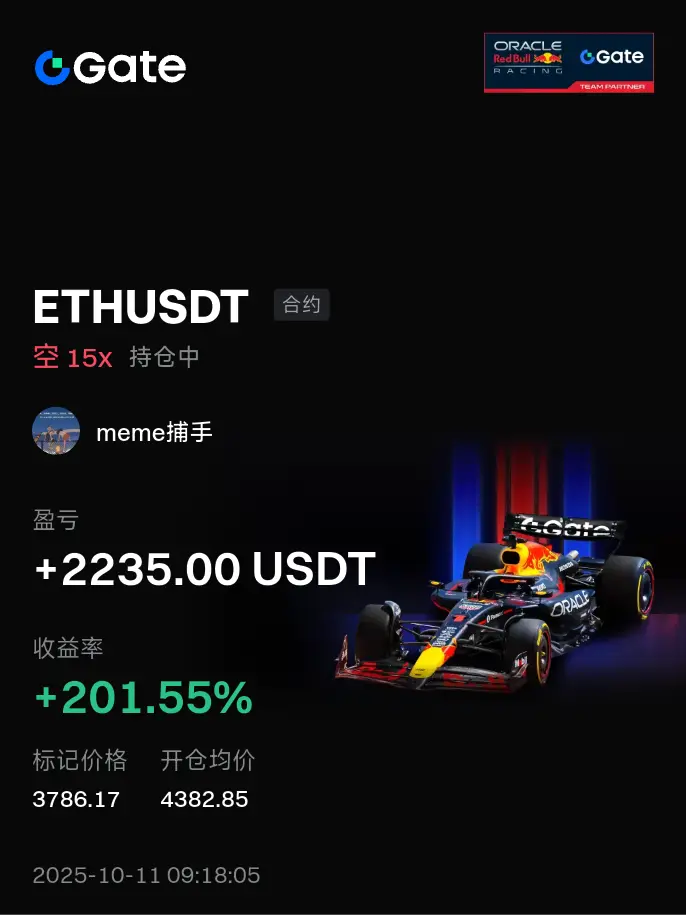

The market has almost priced in: money is about to flow out again.

Looking back at history, before each round of interest rate cuts begins,

U.S. stocks rebounded first, gold rose, and crypto assets surged the most.

Because interest rate cuts mean lower capital costs,

Market liquidity has become active again, and risk assets are reignited!

From a macro perspective:

• Internal data in the US weakens, consumption slows down;

The Trump administration continues to exert pressure, forcing the Federal Reserve to ease.

Major global economies are also releasing easing signals in sync.

This round of in

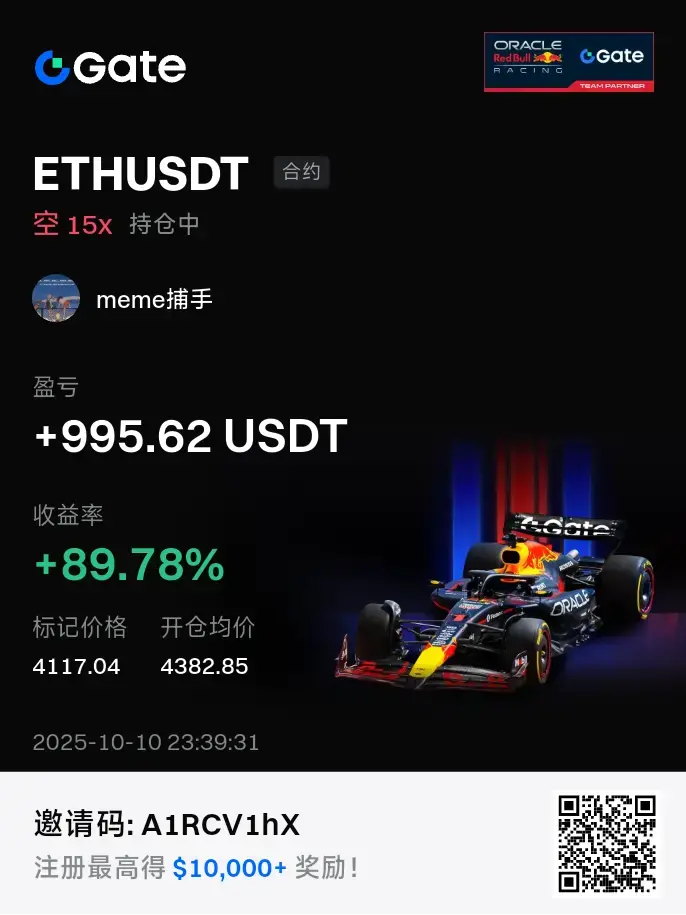

View OriginalLooking back at history, before each round of interest rate cuts begins,

U.S. stocks rebounded first, gold rose, and crypto assets surged the most.

Because interest rate cuts mean lower capital costs,

Market liquidity has become active again, and risk assets are reignited!

From a macro perspective:

• Internal data in the US weakens, consumption slows down;

The Trump administration continues to exert pressure, forcing the Federal Reserve to ease.

Major global economies are also releasing easing signals in sync.

This round of in