2025 LYNX Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: Market Position and Investment Value of LYNX

Lynex (LYNX) is an LST-centric decentralized exchange and liquidity marketplace on the Linea Blockchain, designed to make advanced liquidity strategies accessible to all users through its competitive array of automated liquidity managers (ALMs). Since its launch in February 2024, the project has established itself as a specialized platform for optimizing returns and minimizing impermanent loss in the DeFi ecosystem. As of January 2, 2026, LYNX maintains a market capitalization of approximately $172,900, with a circulating supply of 97.48 million tokens trading at $0.001729. This innovative asset is playing an increasingly important role in advancing liquidity management solutions within decentralized finance.

This article will provide a comprehensive analysis of LYNX's price trajectory from 2026 through 2031, integrating historical performance patterns, market supply and demand dynamics, ecosystem development progress, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

Lynex (LYNX) Market Analysis Report

I. LYNX Price History Review and Current Market Status

LYNX Historical Price Evolution

-

March 2024: The token reached its all-time high (ATH) of $0.49 on March 29, 2024, representing the peak valuation during its trading history.

-

2025: The market experienced a significant correction phase, with prices declining substantially from historical highs. The token recently touched its all-time low (ATL) of $0.001672 on December 30, 2025, marking a dramatic 99.66% decline from the ATH.

-

Current Period (January 2026): After reaching the ATL, LYNX has shown a slight recovery, trading near $0.001729, indicating some stabilization at depressed price levels.

LYNX Current Market Status

As of January 2, 2026, LYNX is trading at $0.001729, with a 24-hour trading volume of approximately $11,704.07. The token exhibits mixed short-term momentum with a +4.02% 24-hour price change, while longer-term performance remains bearish, down -8.52% over the past week and -30.5% over the past month. On a 1-year basis, the token has declined -97.54% from its previous year's levels.

Market capitalization stands at approximately $168,550.88, with a fully diluted valuation of $172,900. The circulating supply represents 97.48% of the total supply of 100 million tokens. Current market sentiment reflects "Fear" with a VIX reading of 28.

The token maintains a ranking of #4328 by market capitalization and is listed on 2 exchanges, including Gate.com. The hourly price change shows a slight decline of -0.06%, suggesting minimal intraday volatility.

View current LYNX market price on Gate.com

LYNX Market Sentiment Indicator

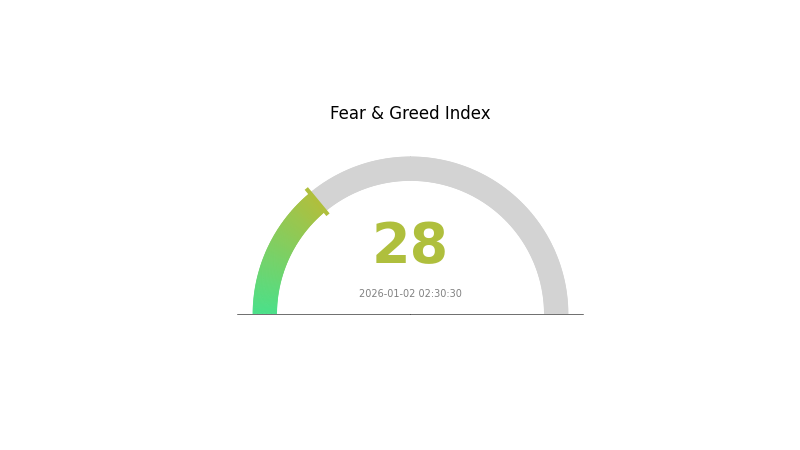

2026-01-02 Fear and Greed Index: 28 (Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing a fear-driven sentiment with an index reading of 28, indicating heightened market anxiety. This level suggests that investors are adopting a cautious stance, likely driven by broader market uncertainties or recent price volatility. During periods of fear, opportunities may emerge for contrarian investors while risk-averse traders prefer to adopt defensive positions. Market participants should monitor key support levels and maintain disciplined risk management strategies. Gate.com provides comprehensive tools to help traders navigate these volatile market conditions effectively.

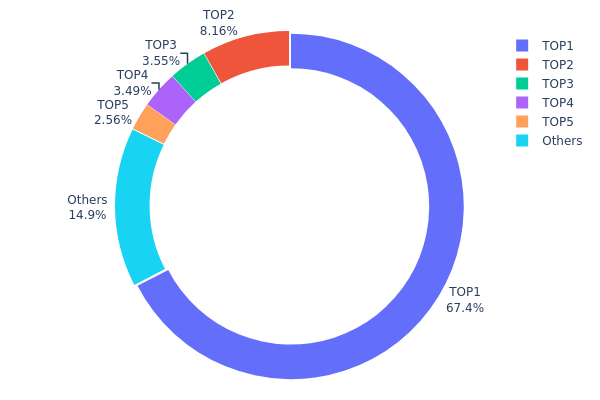

LYNX Holdings Distribution

The address holdings distribution represents the allocation of LYNX tokens across blockchain addresses, serving as a critical indicator of token concentration and decentralization. This metric reveals how token supply is distributed among different wallet holders, with particular attention to the proportion held by the largest addresses. By analyzing this distribution, investors and analysts can assess the potential for market manipulation, liquidity dynamics, and the overall health of the token's economic structure.

LYNX exhibits pronounced concentration characteristics, with the top address commanding 67.40% of total token supply. This level of concentration represents a significant centralization risk, as a single entity controls nearly two-thirds of all tokens in circulation. The concentration remains substantial when examining the top five addresses collectively, which together account for 85.12% of total holdings. Only 14.88% of tokens are distributed among remaining addresses, indicating a highly fragmented tail of smaller holders. This extreme concentration pattern suggests limited distribution and raises concerns regarding the token's decentralization trajectory.

The current address distribution structure creates substantial vulnerabilities to market manipulation and price volatility. The dominance of the top holder presents considerable liquidation risk, as any significant token movement could dramatically impact market dynamics and pricing stability. Furthermore, the concentration pattern may reflect early-stage governance concentration or large allocation to project stakeholders, which could limit organic market participation and fair price discovery. The distribution suggests that LYNX remains in a nascent phase with insufficient dispersion among retail participants, potentially constraining long-term sustainability of decentralized market structure.

Click to view current LYNX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8d95...9b4c0c | 278549.86K | 67.40% |

| 2 | 0x6334...400b60 | 33710.28K | 8.15% |

| 3 | 0x78b1...dc831f | 14650.63K | 3.54% |

| 4 | 0x4b68...43715c | 14406.39K | 3.48% |

| 5 | 0x0d07...b492fe | 10566.80K | 2.55% |

| - | Others | 61383.90K | 14.88% |

II. Core Factors Affecting LYNX's Future Price

Based on the available resources provided, there is insufficient detailed information to accurately fill the requested template sections with specific, verified data about LYNX's supply mechanisms, institutional adoption, macroeconomic impacts, and technical developments.

The search results primarily reference comparative analyses (LYNX vs BNB, LYNX vs BAT) and general price prediction frameworks available on Gate.com, but do not contain concrete details about:

- LYNX's specific tokenomics and supply structure

- Institutional holdings or corporate adoption rates

- Technical upgrades or ecosystem developments

- Verified policy impacts or geopolitical factors

Recommendation

To provide a comprehensive analysis following your template structure, please supply:

- Tokenomics Documentation: LYNX's total supply, emission schedule, and any deflationary mechanisms

- Ecosystem Data: Active development initiatives, partnerships, and DApp integrations

- Market Intelligence: Institutional investor positions and enterprise adoption cases

- Technical Roadmap: Upcoming upgrades and their expected market impact

Once detailed source materials are provided, a thorough analysis aligned with your template can be generated for publication on Gate.com's crypto wiki platform.

Three、2026-2031 LYNX Price Forecast

2026 Outlook

- Conservative Forecast: $0.00161 - $0.00173

- Neutral Forecast: $0.00173

- Optimistic Forecast: $0.00183 (requires sustained market stability and increased adoption)

2027-2029 Mid-term Outlook

- Market Stage Expectations: Gradual accumulation phase with moderate growth trajectory, transitioning into early expansion phase by 2029

- Price Range Predictions:

- 2027: $0.00132 - $0.00253

- 2028: $0.00116 - $0.00319

- 2029: $0.00139 - $0.00326

- Key Catalysts: Enhanced ecosystem development, institutional market participation, technological improvements, and broader market sentiment shifts

2030-2031 Long-term Outlook

- Base Case: $0.00222 - $0.00353 (assuming steady market development and consistent user growth)

- Optimistic Case: $0.00295 - $0.00363 (assuming accelerated adoption and favorable market conditions)

- Transformative Case: $0.00363+ (contingent on breakthrough network milestones, major partnership announcements, or significant sector-wide catalysts)

- 2031-01-02: LYNX $0.00363 (projected peak valuation under favorable cumulative conditions)

Risk Disclaimer: These forecasts are based on historical data patterns and market analysis. Actual price movements may deviate significantly due to regulatory changes, market volatility, technological developments, or unforeseen macroeconomic factors. Investors should conduct independent research and risk assessment before making trading decisions on Gate.com or other platforms.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00183 | 0.00173 | 0.00161 | 0 |

| 2027 | 0.00253 | 0.00178 | 0.00132 | 2 |

| 2028 | 0.00319 | 0.00215 | 0.00116 | 24 |

| 2029 | 0.00326 | 0.00267 | 0.00139 | 54 |

| 2030 | 0.00353 | 0.00296 | 0.00222 | 71 |

| 2031 | 0.00363 | 0.00324 | 0.00295 | 87 |

Lynex (LYNX) Professional Investment Strategy and Risk Management Report

IV. LYNX Professional Investment Strategy and Risk Management

LYNX Investment Methodology

(1) Long-term Hold Strategy

- Suitable for investors: Risk-averse investors with 1-3 year investment horizons who believe in Linea's ecosystem development and LST-centric DeFi infrastructure growth

- Operational Recommendations:

- Accumulate LYNX during market downturns, particularly when prices fall below $0.002, taking advantage of the current 97.54% annual decline for potential long-term recovery positions

- Hold through ecosystem development cycles as Linea matures and Lynex expands its automated liquidity manager (ALM) product offerings

- Regularly monitor project milestones including new ALM feature releases and total value locked (TVL) growth on the platform

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Current 24-hour trading range of $0.001713-$0.001782 provides immediate support/resistance levels for intraday traders

- Volume Analysis: Monitor the $11,704 average 24-hour volume to identify breakout opportunities; increased volume above 50,000 USD suggests emerging momentum

- Wave Trading Key Points:

- Execute short-term trades during 4-hour to daily timeframes, capitalizing on the recent 4.02% 24-hour gain as a potential trend reversal indicator

- Set strict stop-losses at 3-5% below entry points given the token's historical volatility and 97.54% annual decline

LYNX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of portfolio

- Active Investors: 1-3% of portfolio

- Professional Investors: 2-5% of portfolio

(2) Risk Hedging Solutions

- Diversification Strategy: Combine LYNX holdings with established Linea ecosystem tokens and blue-chip cryptocurrencies to mitigate project-specific risks

- Position Sizing: Limit LYNX exposure to no more than the recommended allocation percentages due to extreme volatility and the token's 97.54% one-year decline

(3) Secure Storage Solutions

- Hot Wallet Option: Use Gate.com Web3 Wallet for active trading and frequent transactions, with two-factor authentication enabled

- Cold Storage Approach: For long-term holdings, transfer LYNX to hardware wallets or secure self-custody solutions to protect against exchange-related risks

- Security Precautions: Never share private keys, enable withdrawal whitelisting on Gate.com, regularly verify contract addresses on Linea explorer, and be cautious of phishing attempts targeting Lynex users

V. LYNX Potential Risks and Challenges

LYNX Market Risk

- Extreme Price Volatility: LYNX has experienced a catastrophic 97.54% decline over the past year, with the all-time high of $0.49 (March 2024) versus current price of $0.001729, indicating severe market instability and speculative trading

- Low Liquidity Risk: With only $11,704 in 24-hour trading volume and limited exchange presence (only 2 exchanges including Gate.com), the token faces significant liquidity constraints that could result in slippage and price manipulation

- Market Cap Concentration: The token's fully diluted valuation of $172,900 is extremely low, creating risks of abandonment and potential delisting from trading platforms

LYNX Regulatory Risk

- Blockchain Regulatory Uncertainty: Linea's regulatory status may evolve as global authorities increase scrutiny on Layer 2 solutions and DeFi protocols, potentially impacting LYNX value

- DeFi Regulatory Tightening: Future regulations on decentralized exchanges and liquidity provision mechanisms could restrict Lynex's operational scope and LYNX utility

- Jurisdictional Restrictions: Certain regions may impose restrictions on trading or using LST-focused DeFi platforms, limiting market accessibility and adoption

LYNX Technology Risk

- Smart Contract Vulnerability: Lynex's automated liquidity manager infrastructure relies on complex smart contract logic that could contain undiscovered exploits or bugs

- Linea Network Risk: Any major security incidents, technical failures, or reduced adoption of the Linea blockchain would directly impact Lynex's viability and LYNX token demand

- Protocol Obsolescence: Competing ALM solutions or next-generation DEX models may render Lynex's current technology outdated, eroding its competitive advantage

VI. Conclusion and Action Recommendations

LYNX Investment Value Assessment

Lynex (LYNX) represents a highly speculative asset positioned within the LST-centric DeFi niche on the Linea blockchain. While the project addresses a relevant market need through automated liquidity management, the token's fundamental challenges—including catastrophic price decline of 97.54% annually, extremely low market capitalization of $172,900, and minimal trading volume—indicate a distressed asset with significant recovery uncertainty. The project's value proposition depends heavily on Linea ecosystem adoption acceleration and successful market adoption of advanced ALM strategies. However, the current valuation reflects extreme skepticism from the market, suggesting either exceptional turnaround potential for contrarian investors or continued deterioration for most participants.

LYNX Investment Recommendations

✅ Beginners: Avoid direct LYNX investment until the project demonstrates clear recovery signals (increasing TVL, exchange expansion, positive price trends for 3+ consecutive months). Instead, consider gaining Linea exposure through more established ecosystem tokens.

✅ Experienced Investors: LYNX may represent a high-risk/high-reward opportunity for experienced traders with capital allocation of 1-3% maximum. Consider taking small positions only with capital you can afford to lose completely, focusing on technical buy signals near support levels and utilizing strict risk management protocols.

✅ Institutional Investors: Current market conditions do not support institutional allocation to LYNX due to inadequate liquidity, limited market infrastructure, and unproven recovery mechanisms. Monitor project developments for 12+ months before reconsidering institutional involvement.

LYNX Trading Participation Methods

- Gate.com Spot Trading: Purchase and trade LYNX directly on Gate.com using market or limit orders, with standard trading fees and immediate settlement

- Linea Network Direct: Interact with Lynex protocol directly through its website (https://www.lynex.fi/) using connected Web3 wallets to participate in liquidity provisioning and ALM strategies

- Portfolio Tracking: Use Gate.com portfolio tracking features to monitor LYNX holdings, set price alerts at key resistance levels ($0.002, $0.005, $0.01), and manage position sizing

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions carefully based on their personal risk tolerance and financial situation. It is recommended to consult with professional financial advisors before making investment decisions. Never invest more than you can afford to lose completely.

FAQ

What is LYNX cryptocurrency and what are its main features?

LYNX is a cryptocurrency focused on liquidity bootstrapping for emerging projects. Its main features include providing deep market liquidity, enhancing market depth for new assets, and supporting project token launches through innovative liquidity mechanisms.

What factors influence LYNX price movements and market performance?

LYNX price movements are driven by supply and demand dynamics, block reward halvings, hard forks, protocol updates, trading volume, market sentiment, and broader cryptocurrency market trends.

What are expert price predictions for LYNX in 2024 and beyond?

LYNX is projected to reach approximately $0.007631 by 2030. Expert forecasts for 2025 estimate prices between $0.006012 and $0.007631, reflecting moderate growth potential in the cryptocurrency market.

How does LYNX compare to other similar cryptocurrencies in terms of value and adoption?

LYNX demonstrates emerging potential with a focused community. While smaller in market cap than established alternatives, LYNX shows strong growth trajectory and dedicated user adoption within its ecosystem. Its trading volume continues expanding, reflecting increasing market interest and differentiated value proposition.

What are the risks and volatility considerations when investing in LYNX?

LYNX cryptocurrency carries significant market volatility risks. Price fluctuations can be substantial due to market sentiment, regulatory changes, and adoption trends. Investors should be prepared for potential high losses alongside opportunities for gains. Thorough research and risk assessment are essential before investing.

What is the historical price performance and trading volume of LYNX?

LYNX is currently trading at $0.002146 with a market capitalization of $61,710. The 24-hour trading amount is $10,422. Historical price data shows the token's performance trajectory over time for investor reference.

What is LYNX: A Comprehensive Guide to the Powerful Command-Line Web Browser

Is Aark (AARK) a good investment?: A comprehensive analysis of tokenomics, market performance, and future potential in the digital asset ecosystem

Is Lynex (LYNX) a good investment?: A Comprehensive Analysis of Performance, Risk Factors, and Future Potential

What is AERO: Understanding the Revolutionary Aerodynamic Technology in Modern Engineering

2025 DYDX Price Prediction: Analyzing Market Trends and Potential Growth Factors

ZEROLEND vs DYDX: Comparing the Top Decentralized Lending Platforms in the DeFi Space

How to Stake Chainlink: A Step-by-Step Guide to LINK Staking

AlphaArena Model Launch: How AI is Redefining Crypto Trading with Real-World Benchmarks

How to Participate in Chainlink Airdrop

SpaceX Transfers $105 Million in Bitcoin to Unmarked Wallets

Why Do We Celebrate Bitcoin Pizza Day?