Search results for "BATCH"

Trump's Financial Empire Expands! Truth Social ETF Listing Behind $6 Billion Fusion Merger and Acquisition

Trump Media's Truth.Fi launches the first batch of five Truth Social ETFs on the New York Stock Exchange, including Defense (TSSD), Frontier Technology (TSFN), American Idol (TSIC), Energy (TSES), and Red State Real Estate (TSRS). Focused on American manufacturing companies. On December 18, announced a $6 billion merger with nuclear fusion company TAE, paving the way for ETF launches.

ETH3,15%

MarketWhisper·2025-12-31 02:07

ZachXBT Warning: Trust Wallet has a major vulnerability, official statement confirms and update completed

Trust Wallet Extension 2.68 update causes a systemic theft, hundreds of users' assets instantly wiped out, official confirmation and urgent patch of the vulnerability.

On-chain abnormal transfers emerge, ZachXBT points out that funds were instantly cleared after the update

-------------------------------

Renowned on-chain investigator ZachXBT recently issued warnings on social media platforms and Telegram channels, reporting that multiple Trust Wallet users experienced unauthorized transfers of funds in a short period. Most cases occurred shortly after updating the Chrome browser extension. According to reports, users who imported their seed phrases into the new extension saw their assets almost immediately wiped out, with no signs of batch or delayed transfers.

Image source: ZachXBT Zach

TRUST2,74%

CryptoCity·2025-12-26 02:30

Foreign media accuses: HTX Huobi exchange misappropriated reserve assets, actual USDT reserves are only 12%.

Foreign media Protos discovered a batch of addresses belonging to HTX and the various asset balances held by each address from a toolkit owned by huobiapi on GitHub. Protos accused HTX of not only having an ambiguous relationship with Sun Yuchen but also having issues with the misappropriation of reserve assets. The reserve assets, which should have been properly safeguarded to provide users with peace of mind, were instead used for on-chain lending, with $1.78 billion of USDT, where only 12% of the reserves are actually safe. Furthermore, various assets were used to provide liquidity for Sun Yuchen's JustLend.

Protos questions the reserve of wrapped tokens on the Tron chain.

Protos indicates that TRC-20's

HTX1,32%

ChainNewsAbmedia·2025-12-24 03:35

Tom Lee’s Bitmine Adds $88M in ETH as Spot Ethereum ETFs Snap Outflow Streak

Bitmine Immersion Technologies, the Ethereum treasury firm chaired by Fundstrat’s Tom Lee, continued its aggressive accumulation on December 23, purchasing another large batch of ETH amid renewed inflows into U.S. spot Ethereum ETFs.

CryptopulseElite·2025-12-23 10:01

AI automatically resolves IT issues... Resolve AI, with a corporate value of 1.44 trillion won.

It is reported that Resolve AI, a company providing an automated diagnostic and solution platform for enterprise technology infrastructure issues, recently achieved a corporate valuation of $10 billion (approximately 14.4 trillion Korean won) through a round of financing. According to sources, this Series A financing adopted a multi-batch structure, and some shares appear to be trading at prices below this valuation.

According to reports, this round of investment is led by global venture capital firm Lightspeed Venture Partners, with participation from several anonymous investors. Resolve AI also received $35 million (approximately 50.4 billion South Korean won) in seed funding last year from existing investors such as Graylock, global AI expert Fei-Fei Li, and Google DeepMind chief scientist Jeff Dean. Its two co-founders, Spyros Kotsantonis and Mayank Agarwal, sold their startup in 2019 to

TechubNews·2025-12-22 21:13

CryptoPunks has become an official collection of the Museum of Modern Art (MoMA) in New York.

The Museum of Modern Art in New York has announced the inclusion of CryptoPunks in its collection, providing "museum-quality" endorsement for NFTs.

(Previously: Bought CryptoPunks as a reserve, didn't expect PunkStrategy to really take off)

(Background: Yuga Labs sold CryptoPunks! Infinite Node Foundation acquired the intellectual property rights: will continue the spirit of cyberpunk)

The Museum of Modern Art in New York ( MoMA ) has announced the inclusion of the NFT avatar series CryptoPunks in its permanent collection. It has been listed on the collection page. This announcement, following the retreat of the NFT bubble, is seen as a milestone for traditional art institutions formally engaging with blockchain assets.

This batch of CryptoPunks is from multiple private collectors.

ETH3,15%

動區BlockTempo·2025-12-21 03:15

CryptoPunks becomes an official collection of the Museum of Modern Art (MoMA) in New York

The Museum of Modern Art (MoMA) in New York has announced the inclusion of CryptoPunks into its permanent collection, providing a "museum-grade" endorsement for NFTs.

(Previous context: Buying CryptoPunks as reserves, unexpectedly PunkStrategy really took off)

(Additional background: Yuga Labs sold CryptoPunks! Infinite Node Foundation acquired the intellectual property rights: continuing the cyberpunk spirit)

The Museum of Modern Art (MoMA) has officially announced the addition of the NFT avatar series CryptoPunks to its permanent collection. It is now listed on the collection page. In the aftermath of the NFT bubble burst, this move is seen as a milestone for traditional art institutions to officially engage with blockchain assets.

This batch of CryptoPunks was assembled by multiple private collectors.

ETH3,15%

動區BlockTempo·2025-12-20 03:10

Trump appoints two successors! The Federal Reserve spends 40 billion to buy bonds, causing volatility in the US stock market and Bitcoin

President Trump of the United States, in an interview with The Wall Street Journal, named Kevin Hassett and Kevin Warsh as the preferred candidates to succeed current Federal Reserve Chair Jerome Powell, and called for a significant cut in interest rates. The New York Federal Reserve Bank's trading department has begun purchasing short-term Treasury bonds, with an initial batch of $40 billion worth of bonds maturing in about 30 days. What impact will this have on the US stock market and Bitcoin?

MarketWhisper·2025-12-16 02:48

Ripple sends $152 million in XRP to Binance – market reacts

Ripple has once again drawn the attention of the crypto market after transferring another massive batch of XRP to a wallet linked to Binance. The move came just hours after the company internally reorganized more than 600 million XRP across its sub-wallets — prompting speculation about whether Rippl

Moon5labs·2025-12-12 17:02

Tether enters the humanoid industrial robot sector, participates in $81.5 million Italian fundraising project

Tether has recently continued to expand its presence in the AI and robotics sectors, and on 12/9 participated in the $81.5 million funding round for the Italian startup Generative Bionics. The company was spun off from the Italian Institute of Technology (IIT), focusing on humanoid industrial robots capable of working in hazardous and high-labor-demand production environments. Generative Bionics plans to gradually deploy its first batch of mass-produced models in the manufacturing, logistics, healthcare, and retail industries starting in early 2026.

Tether and multiple institutions participate in funding, aiming to create humanoid industrial robots

Generative Bionics recently completed its $81.5 million funding round, with capital coming from Tether,

BTC1,45%

ChainNewsAbmedia·2025-12-09 03:04

Solana dark pool DEX leader HumidiFi sale sniped by bots, $69 million FDV project forced to relaunch public sale

The highly anticipated dark pool DEX project HumidiFi in the Solana ecosystem experienced what can only be described as a textbook “bot sniping war.” At the moment of its WET token public sale, a bot farm consisting of thousands of pre-funded wallets used batch transactions to sweep up all 20 million public sale shares within seconds, leaving ordinary community members completely unable to participate.

As a result, after raising $1.39 million USDC, the project team decided to invalidate the sniped tokens and urgently deploy a new audited contract, with plans to relaunch the sale on December 8th. This offensive and defensive battle not only tests the technical capabilities and credibility of the project team, but also brings the long-standing “fair launch” problem in the Solana ecosystem into the spotlight.

MarketWhisper·2025-12-08 08:20

U.S. Market Opens the Floodgates: Altcoin ETFs Usher in a New Era

1. Concentrated Listing of Altcoin ETFs

In Q4 2025, the US market will experience a concentrated surge in spot ETFs for altcoins. Following the opening of the ETF market with Bitcoin and Ethereum, ETFs for altcoins such as XRP, DOGE, LTC, and HBAR have successively launched in the US, while assets like AVAX and LINK are also entering a fast-track approval phase. In stark contrast to the decade-long regulatory battle over Bitcoin ETFs, this batch of altcoin ETFs completed the entire process from application to listing within just a few months, highlighting a significant shift in the US regulatory stance. The emergence of altcoin ETFs is no longer an isolated event but the natural result of a structural relaxation in crypto regulation.

The key factors igniting this listing boom are mainly twofold: the amendment to the "Generic Listing Standards for Commodity Trust Shares" approved by the SEC on September 17, 2025, and the triggering of "8(a) provisions" during the US government shutdown in November.

PANews·2025-12-08 03:02

iAero Protocol Launches Token Sweeper, Distributes 5% of LIQ Supply to Stakers

Press Release

Sheridan, Wyoming, USA, December 4th, 2025, Chainwire

iAero Protocol Launches Token Sweeper Application, Announces LIQ Distribution Campaign.

Base-native liquid staking protocol introduces multi-token batch swap tool and six-month staker rewards program.

iAero Protocol, a liquid s

BitcoinInsider·2025-12-04 21:13

iAero Protocol Launches Token Sweeper, Distributes 5% of LIQ Supply to Stakers

Sheridan, Wyoming, USA, December 4th, 2025, Chainwire

iAero Protocol Launches Token Sweeper Application, Announces LIQ Distribution Campaign.

Base-native liquid staking protocol introduces multi-token batch swap tool and six-month staker rewards program.

iAero Protocol, a liquid staking protocol

CryptoFrontNews·2025-12-04 19:45

Greenfield Outlook on Crypto 2026: Top Ten Key Issues and Opportunities - ChainCatcher

Source: Greenfield

Translation: Zhou, ChainCatcher

The digital asset ecosystem is evolving in unexpected ways: new fundamental elements, new behavior patterns, and new coordination tools are constantly emerging. What was considered experimental a year ago may have already become foundational today. As investors, our duty is to closely monitor these changes and understand which emerging ideas can develop into lasting infrastructure and truly gain market recognition.

Last year, we shared our predictions for the trends in the coming year. This year, we are taking a different approach. We no longer claim to foresee the future; instead, we want to share our vision: a wish list of ten ideas, questions, and products that we hope founders will begin to address by 2026.

Through these reflections, we can gain a deeper understanding of the next batch of significant opportunities.

DEFI-0,97%

链捕手·2025-12-04 10:20

From Sahara to Tradoor: A Look at Recent "Creative Downtrend" Tactics in Altcoins

Airdrops turn into "shorts," with project benefits becoming cash machines for insiders. From Sahara AI and aPriori to Irys and Tradoor, newly launched altcoins have been crashing one after another—halving in a single day, dropping more than 80%, and airdrops being heavily dumped, casting a shadow of decline over the crypto space.

(Previous context: Meteora airdrop trust disaster: 4 whales grabbed 28.5%, over 60,000 retail investors only shared 7%)

(Background supplement: Why are ICOs dominating on-chain fundraising again? The three underlying logics defeating airdrops)

Airdrops turn into "shorts," with project benefits becoming cash machines for insiders. Although the market has warmed up somewhat recently, the crypto world has still been shrouded in a lingering gloom since the "1011 crash." What's particularly notable is that a batch of newly launched altcoins seem to have all been switched to "decline mode," repeatedly experiencing dramatic crashes: halving in a single day, dropping more than 8

動區BlockTempo·2025-12-04 06:35

ETHZilla acquires 20% stake in Karus to advance AI auto loan tokenization

ETHZilla Corporation announced the acquisition of a 20% stake in AI auto finance platform Karus, Inc. for $8 million. ETHZ will integrate Karus's loan evaluation technology to enable the tokenization of auto loan assets, with the first batch of tokenized portfolios planned for launch in early 2026.

DeepFlowTech·2025-12-04 01:06

BlockDAG’s $438M+ Presale Dominates December While HYPE Turns Bearish & CRO Slides Below Support

As volatility spreads across December’s top-rated cryptocurrencies, BlockDAG (BDAG) continues to stand out with the presale surpassing $438 million. Hyperliquid (HYPE) bearish pattern now signals caution, while Cronos (CRO) market movement reflects mixed market confidence. With Batch 33 active at $0

CaptainAltcoin·2025-12-03 18:04

Renaiss Appears at Binance Blockchain Week: Closed Beta Card Packs Sell Out in Ten Minutes, Public Beta Coming Soon

Mars Finance news, on December 3, Renaiss Protocol announced that its last batch of high-grade Pokémon card packs with PSA authentication in the Closed Beta, "Da Vinci Pack 4.0," has officially launched and sold out within just ten minutes of release, continuing the strong demand seen in previous batches. The Renaiss team also appeared at Dubai Binance Blockchain Week, hosting an offline event called "Catch Pikachu": participants only needed to find founder Winchman at the venue and complete an interactive sharing session to receive a card pack and a special SBT. There was also a card price guessing segment at the event, where the person whose guess was closest to the actual price of the card held by the founder could win 1...

MarsBitNews·2025-12-03 13:54

A diamond hand trader closed all positions of 24.8 million PIPPIN tokens, making a profit of 3.65 million USD.

According to Deep Tide TechFlow news on December 1, on-chain analysis platform Lookonchain monitored that diamond hand trader 2Gc2Xg closed all positions of 24.8 million PIPPIN Tokens, worth 3.74 million USD, locking in a profit of 3.65 million USD, with a Return on Investment of 4066%.

The trader spent 450 SOL (approximately 90,000 USD) to purchase this batch of PIPPIN tokens a year ago. On January 11 of this year, the value of his holdings reached approximately 7.6 million USD but he did not sell, and subsequently, the market value of PIPPIN dropped below 10 million USD.

In the recent rebound, the trader sold a total of 29,527 SOL (3.74 million USD), successfully avoiding missing another cash-out opportunity.

DeepFlowTech·2025-12-01 11:49

Cocoon is live! Telegram founder: Rent GPUs to earn TON against AWS giants.

Cocoon Decentralization AI network has officially launched, which is a privacy-preserving decentralized computing platform built on an open network (TON). TON is an independent Layer 1 Blockchain associated with the Telegram instant messaging application. Telegram co-founder Pavel Durov stated that the Decentralization AI network has handled its first batch of user requests, and GPU owners have also begun to profit by renting out their hardware.

TON6,26%

MarketWhisper·2025-12-01 03:00

SpaceComputer raises $10 million: Space Blockchain Computing opens a new era

The space computing startup SpaceComputer recently announced the completion of a $10 million seed round financing, aimed at providing a secure space computing environment for Blockchain through satellite networks. This round of financing was co-led by Maven11 and Lattice, with participation from organizations like the Arbitrum Foundation. The funds will be used to launch the first batch of satellites and develop dedicated hardware. This initiative marks an important step in the expansion of Blockchain infrastructure into space, with the potential to enhance the network's security and anti-interference capabilities, while also bringing new possibilities for Decentralization applications.

MarketWhisper·2025-11-27 01:18

Behind the slashing of 150 billion BTC from the BCH group is a new type of digital bullying?

In October 2025, the U.S. Department of Justice announced the seizure of 127,000 Bitcoins belonging to Chen Zhiming, the founder of the Cambodian BCH Group, causing a huge stir in the global crypto assets sector.

This batch of digital assets, which once had a market value of up to 15 billion USD, transformed from "victim assets" stolen in 2020 to "involved subjects" identified in 2025, not only turning Chen Zhi from a victim into a transnational defendant but also exposing many deep contradictions in cross-border law enforcement and Bitcoin regulation in the digital economy era.

Sister Sa's team introduced the case overview of "Chen Zhi" to explore the technological truths and legal controversies behind this case. By discussing issues related to private keys in Crypto Assets, it reveals the challenges and cooperation shortcomings in governing transnational crimes in the digital age, providing an important sample for us to examine the legal positioning and regulatory paths of Crypto Assets.

Case Analysis

December 29, 2020

BTC1,45%

金色财经_·2025-11-24 13:29

SpaceAgri's first batch of Nodes is officially on sale, constructing a decentralized space agriculture ecosystem through Ether breeding and distributed research.

SpaceAgri will launch its first batch of node sales on November 24, with a project that combines "space breeding + distributed planting pods," starting at a price of 1,500 USDC, with limited quantities available. Node holders can enjoy discounts and benefits, while also initiating a 20,000 USDT airdrop incentive to promote a decentralized space agriculture ecosystem.

USDC-0,07%

DeepFlowTech·2025-11-24 05:07

Ripple New: Bloomberg Expert Reveals the New Timeline for Remaining XRP ETF Launches

The XRP ETF story keeps growing, and this week brought one of the clearest updates yet. Bloomberg analyst James Seyffart, one of the most trusted voices on ETF filings shared fresh expectations for when the next batch of XRP ETFs could officially start trading in the U.S

With a mix of amended fili

XRP8,26%

CaptainAltcoin·2025-11-21 17:34

Hong Kong Financial Services and the Treasury Bureau: Will promote the tokenization of the bond market, details to be announced in the first half of 2026.

According to Mars Finance, the Secretary for Financial Services and the Treasury of Hong Kong, Xu Zhengyu, stated that they are jointly advancing research on the applicability of current laws to tokenized bonds, in order to promote the adoption of tokenization technology in Hong Kong's bond market. More details will be announced in the first half of next year. Xu Zhengyu mentioned that the previously issued third batch of tokenized green bonds introduced options for settlement in Central Bank digital currencies tokenized in RMB and HKD, making it one of the first digital bonds globally to apply these two types of tokenized Central Bank currencies in the settlement process.

MarsBitNews·2025-11-21 11:57

Bitcoin OG Whale Owen Gunden Dumps Entire $1.3 Billion Holdings: Institutions Buy the Dip

Bitcoin OG whale Owen Gunden has liquidated his entire portfolio of 11,000 BTC, valued at approximately $1.3 billion, over the past month, transferring the final batch to a major exchange.

BTC1,45%

CryptopulseElite·2025-11-21 05:23

MicroStrategy invests $800 million, Harvard increases its position by 200%: is the Whale buying the dip or is it a bull trap prelude?

Original Title: MicroStrategy and Harvard University, two major institutions, are increasing their positions against the trend. Is it bottom accumulation or a chase the price trap?

Original Author: Blockchain Knight

Source:

Reprinted: Daisy, Mars Finance

MicroStrategy and Harvard University, two major institutions, are increasing their positions against the trend. Is this bottom accumulation or a chase the price trap?

MicroStrategy purchased 8,178 Bitcoins for $835.6 million, locking in an average price of $102,171. Although the current price has dropped below $90,000, resulting in unrealized losses for this batch, the overall average cost of the company's holdings is approximately $74,433, still in a profitable state. It is estimated that 40% of its holdings were acquired at a trading price below cost.

Harvard Management Company disclosed in its 13F filing on September 30 that it holds 6.8 million shares of BlackRock Bitcoin ETF (IBIT), valued at $442.9 million, an increase of 200% from the previous quarter, making it the highest valued position among its U.S. listed stocks.

BTC1,45%

MarsBitNews·2025-11-20 13:26

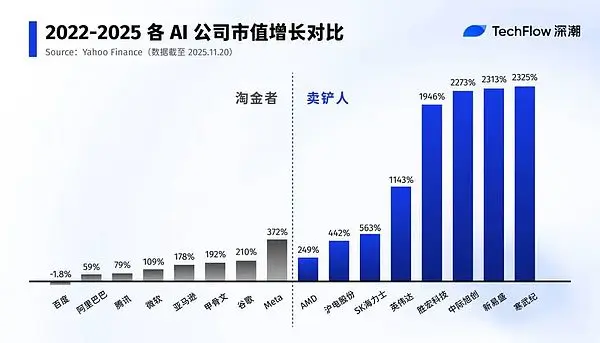

From NVIDIA to Binance, selling shovels is the strongest business model.

In 1849, during the California Gold Rush, countless people with dreams of getting rich flocked to the American West.

German immigrant Levi Strauss originally wanted to join the gold rush, but he keenly discovered another business opportunity: miners' pants often wore out and there was a pressing need for more durable work clothing.

So, he made a batch of jeans from canvas, specifically to sell to gold miners, thus giving birth to a clothing empire called "Levi's", while the vast majority of those who actually participated in the gold rush ended up losing everything.

On November 20, 2024, NVIDIA once again delivered a "remarkable" financial report.

Q3 revenue reached a record of $57 billion, a year-on-year increase of 62%; net profit was $31.9 billion, a year-on-year surge of 65%. The latest generation of GPUs remains a scarce resource that "even with money, one may not be able to buy it," and the entire AI industry is working for it.

At the same time, on the other side of cyberspace.

金色财经_·2025-11-20 09:33

From NVIDIA to Binance, selling shovels is the strongest business model.

Written by: Liam, Deep Tide TechFlow

In 1849, during the California Gold Rush, countless people with dreams of striking it rich flocked to the American West.

German immigrant Levi Strauss initially wanted to join the gold rush, but he keenly discovered another business opportunity: miners' pants often got torn and there was a pressing need for more durable work clothes.

Thus, he made a batch of denim pants from canvas specifically to sell to gold miners, and from this, a clothing empire called "Levi's" was born, while the vast majority of those who actually participated in the gold rush ended up with nothing.

On November 20, 2024, NVIDIA once again delivered an "incredible" financial report.

Q3 revenue reached a record 57 billion dollars, a year-on-year increase of 62%; net profit was 31.9 billion dollars, a year-on-year surge of 65%. The latest generation of GPUs remains a scarce commodity that "one may not necessarily be able to buy with money," the entire AI

DeepFlowTech·2025-11-20 09:01

Did the United States plan and steal 127,000 Bitcoins from China?

A batch of up to 127,000 Bitcoins, a mysterious wealthy businessman in Cambodia, and the increasingly tense standoff between the two superpowers of China and the United States—these elements intertwine to form a crypto asset mystery that can be described as a "Rashomon". Recently, China's official cybersecurity agency publicly accused the U.S. government of orchestrating and stealing this asset, while the U.S. insists that this is a legitimate seizure action against transnational crime. Who truly owns this massive amount of Bitcoin worth hundreds of billions of dollars? What geopolitical struggles and digital sovereignty disputes are hidden behind it?

China's accusations

The trigger point of the event stems from a technical analysis report released by the China National Computer Virus Emergency Response Center (CVERC). The report directly points to the U.S. government as the mastermind behind the major Bitcoin theft case that occurred at the Chinese mining pool "LuBian" at the end of 2020.

According to the description in the report, December 2020

BTC1,45%

LinkFocus·2025-11-19 12:44

US-listed company Onfolio Holdings secures up to $300 million in funding, which will be used to establish a digital asset treasury.

According to Deep Tide TechFlow news on November 18, GLOBE NEWSWIRE reported that online business operating company Onfolio Holdings Inc. (NASDAQ: ONFO) announced that it has secured up to $300 million in financing through convertible note financing instruments.

The first batch of 6 million USD will be delivered on November 18, with an expected additional 2 million USD approximately 30 days later. The remaining up to 292 million USD can be withdrawn in batches in the future. The funds will be used to establish a digital asset repository, generate income through staking, strengthen the balance sheet, and accelerate operational growth.

CEO Dom Wells stated that the company will directly invest in Bitcoin, Ethereum, and

DeepFlowTech·2025-11-18 13:58

Important news from last night to this morning (November 16 - November 17)

Messari releases Filecoin Q3 report: utilization rises to 36%, capacity shrinks to 3.0 EiB

According to the Filecoin Q3 status report released by Messari, the network utilization of Filecoin rose to 36% in the third quarter, total capacity decreased to 3.0 EiB, and network fees increased by 14% quarter-on-quarter to approximately $793,000, of which penalties account for about 99.5%. The v27 "Golden Week" upgrade removed the old sector method, with base and batch fees nearly zero. Active storage volume slightly decreased by 1% to 1,110 PiB, and the daily average new transaction volume dropped by 19%. The number of real datasets online increased to 2,491, with 925 exceeding 1,000 TiB. FVM token activity remained stable in FIL; DeFi.

PANews·2025-11-17 02:42

BTC News: Arthur Hayes Accelerates Selling as BTC Hits Six-Month Low

Arthur Hayes, BitMEX co-founder, accelerates the selling of ETH, ENA, and ETHFI as BTC plunges to a six-month low.

Hayes Dumps Altcoins Amid Crypto Market Crash

The first batch of this that was reported by the analytics company showed his disposals. He got rid of 520 ETH, 2.62 million ENA, and 13

LiveBTCNews·2025-11-16 11:22

Berkshire Hathaway, under Buffett, disclosed a $4.3 billion Holdings in Alphabet.

Berkshire Hathaway, led by Buffett, recently reduced its stake in Apple while increasing its holdings in Alphabet by $4.3 billion. This may be the last batch of new stocks added before Buffett's retirement, diverging from his long-held philosophy of investing in value stocks. Aside from Apple and Alphabet, Berkshire's other major investments remain unchanged.

DeepFlowTech·2025-11-15 02:12

Strategy EVP Shao Wei-Ming Sells 2,600 MSTR Shares for $581K

Strategy Inc.’s Executive Vice President and General Counsel, Shao Wei-Ming. He has sold another batch of company stock as part of his ongoing pre-scheduled trading plan. The latest sale involved 2,600 shares of MSTR, bringing in $581,535 at an average price of $223.67. The transaction was

Coinfomania·2025-11-14 10:00

Japan exchange warns: If companies dare to transform into DAT, it will limit your fundraising space.

Recently, more and more listed companies in Japan want to learn from the MicroStrategy (Strategy) model and transition to digital asset financial companies (DAT). This wave of trend has also alerted the Japan Exchange Group (JPX), which is concerned that investors may bear excessive risks and is considering implementing stricter "reverse listing" rules, even requiring companies to undergo re-audits and raising fundraising thresholds. Since September, at least three Japanese companies have suspended their cryptocurrency plans due to opposition from JPX.

Companies listed on the market are frantically hoarding coins, and JPX has begun to take control.

This year, after the cryptocurrency market has warmed up, Japan has seen a batch of DATs modeled after MicroStrategy. So far, Japan has 14 listed Bitcoin DATs, ranking first in Asia. As seen in the image below:

"Listed companies and institutions collectively hold about 80,000 BTC, and it is also the 4th country with the most Bitcoin DAT in the world, at the same time

BTC1,45%

ChainNewsAbmedia·2025-11-13 04:55

ZKsync bets on institutional-level privacy needs; the first batch of production deployment is expected to be completed by the end of the year.

Recently, Alex Gluchowski, CEO of ZKsync developer Matter Labs, stated in an interview with Cointelegraph that financial institutions must rely on a reliable system-level privacy layer to migrate payment settlement processes to public blockchains. Data shows that over 140 companies currently hold approximately $137 billion in crypto assets on their balance sheets.

Unlike traditional consumer-focused account-level privacy, institutions require a system-level privacy solution that allows transactions on shared infrastructure while keeping internal data fully visible. As an Ethereum Layer 2 network, ZKsync is building a privacy framework that meets this need using zero-knowledge proof technology, with the first production deployments expected to be completed by the end of the year.

MarketWhisper·2025-11-12 05:42

"Batch approval" countdown: DTCC list exposed, the institutional bull of alt season is about to begin.

Written by: Luke, Mars Finance

On November 12th, a document had the entire crypto market’s Alpha traders holding their breath: Canary submitted the Form 8-A for its XRP spot ETF.

For outsiders, this is just another regulatory document. But for professional ETF analysts, this is the ultimate signal just before the listing.

The emergence of this signal is perfectly timed.

In just 18 hours (5 AM Beijing time on November 13), the U.S. House of Representatives will hold a final vote on "ending the government shutdown." Once passed, a clear timeline will be established for the release of the trillions of dollars frozen in the Treasury General Account (TGA) due to the "government shutdown."

The trillion liquidity (new money) released by TGA is about to encounter the first confirmed compliant channel (XRP ETF).

XRP8,26%

MarsBitNews·2025-11-12 03:53

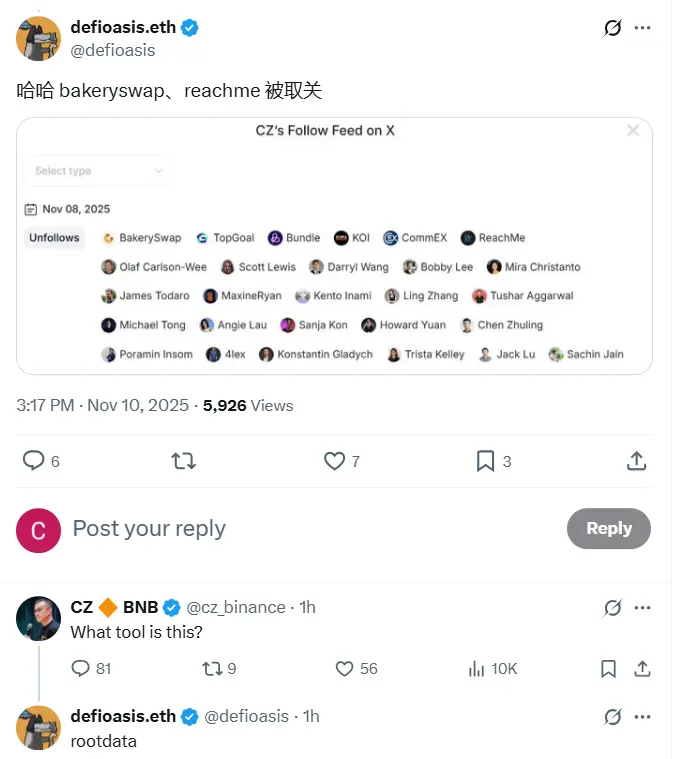

CZ mass unfollowing: Is the absurd "follow business" completely over?

Author: Zhou, ChainCatcher

On November 10th, a comparison chart of X followers ignited discussions in the crypto community. Binance founder Zhao Changpeng (CZ) unfollowed over three hundred people from his X account in less than two months. This number far exceeds his usual maintenance and is seen as a precise cleanup, revealing a hidden yet once highly active gray industry chain: accounts followed by CZ were once openly traded for tens of thousands of dollars.

Image source: X user @_FORAB

According to the crypto data platform RootData, on November 8-9, CZ unfollowed a batch of accounts, including active projects on the BNB Chain such as BakerySwap and ReachMe. CZ initially responded that he was simply cleaning up inactive accounts, and later publicly stated, "Do not buy the accounts I follow."

金色财经_·2025-11-11 12:25

From trading, prediction, and gaming to AI Agents: the next wave of Builders is gathering on Monad

Author: Harvey C

🧩 Monad Momentum Selected Projects Summary

From trading, prediction, gaming to AI Agents: the next wave of Builders is gathering on @Monad

When a new chain launches Momentum, the key is not how much subsidy is provided, but — who will retain users and truly build value.

In the first wave of Monad Momentum plans, we see a group of projects:

They do not chase trends or rely on airdrops to hype up, but speak through products, speed, and execution.

From DeFi to Prediction, and then to gaming and creator economy, they collectively form the first batch of Builders in the Monad ecosystem.

💱 DeFi

DeepFlowTech·2025-11-11 02:51

CZ Unfollows in Bulk: Is the Absurd "Follow Business" Completely Doomed?

null

Author: zhou, ChainCatcher

On November 10, a comparison chart of X followers ignited heated discussions in the crypto community. Binance founder Zhao Changpeng (CZ) unfollowed more than 300 people from his X account in less than two months, a number far exceeding normal maintenance, which is seen as a precise cleanup, revealing a hidden yet once highly active gray industry chain: accounts that were followed by CZ were previously traded publicly for tens of thousands of dollars.

Image Source: X User @\_FORAB

According to the cryptocurrency data statistics platform RootData, on November 8-9, CZ unfollowed a batch of accounts, including active projects on the BNB chain such as BakerySwap and ReachMe. CZ initially responded that it was just a cleanup of inactive accounts, and later made a public statement.

MarsBitNews·2025-11-11 02:36

Hong Kong is launching the third batch of multi-coin digital green bonds, using HSBC's Distributed Ledger platform.

According to Mars Finance, Bloomberg reported that the Hong Kong government is marketing a new batch of "digitally native" green bonds, covering USD, HKD, EUR, and offshore RMB (CNH), which will be recorded and settled through the HSBC Distributed Ledger platform, rated AA+ by S&P. The proposed issuance specifications include: USD 2-year T3+3, EUR 4-year MS+23, CNH 5-year coupon 1.9%, HKD 2-year coupon 2.5, with a scale of

MarsBitNews·2025-11-10 09:58

ZKasino partial refund launched: $33 million scam case reaches a turning point

On November 10, 2025, ZKasino anonymous founder Derivatives Monke announced the initiation of partial user refunds on social media. Currently, funds have been returned to 35% of affected addresses, distributed through the zkSync Lite and zkSync Era networks. The project experienced a $33 million exit scam in April 2024, causing over 10,000 users to suffer losses as the platform forcibly converted staked ETH into locked ZKAS tokens. Although Dutch authorities initially made arrests and recovered a small amount of funds, this systematic refund marks a new phase in an 18-month-long dispute. It is expected that the second batch of refunds next week will bring the total compensation rate to 75%.

ETH3,15%

MarketWhisper·2025-11-10 06:39

Cryptocurrency market rebounds across the board: US government shutdown ends, first batch of XRP ETFs about to be listed?

November 10, 2025, the cryptocurrency market experienced a full rebound, with Bitcoin breaking through the $106,000 mark, Ethereum and XRP soaring by 7% and 10% respectively. The total global cryptocurrency market capitalization increased by 4.5% in one day to $3.57 trillion. The immediate trigger for this rally was the U.S. Senate passing a procedural vote to end the government shutdown with a 60-40 vote, clearing obstacles for the reactivation of federal agencies, and simultaneously opening the door for cryptocurrency ETF approvals — the first XRP ETF is expected to be listed and traded this week. The derivatives market responded strongly, with open Bitcoin contracts increasing by $700 million, and funding rates rising rapidly, indicating bullish sentiment. Technical analysis shows Bitcoin has successfully regained the key support of the 50-week moving average.

MarketWhisper·2025-11-10 05:46

XRP Today's News: DTCC lists five spot ETFs, approval expectations for November increase

On November 9, 2025, the Depository Trust & Clearing Corporation (DTCC) in the United States officially classified five XRP spot ETFs under the category of "Active and Pre-Listing Funds," involving issuers such as Bitwise (XRP), Franklin Templeton (XRPZ), 21Shares (TOXR), Canary (XRPC), and CoinShares (XRPL).

This significant development occurred as Canary CEO Steven McClurg publicly stated that they are ready to launch next week, coinciding with the U.S. Senate reaching a preliminary agreement to end the government shutdown. Although DTCC listing does not equate to final SEC approval, combined with new regulations allowing issuers to revise S-1 filings to avoid procedural delays, market expectations suggest that the first batch of XRP spot ETFs could potentially begin trading in mid to late November.

MarketWhisper·2025-11-10 03:23

The Hong Kong government plans to issue the third batch of digital bonds, with pricing as early as today.

The Hong Kong government plans to issue digital green bonds again, denominated in USD, HKD, EUR, and RMB, with pricing expected today. This is the third issuance since 2023, with the previous two totaling HKD 6.8 billion, rated "AA+" and "AA-". Digital bonds can be issued using distributed ledger technology, offering advantages such as shorter settlement times and lower costs.

DeepFlowTech·2025-11-10 02:41

Four.Meme: Reload Airdrop batch four has been completed distribution.

According to Mars Finance news on November 7, the official announcement states that the $45 million Reload Airdrop initiated by BNB Chain and Four.Meme has completed the distribution of the fourth batch, and the eligible Wallets have received BNB Tokens.

BNB1,21%

MarsBitNews·2025-11-07 11:01

Balancer Breach Tied to Batch Swap Rounding Bug; Investigation Ongoing

Balancer has confirmed a significant security breach of its V2 protocol, with preliminary estimates suggesting losses over $116 million due to a vulnerability in its smart contracts. Recovery efforts are ongoing, with $20.7 million already retrieved by Stakewise DAO.

BAL2,3%

Coinpedia·2025-11-06 11:23

Load More