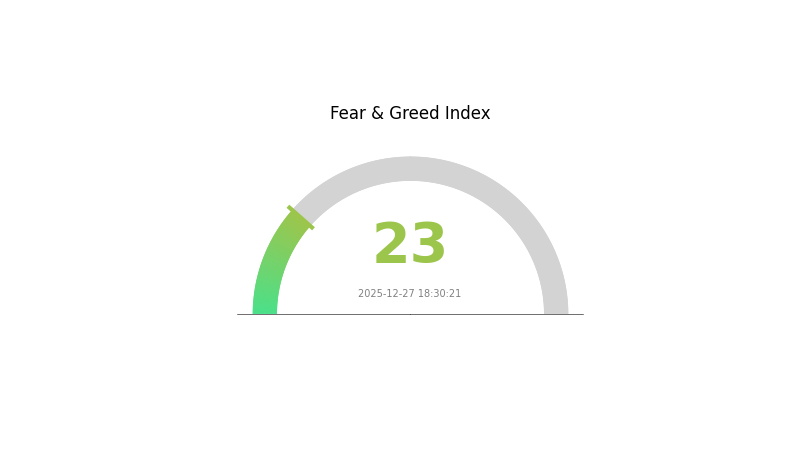

Current market sentiment reflects extreme fear conditions in the broader cryptocurrency market, with the VIX reading at 23, indicating heightened volatility and risk-averse investor positioning.

Click to view current BABYBNB market price

Market Sentiment Indicator

2025-12-27 Fear and Greed Index: 23 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the sentiment index dropping to 23. This indicates heightened market pessimism and investor anxiety about asset valuations. During such periods, panic selling often dominates trading activity, presenting potential buying opportunities for long-term investors. Market volatility typically increases under extreme fear conditions, creating both risks and opportunities. Traders should exercise caution and implement proper risk management strategies. Monitor key support levels closely and consider dollar-cost averaging entry points. This sentiment phase often precedes market recovery, making it crucial to stay informed through Gate.com's comprehensive market data and analysis tools.

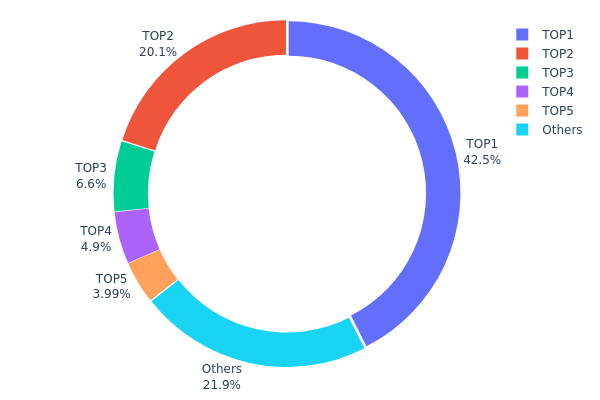

BABYBNB Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across the blockchain network by tracking the percentage of total supply held by individual addresses. This metric serves as a critical indicator of decentralization levels and potential market risk, as it reveals whether token supply is dispersed among numerous participants or concentrated within a limited number of holders.

BABYBNB exhibits pronounced concentration characteristics that warrant careful consideration. The top two addresses collectively control 62.59% of the total supply, with the leading address alone commanding 42.51%. This degree of concentration significantly exceeds healthy decentralization thresholds for most cryptocurrency projects. The distribution pattern demonstrates a steep hierarchy, where the top five addresses account for 78.06% of holdings, leaving only 21.94% dispersed among remaining holders. Such extreme concentration creates structural vulnerabilities within the token ecosystem.

This concentrated ownership structure presents material implications for market dynamics and price stability. Large holders possess disproportionate influence over supply dynamics and trading volume, creating elevated susceptibility to significant price volatility should these addresses engage in substantial transactions. The dominance of a few addresses fundamentally alters market microstructure, potentially enabling coordinated selling pressure or rapid market movements independent of broader adoption fundamentals. Additionally, the illiquidity risk associated with such distribution patterns means that genuine price discovery mechanisms may be impaired, with market movements increasingly reflective of whale activity rather than organic demand signals.

Click to view current BABYBNB Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2c31...6462ee | 425161.29K | 42.51% |

| 2 | 0xd290...2180d1 | 200897.83K | 20.08% |

| 3 | 0xf399...2bdcc6 | 66037.62K | 6.60% |

| 4 | 0x53f7...f3fa23 | 48982.58K | 4.89% |

| 5 | 0x83c2...c40dbd | 39893.09K | 3.98% |

| - | Others | 219027.60K | 21.94% |

II. Core Factors Influencing BABYBNB's Future Price

Institutional and Major Holder Dynamics

-

Key Figure Influence: BABYBNB's price experienced a significant 43% surge following CZ's (former Binance CEO) release from incarceration and his public announcement of future plans on social media. CZ outlined his intentions to focus on Giggle Academy, an education initiative, and increase involvement in charitable activities, while planning to rest before deciding on next steps.

-

Project Association: BABYBNB is a new project that benefits from market interest in Binance and BNB token developments. The token's value is closely tied to sentiment around the Binance ecosystem and CZ's future endeavors.

Technology Development and Ecosystem Building

-

Smart Contract Security Concerns: During BABYBNB's price surge, GoPlus identified that the project's smart contract calls functions from other contracts when executing its primary methods, which represents a potential security consideration for investors.

-

Trading Infrastructure: BABYBNB is actively traded on decentralized exchanges including PancakeSwap V3, providing liquidity and accessibility through major DeFi protocols.

-

Technical Price Action: Price analysis on 1-hour timeframes shows BABYBNB forming an ascending channel with higher highs and higher lows, indicating sustained upward momentum. The 50-period moving average stands at $0.1052, with the current price trading above this level, demonstrating short-term bullish sentiment. RSI at 55.39 indicates moderate bullish momentum with room for further upside before entering overbought territory. Trading volume of 343.787K reflects active trading activity, a positive indicator of trend strength.

III. 2025-2030 BABYBNB Price Forecast

2025 Outlook

- Conservative Prediction: $0.00057 - $0.00087

- Neutral Prediction: $0.00087

- Optimistic Prediction: $0.00122 (requires positive market sentiment and increased adoption)

2026-2028 Mid-term Outlook

- Market Phase Expectation: Steady growth phase with gradual accumulation and recovery in market confidence, characterized by incremental price appreciation and volatility normalization.

- Price Range Predictions:

- 2026: $0.00099 - $0.00143 (19% potential upside)

- 2027: $0.00084 - $0.00157 (41% potential upside)

- 2028: $0.00117 - $0.00181 (61% potential upside)

- Key Catalysts: Enhanced ecosystem development, increased liquidity on trading platforms such as Gate.com, growing community engagement, and potential integration with broader DeFi protocols.

2029-2030 Long-term Outlook

- Base Case: $0.00111 - $0.00211 by 2029 (84% potential appreciation), with consolidation to $0.00167 - $0.00193 by 2030 (112% total gain).

- Optimistic Scenario: $0.00211 by 2029 (assuming accelerated adoption, sustained market recovery, and strong institutional interest).

- Transformational Scenario: Sustained above $0.00193 by 2030 (assuming breakthrough technological innovations, mainstream adoption acceleration, and favorable macroeconomic conditions).

Note: These forecasts are based on technical analysis and market trend modeling. Actual price movements may vary significantly based on market conditions, regulatory developments, and broader cryptocurrency market dynamics.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00122 | 0.00087 | 0.00057 | 0 |

| 2026 | 0.00143 | 0.00104 | 0.00099 | 19 |

| 2027 | 0.00157 | 0.00124 | 0.00084 | 41 |

| 2028 | 0.00181 | 0.0014 | 0.00117 | 61 |

| 2029 | 0.00211 | 0.00161 | 0.00111 | 84 |

| 2030 | 0.00193 | 0.00186 | 0.00167 | 112 |

BABYBNB Professional Investment Strategy and Risk Management Report

IV. BABYBNB Professional Investment Strategy and Risk Management

BABYBNB Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Community-oriented participants, BNB ecosystem enthusiasts, and long-term believers in meme coin culture

- Operational Recommendations:

- Accumulate during price dips below $0.0008, aligning with current market support levels

- Hold through market volatility cycles, as meme coins often experience extended consolidation periods before recovery phases

- Reinvest any gains back into the position to benefit from compound growth potential

- Set clear portfolio allocation limits (typically 1-3% of total crypto holdings for speculative assets)

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Averages (MA 20/50/200): Use for identifying trend direction and support/resistance levels

- Relative Strength Index (RSI): Monitor overbought (>70) and oversold (<30) conditions to optimize entry and exit points

- Volume Analysis: Confirm price movements with transaction volume spikes to validate breakouts

- Bollinger Bands: Identify volatility expansion and contraction phases for range-bound trading

-

Swing Trading Considerations:

- Monitor the 24-hour price volatility (current range: $0.0008595 - $0.0009166) for intraday opportunities

- Take partial profits at resistance levels after 15-25% gains to lock in returns

- Use stop-loss orders at 8-10% below entry to protect against sudden downside moves

BABYBNB Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: Allocate 0.5-1% of portfolio to BABYBNB

- Aggressive Investors: Allocate 2-5% of portfolio, with dollar-cost averaging over 3-6 months

- Professional Investors: Deploy 1-3% with systematic rebalancing quarterly based on technical signals

(2) Risk Hedging Strategies

- Diversification Approach: Balance BABYBNB exposure with established Layer 1 and Layer 2 cryptocurrencies to reduce concentration risk

- Position Sizing: Never allocate funds that would create unmanageable losses; maintain strict position limits and use automated stop-loss mechanisms

(3) Secure Storage Solution

- Exchange Custody: For active traders, maintain BABYBNB holdings on Gate.com with two-factor authentication (2FA) enabled for fund security

- Self-Custody Option: For long-term holders, transfer BABYBNB to non-custodial wallets using the BSC network (contract: 0x2d5f3b0722acd35fbb749cb936dfdd93247bbc95)

- Security Considerations: Always verify smart contract addresses before transfers; use hardware verification when possible; never share private keys or seed phrases; enable transaction notifications

V. BABYBNB Potential Risks and Challenges

BABYBNB Market Risks

- High Volatility: BABYBNB has declined 86.14% over one year, indicating extreme price instability and potential for substantial capital loss

- Low Trading Volume: With 24-hour volume of only $12,850, liquidity constraints may prevent efficient entry and exit at desired price levels

- Market Sentiment Dependency: As a meme coin, BABYBNB is heavily influenced by social media trends and community activity rather than fundamental metrics

BABYBNB Regulatory Risks

- Classification Uncertainty: Regulatory frameworks for meme coins remain undefined in many jurisdictions, creating potential legal complications for holders

- Exchange Delisting Risk: With presence on only 3 exchanges, reduced regulatory scrutiny in any jurisdiction could trigger delisting and liquidity evaporation

- Tax Treatment Ambiguity: Different countries classify meme coins differently for tax purposes, potentially creating compliance challenges

BABYBNB Technical Risks

- Smart Contract Vulnerability: BEP20 token contracts may contain undiscovered exploits; verify audit status before significant investment

- Blockchain Congestion: BSC network congestion during high-volatility periods could prevent timely transactions

- Liquidity Pool Risk: Decentralized liquidity may be vulnerable to flash loan attacks or rug pull scenarios if governance remains centralized

VI. Conclusion and Action Recommendations

BABYBNB Investment Value Assessment

BABYBNB presents a highly speculative opportunity within the meme coin segment of the BNB ecosystem. The token has experienced significant price deterioration (-86.14% annually), suggesting either market repricing of initial enthusiasm or fundamental challenges in community engagement. With limited liquidity and concentrated holder base (18,097 addresses), the asset remains suitable only for risk-tolerant participants who can afford potential total loss. The token's success depends entirely on sustained community momentum and positive sentiment cycles rather than underlying utility or revenue generation.

BABYBNB Investment Recommendations

✅ Beginners: Start with micro-positions (0.5% of trading capital) through Gate.com after studying meme coin market dynamics; focus on understanding blockchain basics and risk management before increasing exposure

✅ Experienced Traders: Employ tactical swing-trading strategies using technical indicators on 4-hour and daily timeframes; maintain strict position limits and profit-taking discipline; avoid emotional decision-making during volatility spikes

✅ Institutional Investors: Conduct thorough smart contract audits and liquidity analysis before considering allocation; structure positions through derivative markets rather than spot accumulation; implement systematic risk monitoring protocols

BABYBNB Trading Participation Methods

- Gate.com Spot Trading: Purchase BABYBNB directly using BNB or stablecoins on Gate.com's spot market with real-time price feeds and order execution

- Direct Wallet Transfer: Acquire tokens via BSC network using the official contract address (0x2d5f3b0722acd35fbb749cb936dfdd93247bbc95) for self-custody

- Community Participation: Engage with official channels (website: https://babybnb.fun; Twitter: https://x.com/babyBNB_fun) to monitor developments and sentiment indicators

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on individual risk tolerance and consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

Is baby doge a good investment?

Baby Doge offers strong community support and growing adoption, making it an attractive investment opportunity. With increasing transaction volume and market momentum, it shows promising potential for long-term growth. Consider accumulating positions for substantial returns.

What factors could influence BABYBNB price in the coming years?

BABYBNB price could be influenced by market trends, protocol updates, trading volume, cryptocurrency adoption rates, and overall BNB ecosystem performance in the coming years.

How does BABYBNB compare to other meme coins in terms of long-term potential?

BABYBNB stands out with limited supply of 1 billion tokens, zero buy tax, and burned liquidity pool. Its community-driven model, transparent structure, and sustainable growth strategy provide stronger long-term potential than typical meme coins, positioning it for sustained value appreciation.

What is the realistic price target for BABYBNB based on market analysis?

Based on market analysis, BABYBNB's realistic price target for 2029 is $0.001366, representing a projected growth rate of 21.55% from current levels.

2025 BABYBNB Price Prediction: Will This Meme Coin Reach New Heights or Face a Crypto Winter?

2025 BABYBNB Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Emerging Cryptocurrency

Is BABYBNB (BABYBNB) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

2025 BABYBNB Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Is BABYBNB (BABYBNB) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Viability in 2024

Latest Shiba Inu Price Analysis for 2025: Insights into SHIB Token Market Trends

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?