Hyperliquid: Timing is always the best entry point to break the existing structure

Hyperliquid: The Liquidity Singularity Hunter

Exceptional liquidity and consistent arbitrage—@YBSBarker continues to earn returns.

Hyperliquid’s liquidity never fails to surprise—sometimes it’s an opportunity, other times it’s a risk.

On August 27, while Hyperliquid’s BTC spot trading volume was second only to Binance and had just surpassed Robinhood the month prior, news broke of a “super whale” address—allegedly linked to Sun—executing aggressive trades in the $XPL pre-market contract. This resulted in user losses totaling over $10 million.

Unlike mainstream markets such as BTC or ETH, Hyperliquid’s pre-market contract trading is inherently low-volume. With no permission requirements, whales exploited the trading rules, leading to disastrous outcomes for retail users.

On Binance or other major CEXs, whales would have been manually banned before they could even attempt such sniping. Afterwards, the Hyperliquid team addressed the incident on Discord, saying they understood the seriousness, would learn from it, and were committed to improvement, but would not be compensating affected users at this time.

Image caption: HL team response

Image source: @hyperliquidx

Let’s review some recent HL security incidents and their outcomes:

- November 2024: BitMEX founder Arthur Hayes and others criticized Hyperliquid’s centralized architecture.

- Early 2025: A whale with 50x leverage wiped out the HLP vault, leading HL to later adjust leverage limits across several tokens.

- March 26, 2025: Facing a malicious attack on $JELLYJELLY, the HL team intervened directly, even disconnecting to protect the protocol.

- August 27, 2025: A whale attacked the $XPL pre-market contract. HL responded by stating risk was to be borne by participants.

What’s clear is HL’s response changes based on whether its own treasury or core interests are threatened. If it isn’t, they promote decentralized governance; if it is, they use admin privileges.

This isn’t a moral critique—every liquidity-concentrated marketplace faces the “retail vs. whale” dilemma. From Binance’s opaque listing process to Robinhood’s retail investors taking on Wall Street, no one is exempt.

Time Is a Circle, Liquidity Is Gravity

After the 2022 perpetual DEX boom and FTX’s collapse, the perpetual market entered a void. Binance’s listing-focused approach was challenged by PumpFun’s revamp of pricing.

Hyperliquid followed a familiar playbook—it mirrored the $BNB model (Binance mainnet + BNB Chain) by moving liquidity to a no-KYC chain. While Binance grew from regulatory arbitrage, HL drew retail by enabling permissionless arbitrage.

Back in 2022, everything in crypto seemed to restart after FTX’s dramatic collapse. Backpack inherited Solana’s core users, Polymarket captured political prediction markets, perp DEXs braved the reign of GMX and dYdX, and exchanges like Bybit and Bitget sought their share.

There was a brief window during which Binance was under investigation, the Biden administration—hostile to crypto—was in power, and even SBF, after donating tens of millions to Biden, ended up in legal trouble. Gary Gensler led the SEC’s crackdown, and Jump Trading started pulling back.

It was a time of silence, but also opportunity.

With Binance being scrutinized, FTX gone, BitMEX aging, and OKX/Bybit/Bitget battling off-chain, every major CEX admitted the shift to on-chain was inevitable, but most focused on wallets as the migration path.

Hyperliquid took a different route: embracing CLOBs (Central Limit Order Books), matching off-chain with on-chain settlement and integrating GMX-inspired LP token incentives. The incentive game was on.

Image caption: Perp DEX landscape

Image source: @OAK_Res

By 2023–2024, such mechanisms were no longer novel. Then Pump Fun broke Binance’s pricing structure, and the meme coin frenzy helped HL win its first group of dedicated users.

Even before Pump Fun, NFT and meme “dog coins” were around—BNB Chain was the main arena in 2021. Dismissing meme coins as just marketing misses the substance: Pump Fun chose a dual-market setup and leveraged the Solana ecosystem.

- • Dual-market mechanism enabled small-scale capital to experiment at large scale.

- • The Solana ecosystem accelerated the fast-paced nature of meme trading.

This shift disrupted the usual VC-fundraising—project-launch—Binance-exit—BNB-empowerment rhythm. The collapse of inflated valuations was a sign of Binance’s looming liquidity crisis. Today, BNB has become a liability for Binance, and “Binance Alpha” is stuck playing defense.

The meme coin boom marked HL’s first real test: liquidity was everywhere. Once retail had experimented with small tokens and capital, bigger funds and mainstream coins followed. Marketing was reverse-engineered—promote the presence of whales to attract retail. But fundamentally, without retail losses, there are no profits for market makers, whales, or protocols.

There’s no way Hyperliquid could maintain peak liquidity using only its own funds; outside capital was inevitable. That doesn’t contradict a lack of traditional VC. In November 2024, Paradigm entered the $HYPE ecosystem. According to @mlmabc, the estimated purchase was 16 million tokens.

Image caption: Paradigm buys $HYPE

Image source: @matthuang

VCs can buy directly—whether this counts as “investment” is debatable. Similarly, market makers may enter this way. Logically, it’s no different from an airdrop or retail buy-in.

Narratively, token inflation and sell-offs present the classic game theory dilemma: teams, VCs, and exchanges don’t trust one another. Even if immediate selling after unlocks means missing future gains, it preserves current profits. The result? Everyone sells, and only exchanges and project teams get hurt.

Hyperliquid maintained control via the $HYPE airdrop and kept spot trading primarily on its own platform, stabilizing the flywheel’s launch. By mid-2025, Bybit finally listed $HYPE spot, likely through direct purchase to add pairs, not because HL promoted the listing.

HL is far from mysterious. When Pump Fun launched on Hyperliquid, the wealth effect was even stronger than on Binance—though Binance later regained ground. The competition is far from over; during the $JELLYJELLY saga, even Binance and OKX joined forces against Hyperliquid.

This market is a marathon, with few genuine breakthroughs.

Retail Trading Meme Coins; Large Players Flood HL

In an era of retail reluctance, what are the whales really earning?

Meme collapses, Pump Fun, Berachain, Story Protocol—if you guess which protocol has the most revenue, it’s Pump Fun, even with retail largely out. Berachain, built for DeFi, has faded to the sidelines.

Retail isn’t touching altcoins; the recent rally is driven by U.S. equity liquidity spillover. DAT has already started selling, and while (MSTR)’s “Bitcoin-stock-bond flywheel” is slick in theory, it’s near impossible to mirror. ETH also lacks BTC’s resilience.

With retail hesitating, everyone’s chasing whales and institutions. They believe that if whales trade against each other, the fees and middleman profits will follow. That’s more than lazy thinking—it sells Hyperliquid short.

Liquidity is the backbone of crypto, and Hyperliquid thrives by directly serving retail users.

If all 500,000 no-KYC accounts were whales, crypto would have taken over traditional finance. For context, even Trump’s $5 million gold cards didn’t move those numbers. Like USDT, permissionless entry attracts capital at scale. Some claim it enables gray-market users—but this is no small-time phenomenon.

This recent attack saw real users sharing their losses on Twitter (X). Even if pre-market trading is thin, Hyperliquid’s pull and base are proven; the core problem was HL undermining its own governance with its liquidity play.

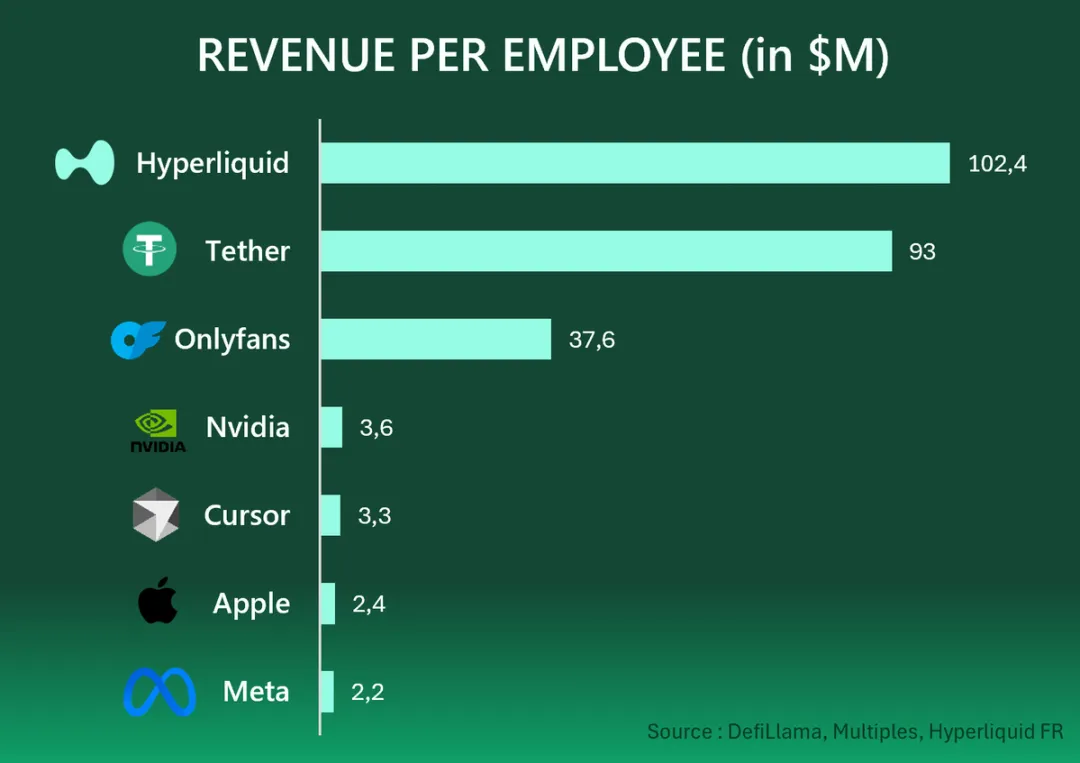

Just eleven people generated $1.167 billion in annual profit—$106 million each. Tether’s per-head figure is $93 million, OnlyFans’ is $37.6 million. This is internet scale in action: human incentives building a vast world—both off-chain and on-chain—across global markets.

Image caption: Web2 & Web3 company per-capita earnings

Image source: @HyperliquidFR

If you think Hyperliquid is just whales trading among themselves, then is Tether just whales swapping, or OnlyFans just big spenders?

With retail shunning altcoins and memes, high-leverage BTC and ETH trades are among the last real “opportunities”—they’re tempting, but the risk of getting liquidated is just as real.

No one can abandon the very road that brought them success.

Binance will over-optimize its listing logic until it’s stuck in a rut;

CEXs will raise rebates to boost liquidity, until they break their own razor-thin margins;

CLOB DEXs will try to clone Binance, eventually turning into GMX lookalikes post-token launch.

Genuine outliers are rare, even as many try to serve whales’ asset-management needs. If you still think CEXs have the deepest liquidity, you’re likely unfit for the next crypto cycle.

Retail gets a permissionless market, whales get liquidity-driven exits, Paradigm profits from $HYPE exposure, and retail finds asymmetric potential—if they avoid small-cap tokens.

We all price our own fate; going all-in on crypto is the only constant.

Conclusion

Active intervention is a hallmark of Hyperliquid; the entire perpetual DEX race remains heavily driven by human operators.

HL’s success is not about airdrops, profit-sharing, or even Jeff’s technical architecture. The real edge was timing: after FTX’s collapse and Binance’s regulatory woes, competition was thin. Timing always breaks established patterns.

FTX collapses —> Binance is hobbled by regulation and fixated on listings —> PumpFun disrupts Binance’s listing/pricing logic —> Perp DEXs rush into the new market gap —> Bybit rides legacy thinking, Hyperliquid spins up the $HYPE flywheel.

Disclaimer:

- This article is reprinted from [Zuoye Waiboshu] with all rights belonging to the original author [Zuoye Waiboshu]. For republication concerns, please contact the Gate Learn team, and we’ll address your request promptly.

- Disclaimer: The views and opinions expressed here are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Without reference to Gate, you may not reproduce, distribute, or plagiarize the translated content.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?