Resultados da pesquisa de "TYPE"

O banco suíço AMINA obteve licença em Hong Kong, tornando-se o primeiro grupo bancário internacional a oferecer encriptação.

Em 18 de novembro de 2025, a filial do AMINA Bank, supervisionada pela Autoridade de Supervisão do Mercado Financeiro da Suíça, obteve a atualização da licença Type 1 da Comissão de Valores Mobiliários de Hong Kong, tornando-se o primeiro grupo bancário internacional a oferecer serviços completos de negociação à vista de ativos de criptografia e custódia em Hong Kong. A plataforma suporta 13 ativos de criptografia, incluindo Bitcoin e Ethereum, oferecendo aos investidores profissionais negociação 24/7, custódia com verificação SOC 2 e serviços de execução em nível institucional.

Este marco marca a rápida evolução da estrutura regulatória de ativos digitais em Hong Kong, com o mercado de ativos digitais de Hong Kong alcançando um crescimento anual de 233% em 2025, enquanto a demanda institucional por infraestrutura de custódia segura e em conformidade continua a aumentar.

MarketWhisper·2025-11-19 06:24

AMINA obteve a licença tipo 1 da SFC de Hong Kong, oferecendo transações encriptação e custódia em conformidade.

A AMINA (Hong Kong) Limited obteve a licença Type 1 da Comissão de Valores Mobiliários de Hong Kong, tornando-se o primeiro grupo bancário internacional a oferecer negociação à vista de encriptação e custódia de ativos a investidores profissionais. Os serviços abrangem uma variedade de ativos encriptados, com planos de expansão para gestão de fundos de venda privada e derivação.

MarsBitNews·2025-11-18 01:08

O criador da Thodex foi encontrado morto na cela após uma sentença de 11.000 anos.

Faruk Fatih Özer, o fundador da bolsa Thodex, foi encontrado morto na cela da prisão de segurança máxima Tekirdağ F-Type, de acordo com a GDH Digital. A suspeita inicial é de que ele tenha cometido suicídio, mas a causa oficial ainda está sendo investigada.

Thodex, fundada em 2017, foi uma das principais plataformas de negociação da Turquia.

TapChiBitcoin·2025-11-01 11:40

moeda estável vai levar os pagamentos eletrónicos a um crescimento económico na próxima década?

Escrito por: Level

Compilado por: AididiaoJP, Foresight News

As stablecoins reshape the underlying architecture of the global financial system. As a new type of digital asset, its core value is reflected in three dimensions: the programmability at the technical level allows it to be embedded in smart contracts for automatic execution; the borderless nature at the geographical level breaks the regional barriers of traditional finance; and the high speed at the efficiency level reduces settlement time from the traditional finance's T+1 or even T+3 to nearly real-time.

No entanto, além da função de pagamento, as stablecoins também estão silenciosamente aumentando a velocidade de circulação da moeda: mudando a frequência de uso de cada dólar, a direção do fluxo e estimulando a velocidade das atividades econômicas. O impacto das stablecoins na velocidade de circulação da moeda apresenta um efeito único de "dupla hélice": por um lado, a liquidação automática realizada por contratos inteligentes libera as garantias de liquidação ociosas no sistema financeiro tradicional; por outro lado, 7×24

DEFI-4,3%

COINVOICE(链声)·2025-08-08 03:24

As moedas estáveis vão levar os pagamentos eletrónicos a um novo salto económico na próxima década?

Redação: Level

Compilado por: AididiaoJP, Foresight News

As stablecoins reshape the underlying architecture of the global financial system. As a new type of digital asset, its core value is reflected in three dimensions: the programmability at the technical level allows it to be embedded in smart contracts for automatic execution; the borderless nature at the geographical level breaks down the regional barriers of traditional finance; and the high speed at the efficiency level reduces settlement time from the traditional finance T+1 or even T+3 to almost real-time.

No entanto, além da função de pagamento, as stablecoins também estão silenciosamente aumentando a velocidade de circulação da moeda: alterando a frequência de uso de cada dólar, a direção do fluxo e estimulando a velocidade das atividades econômicas. O impacto das stablecoins na velocidade de circulação da moeda apresenta um efeito "dupla hélice" único: por um lado, a liquidação automática realizada por contratos inteligentes libera as garantias de liquidação ociosas no sistema financeiro tradicional; por outro lado,

DEFI-4,3%

TechubNews·2025-08-07 05:55

A Batoshi Foundation estabeleceu uma parceria com a Cactus Custody para fornecer custódia de segurança a nível institucional para os ativos dos usuários.

CoinVoice latest news, a Batoshi Foundation (beraBTC emissão e operação) anunciou uma parceria com a marca de custódia Cactus Custody do Matrixport, para fornecer custódia segura em nível institucional com multi-assinatura + separação quente e fria + HSM para seu BTC na cadeia e sistema beraBTC. O serviço passa pela verificação de auditoria SOC 1 Type 1 / SOC 2 Type 2 da Deloitte, com Conformidade transparente, confiável para instituições e seguro para os usuários.

Os BTC que os usuários usam para emitir beraBTC na Berachain serão mantidos em segurança através da colaboração de custódia com a Cactus Custody, garantindo que os fundos sejam verificáveis, rastreáveis e resgatáveis.

Batoshi Foundation baseado em

BTC-1,27%

CoinVoice·2025-07-16 11:00

Por que precisamos de moeda estável?

Fonte: A Perspectiva de Wang Jian

01 O que são stablecoins

As stablecoins are a type of currency system design that differs from fiat currencies and cryptocurrencies. Here we used a somewhat awkward term called "currency system design" because we still cannot determine whether it counts as a true form of currency.

Um mecanismo típico de stablecoin é (referindo-se à proposta de Hong Kong. As propostas em outros lugares podem variar):

O emissor (setor privado) reserva certos ativos reais (moedas fiduciárias nacionais ou estrangeiras, ou outros ativos financeiros com crédito, como títulos do governo, metais preciosos, também podendo incluir criptomoedas), para emitir uma certa quantidade de stablecoins com 100% de um ou um conjunto de ativos reais como reservas, e então essa stablecoin é negociada em um livro-razão distribuído.

Nota alguns pontos:

(1) O emissor é do setor privado, não da autoridade monetária oficial (como o banco central).

(2) Tem 100% de ativos reais armazenados

BTC-1,27%

金色财经_·2025-05-29 10:08

HashKey Exchange já passou pela verificação SOC 1 Tipo 2 e SOC 2 Tipo 2.

A maior exchange de ativos digitais licenciada de Hong Kong, HashKey Exchange, anunciou hoje que a HashKey Custody Services Limited (doravante denominada "HashKey Exchange") obteve com sucesso as certificações SOC 1 Tipo 2 e SOC 2 Tipo 2, tornando-se uma das poucas empresas do setor a obter essas duas certificações internacionais de prestígio. Isso marca o progresso contínuo da HashKey Exchange em conformidade e segurança, proporcionando serviços de ativo digital em nível empresarial mais confiáveis para investidores individuais e institucionais.

A HashKey Exchange obteve simultaneamente duas certificações, destacando sua força profissional e vantagem em conformidade no campo dos ativos digitais. Entre elas, a certificação SOC 1 Type 2 foca na verificação da HashKey Ex

DeepFlowTech·2025-05-09 09:31

CoinVoice latest news, according to Bitcoin.com, the Central Bank of Bolivia, under the leadership of President Edwin Rojas Ulo, is designing a new type of moeda chamada "Virtual Boliviano" para ser utilizada na Liquidação internacional.

De acordo com informações, a proposta será oficialmente anunciada durante as celebrações do 200º aniversário da independência da Bolívia em 6 de agosto. Para garantir a robustez do design, o banco central está colaborando com instituições internacionais e outros bancos centrais. As autoridades afirmam que a "Bolívar virtual" deverá modernizar o sistema de pagamentos, ao mesmo tempo que ajudará a economizar reservas de moeda estrangeira.

CoinVoice·2025-05-08 12:21

De decisões humanas à dominação do código: como a terceira classe de moeda estável permite que os rendimentos "se auto-financiem"?

Título original: "Type III Stablecoins"

Autor original: STANFORD BLOCKCHAIN CLUB

Compilado por|Odaily Planet Daily Ethan(@ethanzhang\_web3)

! [Da tomada de decisão humana à dominação de código: como as stablecoins de classe 3 podem tornar os rendimentos "auto-hematopoiéticos"?] ](https://piccdn.0daily.com/202504/03103924/35sij4e7ecwlzbvf.jpg!webp)

As moedas estáveis, como componentes chave do setor de criptomoedas, alcançaram um valor de mercado total de ativos líquidos superior a 200 bilhões de dólares, mantendo uma posição central no mercado de criptomoedas atual. Alguns acreditam que o tamanho das moedas estáveis já se desvinculou do volátil mercado de criptomoedas - embora o mercado de criptomoedas passe por uma correção em 2025,

星球日报·2025-04-03 10:56

Um Juiz Federal Acaba de Dar uma Tareia na SEC. Eis o que Significa. - BlockTelegraph

*

*

*

*

*

If the SEC were a sports team measured by its “win” rate, it would be a runaway champ.

But that win-loss record suffered a mild hit — and its first ever loss in an “ICO” case — one that refers to the controversial method of crowd fundraising and that borrows from the public company “IPO” or initial public offering.

A federal judge denied the SEC a preliminary injunction against Blockvest after he granted a temporary restraining order on the same issue. We chat with Amit Singh, attorney and shareholder in Stradling’s corporate and securities practice group about the SEC’s fresh loss.

His take? They’ll be out for blood, next.

**For those not in the know, share the legal background leading up to this case.**

In October of this year, the Securities Exchange Commission filed a complaint against Blockvest LLC and its founder, Reginald Buddy Ringgold III. According to the complaint, Blockvest falsely claimed its planned December initial coin offering was “registered” and “approved” by the SEC and created a fake regulatory agency, the Blockchain Exchange Commission, which included a phony logo that was nearly identical to that of the SEC. The SEC also alleged Blockvest conducted pre-sales of its digital token, BLV, ahead of the ICO and raised more than $2.5 million.

The SEC’s complaint alleged violations of the anti-fraud provisions of the Securities Exchange and the Securities Act and violations of the Securities Act’s prohibitions against the offer and sale of unregistered securities in the absence of an exemption from the registration requirements.

U.S. District Judge Gonzalo Curiel issued a temporary restraining order “freezing assets, prohibiting the destruction of documents, granting expedited discovery, requiring accounting and order to show cause why a preliminary injunction should not be granted” on October 5, 2018.

On Tuesday, November 27, in the SEC’s first loss in stopping an ICO, judge Gonzalo Curiel stated that the SEC had not shown at this stage of the case that the BLV tokens were securities under the Howey Test, a decades-old test established by the U.S. Supreme Court for determining whether certain transactions are investment contracts and thus securities. If the tokens weren’t securities, all the SEC’s other allegations automatically fail Under the Howey Test, a transaction is an investment contract (or security) if:

– It is an investment of money;

– There is an expectation of profits from the investment;

– The investment of money is in a common enterprise; and

– Any profit comes from the efforts of a promoter or third party

Later cases have expanded the term “money” in the Howey Test to include investment assets other than money.

The judge said that the SEC failed to show investors had an expectation of profits. “While defendants claim that they had an expectation in Blockvest’s future business, no evidence is provided to support the test investors’ expectation of profits,” the judge wrote. Blockvest argued that the pre-ICO money came from 32 “test investors” and said the BLV tokens were only designed for testing its platform. It presented statements from several investors who said they either did not buy BLV tokens or rely on any representations that the SEC has alleged are false. The SEC responded by noting that various individuals wrote “Blockvest” or “coins” on their checks and were provided with a Blockvest ICO white paper describing the project and the terms of the ICO. Judge Curiel said that evidence, by itself, wasn’t enough: “Merely writing ‘Blockvest or coins’ on their checks is not sufficient to demonstrate what promotional materials or economic inducements these purchasers were presented with prior to their investments. Accordingly, plaintiff has not demonstrated that ‘securities’ were sold to [these] individuals.”

**Won’t the case proceed? Why is the denial of an injunction important here?**

This does not mean that the SEC cannot pursue an action against the defendants Rather it just means that the SEC didn’t meet the high burden required to receive a preliminary injunction of proving “(1) a prima facie case of previous violations of federal securities laws, and (2) a reasonable likelihood that the wrong will be repeated.”

The court determined that, at this stage, without full discovery and disputed issues of material facts, the Court could not decide whether the BLV token were securities. Since the SEC didn’t meet its burden of proving the tokens were securities in the first place, it couldn’t have shown that there was a previous violation of the federal securities laws So, the first prong was not met Further, the defendants agreed to stop the ICO and provide 30 days’ prior notice to the SEC if they intend to move forward with the ICO So, the court determined that there was not a reasonable likelihood that the wrong will be repeated As a result, the SEC’s motion for a preliminary injunction was denied.

Nonetheless, this is an important case as it is the first time the SEC went after an ICO issuer and the issuer pushed back and won (if only temporarily) It reminds us that, though most people think of the SEC as judge and jury in securities actions, that isn’t the case Ultimately, an issuer that pushes back may have a chance if it has the wherewithal to fight and if it has good arguments However, this does not mean that the SEC is done with them and we may very well see this case continue.

**Won’t media coverage of this case ultimately impair Blockvest’s ability to raise funds — its ultimate goal?**

That may very well be the case.

Unfortunately, unsophisticated investors could ultimately merely remember the Blockvest name and decide that it must be a good investment since they’ve heard of it (ala PT Barnum – “I don’t care what the newspapers say about me as long as they spell my name right.”). But I may be too cynical (hopefully I am). In any case, I would be surprised if Blockvest attempts to pursue an ICO without either registering the tokens or utilizing an exemption from the registration requirements. They clearly have a target on their back, so the SEC would love another crack at them I’m sure.

Plus, even though a preliminary injunction was denied here, the SEC still got what it wanted as Blockvest agreed not to pursue the ICO without giving the SEC 30 days’ prior notice of its intent to do so. So, the investing public was ultimately protected.

**What is the SEC’s current stance on what constitutes a security based on this case?**

The SEC will still point to the Howey Test Further, as stated in recent speeches by Hinman and others, the SEC seems to be focused not only on the utility of any tokens (i.e., they can be used on the platform for which they were created), but also on decentralization (that the efforts of the promoters are no longer required to maintain the value/utility of the tokens/platform).

However, the court in this case looked at the investment of money prong differently than has historically been the case Normally, the investment of money prong is assumed with little analysis as any consideration is considered “money” for purposes of the test But this case looked at the investment not from the purchaser’s subjective intent when committing funds, but instead based the analysis on what was offered to prospective purchasers and what information they relied on So, issuers are well advised to be very careful in how they advertise an offering.

Further, the expectation of profits prong wasn’t met because, according to Blockvest, these were just test investors So, it wasn’t clear these folks invested for a profit The tokens were never even used or sold outside the platform.

**Where does the Ninth Circuit sit in regards to what is a security?**

The Ninth Circuit follows the Howey Test.

However, the common enterprise element has received extensive and varied analysis in the federal circuit courts For example, while all circuits accept “horizontal” commonality as satisfying the common enterprise prong of the Howey Test, a minority of circuits (including the ninth) also accept “vertical” commonality in this analysis.

Horizontal commonality involves the pooling of assets, profits and risks in a unitary enterprise, while vertical commonality requires that profits of investors be “interwoven with and dependent upon the efforts and success of those seeking the investment or of third parties” (narrow verticality), or “that the well-being of all investors be dependent upon the promoter’s expertise” (broad commonality). SEC v. SG Ltd., 265 F.3d 42, 49 (1st Cir. 2001).

The Ninth Circuit is the only one to accept the narrow vertical approach (though it also accepts horizontal commonality), which finds a common enterprise if there is a correlation between the fortunes of an investor and a promoter.” Sec. & Exch. Comm’n v. Eurobond Exchange, Ltd., 13 F.3d 1334, 1339 (9th Cir., 1994). Under this approach a common enterprise is a venture “in which the ‘fortunes of the investor are interwoven with and dependent upon the efforts and success of those seeking the investment….'” Investors’ funds need not be pooled; rather the fortunes of the investors must be linked with those of the promoters, which suffices to establish vertical commonality. So, a common enterprise exists if a direct correlation has been established between success or failure of the promoter’s efforts and success or failure of the investment.

**Which Federal Circuits might offer an equal or even bigger split with the SEC?**

I wouldn’t really say that any courts split with the SEC as the SEC’s decisions take precedent over any decisions of those courts. However, there is a split among the circuits as described above with respect to what type of commonality is sufficient to find a common enterprise.

**What impact could the outcome of this case have on ICOs at large?**

This case may embolden companies who have already conducted ICOs to push back on any SEC actions that they might not otherwise fight as it shows that the SEC will always have to meet the burden of proving all factors of the Howey Test are met before the SEC has jurisdiction over the offering in the first place.

**Has the Supreme Court addressed anything crypto, crypto related, or analogous?**

The only case I know of where the Supreme court has addressed crypto currencies is Wisconsin Central Ltd. v. United States.

That was a case about whether stock counts as “money remuneration” The dissent in that case talked about how our concept of money has changed over time and said that perhaps “one day employees will be paid in bitcoin or some other type of cryptocurrency.” This goes against the IRS’s position that cryptocurrencies are property and should be taxed as such But, it was just a passing comment in the dissent. So, it has no precedential value. But, it may embolden someone to fight the IRS’s position.

BlockTelegraph·2024-12-19 05:53

Caminho avançado do OP Stack: Desbloqueando o potencial do ZK Rollup com OP Succinct

Resumo; Não li

● OP Succinct 提供的主要功能是将 ZKP 融入 OP Stack 的模块化架构中以完成将 OP Stack Rollup 转换为完全验证的 ZK Rollup;

● Se o objetivo final da expansão do Ethereum é transformar cada Rollup em ZK Rollup, o OP Succinct tem como objetivo implementar a implantação do OP Stack Type-1 zkEVM (totalmente equivalente ao Ethereum) combinando Rust e SP1.

● OP Succinct Proposer mainly completes parallel proof generation and proof aggregation with verification;

● O sistema OP Stack atual depende do "7

律动·2024-09-26 01:05

Hashed: Porque investimos na Taiko?

原文作者: Ryan Kim, Edward Tan, Dan Park

原文编译:深潮 TechFlow

想象 uma situação em que, neste mundo, a escalabilidade do Ethereum é ilimitada, a velocidade das transações é rápida como um relâmpago e a privacidade do usuário é sagrada e inviolável. Isso não é um sonho distante, mas sim uma realidade rapidamente se aproximando, tudo graças ao Taiko.

作为主要投资者,我们很高兴支持 Taiko 在Ethereum生态系统中进行革命性创新的旅程,他们的Type-1

星球日报·2024-05-28 06:02

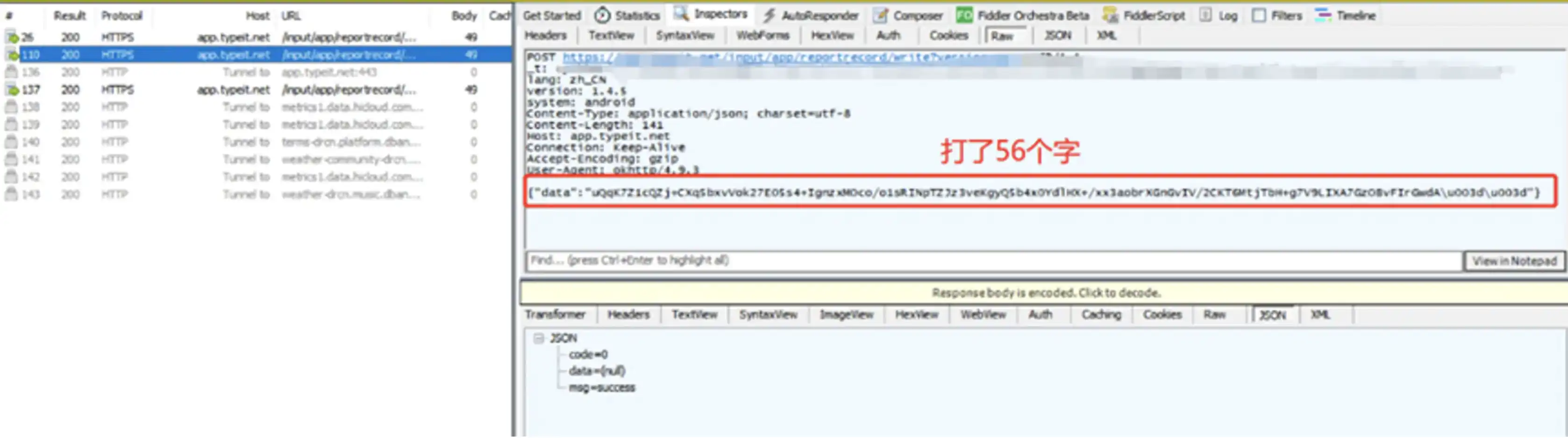

TypeIt!: método de entrada Web3 protegido por privacidade, lançamento inovador do Type to Earn

Type!t é o primeiro método de entrada Web3 do mundo, baseado em tecnologia de criptografia e armazenamento descentralizado para proteger os dados de uso dos usuários e outras informações privadas, e também possui funções Web3 como Type To Earn, Gamefi, chat criptografado e AI thesaurus.

律动·2023-05-31 14:25

Carregar mais