2025 ALI Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of ALI

Artificial Liquid Intelligence (ALI) is a decentralized protocol token developed by Alethea AI, positioned at the intersection of generative artificial intelligence and blockchain technology. As the native ERC-20 utility token for the iNFT protocol, ALI enables the creation, training, and monetization of interactive and intelligent NFTs within the Noah's Ark smart metaverse ecosystem.

As of December 20, 2025, ALI has achieved a market capitalization of approximately $19.36 million, with a circulating supply of 9.12 billion tokens trading at $0.002123 per unit. The token maintains a circulating supply ratio of 92.37%, reflecting substantial distribution within the market. This innovative asset is playing an increasingly significant role in bridging decentralized artificial intelligence governance with blockchain-based ownership models.

This article will provide a comprehensive analysis of ALI's price trends and market dynamics, examining historical price movements, market supply and demand factors, ecosystem development, and broader market conditions to deliver professional price forecasting and actionable investment strategies for the period through 2030.

ALI (Artificial Liquid Intelligence) Market Analysis Report

I. ALI Price History Review and Current Market Status

ALI Historical Price Evolution Trajectory

-

April 2, 2022: ATH (All-Time High) reached at $0.201312, marking the peak of ALI's market performance since inception.

-

December 18, 2025: ATL (All-Time Low) recorded at $0.00196181, reflecting significant downward pressure over the extended period.

-

Full Year Performance (1Y): Price declined by 82.03%, decreasing from approximately $0.0119 to the current level of $0.002123, indicating substantial losses for holders over the 12-month period.

ALI Current Market Status

As of December 20, 2025, 20:28:34 UTC, ALI is trading at $0.002123, demonstrating modest positive momentum in the short term:

- 24-Hour Performance: Up 1.23% (+$0.000025795), showing recovery from lower trading ranges.

- 1-Hour Performance: Up 0.24% (+$0.000005083), indicating slight bullish pressure in immediate timeframe.

- 7-Day Performance: Down 10.9% (-$0.000259716), reflecting medium-term selling pressure.

- 30-Day Performance: Down 17.48% (-$0.000449709), showing consistent downtrend over the monthly period.

Market Capitalization & Supply Metrics:

- Market Cap: $19,357,707.58 (ranking #881 globally)

- Fully Diluted Valuation: $20,955,928.62

- Circulating Supply: 9,118,091,184 ALI (92.37% of total supply)

- Total Supply: 9,870,903,732.81 ALI

- 24-Hour Trading Volume: $21,504.17

- Market Dominance: 0.00065%

- Active Token Holders: 16,147

Trading Range (24-Hour):

- High: $0.002128

- Low: $0.002025

Click to view current ALI market price

ALI Market Sentiment Index

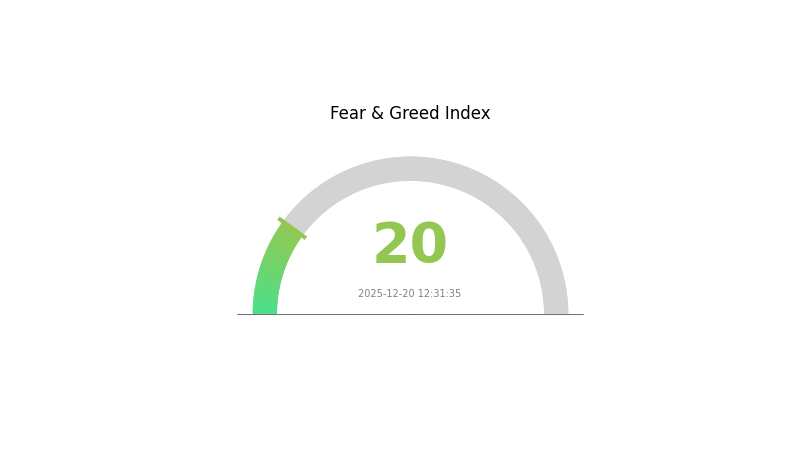

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the index plummeting to 20. This historically low reading suggests investors are highly cautious and risk-averse. Such extreme fear often creates opportunities for contrarian traders, as markets tend to recover from these oversold conditions. However, continued vigilance is essential as this sentiment reflects significant market uncertainty. Traders should consider their risk tolerance carefully and diversify their portfolios accordingly on Gate.com.

ALI Holdings Distribution

The address holdings distribution chart illustrates how ALI tokens are distributed across the blockchain network by analyzing the top token holders and their respective ownership percentages. This metric serves as a critical indicator of token concentration, market structure health, and the degree of decentralization within the ALI ecosystem.

Current analysis of ALI's top five addresses reveals a moderate concentration pattern. The leading address (0x6c63...0ec75c) commands 20.06% of total holdings, while the second-largest holder (0x404f...79c770) controls 9.98%. The top five addresses collectively account for 46.76% of all ALI tokens in circulation, indicating that a significant portion of the token supply remains distributed among these major stakeholders. However, the relatively balanced distribution among the top five addresses—with no single entity dominating excessively—suggests a less concerning concentration scenario compared to highly centralized tokens where top holders exceed 30-40% individually.

The remaining 53.24% of ALI tokens held across all other addresses demonstrates meaningful decentralization, which mitigates extreme concentration risks. This distribution pattern suggests that while institutional or early investors maintain substantial positions, the token ecosystem maintains sufficient holder diversity to reduce vulnerability to coordinated price manipulation or sudden large liquidations. The current structure indicates a relatively stable on-chain foundation, though continuous monitoring of whether the top addresses exhibit accumulation or distribution trends would be essential for assessing long-term market dynamics and potential governance implications.

Click to view current ALI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6c63...0ec75c | 1980159.51K | 20.06% |

| 2 | 0x404f...79c770 | 985833.33K | 9.98% |

| 3 | 0x26aa...7603c8 | 659062.52K | 6.67% |

| 4 | 0x9812...4ef859 | 500000.00K | 5.06% |

| 5 | 0x7871...6f2a1d | 492701.64K | 4.99% |

| - | Others | 5253146.74K | 53.24% |

II. Core Factors Influencing ALI's Future Price Trajectory

Technology Development and Ecosystem Construction

-

AI Large Language Model Innovation: Alibaba launched Qwen 2.5 Max, a large-scale Mixture of Experts (MoE) model with over 20 trillion tokens of pre-training data. In all 11 benchmark tests, it surpassed competing models including DeepSeek V3 and Llama-3.1-405B. The model demonstrates exceptional capability in understanding business scenarios, providing precise business strategy recommendations, marketing copywriting, and market trend analysis for enterprises.

-

Cloud Infrastructure Upgrade: In September 2025, Alibaba Cloud announced a major upgrade of its entire AI technology stack, including new servers, network technology, distributed storage solutions, and computing clusters. The company plans to expand international data centers across Brazil, France, the Netherlands, Malaysia, Dubai, Mexico, Japan, and South Korea, with capacity projected to increase five-fold compared to 2022 levels.

-

AI Revenue Growth: AI-related product revenues have achieved triple-digit year-over-year growth for nine consecutive quarters. Cloud Intelligence business unit revenue grew 34% to $5.6 billion, with adjusted EBITDA increasing 89% to 2.7 billion RMB and EBITDA margin expanding 4 percentage points to 9%.

-

Ecosystem Application: Qwen platform achieved over 10 million downloads in its first week of public release. Alibaba Cloud provides comprehensive one-stop services including model invocation, custom development, and deployment operations, significantly lowering the barrier to entry for enterprises using AI technology. Strategic partnership with Apple to integrate AI capabilities into iPhones for the Chinese market demonstrates the technical maturity and compliance of Alibaba's AI solutions.

Macroeconomic Environment

-

Monetary Policy Impact: As a leading AI infrastructure provider in China, Alibaba benefits from China's emphasis on technological self-sufficiency and capital investment. The company announced 380 billion RMB in investments over three years for cloud computing and AI infrastructure, exceeding total spending from the previous decade, reflecting strong policy support for domestic AI development.

-

Geopolitical Factors: U.S.-China tensions may limit access to critical semiconductor technologies and hinder expansion plans. However, China's focus on technological independence creates tailwinds for domestic AI infrastructure providers. The strong support from mainland Chinese investors, with net purchases of 13.5 billion Hong Kong dollars in a single week through Stock Connect channels, reflects confidence in Alibaba's long-term positioning.

Institutional and Major Holder Dynamics

-

Analyst Consensus: At least 20 analysts have raised Alibaba's price targets since the latest earnings release. The average analyst price target indicates approximately 17% upside potential over the next year. Citibank raised its price target from $187 to $217, reaffirming a "buy" rating, citing stronger cloud computing and data center capital expenditure assumptions as key drivers.

-

Stock Buyback Program: In the first half of fiscal 2025, a $4.1 billion stock repurchase plan reduced outstanding shares by 4.4%, providing direct support to stock price through capital allocation strategy.

-

Cash Reserves: Alibaba has accumulated 352.1 billion RMB in cash reserves, providing substantial financial flexibility to fund its aggressive AI infrastructure investments and weather market uncertainties.

Three、2025-2030 ALI Price Forecast

2025 Outlook

- Conservative Forecast: $0.00178 - $0.00212

- Neutral Forecast: $0.00212

- Optimistic Forecast: $0.00284 (requires sustained market sentiment and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with moderate growth trajectory as the project matures and adoption increases

- Price Range Forecast:

- 2026: $0.00191 - $0.00362 (16% potential upside)

- 2027: $0.00241 - $0.00369 (43% potential upside)

- Key Catalysts: Enhanced platform functionality, expanded partnerships, increased institutional interest, and broader market recovery in the crypto sector

2028-2030 Long-term Outlook

- Base Case Scenario: $0.00216 - $0.00425 by 2028 (assumes steady ecosystem growth and moderate market expansion)

- Optimistic Scenario: $0.00303 - $0.00567 by 2029 (assumes significant adoption acceleration and favorable macroeconomic conditions)

- Transformative Scenario: $0.00331 - $0.00498 by 2030 (assumes breakthrough innovations, mainstream integration, and substantial market capitalization increase of approximately 123%)

- 2030-12-31: ALI reaching $0.00474 average price (reflecting 123% cumulative growth from 2025 baseline, indicating mature market positioning)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00284 | 0.00212 | 0.00178 | 0 |

| 2026 | 0.00362 | 0.00248 | 0.00191 | 16 |

| 2027 | 0.00369 | 0.00305 | 0.00241 | 43 |

| 2028 | 0.00425 | 0.00337 | 0.00216 | 58 |

| 2029 | 0.00567 | 0.00381 | 0.00331 | 79 |

| 2030 | 0.00498 | 0.00474 | 0.00303 | 123 |

Artificial Liquid Intelligence (ALI) Professional Investment Strategy and Risk Management Report

IV. ALI Professional Investment Strategy and Risk Management

ALI Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Believers in AI-driven NFT technology; long-term cryptocurrency portfolio diversifiers; investors with high risk tolerance seeking exposure to emerging AI and blockchain intersections

- Operational Recommendations:

- Accumulate ALI during market downturns, particularly given the current 82.03% year-over-year decline which may present entry opportunities for conviction investors

- Hold through protocol development cycles and ecosystem expansion announcements

- Reinvest any protocol rewards or staking yields to compound returns over time

- Maintain a minimum holding period of 12-24 months to weather market volatility

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Price Action: Current price of $0.002123 sits between the 24-hour low of $0.002025 and high of $0.002128, suggesting consolidation patterns

- Volume Analysis: Monitor the 24-hour trading volume of 21,504.17 ALI against historical averages to identify breakout opportunities or trend confirmation

-

Wave Trading Key Points:

- Enter positions when price approaches historical support levels established by the 24-hour lows

- Take partial profits during 1-3% daily upswings to reduce capital risk

- Avoid holding through major market-wide corrections, given the 10.9% weekly decline

ALI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto portfolio; primarily for diversification into AI-NFT sector exposure rather than significant capital allocation

- Active Investors: 3-5% of total crypto portfolio; allows for meaningful positions while maintaining prudent risk management

- Professional Investors: 5-10% of total crypto portfolio; suitable for those with dedicated research capacity and high risk tolerance for emerging protocols

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Deploy capital in monthly tranches rather than lump-sum purchases to reduce timing risk and average entry prices

- Portfolio Diversification: Balance ALI holdings with established Layer-1 or Layer-2 blockchain assets to mitigate concentration risk in early-stage protocols

(3) Secure Storage Solutions

- Hot Wallet Approach: Gate Web3 Wallet offers a balance of convenience and security for active traders requiring frequent access to ALI tokens

- Cold Storage Method: Transfer ALI holdings to hardware-secured addresses on the Ethereum blockchain for long-term storage, reducing exposure to exchange hacks or wallet vulnerabilities

- Security Precautions: Never share private keys or seed phrases; use hardware wallets for holdings exceeding $5,000 USD; enable multi-signature authentication where available

V. ALI Potential Risks and Challenges

ALI Market Risk

- Extreme Volatility: ALI has experienced an 82.03% decline over the past year and a 17.48% drop over 30 days, reflecting significant price instability and illiquidity relative to larger-cap tokens

- Low Liquidity: With only 8 exchange listings and $21,504 in 24-hour volume, ALI faces substantial slippage on large trades, limiting institutional adoption potential

- Market Sentiment Risk: The token currently ranks #881 by market cap with only 16,147 unique holders, indicating limited community adoption and potential for sudden price collapse if key holders exit

ALI Regulatory Risk

- ERC-20 Compliance Uncertainty: As regulatory frameworks for AI-generated NFTs remain undefined in most jurisdictions, future compliance requirements could impact protocol functionality or token utility

- Securities Classification Risk: Depending on how ALI token governance functions evolve, regulators may reclassify the token, triggering compliance obligations or delisting requirements

- Jurisdiction-Specific Restrictions: Certain countries may restrict iNFT creation or trading, limiting addressable market and revenue potential for the Alethea AI ecosystem

ALI Technology Risk

- Protocol Maturity: As an emerging AI-NFT protocol, Alethea AI faces execution risk on roadmap commitments, including the Noah Metaverse development and iNFT training infrastructure scaling

- Smart Contract Vulnerability: Early-stage protocols are susceptible to undiscovered code vulnerabilities; audits do not eliminate all smart contract risk

- AI Model Deprecation: Rapid advances in generative AI technology may render current iNFT training models obsolete, requiring significant protocol upgrades and potentially diluting existing token value

VI. Conclusion and Action Recommendations

ALI Investment Value Assessment

Artificial Liquid Intelligence (ALI) represents a speculative investment in the intersection of generative AI and blockchain technology. While the Alethea AI protocol addresses an innovative use case combining intelligent NFTs with decentralized governance, the token's 82% annual decline, minimal trading volume, and limited holder base suggest early-stage risk. The project's long-term viability depends heavily on protocol adoption, iNFT ecosystem growth, and regulatory clarity around AI-generated digital assets. Current market conditions reflect investor skepticism regarding commercialization timelines and competitive positioning against larger AI-focused blockchain projects.

ALI Investment Recommendations

✅ Beginners: Start with a micro-allocation (0.1-0.5% of crypto portfolio) via Gate.com if you wish to gain AI-blockchain sector exposure; use dollar-cost averaging over 3-6 months; prioritize learning about the iNFT protocol before increasing position size.

✅ Experienced Investors: Consider a 2-5% allocation as a speculative position within a diversified portfolio; establish clear entry points aligned with ecosystem milestone announcements; maintain strict stop-loss orders at 30-40% below entry price given elevated volatility.

✅ Institutional Investors: Conduct thorough due diligence on Alethea AI's technical roadmap, team credentials, and competitive positioning before any commitment; monitor regulatory developments affecting AI governance tokens; consider this allocation only within innovation-focused venture crypto strategies with 5+ year time horizons.

ALI Trading Participation Methods

- Direct Spot Trading: Purchase ALI directly on Gate.com, which supports the token across multiple trading pairs

- Dollar-Cost Averaging Program: Establish automated weekly or monthly purchases through Gate.com to reduce timing risk and average purchase prices

- Limit Order Strategy: Set buy orders at key support levels (previous 24-hour lows) and sell orders at resistance levels to manage entry and exit discipline

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and financial circumstances. Always consult qualified financial advisors before committing capital. Never invest more than you can afford to lose completely.

FAQ

Does Ali Coin have a future?

Ali Coin shows promising potential for future growth. With increasing market interest and strong fundamentals, predictions suggest it could reach $0.00210535 by 2028. The outlook remains positive for long-term investors.

Is Ali a good buy?

Yes, Ali shows strong investment potential with solid fundamentals and growing market demand. The token has demonstrated resilience and offers attractive entry opportunities for long-term holders seeking exposure to the Web3 ecosystem.

What is the current price of ALI coin and how has it performed historically?

ALI is currently trading at $0.002104 USD with a market cap of $19.19M. Historically, the token has experienced fluctuations but remains below $0.01, showing steady consolidation in the mid-tier price range.

What factors influence ALI coin price movements?

ALI price movements are driven by supply and demand dynamics, market sentiment, trading volume, protocol updates, technological developments, and broader cryptocurrency market trends.

What are the risks associated with investing in ALI coin?

ALI coin faces market volatility risks, potential price manipulation, and regulatory uncertainty. As an emerging crypto asset, liquidity fluctuations and technology risks exist. Investors should conduct thorough research before participating in this market segment.

Is Schrodinger (SGR) a good investment?: Analyzing the Potential of this Biotech Stock in a Volatile Market

VANA vs BAT: The Battle for AI Supremacy in the Tech Industry

Is Schrodinger (SGR) a good investment? A Comprehensive Analysis of the Biotech Company's Financial Performance, Technology Platform, and Future Growth Prospects

Is Atlas Navi (ANAVI) a good investment? Comprehensive Analysis of Market Performance, Use Cases, and Risk Factors for 2024

Sahara AI (SAHARA) Price Analysis: Recent Volatility Trends and Market Correlations

why is crypto crashing and will it recover ?

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?