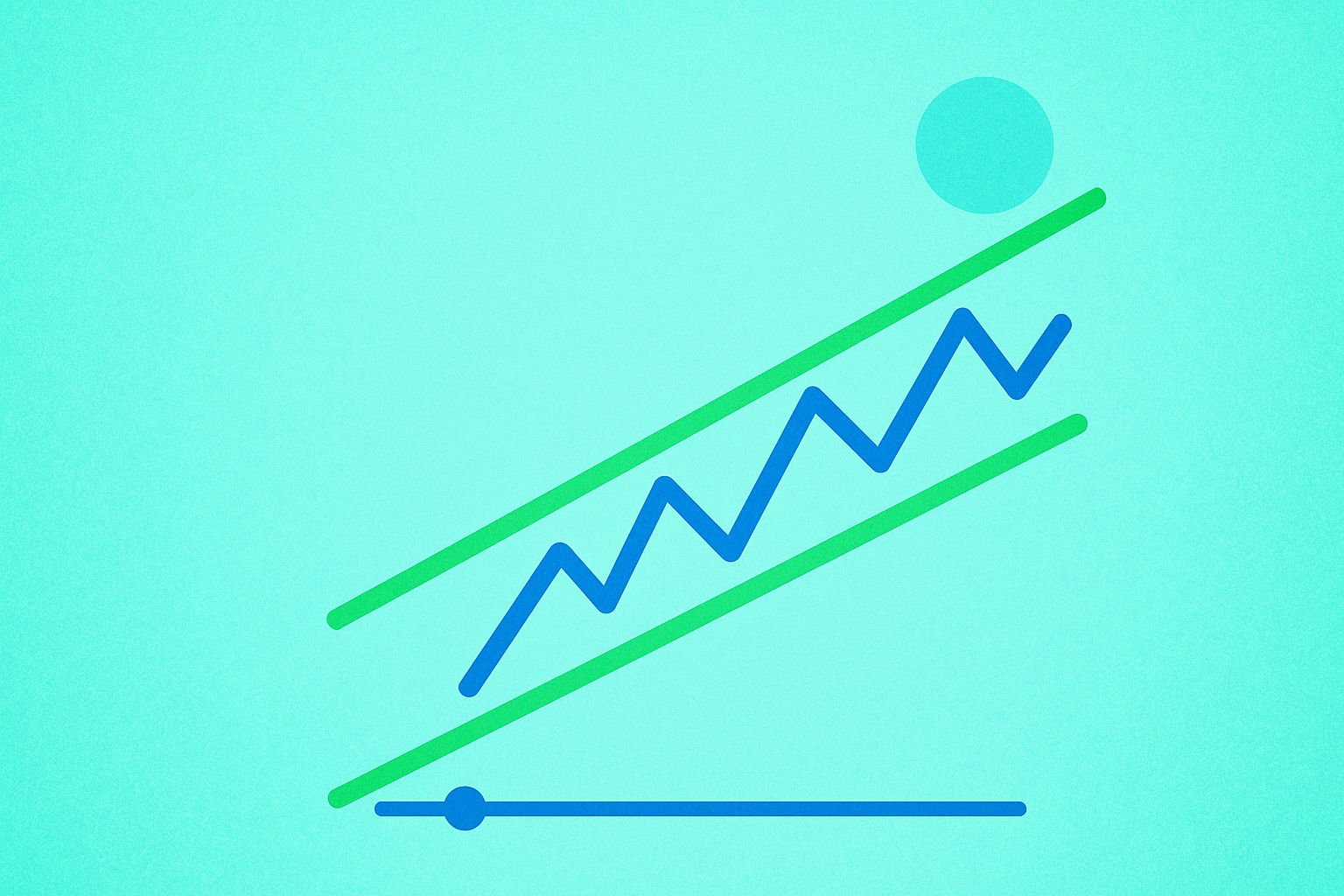

rising channel pattern

The rising channel pattern is a classic chart formation in technical analysis used to identify and confirm upward market trends. It consists of two parallel trend lines: one connecting higher lows in price action and another connecting higher highs, forming an upward-sloping channel. This pattern indicates that buying pressure consistently outweighs selling pressure, with prices steadily climbing within a predictable range. In cryptocurrency markets, the rising channel pattern is widely applied to medium and long-term trend analysis of Bitcoin, Ethereum, and other major assets, helping traders identify entry opportunities and potential trend reversal signals. Due to the high volatility of crypto markets, accurately identifying a rising channel requires not only technical analysis skills but also comprehensive judgment incorporating on-chain data, market sentiment, and macroeconomic conditions. The effectiveness of this pattern lies in its ability to provide traders with clear reference points for support and resistance levels, enabling the development of risk-controlled trading strategies.

Key Features of Rising Channel Pattern

The rising channel pattern exhibits several distinctive technical characteristics that make it a reliable tool for identifying bullish trends. First, the formation requires at least two higher lows to draw the lower support trendline and two higher highs to draw the upper resistance trendline, with these parallel lines defining the channel boundaries. Second, price movement within the channel should display an orderly oscillation pattern, bouncing off support near the lower trendline during pullbacks and encountering resistance near the upper trendline during rallies. In cryptocurrency markets, the angle of a rising channel often reflects trend strength: steeper channels indicate powerful bullish momentum but also suggest higher risks of breakout or collapse, while more gradual channels demonstrate steady uptrends with typically better sustainability. Volume plays a critical validation role in rising channels—ideally, volume should expand during price advances and contract during pullbacks, with this price-volume coordination confirming trend health. Additionally, crypto-specific on-chain metrics such as active addresses, exchange inflow-outflow volumes, and changes in coin concentration can provide extra validation for channel effectiveness. When price operates within the channel, traders typically seek buying opportunities near the lower trendline and consider profit-taking or partial position reduction near the upper trendline. It's important to note that rising channels are not permanently valid—once price decisively breaks above the upper trendline or falls below the lower trendline, it often signals trend acceleration or reversal, requiring reassessment of market structure and trading strategy.

Market Impact of Rising Channel Pattern

The rising channel pattern exerts multilayered influence on cryptocurrency markets, playing important roles from individual trading decisions to overall market sentiment. On the technical analysis level, this formation provides a clear trading signal framework for algorithmic trading systems and quantitative strategies, with many automated trading programs triggering buy orders when price approaches the channel's lower boundary and executing sell operations near the upper boundary—this programmatic trading behavior further reinforces channel effectiveness. From a market psychology perspective, a clearly defined rising channel can enhance investor confidence and attract more capital inflows, creating a self-reinforcing bullish cycle. During bull market cycles, major assets like Bitcoin often form large-scale rising channels lasting months or even years, with these channels becoming important reference coordinates for market participants and influencing institutional allocation decisions and retail trading behavior. The existence of rising channels also impacts derivatives markets, with options traders setting strike prices based on channel boundaries and futures traders developing arbitrage strategies utilizing channel structure. Furthermore, when mainstream assets like Bitcoin form obvious rising channels, this often elevates risk appetite across the entire crypto market, with altcoins and emerging projects receiving increased attention and capital inflows. However, excessive reliance on rising channel patterns can lead to homogenized market behavior—when large numbers of traders execute similar operations at identical positions, it may trigger violent price volatility or pattern failure, particularly common in lower-liquidity small-cap tokens.

Risks and Challenges of Rising Channel Pattern

Despite being a powerful tool in technical analysis, the rising channel pattern faces numerous risks and challenges in practical application within cryptocurrency markets. First is the issue of subjectivity in pattern identification—different traders may draw channel lines at varying angles and positions, leading to divergent judgments about support and resistance levels. This subjectivity is especially pronounced in highly volatile crypto markets, where violent price swings can generate substantial "noise" that makes trendline drawing difficult. Second, rising channel patterns are susceptible to false breakout interference—in crypto markets, due to the absence of circuit breakers and liquidity buffers found in traditional financial markets, prices may briefly breach channel boundaries before rapidly reverting, causing traders to enter or exit positions prematurely. Market manipulation represents a crypto-specific risk factor, where whales or institutions may deliberately create false rising channel patterns through large trades at key levels to lure retail followers, then suddenly reverse direction for profit. Additionally, the 24/7 non-stop trading and globalized nature of crypto markets means critical pattern breakouts may occur during low-liquidity periods, resulting in expanded slippage and execution prices deviating from expectations. Sudden regulatory policy changes also constitute a significant cause of rising channel pattern failure—when a country announces strict cryptocurrency regulations, prices may collapse rapidly regardless of perfect technical formations. Over-reliance on single patterns while ignoring fundamental factors represents another common mistake—for example, a project may display a perfect rising channel, but if its underlying technology contains major vulnerabilities or the team experiences problems, the pattern will quickly fail. Traders must also be wary of steep rising channels forming during late bull market stages, as these formations often signal market overheating and may be followed by sharp corrections or even trend reversals. Therefore, using rising channel patterns must be combined with multi-timeframe analysis, volume confirmation, on-chain data validation, and risk management measures—relying solely on patterns for trading is extremely likely to result in significant losses.

The importance of the rising channel pattern lies in its provision of a structured trend analysis framework and risk management tool for cryptocurrency traders. In the highly volatile digital asset market, traders who can identify and utilize rising channel patterns are often better able to grasp market rhythm, capturing steady returns during trend continuation phases and timely exiting before trend reversals to protect capital. The core value of this pattern extends beyond price direction prediction to helping traders establish disciplined trading systems through clearly defined entry points, stop-loss levels, and target prices for risk management. As crypto markets gradually mature with increasing institutional investor participation, the application of technical analysis tools including rising channel patterns will become more widespread and systematic. However, traders must recognize that no technical pattern is omnipotent—comprehensive judgment incorporating fundamental research, market sentiment analysis, and macroeconomic conditions is essential for achieving long-term stable returns in the complex and ever-changing crypto market.

Share

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?