2025 AFC Price Prediction: Bullish Outlook as Adoption and Utility Drive Growth

Introduction: AFC's Market Position and Investment Value

Arsenal Fan Token (AFC), as the official fan token of Arsenal Football Club, has been strengthening the relationship between fans and the club since its inception. As of 2025, AFC's market capitalization has reached $4,339,473, with a circulating supply of approximately 11,599,769 tokens, and a price hovering around $0.3741. This asset, often referred to as a "digital fan engagement tool," is playing an increasingly crucial role in sports fan interaction and club decision-making processes.

This article will comprehensively analyze AFC's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. AFC Price History Review and Current Market Status

AFC Historical Price Evolution

- 2021: All-time high of $8.13 reached on October 27, marking peak market enthusiasm

- 2025: All-time low of $0.297579 recorded on October 11, indicating significant market correction

- 2021-2025: Prolonged bear market cycle, price declined from $8.13 to under $0.40

AFC Current Market Situation

The Arsenal Fan Token (AFC) is currently trading at $0.3741, showing a 7.74% increase in the last 24 hours. Despite this short-term uptick, AFC has experienced a substantial 57.17% decline over the past year. The token's market capitalization stands at $4,339,473, with a circulating supply of 11,599,769 AFC out of a total supply of 40,000,000. The fully diluted valuation is $14,964,000, indicating potential for growth if the entire supply enters circulation. AFC's trading volume in the last 24 hours is $123,277, suggesting moderate market activity. The token is currently ranked 1651 in the cryptocurrency market, reflecting its niche position in the fan token segment.

Click to view the current AFC market price

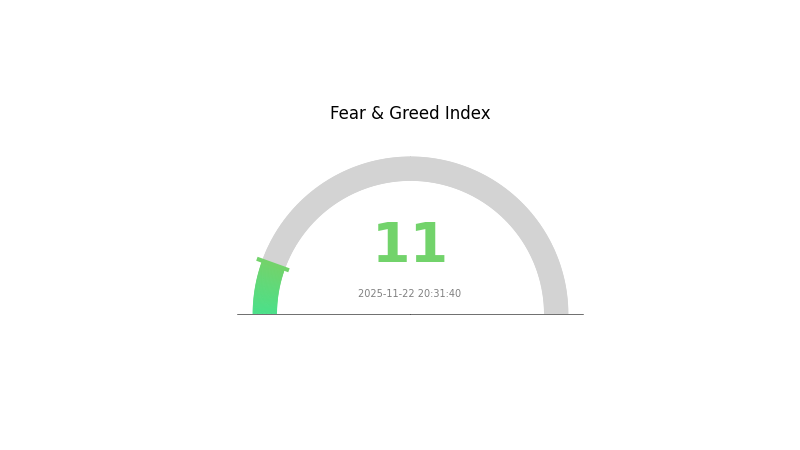

AFC Market Sentiment Indicator

2025-11-22 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the sentiment index plummeting to 11. This heightened anxiety suggests a potential buying opportunity for savvy investors, as markets often overreact in times of panic. However, caution is advised. While historically low index values have preceded market rebounds, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Stay informed and trade wisely on Gate.com.

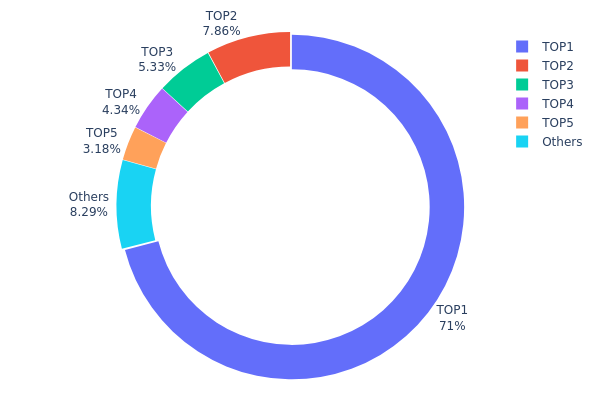

AFC Holdings Distribution

The address holdings distribution data for AFC reveals a highly concentrated ownership structure. The top address holds a staggering 71% of the total supply, with 28,400,230 AFC tokens. This level of concentration is significant and potentially concerning for market stability. The next four largest holders collectively account for an additional 20.71% of the supply, leaving only 8.29% distributed among all other addresses.

Such a concentrated distribution raises questions about the token's decentralization and market vulnerability. With over 90% of the supply controlled by just five addresses, there's an increased risk of price manipulation and volatility. The dominant address, in particular, has the potential to significantly impact market dynamics with any large-scale transactions.

This distribution pattern suggests a relatively immature market structure for AFC, with limited widespread adoption at present. It may indicate that the token is still in early stages of distribution or that a significant portion is held by project insiders or large institutional investors. Potential investors should be aware of these dynamics, as they could influence price stability and liquidity in the AFC market.

Click to view the current AFC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6F45...41a33D | 28400.23K | 71.00% |

| 2 | 0xc368...816880 | 3142.45K | 7.86% |

| 3 | 0xc80A...e92416 | 2133.45K | 5.33% |

| 4 | 0x76eC...78Fbd3 | 1736.38K | 4.34% |

| 5 | 0x50B1...B5017f | 1270.95K | 3.18% |

| - | Others | 3316.53K | 8.29% |

II. Key Factors Affecting AFC's Future Price

Macroeconomic Environment

- Impact of Monetary Policy: Major central banks are expected to maintain accommodative policies in the near term, which could potentially benefit crypto assets like AFC.

- Inflation Hedging Properties: In the current inflationary environment, AFC may be viewed as a potential hedge against currency devaluation.

- Geopolitical Factors: Ongoing global tensions and economic uncertainties could drive interest in alternative assets like AFC.

Technological Development and Ecosystem Building

- Ecosystem Applications: AFC is likely developing its ecosystem with various DApps and projects, which could enhance its utility and value proposition.

III. AFC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.29904 - $0.3738

- Neutral prediction: $0.3738 - $0.46351

- Optimistic prediction: $0.46351 - $0.55322 (requires strong market momentum)

2027-2028 Outlook

- Market phase expectation: Potential consolidation followed by gradual growth

- Price range forecast:

- 2027: $0.42189 - $0.53508

- 2028: $0.4933 - $0.62975

- Key catalysts: Increasing adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.57727 - $0.59747 (assuming steady market growth)

- Optimistic scenario: $0.61768 - $0.72892 (assuming accelerated adoption)

- Transformative scenario: $0.72892 - $0.80000 (exceptional market conditions and widespread use)

- 2030-12-31: AFC $0.72892 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.55322 | 0.3738 | 0.29904 | 0 |

| 2026 | 0.56548 | 0.46351 | 0.25957 | 23 |

| 2027 | 0.53508 | 0.5145 | 0.42189 | 37 |

| 2028 | 0.62975 | 0.52479 | 0.4933 | 40 |

| 2029 | 0.61768 | 0.57727 | 0.34636 | 54 |

| 2030 | 0.72892 | 0.59747 | 0.39433 | 59 |

IV. AFC Professional Investment Strategies and Risk Management

AFC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Football enthusiasts and long-term crypto investors

- Operation suggestions:

- Accumulate AFC tokens during price dips

- Participate in club decisions to maximize token utility

- Store tokens in a secure Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Determine overbought/oversold conditions

- Key points for swing trading:

- Monitor club news and performance for potential price impacts

- Set stop-loss orders to manage downside risk

AFC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance AFC with other crypto assets and traditional investments

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. AFC Potential Risks and Challenges

AFC Market Risks

- High volatility: Fan token prices can fluctuate dramatically

- Limited liquidity: Potential difficulty in executing large trades

- Correlation with team performance: Price may be affected by club's success

AFC Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations on fan tokens

- Cross-border restrictions: Possible limitations on international trading

- Tax implications: Evolving tax treatment of fan token transactions

AFC Technical Risks

- Smart contract vulnerabilities: Potential for hacks or exploits

- Blockchain network issues: Possible transaction delays or higher fees

- Wallet security: Risk of loss due to inadequate security measures

VI. Conclusion and Action Recommendations

AFC Investment Value Assessment

AFC offers unique potential for fan engagement and speculative gains, but carries significant volatility and regulatory uncertainty. Long-term value depends on Arsenal's performance and fan token adoption.

AFC Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about fan token utility

✅ Experienced investors: Consider AFC as part of a diversified crypto portfolio

✅ Institutional investors: Conduct thorough due diligence, monitor regulatory developments

AFC Trading Participation Methods

- Spot trading: Buy and sell AFC tokens on Gate.com

- Staking: Participate in potential staking programs for additional rewards

- Fan engagement: Utilize AFC tokens for club-related activities and voting

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is AFC Energy a good buy?

AFC Energy shows promise in the clean energy sector. With growing demand for hydrogen fuel cells, it could be a good long-term investment. However, always research thoroughly before investing.

What is the stock price forecast for AFC?

AFC's price is expected to reach $0.15 by the end of 2025, with potential for further growth in 2026 due to increased adoption and market demand.

What are the risks of investing in AFC Energy?

Risks include market volatility, regulatory changes, technological challenges, and competition in the clean energy sector. AFC's performance may be affected by shifts in hydrogen demand and energy policies.

What is happening to AFC Energy?

AFC Energy is experiencing growth in the clean energy sector, with increasing demand for its hydrogen fuel cell technology. The company is expanding its partnerships and projects globally.

Share

Content