2025 ARIO Price Prediction: Analyzing Market Trends and Growth Potential for the Emerging Cryptocurrency

Introduction: ARIO's Market Position and Investment Value

The AR.IO Network (ARIO) has established itself as a pioneering decentralized permanent cloud network since its inception. As of 2025, ARIO's market capitalization has reached $2,932,021, with a circulating supply of approximately 515,565,659 tokens, and a price hovering around $0.005687. This asset, hailed as the "gateway to permanent digital infrastructure," is playing an increasingly crucial role in ensuring universal, censorship-resistant access to data, storage, and domains.

This article will provide a comprehensive analysis of ARIO's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. ARIO Price History Review and Current Market Status

ARIO Historical Price Evolution Trajectory

- 2025: ARIO launched, price reached all-time high of $0.0601 on March 19

- 2025: Market correction, price dropped to all-time low of $0.004783 on September 23

- 2025: Recent recovery, price currently at $0.005687 as of November 24

ARIO Current Market Situation

ARIO is currently trading at $0.005687, with a 24-hour trading volume of $15,907.78. The token has experienced a 3.65% decrease in the last 24 hours. Its market cap stands at $2,932,021.91, ranking it at 1927th position in the overall cryptocurrency market. The circulating supply is 515,565,659.41 ARIO tokens, which represents 29.75% of the total supply of 1,000,000,000 ARIO. In the past 30 days, ARIO has shown a significant increase of 16.47%, indicating a positive short-term trend despite recent daily fluctuations.

Click to view the current ARIO market price

Here's the content in English as requested:

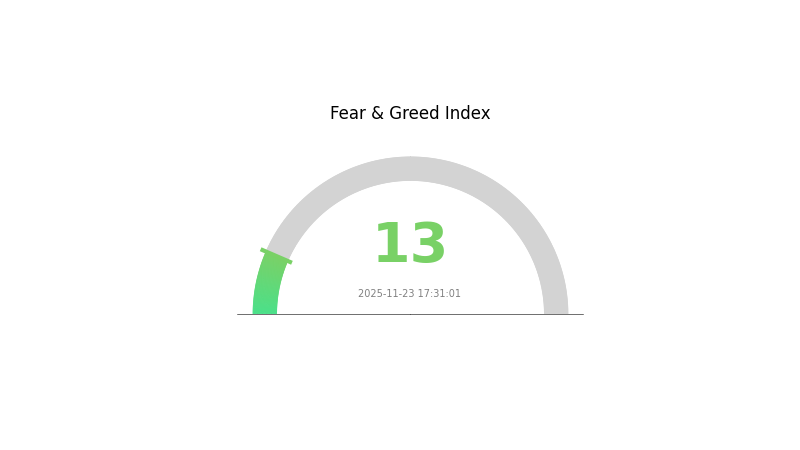

ARIO Market Sentiment Indicator

2025-11-23 Fear and Greed Index: 13 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the Fear and Greed Index plummeting to a mere 13. This indicates a highly pessimistic sentiment among investors, often presenting a potential buying opportunity for contrarian traders. However, it's crucial to approach with caution and conduct thorough research before making any investment decisions. Remember, market sentiment can shift rapidly, and past performance doesn't guarantee future results. Stay informed and consider diversifying your portfolio to mitigate risks in these uncertain times.

ARIO Holdings Distribution

The address holdings distribution data for ARIO reveals an interesting pattern in token concentration. This metric provides insights into how tokens are distributed among different addresses, offering a glimpse into the project's decentralization and potential market dynamics.

In this case, the absence of specific address data suggests a highly distributed token allocation. This could indicate a well-dispersed ownership structure, where no single address holds a significant portion of the total supply. Such a distribution pattern often contributes to increased market stability and reduced risk of price manipulation by large holders.

The lack of concentrated holdings typically reflects positively on the project's decentralization efforts. It suggests that ARIO has likely achieved a broad user base, potentially indicating strong community engagement and a reduced risk of centralized control. This distribution structure may contribute to more organic price movements and potentially lower volatility in the market.

Click to view the current ARIO holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting ARIO's Future Price

Technical Development and Ecosystem Building

- Ecosystem Applications: ARIO is building a decentralized ecosystem focused on AI and robotics. The project aims to integrate AI technologies with blockchain, potentially creating innovative applications in these fields.

III. ARIO Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00414 - $0.00500

- Neutral prediction: $0.00500 - $0.00650

- Optimistic prediction: $0.00650 - $0.00788 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased adoption

- Price range forecast:

- 2027: $0.00660 - $0.00986

- 2028: $0.00522 - $0.01274

- Key catalysts: Technological advancements, wider market acceptance

2029-2030 Long-term Outlook

- Base scenario: $0.01065 - $0.01267 (assuming steady market growth)

- Optimistic scenario: $0.01470 - $0.01825 (with strong ecosystem development)

- Transformative scenario: $0.02000+ (under extremely favorable market conditions)

- 2030-12-31: ARIO $0.01825 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00788 | 0.00567 | 0.00414 | 0 |

| 2026 | 0.00772 | 0.00677 | 0.0042 | 19 |

| 2027 | 0.00986 | 0.00725 | 0.0066 | 27 |

| 2028 | 0.01274 | 0.00855 | 0.00522 | 50 |

| 2029 | 0.0147 | 0.01065 | 0.00554 | 87 |

| 2030 | 0.01825 | 0.01267 | 0.01166 | 122 |

IV. ARIO Professional Investment Strategies and Risk Management

ARIO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors focused on decentralized infrastructure

- Operation suggestions:

- Accumulate ARIO tokens during market dips

- Stake tokens to earn rewards and support network security

- Store tokens in non-custodial wallets for enhanced security

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor for overbought/oversold conditions

- Key points for swing trading:

- Monitor AR.IO network growth and adoption metrics

- Stay informed about updates and partnerships in the decentralized storage space

ARIO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various decentralized storage projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use strong passwords, enable 2FA, and regularly update software

V. Potential Risks and Challenges for ARIO

ARIO Market Risks

- Volatility: High price fluctuations common in emerging crypto projects

- Competition: Increasing number of decentralized storage solutions

- Adoption: Slow uptake of decentralized storage by mainstream users

ARIO Regulatory Risks

- Uncertain regulations: Potential for new laws affecting decentralized networks

- Data privacy concerns: Possible scrutiny over permanent data storage

- Cross-border compliance: Challenges in adhering to various international regulations

ARIO Technical Risks

- Network scalability: Potential limitations in handling increased data loads

- Smart contract vulnerabilities: Risks associated with the underlying code

- Interoperability challenges: Potential difficulties in integrating with other blockchain networks

VI. Conclusion and Action Recommendations

ARIO Investment Value Assessment

ARIO presents a promising long-term value proposition in the decentralized storage space, with potential for significant growth. However, short-term volatility and adoption challenges pose considerable risks.

ARIO Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about decentralized storage technology ✅ Experienced investors: Consider a balanced approach, combining holding and strategic trading ✅ Institutional investors: Explore partnerships and integration opportunities within the AR.IO ecosystem

ARIO Participation Methods

- Token purchase: Acquire ARIO tokens through Gate.com

- Staking: Participate in network security and earn rewards

- Network contribution: Run AR.IO gateways to support the network's infrastructure

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance, and it is advisable to consult a professional financial advisor. Never invest more than you can afford to lose.

FAQ

What is the price target for Airo?

Based on market analysis and current trends, Airo's price target for 2026 is projected to reach $0.15 to $0.20, reflecting potential growth in the Web3 ecosystem.

Which AI can predict crypto prices?

AI models like ARIO can analyze market data and trends to forecast crypto prices, but predictions are not guaranteed and should be used cautiously.

How much is Ario?

As of November 2025, Ario is trading at approximately $0.15 per token. The price has seen a steady increase over the past year, reflecting growing interest in the project.

What is the stock market prediction for Argo Blockchain 2025?

Argo Blockchain's stock is predicted to reach $5.50 by 2025, showing a potential 120% increase from current levels due to improved market conditions and operational efficiency.

Share

Content