IntoTheBlock

No content yet

IntoTheBlock

Supervised loans are a cornerstone of institutional DeFi.

Here’s what they are, how they work, and why they matter 👇

Here’s what they are, how they work, and why they matter 👇

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Our next webinar will unpack different approaches to curation, risk management and strategy design.

Sign up below 👇

Sign up below 👇

- Reward

- like

- Comment

- Repost

- Share

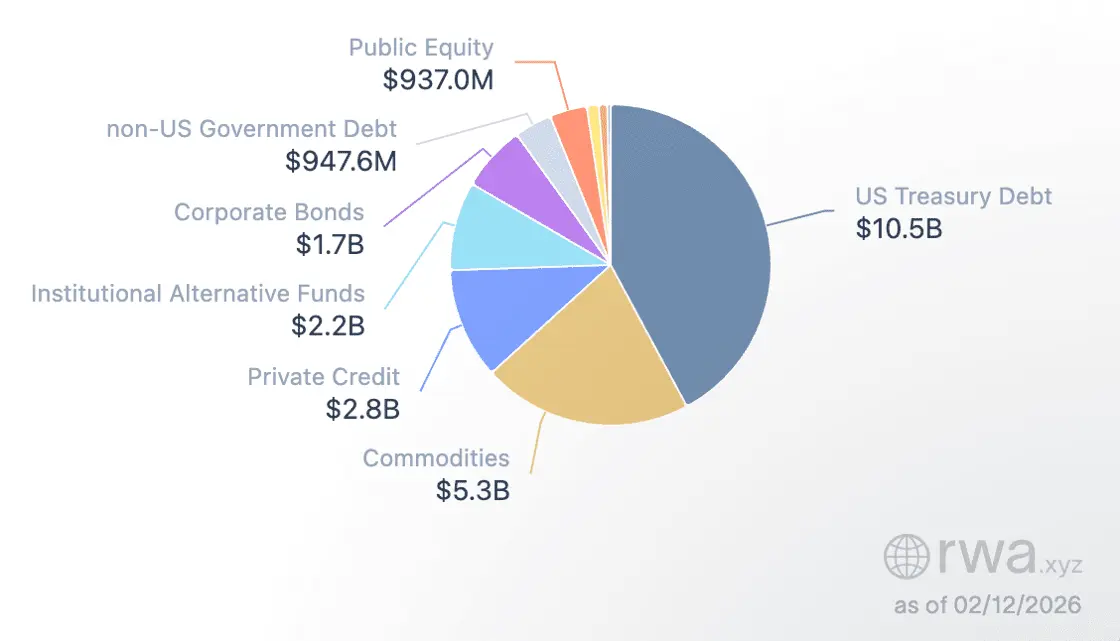

While tokenized U.S. Treasuries still dominate RWA market cap, equities are the fastest-growing vertical. Combined with the rising DeFi utility of tokenized stocks, this is a clear signal that 2026 is the year of real-world asset utility.

RWA1,02%

- Reward

- 1

- Comment

- Repost

- Share

This week: tokenization is gaining momentum in markets, and we’re unpacking what’s happening with DeFi rates 👇

- Reward

- like

- Comment

- Repost

- Share

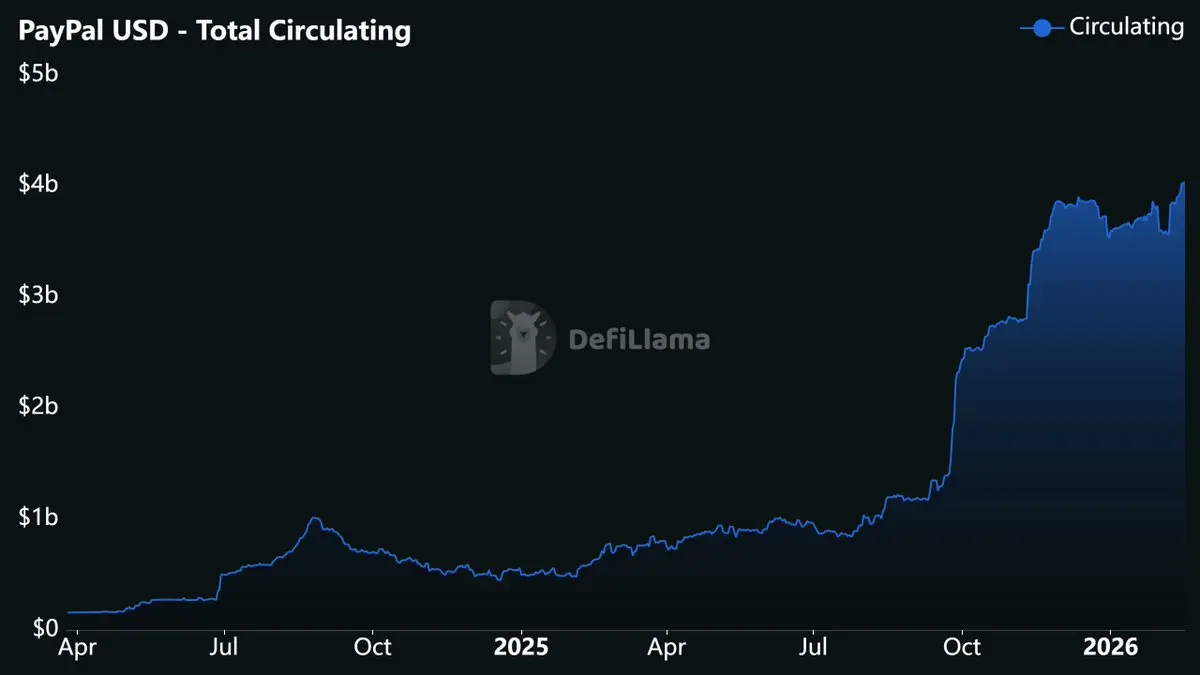

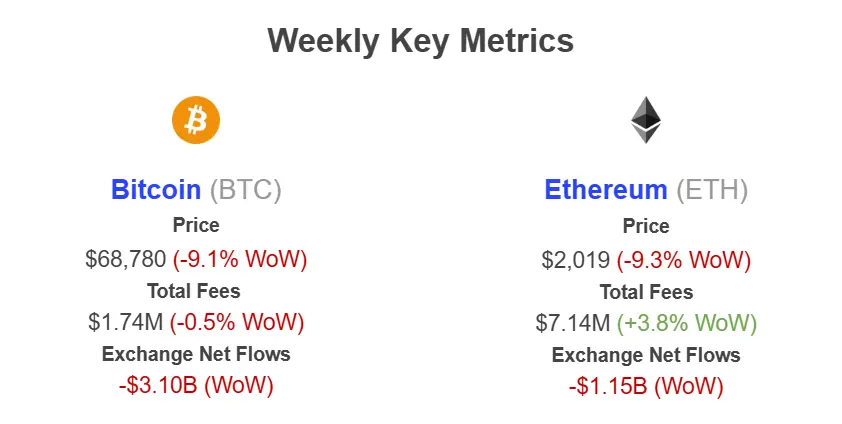

Both Bitcoin and Ether saw significant outflows from exchange wallets this week, hinting at ongoing accumulation amid price weakness.

BTC-1,13%

- Reward

- like

- Comment

- Repost

- Share

DeFi has moved from “Can we build it?” to “Can we run it safely at scale?” and a key part of that move is risk curation.

In our next webinar, we’ll unpack different approaches to curation, risk management and strategy design.

Sign up below 👇

In our next webinar, we’ll unpack different approaches to curation, risk management and strategy design.

Sign up below 👇

- Reward

- like

- Comment

- Repost

- Share

DeFi apps don’t become successful in isolation.

You can optimize one product, but lasting value shows up when the full stack aligns: rails, primitives, liquidity, risk, and the access layer that routes users.

You can optimize one product, but lasting value shows up when the full stack aligns: rails, primitives, liquidity, risk, and the access layer that routes users.

- Reward

- like

- Comment

- Repost

- Share

DeFi apps don’t become successful in isolation.

You can optimize one product, but lasting value shows up when the full stack aligns: rails, primitives, liquidity, risk, and the access layer that routes users.

You can optimize one product, but lasting value shows up when the full stack aligns: rails, primitives, liquidity, risk, and the access layer that routes users.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

In this week\'s newsletter, we break down the recent market crash and key risks to watch. Catch up on it here👇

- Reward

- like

- Comment

- Repost

- Share

✔️All supervised loan positions remain at conservative health factors✔️There have been no liquidations and no bad debt.✔️All assets are safe.Learn more about our risk management approach here👇

- Reward

- like

- Comment

- Repost

- Share

Despite market volatility, all Sentora Vaults are still delivering steady results. Sentora Smart Yield\'s automated risk management engine rebalances in real time when seconds matter.

- Reward

- like

- 1

- Repost

- Share

Lock_433 :

:

Buy To Earn 💎Tokenized Equities: The Next Major Disruption

- Reward

- like

- Comment

- Repost

- Share