2025 AERGO Price Prediction: Expert Analysis and Market Forecast for the Next 12 Months

Introduction: Aergo's Market Position and Investment Value

Aergo (AERGO) is an open-source hybrid blockchain protocol designed for enterprise and government use cases, combining the advantages of both public and private blockchains. Since its inception in 2017, Aergo has established itself as a platform enabling enterprises to share data and build innovative applications within a trustless and distributed IT ecosystem. As of December 2025, Aergo's market capitalization stands at approximately $33.06 million, with a circulating supply of around 472.5 million tokens, currently trading at $0.06612 per token. This utility-driven asset continues to play an increasingly important role in the enterprise blockchain and hybrid blockchain ecosystem.

This article will provide a comprehensive analysis of Aergo's price trajectory and market dynamics, combining historical trends, supply-demand dynamics, ecosystem development, and macroeconomic factors to offer investors professional price forecasts and actionable investment strategies for the period through 2030.

AERGO Market Analysis Report

I. AERGO Price History Review and Current Market Status

AERGO Historical Price Evolution

AERGO was launched on December 18, 2018, with an initial listing price of $0.01. The token has experienced significant volatility throughout its market history:

- All-Time High (ATH): $0.658178 reached on April 16, 2025

- All-Time Low (ATL): $0.01354723 reached on March 13, 2020

- Price Range: The token has traded within a range representing approximately a 48x difference between its peak and lowest valuations

Over the past year, AERGO has declined 50.66%, reflecting broader market pressures and sector-specific challenges. However, the token demonstrated notable strength over the 7-day period with a 25.67% gain, suggesting recent positive momentum despite longer-term headwinds.

AERGO Current Market Condition

Price and Market Capitalization:

- Current Price: $0.06612 (as of December 19, 2025, 18:29:43 UTC)

- 24-Hour Range: $0.06485 - $0.07586

- Market Capitalization: $31.24 million

- Fully Diluted Valuation: $33.06 million

- Market Dominance: 0.0010%

Trading Activity:

- 24-Hour Volume: $733,694.53

- Market Cap to FDV Ratio: 94.5%

- Circulating Supply: 472,499,995.77 AERGO (94.50% of total supply)

- Total Supply: 500,000,000 AERGO

- Number of Holders: 9,431

Price Performance:

- 1-Hour Change: -0.66%

- 24-Hour Change: -1.3%

- 7-Day Change: +25.67%

- 30-Day Change: -4.22%

- Year-to-Date Change: -50.66%

AERGO is currently listed on 19 exchanges and maintains active development with presence on multiple platforms including Ethereum (contract: 0x91af0fbb28aba7e31403cb457106ce79397fd4e6).

Click to view current AERGO market price

AERGO Market Sentiment Index

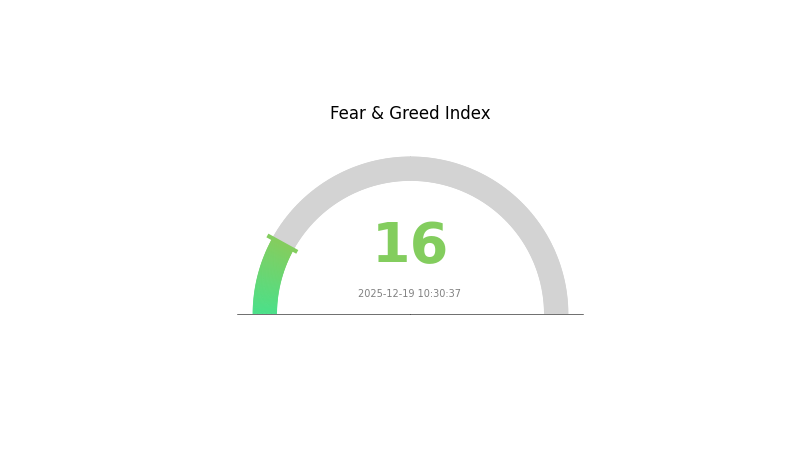

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The market is currently experiencing extreme fear, with the Fear and Greed Index registering at just 16 points. This exceptionally low reading indicates widespread investor anxiety and pessimistic sentiment across the cryptocurrency market. During periods of extreme fear, assets are typically undervalued as panic selling intensifies. Experienced investors often view such conditions as potential buying opportunities, as historical data suggests markets tend to recover from extreme fear phases. However, caution remains essential as further downside could still occur. Monitor market developments closely on Gate.com to identify entry points aligned with your investment strategy.

AERGO Holdings Distribution

The address holdings distribution chart provides a detailed breakdown of AERGO token concentration across blockchain addresses, revealing the proportion of total token supply held by major stakeholders. This metric serves as a critical indicator for assessing decentralization levels, market structure stability, and potential systemic risks within the AERGO ecosystem.

AERGO exhibits pronounced concentration characteristics, with the top address commanding 59.09% of total token supply, representing a significant centralization concern. The top five addresses collectively hold 76.75% of all tokens, while the remaining network participants share only 23.25%. This distribution pattern indicates substantial holder concentration, primarily driven by a single dominant address that controls nearly three-fifths of the circulating supply. Such extreme concentration suggests potential governance risks and raises questions regarding the token's true decentralization status within the broader Web3 landscape.

The highly concentrated holdings structure creates meaningful implications for market dynamics and price stability. A single large stakeholder wielding nearly 60% of token supply possesses considerable influence over market movements, liquidity provision, and protocol governance decisions. This concentration amplifies concerns regarding potential market manipulation, sudden liquidation risks, and reduced resilience against adverse price movements. Furthermore, the remaining minority holders face elevated counterparty risk exposure, as major decisions or token transfers by top holders could disproportionately impact overall market sentiment and volatility. The current distribution pattern reflects a market structure characterized by low decentralization, concentrated decision-making power, and elevated structural fragility that merit careful monitoring by investors and stakeholders.

Click to view current AERGO holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4814...904c71 | 295490.92K | 59.09% |

| 2 | 0xfefb...88a923 | 34932.06K | 6.98% |

| 3 | 0xc29b...b7eee5 | 29599.59K | 5.91% |

| 4 | 0x3c96...16c89d | 12499.84K | 2.49% |

| 5 | 0x91d4...c8debe | 11432.33K | 2.28% |

| - | Others | 116045.26K | 23.25% |

II. Core Factors Affecting AERGO's Future Price

Technology Development and Ecosystem Building

-

Smart Contract Engine: AERGO's core technology features a smart contract engine with SQL-compatible Lua smart contract language, enabling developers to build applications with greater accessibility and efficiency compared to traditional blockchain development environments.

-

Market Dynamics: AERGO's future price is influenced by market demand, project development progress, and broader cryptocurrency market trends. Regulatory changes and technological advancements play key roles in determining price movements.

Macro Economic Environment

- Market Volatility Impact: Current cryptocurrency market volatility adds significant uncertainty to AERGO price forecasts. Market trends, technical developments, and regulatory changes all directly influence price prediction outcomes and investor sentiment.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrency markets carry substantial risk. Always conduct thorough research and consult with qualified financial professionals before making investment decisions. Past performance does not guarantee future results.

III. 2025-2030 AERGO Price Forecast

2025 Outlook

- Conservative Forecast: $0.0336 - $0.0660

- Neutral Forecast: $0.0660

- Bullish Forecast: $0.0917 (requiring sustained ecosystem development and increased institutional adoption)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with steady growth trajectory as the project matures and market sentiment stabilizes

- Price Range Forecast:

- 2026: $0.0615 - $0.1041

- 2027: $0.0887 - $0.1317

- 2028: $0.0792 - $0.1528

- Key Catalysts: Enterprise blockchain adoption, improvement in DeFi ecosystem integration, strategic partnerships in the Web3 infrastructure space, and positive regulatory developments

2029-2030 Long-term Outlook

- Base Case: $0.0991 - $0.1573 (assuming steady technological advancement and moderate market expansion)

- Optimistic Case: $0.1321 - $0.1573 (assuming accelerated mainstream adoption and successful enterprise solutions deployment)

- Transformational Case: $0.1375 - $0.1549 (assuming breakthrough in scalability solutions, major institutional backing, and AERGO becoming a key infrastructure player in enterprise blockchain networks)

- 2030-12-19: AERGO projected near $0.1549, representing approximately 118% potential upside from baseline levels (if favorable conditions materialize across adoption metrics and market sentiment)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.09168 | 0.06596 | 0.03364 | 0 |

| 2026 | 0.10405 | 0.07882 | 0.06148 | 19 |

| 2027 | 0.13166 | 0.09143 | 0.08869 | 38 |

| 2028 | 0.15282 | 0.11155 | 0.0792 | 68 |

| 2029 | 0.1573 | 0.13219 | 0.09914 | 99 |

| 2030 | 0.15488 | 0.14474 | 0.13751 | 118 |

Aergo (AERGO) Professional Investment Strategy and Risk Management Report

IV. AERGO Professional Investment Strategy and Risk Management

AERGO Investment Methodology

(1) Long-Term Holding Strategy

- Target Audience: Enterprise-focused investors, blockchain infrastructure believers, and risk-averse institutional participants

- Operational Recommendations:

- Accumulate AERGO during market downturns when prices deviate significantly from fundamental value, leveraging the current -50.66% yearly decline as a potential entry opportunity

- Maintain a 12-24 month holding period to benefit from enterprise adoption cycles and ecosystem development

- Reinvest platform utility rewards to compound token holdings

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour trading range ($0.06485 - $0.07586) and historical price points to identify entry and exit zones

- Volume Analysis: Track the $733,694.53 daily volume to confirm breakout signals and validate price movements

- Wave Trading Key Points:

- Capitalize on the 7-day uptrend of +25.67% to establish partial profit-taking targets at resistance levels

- Implement dollar-cost averaging during consolidation phases to reduce average acquisition costs

AERGO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% portfolio allocation

- Active Investors: 5-8% portfolio allocation

- Professional Investors: 10-15% portfolio allocation

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine AERGO holdings with established Layer-1 blockchain assets to reduce concentration risk

- Position Sizing: Implement strict position limits based on individual risk tolerance and maintain emergency liquidity reserves

(3) Secure Storage Solutions

- Hot Wallet Management: Gate.com Web3 Wallet for frequent trading and immediate liquidity needs

- Cold Storage Best Practices: Transfer long-term holdings to hardware solutions for enhanced security

- Security Precautions: Never share private keys, enable two-factor authentication on all exchange accounts, and regularly audit wallet access permissions

V. AERGO Potential Risks and Challenges

AERGO Market Risk

- Extreme Price Volatility: AERGO exhibits significant volatility with a 94.5% market cap to fully diluted valuation ratio, indicating potential dilution risks as supply approaches the 500 million token maximum

- Low Trading Liquidity: With $733,694.53 in daily volume and a $31.2 million market cap, AERGO faces liquidity constraints that could amplify price movements during large trades

- Historical Underperformance: The -50.66% one-year decline and distance from all-time high of $0.658178 (achieved on April 16, 2025) suggest sustained market skepticism

AERGO Regulatory Risk

- Jurisdiction Uncertainty: As an enterprise-focused blockchain platform, AERGO may face evolving regulatory scrutiny regarding securities classification and compliance obligations in major jurisdictions

- Cross-Border Operations: Providing infrastructure for government and enterprise use cases introduces regulatory complexity across multiple regions

- Compliance Requirements: Stricter anti-money laundering and know-your-customer standards could impact platform adoption and token utility

AERGO Technical Risk

- Competition from Established Platforms: AERGO faces intense competition from established enterprise blockchain solutions with greater resources and market penetration

- Consensus Mechanism Challenges: Reliance on BFT dPOS for mainnet operations and POA consensus for private chains introduces technical complexity and potential vulnerability vectors

- Development Sustainability: Ongoing maintenance and upgrade requirements for hybrid architecture could strain development resources

VI. Conclusion and Action Recommendations

AERGO Investment Value Assessment

Aergo presents a specialized investment case for enterprise blockchain infrastructure participants. The platform's hybrid architecture combining public decentralization with private performance optimization addresses genuine enterprise demand. However, the current market position reflects investor concerns about adoption rates and competitive differentiation. At a $33.06 million market cap with 94.5% circulating supply ratio, AERGO offers asymmetric risk-reward potential for long-term believers in enterprise blockchain adoption, balanced against substantial execution and market adoption uncertainties.

AERGO Investment Recommendations

✅ Beginners: Start with minimal positions (1-2% portfolio) through Gate.com, focusing on understanding platform fundamentals before increasing exposure ✅ Experienced Investors: Implement a layered accumulation strategy during price weakness, targeting the $0.05-0.06 support level with core position building ✅ Institutional Investors: Evaluate AERGO's enterprise adoption metrics and competitive positioning before considering significant allocation, particularly for infrastructure-focused blockchain funds

AERGO Trading Participation Methods

- Spot Trading: Purchase AERGO directly on Gate.com for long-term holdings with no leverage risk

- Limit Orders: Set buy orders at historical support levels ($0.05-0.06 range) to optimize entry prices during market volatility

- Dollar-Cost Averaging: Execute fixed-amount purchases at regular intervals to mitigate timing risk and reduce average acquisition cost

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and are strongly encouraged to consult with professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

How high can an Aergo coin go?

Aergo previously reached an all-time high of $0.6582. Future price depends on market adoption, technology development, and overall market conditions. Potential upside exists with increased utility and ecosystem growth, but prices remain highly volatile and unpredictable.

What happened to Aergo Crypto?

Aergo experienced a severe price crash exceeding 70% in April 2025, raising market concerns. The project's development trajectory shifted, and trading activity declined significantly. Current market sentiment remains cautious as the ecosystem undergoes transition.

Who is the owner of Aergo coin?

Aergo coin was founded by Phil Zamani and Won-Beom Kim in 2017. The project is community-driven and governed through its blockchain protocol rather than single ownership.

Does ergo have a future?

Yes, Ergo shows strong potential for future growth. With solid technical fundamentals and an active development community, ERG is positioned for continued expansion in the blockchain ecosystem.

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

2025 DOT Price Prediction: Will Polkadot Reach $100 Amid Growing Adoption?

2025 NANO Price Prediction: Market Analysis and Growth Potential for the Digital Currency

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?