2025 AA Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: AA's Market Position and Investment Value

ARAI (AA) is building the next-generation interaction layer for Web3, powered by autonomous AI agents. Its core engine, Arai Systems, introduces modular Co-Pilot Agents with real-time perception, strategic reasoning, and adaptive decision-making capabilities. As of January 2026, ARAI has achieved a market capitalization of $9.31 million, with a circulating supply of approximately 14.45 million tokens trading at $0.00931 per unit. This innovative asset is playing an increasingly crucial role in automating complex operations across games and on-chain finance with unprecedented personalization and control.

This article will provide a comprehensive analysis of ARAI's price trends through 2026-2031, incorporating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors considering exposure to this emerging AI-driven Web3 platform.

ARAI (AA) Price Analysis Report

I. AA Price History Review and Current Market Status

AA Historical Price Trajectory

-

September 2025: ARAI reached its all-time high (ATH) of $0.20146, marking the peak of the project's price performance during this period.

-

December 2025: ARAI experienced a significant decline, reaching its all-time low (ATL) of $0.007723 on December 26, 2025, representing a sharp correction from previous highs.

AA Current Market Situation

As of January 3, 2026, ARAI is trading at $0.00931, with a 24-hour trading volume of $23,482.73. The token demonstrates recent positive momentum, gaining 3.55% over the last 24 hours and 1.2% in the past hour. Over a 7-day period, ARAI has appreciated 11.36%, suggesting some recovery from its December lows.

However, the medium and long-term outlook remains challenging. Over the past 30 days, ARAI has declined 85.34%, and the one-year performance shows a loss of 82.87%, indicating substantial headwinds since its September peak. The fully diluted valuation stands at $9.31 million, with a circulating market capitalization of $134,529.50. Circulating supply represents 1.44% of the total 1 billion token supply, with 14.45 million tokens currently in circulation.

The token maintains a presence across 10 exchanges and has accumulated 30,680 token holders. Market sentiment reflects a cautious environment, as indicated by current fear-based market conditions.

Click to view current AA market price

Crypto Market Sentiment Indicator

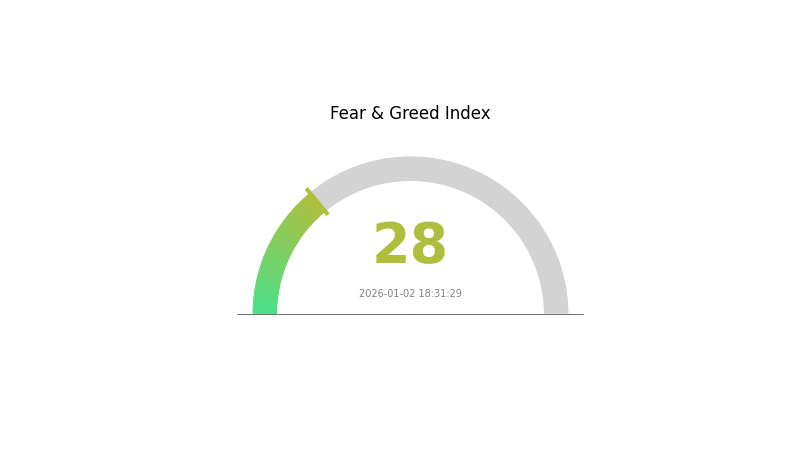

2026-01-02 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a fear sentiment with an index reading of 28, indicating heightened market anxiety. This level suggests that investors are adopting a cautious stance, with increased uncertainty about near-term price movements. During periods of fear, experienced traders often view this as a potential buying opportunity, as excessive pessimism may present attractive entry points. However, risk-averse investors should remain vigilant and continue monitoring market developments closely before making investment decisions.

AA Holdings Distribution

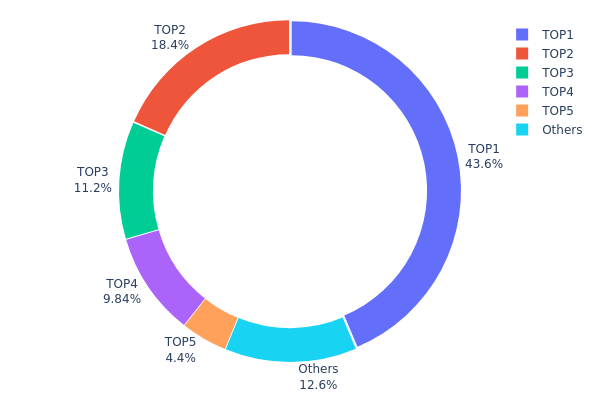

The address holdings distribution map illustrates the concentration of token ownership across the top holders and remaining addresses within a blockchain network. This metric is instrumental in assessing the decentralization level, market structure stability, and potential vulnerability to price manipulation or coordinated actions by major stakeholders.

Analysis of the current AA token distribution reveals a pronounced concentration pattern. The top holder commands 43.64% of total supply, while the combined top four addresses control approximately 83.04% of all tokens in circulation. This represents a significant degree of centralization, with the top two addresses alone accounting for over 62% of holdings. Such concentrated ownership structures typically indicate early-stage projects or those dominated by institutional investors and founding teams, which raises considerations regarding voting power concentration and potential market stability.

The distribution pattern presents meaningful implications for market dynamics and decentralization metrics. With 12.57% of tokens dispersed among remaining addresses, the retail and secondary holder participation remains limited, suggesting potential liquidity constraints and heightened sensitivity to large holder movements. While substantial single-wallet concentration does not necessarily indicate malicious intent, it does create structural vulnerability to significant price volatility should major holders execute sizable transactions. The current configuration reflects a market structure more aligned with early adoption phases, where decentralized participation continues to mature.

Click to view current AA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd128...184cc9 | 436452.37K | 43.64% |

| 2 | 0x61bf...698c04 | 184000.00K | 18.40% |

| 3 | 0xd78a...befd6f | 111600.00K | 11.16% |

| 4 | 0x4005...d8ce0c | 98400.00K | 9.84% |

| 5 | 0x5292...071626 | 43999.00K | 4.39% |

| - | Others | 125548.63K | 12.57% |

II. Core Factors Affecting AA's Future Price

Macro-Economic Environment

-

Monetary Policy Impact: Market expectations suggest that major central banks may adopt more accommodative monetary policies as global economic growth slows and inflationary pressures persist. This environment would lower the opportunity cost of holding alternative assets and provide support for price movements across various commodities and securities.

-

Global Economic Trends: The future price of AA is influenced by market demand, production costs, and global economic conditions. Analysts predict moderate growth based on industry demand dynamics and cost management effectiveness. Long-term prospects depend on technological advancements and regulatory framework changes.

Supply Mechanism

-

Long-Term Demand Drivers: Aluminum represents a critical input for electric vehicles, renewable energy infrastructure, and lightweight construction applications. All these sectors are expected to experience significant growth over the coming decade, providing structural support for long-term aluminum demand and benefiting companies in the aluminum sector.

-

Production Capacity and Cost Control: Vertical integration across mining, refining, and smelting operations enables producers to maintain strong control over costs and supply chains. Even in volatile pricing environments, rigorous capital expenditure discipline and energy efficiency improvements help preserve profit margins during periods of commodity price pressure.

III. Price Forecast for AA (2026-2031)

2026 Outlook

- Conservative Forecast: $0.00788 - $0.00938

- Base Case Forecast: $0.00938

- Optimistic Forecast: $0.01257 (requiring sustained market momentum and positive ecosystem developments)

2027-2029 Medium-term Outlook

- Market Phase Expectation: Gradual accumulation phase with moderate growth trajectory, characterized by increasing institutional interest and ecosystem expansion.

- Price Range Predictions:

- 2027: $0.00593 - $0.01163 (17% upside potential)

- 2028: $0.00735 - $0.01469 (21% growth expected)

- 2029: $0.00923 - $0.01664 (39% appreciation projected)

- Key Catalysts: Platform adoption acceleration, strategic partnerships, technological upgrades, and broader market sentiment improvement toward digital assets.

2030-2031 Long-term Outlook

- Base Scenario: $0.00948 - $0.01615 (59% cumulative gains by 2030, assuming steady ecosystem development and market stabilization)

- Optimistic Scenario: $0.00821 - $0.02276 (66% total appreciation by 2031, contingent on mainstream adoption breakthrough and positive regulatory environment)

- Transformative Scenario: $0.01548 - $0.02276 (substantial upside under conditions of exceptional ecosystem growth, major enterprise integrations, and favorable macroeconomic conditions)

- Jan 03, 2026: AA trading at $0.00938 (baseline valuation point for reference)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.01257 | 0.00938 | 0.00788 | 0 |

| 2027 | 0.01163 | 0.01097 | 0.00593 | 17 |

| 2028 | 0.01469 | 0.0113 | 0.00735 | 21 |

| 2029 | 0.01664 | 0.013 | 0.00923 | 39 |

| 2030 | 0.01615 | 0.01482 | 0.00948 | 59 |

| 2031 | 0.02276 | 0.01548 | 0.00821 | 66 |

ARAI (AA) Professional Investment Strategy and Risk Management Report

IV. AA Professional Investment Strategy and Risk Management

AA Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Believers in autonomous AI agent technology and Web3 infrastructure development

- Operational Recommendations:

- Accumulate during market downturns, particularly given the -85.34% decline over 30 days, which may present entry opportunities for conviction holders

- Establish a dollar-cost averaging (DCA) plan to mitigate volatility and reduce timing risk

- Secure storage on cold storage solutions or custodial services to ensure long-term asset safety

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the historical low of $0.007723 and recent resistance around $0.010399 to identify key price zones

- Moving Averages: Track short-term (1H: +1.2%) and medium-term (7D: +11.36%) trends to identify momentum shifts

- Swing Trading Key Points:

- Watch for recovery bounces from the 30-day low to establish positions with defined risk parameters

- Monitor 24-hour volume patterns ($23,482.73) to confirm breakout authenticity before entering trades

AA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-2% portfolio allocation maximum

- Active Investors: 2-5% portfolio allocation maximum

- Professional Investors: 5-10% portfolio allocation maximum

(2) Risk Mitigation Strategies

- Position Sizing: Implement strict position limits relative to portfolio size given the high volatility (-82.87% over 1 year)

- Stop-Loss Orders: Set predetermined exit points at 15-20% below entry price to protect capital

- Profit-Taking: Lock in gains at predetermined levels (e.g., +30%, +50%) given the extreme price swings

(3) Secure Storage Solutions

- Custody Services: Consider professional custodial solutions for institutional-size holdings to minimize self-custody risks

- Security Protocols: Enable multi-signature authorization and withdrawal whitelisting to prevent unauthorized access

- Security Precautions: Never share private keys, use hardware security measures for sensitive operations, and maintain regular backups of wallet recovery phrases

V. ARAI Potential Risks and Challenges

AA Market Risk

- Extreme Volatility: The token has experienced -85.34% decline over 30 days and -82.87% over 1 year, indicating severe price instability that can lead to rapid capital erosion

- Low Liquidity: 24-hour trading volume of $23,482.73 is relatively modest for the market cap, potentially resulting in slippage on larger trades

- Market Sentiment Deterioration: Current market share of 0.00028% and ranking of 4,571 suggest limited mainstream adoption and investor confidence

AA Regulatory Risk

- Emerging Technology Uncertainty: Autonomous AI agents in blockchain environments face evolving regulatory scrutiny globally, with unclear compliance frameworks

- Jurisdictional Challenges: As a BSC-based token, regulatory changes in key jurisdictions could impact trading accessibility and project viability

- Classification Ambiguity: Regulators may reclassify AI agent tokens, affecting their legal status and trading permissions

AA Technical Risk

- Smart Contract Vulnerability: The modular Co-Pilot agent architecture introduces complexity that may harbor undiscovered security vulnerabilities

- Network Dependency: Reliance on Binance Smart Chain infrastructure exposes the project to BSC-specific risks and network disruptions

- Development Execution: The ambitious vision of autonomous AI agents requires sustained technical development; delays or failures could undermine the project thesis

VI. Conclusion and Action Recommendations

AA Investment Value Assessment

ARAI represents a speculative play on autonomous AI agents in Web3, combining emerging technology trends with significant execution risks. The project's technical vision—modular Co-Pilot agents enabling automation across gaming and onchain finance—addresses real pain points in user experience and operational complexity. However, the extreme price volatility (-85% in 30 days), low market capitalization ($9.31M), and limited liquidity suggest this is an early-stage, high-risk asset suitable only for sophisticated investors with high risk tolerance. The steep declines over recent periods indicate market skepticism regarding near-term prospects, though this may also represent a discounted entry point for long-term believers in the technology thesis.

AA Investment Recommendations

✅ Beginners: Avoid direct exposure; if interested in AI agent themes, research the sector thoroughly before considering any allocation ✅ Experienced Investors: Consider small speculative positions (1-3% of portfolio) only with defined stop-losses and conviction in the autonomous agent thesis ✅ Institutional Investors: Conduct comprehensive technical and regulatory due diligence; if proceeding, use custodial solutions and implement strict risk controls

AA Trading Participation Methods

- Gate.com Spot Trading: Purchase ARAI directly on Gate.com platform with real-time price discovery and order execution

- Dollar-Cost Averaging: Establish recurring buy orders through Gate.com to reduce timing risk and accumulate gradually

- Limit Orders: Set buy orders at support levels ($0.008-$0.009) and sell orders at resistance ($0.010-$0.011) to systematically capture volatility

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and should consult professional financial advisors. Never invest capital you cannot afford to lose completely.

FAQ

What is AA's historical price trend? What were the highest and lowest prices in the past year?

AA reached a high of $16.35 and a low of $15.31 over the past year. The token has demonstrated relatively stable trading within this range, with recent price action showing consolidation near the lower end of the yearly spectrum.

What are the main factors affecting AA price?

AA price is primarily influenced by market supply and demand dynamics, trading volume, investor sentiment, macroeconomic conditions, and broader cryptocurrency market trends. Regulatory developments and technological updates also play significant roles in price movements.

What are the professional AA price prediction methods or tools available currently?

Professional AA price prediction methods include technical analysis using candlestick charts and historical price data. Historical price datasets and K-line data analysis help inform trading decisions and market trend assessment.

How accurate is AA price prediction? What risks should I pay attention to?

AA price prediction accuracy is moderate, influenced by major holders. Key risks include concentrated holdings affecting price volatility and market uncertainty. Investors should monitor whale activity and market sentiment for better predictions.

What is the price prediction target for AA in 2024?

Based on market analysis, AA's 2024 price prediction target is approximately $29.99. This price point reflects market expectations and represents a significant valuation milestone for the asset within the Web3 ecosystem.

How is AA price correlated with other related assets?

AA price shows high volatility correlation with other cryptocurrencies and AI-related tokens. Its correlation strengthens during market-wide movements, particularly with BSC-based assets and Web3 AI infrastructure projects. Low market cap and limited liquidity amplify price sensitivity to broader market sentiment and trading volume fluctuations.

2025 AA Price Prediction: Comprehensive Market Analysis and Expert Forecasts for the Year Ahead

2025 AWE Price Prediction: Comprehensive Analysis of Market Trends and Future Growth Potential

2025 ASM Price Prediction: Future Trajectory Analysis and Key Factors Influencing Market Value

2025 VVV Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 AIL Price Prediction: Navigating the Future of Artificial Intelligence Tokens in a Rapidly Evolving Market

2025 NPC Price Prediction: Analyzing Market Trends and Potential Factors Influencing Virtual Asset Values

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?